|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

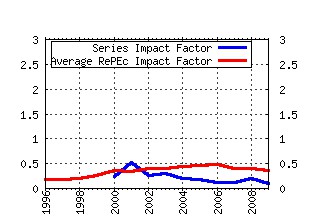

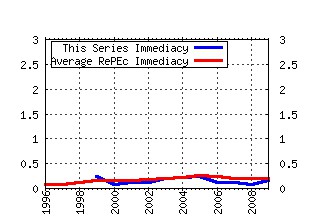

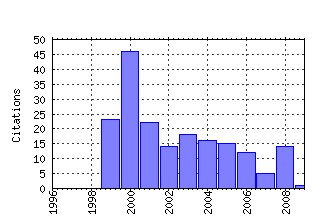

CeNDEF Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ams:ndfwpp:00-02 A Nonlinear Structural Model for Volatility Clustering (2000). (2) RePEc:ams:ndfwpp:00-04 Bifurcation Routes to Volatility Clustering (2000). (3) RePEc:ams:ndfwpp:01-06 Modeling the stylized facts in finance through simple nonlinear adaptive systems (2001). (4) RePEc:ams:ndfwpp:01-01 Evolutionary Dynamics in Financial Markets With Many Trader Types (2001). (5) RePEc:ams:ndfwpp:05-02 A nonlinear structural model for volatility clustering (2005). (6) RePEc:ams:ndfwpp:06-05 Price Stability and Volatility in Markets with Positive and Negative Expectations Feedback: An Experimental Investigation (2006). (7) RePEc:ams:ndfwpp:03-03 Bifurcation Routes to Volatility Clustering under Evolutionary Learning (2003). (8) RePEc:ams:ndfwpp:99-04 Endogenous Fluctuations under Evolutionary Pressure in Cournot Competition (1999). (9) RePEc:ams:ndfwpp:02-10 Evolutionary dynamics in markets with many trader types (2002). (10) RePEc:ams:ndfwpp:08-05 Complex evolutionary systems in behavioral finance (2008). (11) RePEc:ams:ndfwpp:99-01 Complex Nonlinear Dynamics and Computational Methods (1999). (12) RePEc:ams:ndfwpp:03-05 Heterogeneity as a natural source of randomness (2003). (13) RePEc:ams:ndfwpp:99-06 The Instability of a Heterogeneous Cobweb economy: a Strategy Experiment on Expectation Formation (1999). (14) RePEc:ams:ndfwpp:04-16 Goodness-of-fit test for copulas (2004). (15) RePEc:ams:ndfwpp:02-14 Heterogeneous Expectations, Exchange Rate Dynamics and Predictability (2002). (16) RePEc:ams:ndfwpp:00-09 Testing for a Unit Root with Near-Integrated Volatility (2000). (17) RePEc:ams:ndfwpp:04-08 A Computational Electoral Competition Model with Social Clustering and Endogenous Interest Groups as Information Brokers (2004). (18) RePEc:ams:ndfwpp:05-10 Illinois Walls: How barring indirect purchaser suits facilitates collusion (2005). (19) RePEc:ams:ndfwpp:99-05 Cobweb Dynamics under Bounded Rationality (1999). (20) RePEc:ams:ndfwpp:08-03 Partial Likelihood-Based Scoring Rules for Evaluating Density Forecasts in Tails (2008). (21) repec:ams:ndfwpp:04-03 (). (22) RePEc:ams:ndfwpp:03-11 The dynamics of price dispersion, or Edgeworth variations (2003). (23) RePEc:ams:ndfwpp:99-02 Consistent Testing for Serial Independence (1999). (24) RePEc:ams:ndfwpp:07-06 Evolution of Market Heuristics (2007). (25) RePEc:ams:ndfwpp:99-07 Expectation Driven Price Volatility in an Experimental Cobweb Economy (1999). (26) RePEc:ams:ndfwpp:00-06 Succes and Failure of Technical Trading Strategies in the Cocoa Futures Markets (2000). (27) RePEc:ams:ndfwpp:05-12 Behavioral Heterogeneity in Stock Prices (2005). (28) RePEc:ams:ndfwpp:07-02 Informative advertising by an environmental group (2007). (29) RePEc:ams:ndfwpp:03-04 Does eductive stability imply evolutionary