|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

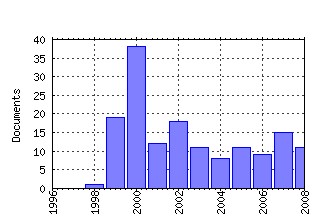

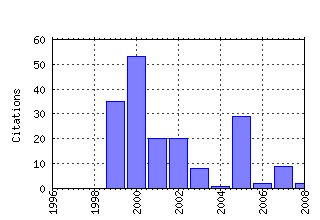

Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:knz:cofedp:0004 Do Lending Relationships Matter? Evidence from Bank Survey Data in Germany (2000). (2) RePEc:knz:cofedp:0206 The processing of non-anticipated information in financial markets: Analyzing the impact of surprises in the employment report (2002). (3) RePEc:knz:cofedp:0005 Does the Governed Corporation Perform Better?

Governance Structures and Corporate Performance in Germany (2000). (4) RePEc:knz:cofedp:0504 Default risk sharing between banks and markets: the contribution of collateralized debt obligations (2005). (5) RePEc:knz:cofedp:9908 Local Polynomial Estimation with a FARIMA-GARCH Error Process (1999). (6) RePEc:knz:cofedp:0111 Iterative plug-in algorithms for SEMIFAR models - definition, convergence and asymptotic properties (2001). (7) RePEc:knz:cofedp:0502 Incentive Contracts and Hedge Fund Management (2005). (8) RePEc:knz:cofedp:9901 When are Options Overpriced? The Black-Scholes Model and

Alternative Characterisations of the Pricing Kernel. (1999). (9) RePEc:knz:cofedp:0104 Estimating the Neighborhood Influence on Decision Makers: Theory and an Application on

the Analysis of Innovation Decisions (2001). (10) RePEc:knz:cofedp:0105 Econometric Analysis of Financial Transaction Data: Pitfalls and Opportunities (2001). (11) RePEc:knz:cofedp:9913 SEMIFAR Forecasts, with Applications to Foreign Exchange Rates (1999). (12) RePEc:knz:cofedp:0002 Horizontal and Vertical R&D Cooperation (2000). (13) RePEc:knz:cofedp:0212 Simultaneously Modelling Conditional Heteroskedasticity and Scale Change (2002). (14) RePEc:knz:cofedp:9916 SEMIFAR Models - A Semiparametric Framework for Modelling Trends, Long

Range Dependence and Nonstationarity (1999). (15) RePEc:knz:cofedp:0509 Mispricing of S&P 500 Index Options (2005). (16) RePEc:knz:cofedp:0016 Data-driven estimation of semiparametric fractional autoregressive models (2000). (17) RePEc:knz:cofedp:0507 An Experimental Test of the Impact of Overconfidence and Gender on Trading Activity (2005). (18) RePEc:knz:cofedp:9904 Misspecified heteroskedasticity in the panel probit model:

A small sample comparison of GMM and SML estimators (1999). (19) RePEc:knz:cofedp:9914 Volatility of Stock Market Indices - An Analysis based on SEMIFAR Models (1999). (20) RePEc:knz:cofedp:0032 Commodity Taxation and international Trade in Imperfect Markets (2000). (21) RePEc:knz:cofedp:0510 The dynamics of overconfidence: Evidence from stock market forecasters (2005). (22) RePEc:knz:cofedp:0305 Multiplicative Background Risk (2003). (23) RePEc:knz:cofedp:0303 A Dynamic Integer Count Data Model for Financial Transaction Prices (2003). (24) RePEc:knz:cofedp:0019 Nonparametric M-Estimation with Long-Memory Errors (2000). (25) RePEc:knz:cofedp:0205 Modelling Intraday Trading Activity Using Box-Cox-ACD Models (2002). (26) RePEc:knz:cofedp:0608 Wie werden Collateralized Debt Obligation-Transaktionen gestaltet? (2006). (27) RePEc:knz:cofedp:0707 Estimating High-Frequency Based (Co-) Variances: A Unified Approach (2007). (28) RePEc:knz:cofedp:9919 Volatility Estimation on the Basis of Price Intensities (1999). (29) RePEc:knz:cofedp:0037 Modifying the double smoothing bandwidth selector in nonparametric regression (2000). (30) RePEc:knz:cofedp:0806 Modelling and Forecasting Multivariate Realized Volatility (2008). (31) RePEc:knz:cofedp:0024 Efficient Bargaining and the Skill-Structure of Wages and Employment (2000). (32) RePEc:knz:cofedp:0708 Two-Dimensional Risk-Neutral Valuation Relationships for the Pricing of

