|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

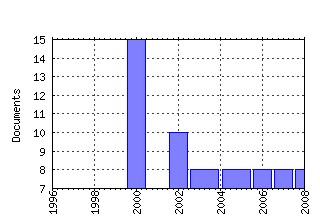

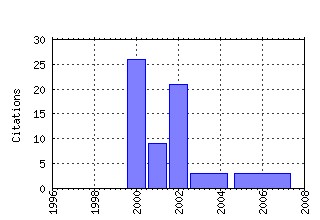

International Review of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:irvfin:v:3:y:2002:i:2:p:71-103 Corporate Governance in Asia: A Survey (2002). (2) RePEc:bla:irvfin:v:1:y:2000:i:3:p:161-194 Large Shareholder Activism in Corporate Governance in Developing Countries: Evidence from India (2000). (3) RePEc:bla:irvfin:v:1:y:2000:i:2:p:81-96 Security Markets versus Bank Finance: Legal Enforcement and Investors Protection (2000). (4) RePEc:bla:irvfin:v:2:y:2001:i:3:p:113-149 An Analytic Solution for Interest Rate Swap Spreads (2001). (5) RePEc:bla:irvfin:v:1:y:2000:i:1:p:11-38 Financial Structure, Corporate Finance and Economic Growth (2000). (6) RePEc:bla:irvfin:v:4:y:2003:i:1-2:p:49-78 Dynamic Optimality of Yield Curve Strategies-super- (2003). (7) RePEc:bla:irvfin:v:3:y:2002:i:3-4:p:163-188 Bank Safety and Soundness and the Structure of Bank Supervision: A Cross-Country Analysis (2002). (8) RePEc:bla:irvfin:v:6:y:2006:i:1-2:p:43-78 The Reach of the Disposition Effect: Large Sample Evidence Across Investor Classes-super- (2006). (9) RePEc:bla:irvfin:v:3:y:2002:i:3-4:p:189-211 Impact of International Cross-listing on Local Exchanges: Evidence from Chile (2002). (10) RePEc:bla:irvfin:v:2:y:2001:i:1&2:p:1-19 (). (11) RePEc:bla:irvfin:v:2:y:2001:i:1&2:p:71-98 (). (12) RePEc:bla:irvfin:v:1:y:2000:i:4:p:245-267 Changes in the Nikkei 500: New Evidence for Downward Sloping Demand Curves for Stocks (2000). (13) RePEc:bla:irvfin:v:2:y:2001:i:4:p:235-246 The Short- and Long-run Performance of New Listings in Tunisia (2001). (14) RePEc:bla:irvfin:v:2:y:2001:i:3:p:179-202 Investing Public Pensions in the Stock Market: Implications for Risk Sharing, Capital Formation and Public Policy in the Developed and Developing World (2001). (15) RePEc:bla:irvfin:v:1:y:2000:i:1:p:39-51 Long-term Investments and Financial Structure (2000). (16) RePEc:bla:irvfin:v:3:y:2002:i:2:p:131-161 Why Do Governments Privatize Abroad? (2002). (17) RePEc:bla:irvfin:v:2:y:2001:i:4:p:217-234 Capital Structure Choices and Taxes: Evidence from the Australian Dividend Imputation Tax System (2001). (18) RePEc:bla:irvfin:v:1:y:2000:i:2:p:123-142 A Variable Reduction Technique for Pricing Average-rate Options (2000). (19) RePEc:bla:irvfin:v:2:y:2001:i:3:p:151-178 On the Demand Elasticity of Initial Public Offerings: An Analysis of Discriminatory Auctions (2001). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||