|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

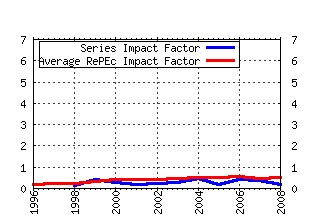

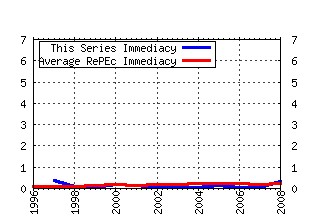

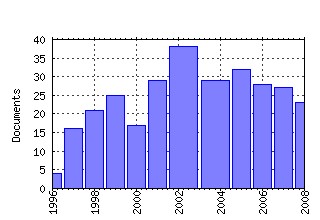

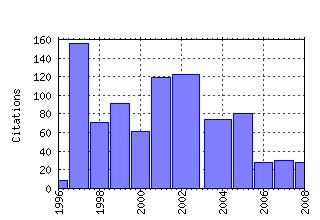

Finance and Stochastics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:spr:finsto:v:1:y:1997:i:4:p:293-330 LIBOR and swap market models and measures (*) (1997). (2) RePEc:spr:finsto:v:1:y:1997:i:2:p:95-129 From the birds eye to the microscope: A survey of new stylized facts of the intra-daily foreign exchange markets (*) (1997). (3) RePEc:spr:finsto:v:2:y:1997:i:1:p:41-68 Processes of normal inverse Gaussian type (1997). (4) RePEc:spr:finsto:v:6:y:2002:i:1:p:49-61 Fourier series method for measurement of multivariate volatilities (2002). (5) RePEc:spr:finsto:v:6:y:2002:i:4:p:429-447 Convex measures of risk and trading constraints (2002). (6) RePEc:spr:finsto:v:5:y:2001:i:3:p:327-341 The numeraire portfolio for unbounded semimartingales (2001). (7) RePEc:spr:finsto:v:3:y:1999:i:2:p:237-248 Hedging and liquidation under transaction costs in currency markets (1999). (8) RePEc:spr:finsto:v:1:y:1997:i:4:p:261-291 Continuous-time term structure models: Forward measure approach (*) (1997). (9) RePEc:spr:finsto:v:5:y:2001:i:2:p:259-272 Utility maximization in incomplete markets with random endowment (2001). (10) RePEc:spr:finsto:v:3:y:1999:i:4:p:391-412 Applications of Malliavin calculus to Monte Carlo methods in finance (1999). (11) RePEc:spr:finsto:v:8:y:2004:i:3:p:311-341 Liquidity risk and arbitrage pricing theory (2004). (12) RePEc:spr:finsto:v:2:y:1998:i:4:p:409-440 Optimization of consumption with labor income (1998). (13) RePEc:spr:finsto:v:3:y:1999:i:4:p:451-482 On dynamic measures of risk (1999). (14) RePEc:spr:finsto:v:6:y:2002:i:4:p:449-471 An analysis of a least squares regression method for American option pricing (2002). (15) RePEc:spr:finsto:v:1:y:1997:i:2:p:131-140 On the range of options prices (*) (1997). (16) RePEc:spr:finsto:v:5:y:2001:i:4:p:557-581 Minimax and minimal distance martingale measures and their relationship to portfolio optimization (2001). (17) RePEc:spr:finsto:v:9:y:2005:i:1:p:29-42 Credit default swap calibration and derivatives pricing with the SSRD stochastic intensity model (2005). (18) RePEc:spr:finsto:v:5:y:2001:i:1:p:61-82 A solution approach to valuation with unhedgeable risks (2001). (19) RePEc:spr:finsto:v:4:y:2000:i:2:p:117-146 Efficient hedging: Cost versus shortfall risk (2000). (20) RePEc:spr:finsto:v:5:y:2001:i:2:p:237-257 Forward rate dependent Markovian transformations of the Heath-Jarrow-Morton term structure model (2001). (21) RePEc:spr:finsto:v:2:y:1998:i:3:p:295-310 Optimal time to invest when the price processes are geometric Brownian motions (1998). (22) RePEc:spr:finsto:v:8:y:2004:i:2:p:229-239 An example of indifference prices under exponential preferences (2004). (23) RePEc:spr:finsto:v:4:y:2000:i:4:p:371-389 Bond pricing in a hidden Markov model of the short rate (2000). (24) RePEc:spr:finsto:v:6:y:2002:i:2:p:173-196 A multicurrency extension of the lognormal interest rate Market Models (2002). (25) RePEc:spr:finsto:v:5:y:2001:i:3:p:389-412 A general characterization of one factor affine term structure models (2001). (26) RePEc:spr:finsto:v:1:y:1997:i:3:p:229-238 An application of hidden Markov models to asset allocation problems (*) (1997). (27) RePEc:spr:finsto:v:9:y:2005:i:4:p:539-561 Conditional and dynamic convex risk measures (2005). (28) RePEc:spr:finsto:v:6:y:2002:i:2:p:237-263 Optimal capital structure and endogenous default (2002). (29) RePEc:spr:finsto:v:2:y:1998:i:3:p:259-273 Local martingales and the fundamental asset pricing theorems in the discrete-time case (1998). (30) RePEc:spr:finsto:v:5:y:2001:i:2:p:131-154 The relaxed investor and parameter uncertainty (2001). (31) RePEc:spr:finsto:v:3:y:1999:i:3:p:251-273 Quantile hedging (1999). (32) RePEc:spr:finsto:v:4:y:2000:i:2:p:209-222 Incompleteness of markets driven by a mixed diffusion (2000). (33) RePEc:spr:finsto:v:5:y:2001:i:4:p:487-509 Existence and structure of stochastic equilibria with intertemporal substitution (2001). (34) RePEc:spr:finsto:v:9:y:2005:i:4:p:453-475 Pricing options on realized variance (2005). (35) RePEc:spr:finsto:v:1:y:1996:i:1:p:69-89 Irreversible investment and industry equilibrium (*) (1996). (36) RePEc:spr:finsto:v:3:y:1999:i:2:p:167-185 A generalization of the mutual fund theorem (1999). (37) RePEc:spr:finsto:v:6:y:2002:i:3:p:371-382 No-arbitrage criteria for financial markets with efficient