|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

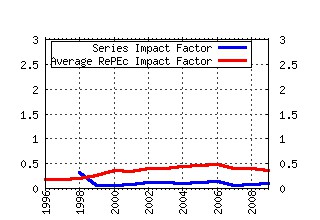

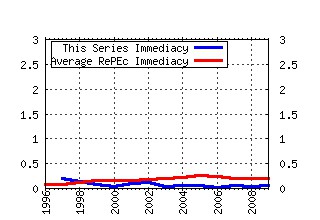

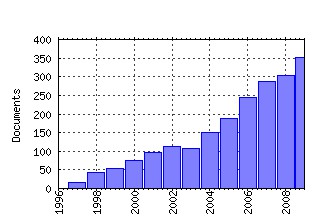

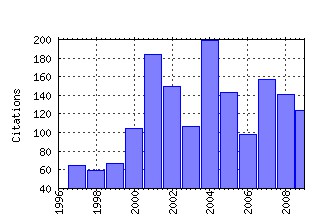

Quantitative Finance Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:arx:papers:0708.2090 The Product Space Conditions the Development of Nations (2007). (2) RePEc:arx:papers:cond-mat/0311053 The long memory of the efficient market (2004). (3) RePEc:arx:papers:cond-mat/0307332 Fluctuations and response in financial markets: the subtle nature of

`random price changes (2003). (4) RePEc:arx:papers:cond-mat/9804100 Universal features in the growth dynamics of complex organizations (1998). (5) RePEc:arx:papers:cond-mat/0104295 On the coherence of Expected Shortfall (2002). (6) RePEc:arx:papers:cond-mat/0312703 What really causes large price changes? (2004). (7) RePEc:arx:papers:cond-mat/9705087 Scaling in stock market data: stable laws and beyond (1997). (8) RePEc:arx:papers:cond-mat/9907161 Scaling of the distribution of price fluctuations of individual

companies (1999). (9) RePEc:arx:papers:physics/0511191 The Production Function (2005). (10) RePEc:arx:papers:cond-mat/9905305 Scaling of the distribution of fluctuations of financial market indices (1999). (11) RePEc:arx:papers:cond-mat/0106520 Significance of log-periodic precursors to financial crashes (2001). (12) RePEc:arx:papers:cond-mat/9702082 Scaling behavior in economics: I. Empirical results for company growth (1997). (13) RePEc:arx:papers:cond-mat/0111310 Testing the Gaussian Copula Hypothesis for Financial Assets Dependences (2001). (14) RePEc:arx:papers:0809.0822 How markets slowly digest changes in supply and demand (2008). (15) RePEc:arx:papers:cond-mat/0105191 Expected Shortfall: a natural coherent alternative to Value at Risk (2001). (16) RePEc:arx:papers:physics/0512005 The Growth of Business Firms: Theoretical Framework and Empirical

Evidence (2005). (17) RePEc:arx:papers:0905.1518 Colloquium: Statistical mechanics of money, wealth, and income (2009). (18) RePEc:arx:papers:1110.5544 The Verdoorn Law in the Portuguese Regions: A Panel Data Analysis (2011). (19) RePEc:arx:papers:physics/0502066 Structure and Evolution of the World Trade Network (2005). (20) RePEc:arx:papers:cond-mat/0309233 The Predictive Power of Zero Intelligence in Financial Markets (2004). (21) RePEc:arx:papers:cond-mat/0310061 Do Pareto-Zipf and Gibrat laws hold true? An analysis with European

Firms (2003). (22) RePEc:arx:papers:cond-mat/0403051 Fitness-dependent topological properties of the World Trade Web (2004). (23) RePEc:arx:papers:1110.5552 Sectoral Convergence in Output Per Worker Between Portuguese Regions (2011). (24) RePEc:arx:papers:cond-mat/0102304 Expected Shortfall as a Tool for Financial Risk Management (2001). (25) RePEc:arx:papers:cond-mat/0006454 Fractional calculus and continuous-time finance II: the waiting-time

distribution (2000). (26) RePEc:arx:papers:0708.1756 Optimal execution strategies in limit order books with general shape

