|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

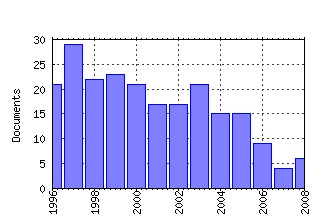

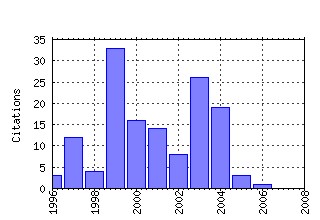

Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics / EPRU Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kud:epruwp:99-17 Can Immigration Alleviate the Demographic Burden? (1999). (2) RePEc:kud:epruwp:00-10 To What Extent Do Fiscal Regimes Equalize Opportunities for Income Acquisition among Citizens? (2000). (3) RePEc:kud:epruwp:03-13 On the Empirics of Foreign Aid and Growth. (2003). (4) RePEc:kud:epruwp:04-03 The Effect of Information on Voter Turnout: Evidence from a Natural Experiment. (2004). (5) RePEc:kud:epruwp:01-07 Tax Spillovers under Separate Accounting and Formula Apportionment. (2001). (6) RePEc:kud:epruwp:93-02 Indirect Taxation in an Integrated Europe. Is there a Way of Avoiding Trade Distortions Without Sacrificing National Tax Autonomy? (1993). (7) RePEc:kud:epruwp:01-05 Formula Apportionment and Transfer Pricing under Oligopolistic Competition. (2001). (8) RePEc:kud:epruwp:97-26 Tax Coordination and Unemployment. (1997). (9) RePEc:kud:epruwp:04-04 Are Corporate Tax Burdens Racing to the Bottom in the European Union? (2004). (10) RePEc:kud:epruwp:04-07 Total Factor Productivity Revisited: A Dual Approach to Development Accounting (2004). (11) RePEc:kud:epruwp:03-16 Information, Polarization and Delegation in Democracy. (2003). (12) RePEc:kud:epruwp:96-13 Is Intervention a Signal of Future Monetary Policy? Evidence from the Federal Funds Futures Market. (1996). (13) RePEc:kud:epruwp:95-06 The Role of Second-Best Theory in Public Economics. (1995). (14) RePEc:kud:epruwp:03-14 Income Skewness, Redistribution and Growth: A Reconciliation. (2003). (15) RePEc:kud:epruwp:99-24 Distributional Effects of Fiscal Consolidation. (1999). (16) RePEc:kud:epruwp:97-24 Protection, Underemployment and Welfare. (1997). (17) RePEc:kud:epruwp:02-12 Sudden Stops and the Mexican Wave: Currency Crises, Capital Flow Reversals and Output Loss in Emerging Markets. (2002). (18) RePEc:kud:epruwp:97-05 Tiebout with Politics: Capital Tax Competition and Constitutional Choices. (1997). (19) RePEc:kud:epruwp:99-05 Lobbying by Ethnic Groups and Aid Allocation. (2003). (20) RePEc:kud:epruwp:05-06 Rules versus Discretion in Foreign Exchange Intervention: Evidence from Official Bank of Canada High-Frequency Data (2005). (21) RePEc:kud:epruwp:98-03 Tax Progression and Human Capital in Imperfect Labour Markets. (1998). (22) RePEc:kud:epruwp:02-10 ECB Foreign Exchange Intervention and the Euro: Institutional Framework, News and Intervention. (2002). (23) RePEc:kud:epruwp:09-07 Club-in-the-Club: Reform under Unanimity (2009). (24) RePEc:kud:epruwp:99-08 Temporary Social Dumping, Union Legalisation and FDI: A Note on the Strategic Use of Standards. (1999). (25) RePEc:kud:epruwp:04-02 A Synthesis of Recent Developments in the Theory of Capital Tax Competition. (2003). (26) RePEc:kud:epruwp:95-07 Environmental Policy and Sustainable Economic Growth - an endogenous growth perspective. (1995). (27) RePEc:kud:epruwp:98-02 When is Policy Harmonisation Desirable? (1998). (28) RePEc:kud:epruwp:03-05 Voluntary Public Unemployment Insurance (2003). (29) RePEc:kud:epruwp:93-06 Why is There Corporate Taxation in a Small Open Economy? The Role of Transfer Pricing and Income Shifting. (1993). (30) RePEc:kud:epruwp:99-09 Is Sterilized Foreign Exchange Intervention Effective After All? An Event Study Approach. (1999). (31) RePEc:kud:epruwp:09-05 Decomposing Firm-level Sales Variation (2009). (32) RePEc:kud:epruwp:01-12 Wage Equality in a General Equilibrium Model with Indivisibilities. (2001). (33) RePEc:kud:epruwp:99-21 Public Schooling, Social Capital and Growth (1999). (34) RePEc:kud:epruwp:04-15 Selection Bias and the Output Costs of IMF Programs (2004). (35) RePEc:kud:epruwp:02-16 The Political Economy of Institutions and Corruption in American States. (2002). (36) RePEc:kud:epruwp:00-20 Political Accountability and the Size of Government: Theory and Cross-Country Evidence. (2000). (37) RePEc:kud:epruwp:97-23 Trade Policy and Access to Retail Distribution. (1997). (38) RePEc:kud:epruwp:00-14 Stopping Hot Money or Signaling Bad Policy? Capital Controls and the Onset of Currency Crises. (2000). (39) RePEc:kud:epruwp:97-04 Borrowed Reserves, Fed Funds Rate Targets, And the Term Structure. (1997). (40) RePEc:kud:epruwp:02-01 Information Sharing, Multiple Nash Equilibria, and Asymmetric Capital-Tax Competition (2002). (41) RePEc:kud:epruwp:06-02 The Causes of Fiscal Transparency: Evidence from the American States (2006). (42) RePEc:kud:epruwp:99-03 Entrepreneurship, Economic Risks, and Risk-Insurance in the Welfare State. (1999). (43) RePEc:kud:epruwp:01-09 A Cure Worse Than The Disease? Currency Crises and the Output Costs of IMF-Supported Stabilization Programs. (2001). (44) RePEc:kud:epruwp:05-01 Technology Spillover through Trade and TFP Convergence: 120 Years of Evidence for the OECD Countries (2005). (45) RePEc:kud:epruwp:99-20 Banking and Currency Crises: How Common Are Twins? (1999). (46) RePEc:kud:epruwp:09-09 The Theory of Optimal Taxation: New Developments and Policy Relevance (2009). (47) RePEc:kud:epruwp:00-17 Why Is the Corporate Tax Rate Lower than the Personal Tax Rate? (2000). (48) RePEc:kud:epruwp:02-07 Taxation if Capital is not Perfectly Mobile: Tax Competition versus Tax Exportation. (2002). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||