friction (2002). (38) RePEc:spr:finsto:v:3:y:1999:i:3:p:295-322 Exercise regions of American options on several assets (1999). (39) RePEc:spr:finsto:v:5:y:2001:i:2:p:181-200 Coherent risk measures and good-deal bounds (2001). (40) RePEc:spr:finsto:v:2:y:1998:i:2:p:143-172 Asymptotic arbitrage in large financial markets (1998). (41) RePEc:spr:finsto:v:6:y:2002:i:4:p:473-493 Optimal stopping and perpetual options for Lévy processes (2002). (42) RePEc:spr:finsto:v:9:y:2005:i:2:p:269-298 Inf-convolution of risk measures and optimal risk transfer (2005). (43) RePEc:spr:finsto:v:9:y:2005:i:2:p:197-209 A note on Wick products and the fractional Black-Scholes model (2005). (44) RePEc:spr:finsto:v:2:y:1998:i:2:p:173-198 Mean-variance hedging for continuous processes: New proofs and examples (1998). (45) RePEc:spr:finsto:v:11:y:2007:i:1:p:107-129 Optimal investments for risk- and ambiguity-averse preferences: a duality approach (2007). (46) RePEc:spr:finsto:v:9:y:2005:i:2:p:151-176 Robust utility maximization for complete and incomplete market models (2005). (47) RePEc:spr:finsto:v:3:y:1999:i:4:p:413-432 Minimal realizations of interest rate models (1999). (48) RePEc:spr:finsto:v:8:y:2004:i:1:p:133-144 Convergence of utility functions and convergence of optimal strategies (2004). (49) RePEc:spr:finsto:v:3:y:1999:i:3:p:345-369 Bounds on prices of contingent claims in an intertemporal economy with proportional transaction costs and general preferences (1999). (50) RePEc:spr:finsto:v:7:y:2003:i:1:p:1-27 Numerical solution of jump-diffusion LIBOR market models (2002). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:arx:papers:0802.1823 Moment Explosions and Long-Term Behavior of Affine Stochastic Volatility Models (2008). arXiv.org / Quantitative Finance Papers (2) RePEc:arx:papers:0803.4416 Consistent price systems and face-lifting pricing under transaction costs (2008). arXiv.org / Quantitative Finance Papers (3) RePEc:arx:papers:0804.0482 An introduction to L{e}vy processes with applications in finance (2008). arXiv.org / Quantitative Finance Papers (4) RePEc:arx:papers:0812.4978 Optimal dividend distribution under Markov-regime switching (2008). arXiv.org / Quantitative Finance Papers (5) RePEc:kap:apfinm:v:15:y:2008:i:3:p:155-173 q-Optimal Martingale Measures for Discrete Time Models (2008). Asia-Pacific Financial Markets (6) RePEc:knz:cofedp:0811 Importance sampling for backward SDEs (2008). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (7) RePEc:spr:finsto:v:12:y:2008:i:2:p:245-264 Long run forward rates and long yields of bonds and options in heterogeneous equilibria (2008). Finance and Stochastics (8) RePEc:spr:finsto:v:12:y:2008:i:3:p:411-422 Universal bounds for asset prices in heterogeneous economies (2008). Finance and Stochastics Recent citations received in: 2007 (1) RePEc:hum:wpaper:sfb649dp2007-026 Robust Optimal Control for a Consumption-investment Problem (2007). Sonderforschungsbereich 649, Humboldt University, Berlin, Germany / SFB 649 Discussion Papers (2) RePEc:spr:finsto:v:11:y:2007:i:3:p:323-355 An ODE approach for the expected discounted penalty at ruin in a jump-diffusion model (2007). Finance and Stochastics Recent citations received in: 2006 (1) RePEc:hum:wpaper:sfb649dp2006-051 Regression methods in pricing American and Bermudan options using consumption processes (2006). Sonderforschungsbereich 649, Humboldt University, Berlin, Germany / SFB 649 Discussion Papers (2) RePEc:kap:apfinm:v:13:y:2006:i:2:p:129-149 Risk measures for derivatives with Markov-modulated pure jump processes (2006). Asia-Pacific Financial Markets Recent citations received in: 2005 (1) RePEc:arx:papers:math/0508489 Dynamic exponential utility indifference valuation (2005). arXiv.org / Quantitative Finance Papers (2) RePEc:hum:wpaper:sfb649dp2005-029 Utility duality under additional information: conditional measures versus filtration enlargements (2005). Sonderforschungsbereich 649, Humboldt University, Berlin, Germany / SFB 649 Discussion Papers (3) RePEc:kap:annfin:v:1:y:2005:i:2:p:149-177 Relative arbitrage in volatility-stabilized markets (2005). Annals of Finance (4) RePEc:ner:leuven:urn:hdl:123456789/122216 Risk measurement with the equivalent utility principles. (2005). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven (5) RePEc:nuf:econwp:0516 Variation, jumps, market frictions and high frequency data in financial econometrics (2005). Economics Group, Nuffield College, University of Oxford / Economics Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||