|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

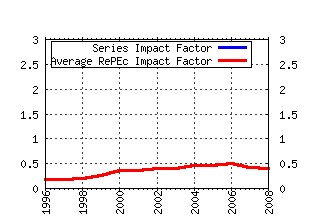

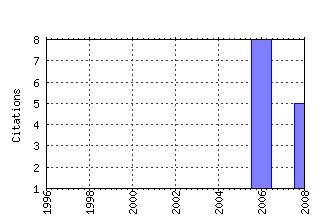

Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ttp:iibwps:08 The Contradiction in Chinaââ¬â¢s Gradualist Banking Reforms (2006). (2) RePEc:ttp:iibwps:13 Tax Policy in Developing Countries: Looking Back and Forward (2008). (3) RePEc:ttp:iibwps:12 Tax Challenges Facing Developing Countries (2008). (4) RePEc:ttp:iibwps:15 The Impact on Investment of Replacing a Retail Sales Tax by a Value-Added Tax: Evidence from Canadian Experience (2008). (5) RePEc:ttp:iibwps:09 Financial reforms in China and India: A comparative analysis (2007). (6) RePEc:ttp:iibwps:14 The Economic Incidence of Replacing a Retail Sales Tax by a Value-Added Tax: Evidence from Canadian Experience (2008). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:ays:ispwps:paper0804 The BBLR Approach to tax Reform in Emerging Countries (2008). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:cdh:commen:273 Growth Oriented Sales Tax Reform for Ontario: Replacing the Retail Sales Tax with a 7.5 Percent Value-Added Tax (2008). C.D. Howe Institute / Commentaries Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||