functions (2010). (27) RePEc:arx:papers:1103.2914 Pollution permits, Strategic Trading and Dynamic Technology Adoption (2011). (28) RePEc:arx:papers:cond-mat/0103600 Agent-based simulation of a financial market (2001). (29) RePEc:arx:papers:cond-mat/0103544 Exponential and power-law probability distributions of wealth and income

in the United Kingdom and the United States (2001). (30) RePEc:arx:papers:cond-mat/0106657 Quantifying Stock Price Response to Demand Fluctuations (2001). (31) RePEc:arx:papers:math/0405293 Optimal investment with random endowments in incomplete markets (2004). (32) RePEc:arx:papers:cond-mat/0301289 Pareto Law in a Kinetic Model of Market with Random Saving Propensity (2004). (33) RePEc:arx:papers:cond-mat/9903369 The statistical properties of the volatility of price fluctuations (1999). (34) RePEc:arx:papers:hep-th/9710148 Physics of Finance (1997). (35) RePEc:arx:papers:cond-mat/0401300 Networks of equities in financial markets (2004). (36) RePEc:arx:papers:cond-mat/0004263 The Nasdaq crash of April 2000: Yet another example of log-periodicity

in a speculative bubble ending in a crash (2000). (37) RePEc:arx:papers:cond-mat/0210475 Statistical theory of the continuous double auction (2002). (38) RePEc:arx:papers:cond-mat/9709118 A Prototype Model of Stock Exchange (1997). (39) RePEc:arx:papers:math/0508448 Utility maximization in incomplete markets (2005). (40) RePEc:arx:papers:cond-mat/0008113 Statistical Properties of Share Volume Traded in Financial Markets (2000). (41) RePEc:arx:papers:cond-mat/0102305 From Rational Bubbles to Crashes (2001). (42) RePEc:arx:papers:0709.1543 Kinetic Exchange Models for Income and Wealth Distributions (2007). (43) RePEc:arx:papers:cond-mat/0203046 Probability distribution of returns in the Heston model with stochastic

volatility (2002). (44) RePEc:arx:papers:cond-mat/0001432 Statistical mechanics of money (2000). (45) RePEc:arx:papers:cond-mat/0104341 A Nonlinear Super-Exponential Rational Model of Speculative Financial

Bubbles (2002). (46) RePEc:arx:papers:cond-mat/0106114 Analyzing and modelling 1+1d markets (2001). (47) RePEc:arx:papers:physics/0303028 2000-2003 Real Estate Bubble in the UK but not in the USA (2003). (48) RePEc:arx:papers:cond-mat/0004256 Statistical mechanics of money: How saving propensity affects its

distribution (2000). (49) RePEc:arx:papers:cond-mat/0309416 On the origin of power law tails in price fluctuations (2004). (50) RePEc:arx:papers:0912.3028 Credit Default Swap Calibration and Equity Swap Valuation under