stability? (2003). (30) RePEc:ams:ndfwpp:00-03 Financial Markets as Nonlinear Adaptive Evolutionary Systems (2000). (31) RePEc:ams:ndfwpp:04-10 A note on the Hiemstra-Jones test for Granger non-causality (2004). (32) RePEc:ams:ndfwpp:06-02 Price and Wealth Dynamics in a Speculative Market with Generic Procedurally Rational Traders (2006). (33) RePEc:ams:ndfwpp:07-10 Wealth Selection in a Financial Market with Heterogeneous Agents (2007). (34) RePEc:ams:ndfwpp:09-12 Bifurcations of optimal vector fields in the shallow lake model (0000). (35) RePEc:ams:ndfwpp:06-10 A Behavioral Model for Participation Games with Negative Feedback (2006). (36) RePEc:ams:ndfwpp:03-02 Nonlinear Mean Reversion in Stock Prices (2003). (37) RePEc:ams:ndfwpp:08-08 Interest Rate Rules with Heterogeneous Expectations (2008). (38) RePEc:ams:ndfwpp:04-09 Skiba points for small discount rates (2004). (39) RePEc:ams:ndfwpp:05-17 Wealth-Driven Competition in a Speculative Financial Market: Examples With Maximizing Agents (2005). (40) RePEc:ams:ndfwpp:02-06 Learning in Coweb Experiments (2002). (41) RePEc:ams:ndfwpp:03-08 Structural analysis of optimal investment for firms with non-concave production (2003). (42) RePEc:ams:ndfwpp:09-02 Forward and Backward Dynamics in implicitly defined Overlapping Generations Models (2009). (43) RePEc:ams:ndfwpp:06-08 Taxation on Agglomeration (2006). (44) RePEc:ams:ndfwpp:08-06 On the Leitmann equivalent problem approach (2008). (45) RePEc:ams:ndfwpp:02-04 A Gevrey regular KAM theorem and the inverse approximation lemma (2002). (46) RePEc:ams:ndfwpp:08-13 Managing the environment and the economy in the presence of hysteresis and irreversibility (2008). (47) RePEc:ams:ndfwpp:04-15 Forming price expectations in positive and negative feedback systems (2004). (48) RePEc:ams:ndfwpp:06-07 Markov-Perfect Nash Equilibria in Models With a Single Capital Stock (2006). (49) RePEc:ams:ndfwpp:02-13 Representativeness of News and Exchange Rate Dynamics (2002). (50) RePEc:ams:ndfwpp:04-07 Imperfect Competition Law Enforcement (2004). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:pra:mprapa:18296 Tariff and Equilibrium Indeterminacy - A Global Analysis (2009). MPRA Paper Recent citations received in: 2008 (1) RePEc:ecb:ecbwps:20080969 Comparing and evaluating Bayesian predictive distributions of asset returns. (2008). Working Paper Series Recent citations received in: 2007 (1) RePEc:ams:ndfwpp:07-07 Complexity, Evolution and Learning: a simple story of heterogeneous expectations and some empirical and experimental validation. (2007). CeNDEF Working Papers (2) RePEc:ams:ndfwpp:07-14 Asset Prices, Traders Behavior, and Market Design (2007). CeNDEF Working Papers Recent citations received in: 2006 (1) RePEc:ams:ndfwpp:06-10 A Behavioral Model for Participation Games with Negative Feedback (2006). CeNDEF Working Papers (2) RePEc:dgr:uvatin:20060073 A Behavioral Model for Participation Games with Negative Feedback (2006). Tinbergen Institute Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||