|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

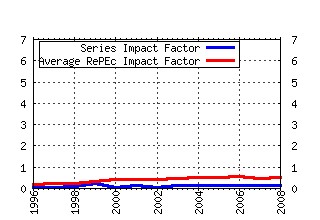

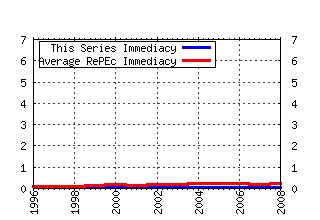

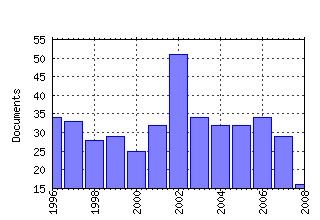

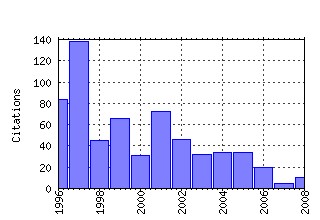

Journal of Financial Research Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jfnres:v:20:y:1997:i:2:p:275-89 Banking Relationships and the Effect of Monitoring on Loan Pricing (1997). (2) RePEc:bla:jfnres:v:20:y:1997:i:2:p:145-58 Cognitive Dissonance and Mutual Fund Investors (1997). (3) RePEc:bla:jfnres:v:24:y:2001:i:2:p:161-78 Systematic Liquidity (2001). (4) RePEc:bla:jfnres:v:19:y:1996:i:1:p:59-74 The Costs of Raising Capital (1996). (5) RePEc:bla:jfnres:v:19:y:1996:i:2:p:175-92 Skewness and Kurtosis in S&P 500 Index Returns Implied by Option Prices (1996). (6) RePEc:bla:jfnres:v:13:y:1990:i:4:p:285-96 Call Option Valuation for Discrete Normal Mixtures (1990). (7) RePEc:bla:jfnres:v:22:y:1999:i:1:p:107-30 A State-Space Approach to Estimate and Test Multifactor Cox-Ingersoll-Ross Models of the Term Structure (1999). (8) RePEc:bla:jfnres:v:19:y:1996:i:2:p:193-207 On the Dynamic Relation between Stock Prices and Exchange Rates (1996). (9) RePEc:bla:jfnres:v:21:y:1998:i:3:p:333-53 Cross-Autocorrelation between A Shares and B Shares in the Chinese Stock Market (1998). (10) RePEc:bla:jfnres:v:20:y:1997:i:2:p:175-90 An Empirical Analysis of Mutual Fund Expenses (1997). (11) RePEc:bla:jfnres:v:22:y:1999:i:2:p:161-87 How Firm Characteristics Affect Capital Structure: An International Comparison (1999). (12) RePEc:bla:jfnres:v:13:y:1990:i:1:p:71-79 Interest Rate Changes and Common Stock Returns of Financial Institutions: Revisited (1990). (13) RePEc:bla:jfnres:v:22:y:1999:i:4:p:371-83 Random Walk Tests for Latin American Equity Indexes and Individual Firms (1999). (14) RePEc:bla:jfnres:v:13:y:1990:i:2:p:155-65 Risky Debt Maturity Choice in a Sequential Game Equilibrium (1990). (15) RePEc:bla:jfnres:v:28:y:2005:i:1:p:41-57 SOCIALLY RESPONSIBLE INVESTING AND PORTFOLIO DIVERSIFICATION (2005). (16) RePEc:bla:jfnres:v:26:y:2003:i:3:p:275-299 Equity Market Liberalization in Emerging Markets (2003). (17) RePEc:bla:jfnres:v:16:y:1993:i:4:p:337-50 Mean and Volatility Spillovers across Major National Stock Markets: Further Empirical Evidence (1993). (18) RePEc:bla:jfnres:v:16:y:1993:i:4:p:269-83 Dual Betas from Bull and Bear Markets: Reversal of the Size Effect (1993). (19) RePEc:bla:jfnres:v:20:y:1997:i:1:p:93-110 The Survival of Initial Public Offerings in the Aftermarket (1997). (20) RePEc:bla:jfnres:v:25:y:2002:i:4:p:559-575 The Effect of Credit Risk on Bank and Bank Holding Company Bond Yields: Evidence from the Post-FDICIA Period (2002). (21) RePEc:bla:jfnres:v:20:y:1997:i:3:p:305-22 Co-movements in International Equity Markets (1997). (22) RePEc:bla:jfnres:v:25:y:2002:i:2:p:283-299 A Comparison of Seasonal Adjustment Methods When Forecasting Intraday Volatility (2002). (23) RePEc:bla:jfnres:v:18:y:1995:i:3:p:299-309 Tests of Random Walk and Market Efficiency for Latin American Emerging Equity Markets (1995). (24) RePEc:bla:jfnres:v:23:y:2000:i:4:p:469-93 Alternative Tests of the Zero-Beta CAPM (2000). (25) RePEc:bla:jfnres:v:24:y:2001:i:4:p:495-512 Executive Compensation Structure and Corporate Governance Choices (2001). (26) RePEc:bla:jfnres:v:29:y:2006:i:4:p:463-479 INDIVIDUAL EQUITY RETURN DATA FROM THOMSON DATASTREAM: HANDLE WITH CARE! (2006). (27) RePEc:bla:jfnres:v:24:y:2001:i:4:p:465-93 Venture Capital and IPO Lockup Expiration: An Empirical Analysis (2001). (28) RePEc:bla:jfnres:v:20:y:1997:i:4:p:509-27 Corporate Control in Commercial Banks (1997). (29) RePEc:bla:jfnres:v:18:y:1995:i:1:p:1-13 Bank Exposure to Interest Rate Risk: A Global Perspective (1995). (30) RePEc:bla:jfnres:v:18:y:1995:i:2:p:223-37 Dynamic Relations between Macroeconomic Variables and the Japanese Stock Market: An Application of a Vector Error Correction Model (1995). (31) RePEc:bla:jfnres:v:20:y:1997:i:3:p:291-304 Market Structure and Reported Trading Volume: NASDAQ versus the NYSE (1997). (32) RePEc:bla:jfnres:v:27:y:2004:i:1:p:75-94 Decimals And Liquidity: A Study Of The Nyse (2004). (33) RePEc:bla:jfnres:v:19:y:1996:i:2:p:273-92 Mutual Fund Brokerage Commissions (1996). (34) RePEc:bla:jfnres:v:17:y:1994:i:2:p:187-203 Nonlinear Dynamics and the Distribution of Daily Stock Index Returns (1994). (35) RePEc:bla:jfnres:v:28:y:2005:i:3:p:385-402 AGENT BANK BEHAVIOR IN BANK LOAN SYNDICATIONS (2005). (36) RePEc:bla:jfnres:v:18:y:1995:i:4:p:415-30 Determinants of Persistence in Relative Performance of Mutual Funds (1995). (37) RePEc:bla:jfnres:v:23:y:2000:i:3:p:353-71 Temporal Changes in the Determinants of Mutual Fund Flows (2000). (38) RePEc:bla:jfnres:v:14:y:1991:i:2:p:155-65 Bank Failure and Contagion Effects: Evidence from Hong Kong (1991). (39) RePEc:bla:jfnres:v:24:y:2001:i:1:p:133-55 Foreign Ownership Restrictions and Market Segmentation in Chinas Stock Markets (2001). (40) RePEc:bla:jfnres:v:24:y:2001:i:4:p:587-602 Stock Prices and Inflation (2001). (41) RePEc:bla:jfnres:v:17:y:1994:i:2:p:231-40 A Re-examination of the Effect of 12B-1 Plans on Mutual Fund Expense Ratios (1994). (42) RePEc:bla:jfnres:v:24:y:2001:i:4:p:523-43 Stock Returns and Volatility on Chinas Stock Markets (2001). (43) RePEc:bla:jfnres:v:27:y:2004:i:1:p:115-132 The Evolution Of Bank Resolution Policies In Japan: Evidence From Market Equity Values (2004). (44) RePEc:bla:jfnres:v:20:y:1997:i:3:p:389-406 Changes in Market Perception of Riskiness: The Case of Too-Big-to-Fail (1997). (45) RePEc:bla:jfnres:v:19:y:1996:i:3:p:443-57 Excess Returns and Risk at the Long End of the Treasury Market: An EGARCH-M Approach (1996). (46) RePEc:bla:jfnres:v:23:y:2000:i:3:p:373-90 The Effect of CEO Tenure on the Relation between Firm Performance and Turnover (2000). (47) RePEc:bla:jfnres:v:17:y:1994:i:2:p:271-88 Causality Tests of the Real Stock Return-Real Activity Hypothesis (1994). (48) RePEc:bla:jfnres:v:26:y:2003:i:1:p:19-30 Regulation And The Rise In Asset-Based Mutual Fund Management Fees (2003). (49) RePEc:bla:jfnres:v:16:y:1993:i:4:p:309-20 The Debt Maturity Choice: An Empirical Investigation (1993). (50) RePEc:bla:jfnres:v:21:y:1998:i:1:p:37-51 A Test of the Two-Tier Corporate Governance Structure: The Case of Japanese Keiretsu (1998). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:mol:ecsdps:esdp08050 Order Dynamics in the Italian Treasury Security Wholesale Secondary Market (2008). University of Molise, Dept. SEGeS / Economics & Statistics Discussion Papers Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:nbr:nberwo:11701 International Capital Flows, Returns and World Financial Integration (2005). National Bureau of Economic Research, Inc / NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||