|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

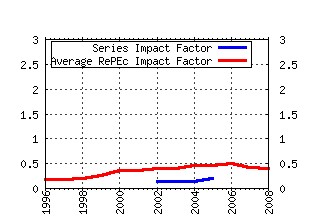

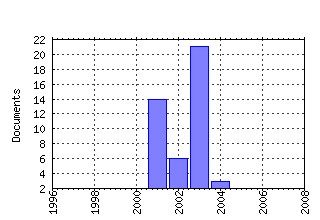

United Nations University, Institute for New Technologies / EIFC - Technology and Finance Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:dgr:unutaf:eifc03-20 Shareholder Wealth Effects of European Domestic and Cross-Border Takeover Bids (2003). (2) RePEc:dgr:unutaf:eifc03-27 Driving Forces of Venture Capital Investments in Europe: A Dynamic Panel Data

Analysis (2003). (3) RePEc:dgr:unutaf:eifc02-11 Financial Constraints on Innovation: A European Cross Country Study (2002). (4) RePEc:dgr:unutaf:eifc01-7 Heterogeneity and Change in European Financial Environments (2001). (5) RePEc:dgr:unutaf:eifc01-3 Technological Diffusion and the Financial Environment (2001). (6) RePEc:dgr:unutaf:eifc03-30 Does Size Matter? Financial Restructuring Under Emu (2003). (7) RePEc:dgr:unutaf:eifc01-4 Venture Capital in Europes Common Market: A Quantitative Description (2001). (8) RePEc:dgr:unutaf:eifc03-26 Labour and Financial Market Determinants of Investment Decisions in Europe (2003). (9) RePEc:dgr:unutaf:eifc03-31 Ingredients for The New Economy: How Much Does Finance Matter? (2003). (10) RePEc:dgr:unutaf:eifc03-24 Learning and Signalling in The French and German Venture Capital Industries (2003). (11) RePEc:dgr:unutaf:eifc01-2 Financial Structure and Investment Decisions: A Survey of Theoretical and Empirical

Work (2001). (12) RePEc:dgr:unutaf:eifc03-28 Financing Constraints in the Inter Firm Diffusion of New Process Technologies (2003). (13) RePEc:dgr:unutaf:eifc01-5 The Growth-Finance Nexus and European Integration. A Review of the Literature (2001). (14) RePEc:dgr:unutaf:eifc02-12 The Determinants of Underpricing: Initial Public Offerings on the Neuer Markt and the

Nouveau Marché (2002). (15) RePEc:dgr:unutaf:eifc01-8 Financial Factors and the Inter Firm Diffusion of New Technology: A Real Options

Model (2001). (16) RePEc:dgr:unutaf:eifc03-25 Investment and Financing Constraints: What Does the Data Tell? (2003). (17) RePEc:dgr:unutaf:eifc01-6 EMU, Monetary Policy and the Role of Financial Constraints (2001). (18) repec:dgr:unutaf:eifc03-23 (). (19) RePEc:dgr:unutaf:eifc03-18 Corporate Finance when Monetary Policy Tightens: How do Banks and Non-Banks Affect

Access to Credit? (2003). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||