Counterparty Risk with a Tractable Structural Model (2009). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:arx:papers:0801.0718 On the Stickiness Property (2009). Quantitative Finance Papers (2) RePEc:arx:papers:0805.3397 How to quantify the influence of correlations on investment diversification (2009). Quantitative Finance Papers (3) RePEc:arx:papers:0809.3405 Analysis of Fourier transform valuation formulas and applications (2009). Quantitative Finance Papers (4) RePEc:arx:papers:0904.1805 Implementing Loss Distribution Approach for Operational Risk (2009). Quantitative Finance Papers (5) RePEc:arx:papers:0904.1903 Minimizing the expected market time to reach a certain wealth level (2009). Quantitative Finance Papers (6) RePEc:arx:papers:0904.4074 Dynamic operational risk: modeling dependence and combining different sources of information (2009). Quantitative Finance Papers (7) RePEc:arx:papers:0904.4075 Modeling operational risk data reported above a time-varying threshold (2009). Quantitative Finance Papers (8) RePEc:arx:papers:0905.1518 Colloquium: Statistical mechanics of money, wealth, and income (2009). Quantitative Finance Papers (9) RePEc:arx:papers:0907.4950 Heterogeneous Beliefs with Partial Observations (2009). Quantitative Finance Papers (10) RePEc:arx:papers:0908.0348 The Structure and Growth of Weighted Networks (2009). Quantitative Finance Papers (11) RePEc:arx:papers:0909.1478 Markov Chain Monte Carlo on Asymmetric GARCH Model Using the Adaptive Construction Scheme (2009). Quantitative Finance Papers (12) RePEc:arx:papers:0909.2885 Financial bubbles analysis with a cross-sectional estimator (2009). Quantitative Finance Papers (13) RePEc:arx:papers:0911.0057 Scaling and memory in the non-poisson process of limit order cancelation (2009). Quantitative Finance Papers (14) RePEc:arx:papers:0911.5503 Finitely additive probabilities and the Fundamental Theorem of Asset Pricing (2009). Quantitative Finance Papers (15) RePEc:arx:papers:0912.0372 Variance Optimal Hedging for continuous time processes with independent increments and applications (2009). Quantitative Finance Papers (16) RePEc:arx:papers:0912.2016 Superfamily classification of nonstationary time series based on DFA scaling exponents (2009). Quantitative Finance Papers (17) RePEc:arx:papers:0912.3031 Credit Default Swap Calibration and Counterparty Risk Valuation with a Scenario based First Passage Model (2009). Quantitative Finance Papers (18) RePEc:arx:papers:0912.4404 Credit Calibration with Structural Models: The Lehman case and Equity Swaps under Counterparty Risk (2009). Quantitative Finance Papers (19) RePEc:fce:doctra:0924 The Structure and Growth of International Trade (2009). Documents de Travail de l'OFCE (20) RePEc:hal:journl:inria-00425077 Systematic risk analysis: first steps towards a new definition of beta (2009). Post-Print (21) RePEc:hal:wpaper:hal-00616581 THE INTRODUCTION OF EMERGING CURRENCIES INTO A PORTFOLIO: TOWARDS A MORE COMPLETE DIVERSIFICATION MODEL (2009). Working Papers (22) RePEc:pra:mprapa:14476 Does economics need a scientific revolution? (2009). MPRA Paper (23) RePEc:pra:mprapa:15039 A fair price for motor fuel in the United States (2009). MPRA Paper (24) RePEc:pra:mprapa:19887 Dynamic Pairs Trading Strategy For The Companies Listed In The Istanbul Stock Exchange (2009). MPRA Paper (25) RePEc:vnm:wpaper:189 The dynamics of social interaction with agentsâ heterogeneity (2009). Working Papers (26) RePEc:zbw:ifwedp:7481 Distribution of Labour Productivity in Japan over the Period 1996Â-2006 (2009). Economics Discussion Papers Recent citations received in: 2008 (1) RePEc:arx:papers:0801.4305 Risk-Seeking versus Risk-Avoiding Investments in Noisy Periodic Environments (2008). Quantitative Finance Papers (2) RePEc:arx:papers:0802.3541 Intermittency and Localization (2008). Quantitative Finance Papers (3) RePEc:arx:papers:0802.4311 Multistep Bayesian strategy in coin-tossing games and its application to asset trading games in continuous time (2008). Quantitative Finance Papers (4) RePEc:arx:papers:0805.0540 Probability distribution of returns in the exponential Ornstein-Uhlenbeck model (2008). Quantitative Finance Papers (5) RePEc:arx:papers:0807.3464 Joint analysis and estimation of stock prices and trading volume in Barndorff-Nielsen and Shephard stochastic volatility models (2008). Quantitative Finance Papers (6) RePEc:arx:papers:0811.0490 Modelling real GDP per capita in the USA: cointegration test (2008). Quantitative Finance Papers (7) RePEc:arx:papers:0812.4052 The general mixture-diffusion SDE and its relationship with an