|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

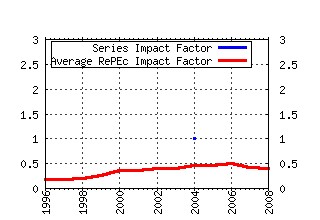

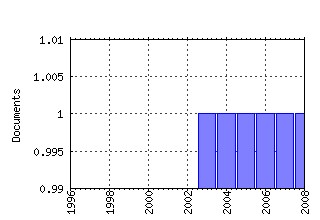

Directorate General Taxation and Customs Union, European Commission / Taxation trends Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:tax:taxtre:2009 Taxation trends in the European Union: 2009 edition (2009). (2) RePEc:tax:taxtre:2008 Taxation trends in the European Union: 2008 edition (2008). (3) RePEc:tax:taxtre:2003 Taxation trends in the European Union: 2003 edition (2003). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:bde:opaper:0809 The composition of public finances and long-term growth: a macroeconomic approach (2008). Banco de Espana / Banco de Espana Occasional Papers (2) RePEc:iza:izadps:dp3721 Effects of Flat Tax Reforms in Western Europe on Income Distribution and Work Incentives (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (3) RePEc:pra:mprapa:14761 Tax burden by economic function A comparison for the EU Member States (2008). University Library of Munich, Germany / MPRA Paper (4) RePEc:wii:rpaper:rr:352 Western Balkan Countries: Adjustment Capacity to External Shocks, with a Focus on Labour Markets (2008). The Vienna Institute for International Economic Studies, wiiw / Research Reports Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||