Options. (2007). (33) RePEc:knz:cofedp:0108 Heterogeneity of Investors and Asset Pricing in a Risk-Value World (2001). (34) RePEc:knz:cofedp:9906 The Service Sentiment Indicator - A Business Climate Indicator for the

German Business - Related Services Sector (1999). (35) RePEc:knz:cofedp:9918 SEMIFAR Models, with Applications to Commodities, Exchange Rates and the

Volatility of Stock Market Indices (1999). (36) RePEc:knz:cofedp:0703 Customer Trading in the Foreign Exchange Market: Empirical Evidence from an Internet Trading Platform (2007). (37) RePEc:knz:cofedp:0033 Taxation of Investment and Finance in an International Setting: Implications for Tax Competition (2000). (38) RePEc:knz:cofedp:0404 Conditionally parametric fits for CAPM betas (2004). (39) RePEc:knz:cofedp:0014 Do Forecasters use Monetary Models? An Empirical Analysis of Exchange Rate Expectations (2000). (40) RePEc:knz:cofedp:0028 Einfache oekonomische Verfahren fuer die Kreditrisikomessung (2000). (41) RePEc:knz:cofedp:0306 Double Taxation, Tax Credits and the Information Exchange Puzzle (2003). (42) RePEc:knz:cofedp:0710 Information asymmetries and securitization design (2007). (43) RePEc:knz:cofedp:0023 Is tax harmonization useful? (2000). (44) RePEc:knz:cofedp:0304 Schätzung ökonometrischer Modelle auf der Grundlage anonymisierter Daten (2003). (45) RePEc:knz:cofedp:0003 Finite Sample Properties of One-step, Two-step and Bootstrap Empirical Likelihood Approaches to Efficient GMM Estimation (2000). (46) RePEc:knz:cofedp:0506 Option Pricing: Real and Risk-Neutral Distributions (2005). (47) RePEc:knz:cofedp:9905 A Survey on Nonparametric Time Series Analysis (1999). (48) RePEc:knz:cofedp:0020 Determinants of Inter-Trade Durations and Hazard Rates Using Proportional Hazard ARMA Model (2000). (49) RePEc:knz:cofedp:0215 ML-Estimation in the Location-Scale-Shape Model of the Generalized Logistic Distribution (2002). (50) RePEc:knz:cofedp:0704 An Inflated Multivariate Integer Count Hurdle Model: An Application to Bid and Ask Quote Dynamics (2007). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:knz:cofedp:0702 Panel Intensity Models with Latent Factors: An Application to the Trading Dynamics on the Foreign Exchange Marketä (2007). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:cpr:ceprdp:5006 Offsetting the Incentives: Risk Shifting and Benefits of Benchmarking in Money Management (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:cpr:ceprdp:5420 Demand-Based Option Pricing (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:ecl:ohidic:2005-17 How Much Do Banks Use Credit Derivatives to Reduce Risk? (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (4) RePEc:fip:fedkpr:y:2005:i:aug:p:313-369 Has financial development made the world riskier? (2005). Proceedings (5) RePEc:knz:cofedp:0501 Employee Stock Options: Much More Valuable Than You Thought (2005). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (6) RePEc:knz:cofedp:0510 The dynamics of overconfidence: Evidence from stock market forecasters (2005). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (7) RePEc:nbr:nberwo:11426 Investor Competence, Trading Frequency, and Home Bias (2005). National Bureau of Economic Research, Inc / NBER Working Papers (8) RePEc:nbr:nberwo:11579 How Much Do Banks Use Credit Derivatives to Reduce Risk? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (9) RePEc:nbr:nberwo:11728 Has Financial Development Made the World Riskier? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:nbr:nberwo:11843 Demand-Based Option Pricing (2005). National Bureau of Economic Research, Inc / NBER Working Papers (11) RePEc:zbw:zewdip:4566 The Dynamics of Overconfidence: Evidence from Stock Market Forecasters (2005). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||