uncertain-volatility option model with volatility-asset decorrelation (2008). Quantitative Finance Papers (8) RePEc:ces:ceswps:_2465 The Great Risk Shift? Income Volatility in an International Perspective (2008). CESifo Working Paper Series (9) RePEc:knz:cofedp:0805 A Boltzmann-type Approach to the Formation of Wealth Distribution Curves (2008). CoFE Discussion Paper (10) RePEc:nbr:nberwo:14220 Happiness Inequality in the United States (2008). NBER Working Papers (11) RePEc:nbr:nberwo:14465 What Happened To The Quants In August 2007?: Evidence from Factors and Transactions Data (2008). NBER Working Papers (12) RePEc:rdg:icmadp:icma-dp2008-06 An analytically tractable time-changed jump-diffusion default intensity model (2008). (13) RePEc:spr:finsto:v:12:y:2008:i:4:p:441-468 Pricing by hedging and no-arbitrage beyond semimartingales (2008). Finance and Stochastics (14) RePEc:zbw:ifwedp:7463 Superstatistics of Labour Productivity in Manufacturing and Nonmanufacturing Sectors (2008). Economics Discussion Papers (15) RePEc:zbw:ifwedp:7466 Power-Law and Log-Normal Distributions in Firm Size Displacement Data (2008). Economics Discussion Papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-43 Microstructure Noise in the Continuous Case: The Pre-Averaging Approach - JLMPV-9 (2007). CREATES Research Papers (2) RePEc:ams:ndfwpp:07-14 Asset Prices, Traders Behavior, and Market Design (2007). CeNDEF Working Papers (3) RePEc:arx:papers:0710.0459 Statistical properties of agent-based market area model (2007). Quantitative Finance Papers (4) RePEc:arx:papers:0710.2402 Intraday pattern in bid-ask spreads and its power-law relaxation for Chinese A-share stocks (2007). Quantitative Finance Papers (5) RePEc:arx:papers:0710.5497 Multifractality in the Random Parameters Model (2007). Quantitative Finance Papers (6) RePEc:arx:papers:0711.1595 Likelihood-based inference for correlated diffusions (2007). Quantitative Finance Papers (7) RePEc:arx:papers:0712.1483 Continuous-time trading and emergence of volatility (2007). Quantitative Finance Papers (8) RePEc:epa:cepawp:2007-3 WP 2007-3 An International Comparison of the Incomes of the Vast Majority (2007). SCEPA Working Papers (9) RePEc:pra:mprapa:2128 Fokker-Planck and Chapman-Kolmogorov equations for Ito processes with finite memory (2007). MPRA Paper (10) RePEc:pra:mprapa:2256 Martingales, Detrending Data, and the Efficient Market Hypothesis (2007). MPRA Paper (11) RePEc:pra:mprapa:5303 Martingales, the efficient market hypothesis, and spurious stylized facts (2007). MPRA Paper (12) RePEc:pra:mprapa:5811 Ito Processes with Finitely Many States of Memory (2007). MPRA Paper (13) RePEc:pra:mprapa:5813 Empirically Based Modeling in the Social Sciences and Spurious Stylized Facts (2007). MPRA Paper (14) RePEc:pra:mprapa:5996 International Trade Patterns over the Last Four Decades: How does Portugal Compare with other Cohesion Countries? (2007). MPRA Paper (15) RePEc:ptu:wpaper:w200714 International Trade Patterns over the Last Four Decades: How does Portugal Compare with other Cohesion Countries? (2007). Working Papers (16) RePEc:spr:jeicoo:v:2:y:2007:i:2:p:111-124 Patterns of dominant flows in the world trade web (2007). Journal of Economic Interaction and Coordination (17) RePEc:ssa:lemwps:2007/25 Using Complex Network Analysis to Assess the Evolution of International Economic Integration: The cases of East Asia and Latin America (2007). LEM Papers Series (18) RePEc:zbw:sfb475:200741 Microstructure noise in the continuous case: the pre-averaging approach (2007). Technical Reports Recent citations received in: 2006 (1) RePEc:arx:papers:cond-mat/0312406 Power law for ensembles of stock prices (2006). Quantitative Finance Papers (2) RePEc:arx:papers:math/0606520 Multivariate risks and depth-trimmed regions (2006). Quantitative Finance Papers (3) RePEc:arx:papers:math/0612649 General Duality for Perpetual American Options (2006). Quantitative Finance Papers (4) RePEc:arx:papers:physics/0508156 Size matters: some stylized facts of the stock market revisited (2006). Quantitative Finance Papers (5) RePEc:arx:papers:physics/0603012 The Process of price formation and the skewness of asset returns (2006). Quantitative Finance Papers (6) RePEc:pra:mprapa:73 The Distribution of Model Averaging Estimators and an Impossibility Result Regarding Its Estimation (2006). MPRA Paper (7) RePEc:spr:eurphb:v:50:y:2006:i:1:p:123-127 A precursor of market crashes: Empirical laws of Japans internet bubble (2006). The European Physical Journal B - Condensed Matter and Complex Systems Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||