|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

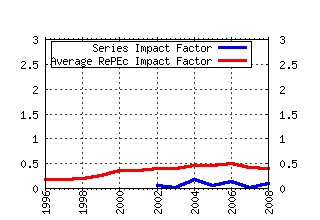

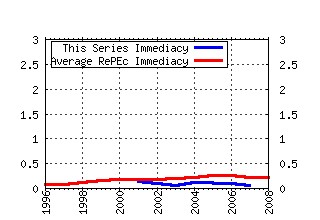

Universidad Carlos III, Departamento de EstadÃstica y EconometrÃa / Statistics and Econometrics Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cte:wsrepe:ws015527 GMM ESTIMATION OF A PRODUCTION FUNCTION WITH PANEL DATA:

AN APPLICATION TO SPANISH MANUFACTURING FIRMS (2001). (2) RePEc:cte:wsrepe:ws010805 IS STOCHASTIC VOLATILITY MORE FLEXIBLE THAN GARCH? (2001). (3) RePEc:cte:wsrepe:ws026218 PSEUDO-MAXIMUM LIKELIHOOD ESTIMATION OF A DYNAMIC STRUCTURAL INVESTMENT MODEL (2002). (4) RePEc:cte:wsrepe:ws025414 ESTIMATION METHODS FOR STOCHASTIC VOLATILITY MODELS: A SURVEY (2002). (5) RePEc:cte:wsrepe:ws036313 DETECTING LEVEL SHIFTS IN THE PRESENCE OF CONDITIONAL HETEROSCEDASTICITY. (2003). (6) RePEc:cte:wsrepe:ws034309 ECONOMETRIC MODELLING FOR SHORT-TERM INFLATION FORECASTING IN THE EMU. (2004). (7) RePEc:cte:wsrepe:ws031126 RANGE UNIT ROOT TESTS (2003). (8) RePEc:cte:wsrepe:ws063012 ON THE CONCEPT OF DEPTH FOR FUNCTIONAL DATA (2006). (9) RePEc:cte:wsrepe:ws041305 VARIANCE CHANGES DETECTION IN MULTIVARIATE TIME SERIES (2004). (10) RePEc:cte:wsrepe:ws035212 GENERALIZED SPECTRAL TESTS FOR THE MARTINGALE DIFFERENCE HYPOTHESIS (2003). (11) RePEc:cte:wsrepe:ws013824 INNOVATION AND JOB CREATION AND DESTRUCTION:

EVIDENCE FROM SPAIN (2001). (12) RePEc:cte:wsrepe:ws042710 A NOTE ON PREDICTION AND INTERPOLATION ERRORS IN TIME SERIES (2004). (13) RePEc:cte:wsrepe:ws030201 ESTIMATION OF INCOME DISTRIBUTION AND DETECTION OF SUBPOPULATIONS: AN EXPLANATORY MODEL (2003). (14) RePEc:cte:wsrepe:ws062911 MODELLING MONETARY TRANSMISSION IN UK MANUFACTURING INDUSTRY (2006). (15) RePEc:cte:wsrepe:ws041104 A RANGE UNIT ROOT TEST (2004). (16) RePEc:cte:wsrepe:ws060402 USING AUXILIARY RESIDUALS TO DETECT CONDITIONAL HETEROSCEDASTICITY IN INFLATION (2006). (17) RePEc:cte:wsrepe:ws050401 FORECASTING INFLATION IN THE EURO AREA USING MONTHLY TIME SERIES MODELS AND QUARTERLY ECONOMETRIC MODELS (2005). (18) RePEc:cte:wsrepe:ws072907 Depth functions based on a number of observations of a random vector (2007). (19) RePEc:cte:wsrepe:ws013321 ON THE (INTRADAILY) SEASONALITY AND DYNAMICS OF A FINANCIAL POINT PROCESS: A SEMIPARAMETRIC APPROACH. (2001). (20) RePEc:cte:wsrepe:ws044211 OUTLIER DETECTION IN MULTIVARIATE TIME SERIES VIA PROJECTION PURSUIT (2004). (21) RePEc:cte:wsrepe:ws062007 MODELLING THE DISCRETE AND INFREQUENT OFFICIAL INTEREST RATE CHANGE IN THE UK (2006). (22) RePEc:cte:wsrepe:ws041003 DIMENSIONALITY REDUCTION WITH IMAGE DATA (2004). (23) RePEc:cte:wsrepe:ws015628 ESTIMATION OF A DYNAMIC DISCRETE CHOICE MODEL OF IRREVERSIBLE

INVESTMENT (2001). (24) RePEc:cte:wsrepe:ws054007 MEAN SQUARED ERRORS OF SMALL AREA ESTIMATORS UNDER A UNIT-LEVEL MULTIVARIATE MODEL (2005). (25) RePEc:cte:wsrepe:ws076316 The effect of realised volatility on stock returns risk estimates (2007). (26) RePEc:cte:wsrepe:ws046315 STOCHASTIC VOLATILITY MODELS AND THE TAYLOR EFFECT (2004). (27) RePEc:cte:wsrepe:ws033208 USING WEIBULL MIXTURE DISTRIBUTIONS TO MODEL HETEROGENEOUS SURVIVAL DATA (2003). (28) RePEc:cte:wsrepe:ws063815 MULTIVARIATE RISKS AND DEPTH-TRIMMED REGIONS (2006). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:spr:finsto:v:11:y:2007:i:3:p:373-397 Multivariate risks and depth-trimmed regions (2007). Finance and Stochastics Recent citations received in: 2006 (1) RePEc:cte:wsrepe:ws063113 DEPTH-BASED INFERENCE FOR FUNCTIONAL DATA (2006). Universidad Carlos III, Departamento de EstadÃstica y EconometrÃa / Statistics and Econometrics Working Papers (2) RePEc:cte:wsrepe:ws066919 THE EXPECTED CONVEX HULL TRIMMED REGIONS OF A SAMPLE (2006). Universidad Carlos III, Departamento de EstadÃstica y EconometrÃa / Statistics and Econometrics Working Papers Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||