|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

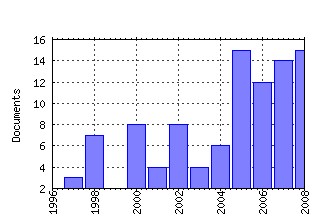

Department of Economics - University Roma Tre / Departmental Working Papers of Economics - University 'Roma Tre' Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

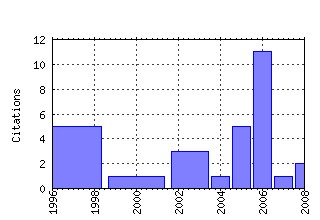

Most cited documents in this series: (1) RePEc:rtr:wpaper:0060 The diffusion of broadband telecommunications: the role of competition (2006). (2) RePEc:rtr:wpaper:0046 A bayesian semi-parametric approach for cost-effectiveness analysis in health economics (2005). (3) RePEc:rtr:wpaper:0034 Semi-parametric modelling for costs of helt care technologies (2003). (4) RePEc:rtr:wpaper:0002 Accomulation of capital (1997). (5) RePEc:rtr:wpaper:0059 Institutional change and human development in transition economies (2006). (6) RePEc:rtr:wpaper:0001 Struttura economica e commercio estero: unanalisi per le province italiane (1997). (7) RePEc:rtr:wpaper:0067 R&D, spillovers, innovatoin systems and the genesis of regional growth in Europe (2006). (8) RePEc:rtr:wpaper:0056 Dynamic portfolio selection in a dual expected utility theory framework (2005). (9) RePEc:rtr:wpaper:0109 Indeterminacy of competitive equilibrium with risk of default (2009). (10) RePEc:rtr:wpaper:0086 CONSTRAINED INEFFICIENCY IN GEI: A GEOMETRIC ARGUMENT (2008). (11) RePEc:rtr:wpaper:0048 Portfolio selection: a linear approach with dual expected utility (2005). (12) RePEc:rtr:wpaper:0089 ASSET PRICES, DEBT CONSTRAINTS AND INEFFICIENCY (2008). (13) RePEc:rtr:wpaper:0042 Credit Frictions, housing prices and optimal monetary policy Rules (2004). (14) repec:rtr:wpaper:0077 (). (15) RePEc:rtr:wpaper:0020 Metodologie per la valutazione delle obbligazioni convertibili in ipotesi di evoluzione stocastica della struttura per scadenza (2000). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:bro:econwp:2008-10 A social welfare function characterizing competitive equilibria of incomplete financial markets (2008). Brown University, Department of Economics / Working Papers Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:liu:liucej:v:3:y:2006:i:2:p:197-238 Institutional Change and Governance Indexes in Transition Economies: the case of Poland (2006). European Journal of Comparative Economics Recent citations received in: 2005 (1) RePEc:rtr:wpaper:0050 Portfolio Selection with minimum transaction lots: an approach with dual expected utility (2005). Department of Economics - University Roma Tre / Departmental Working Papers of Economics - University 'Roma Tre' Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||