|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

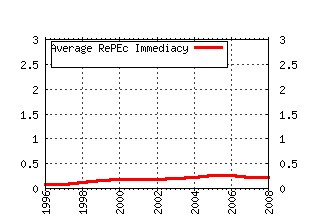

Erasmus University of Rotterdam - Institute for Economic Research / Erasmus University of Rotterdam - Institute for Economic Research Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:erroec:9302-g Theory-Based Measurement of the Saving-Investment Correlation with an Application to Norway. (1993). (2) RePEc:fth:erroec:8905 INTERNATIONAL TRADE AND EXCHANGE RATE VOLATILITY. (1989). (3) RePEc:fth:erroec:9102 AN EMPIRICAL TEST FOR PARITIES BETWEEN METAL PRICES AT THE IME. (1991). (4) RePEc:fth:erroec:9307-p Economic Policy, Model Uncertainty and Elections. (1993). (5) RePEc:fth:erroec:9222-p Rational Voters in Partisanship Model (1992). (6) RePEc:fth:erroec:9115-g Large Multnational Enterprises Based in a Small Economy: Effects on Domestic Investment. (1992). (7) RePEc:fth:erroec:9112-g Popularity Functions Based on the Partisan Theory. (1991). (8) RePEc:fth:erroec:9010 THE DEMAND FOR MONEY IN THE UNITED STATES: EVIDENCE FROM COINTEGRATION TESTS. (1990). (9) RePEc:fth:erroec:9308-g The Dynamics of Entry, Exit and Profitability: An Error Correction Approach for the Retail Industry. (1993). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||