|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

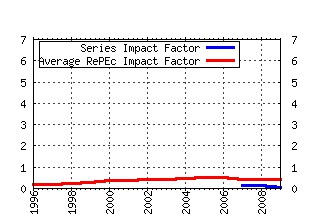

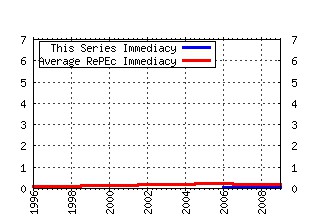

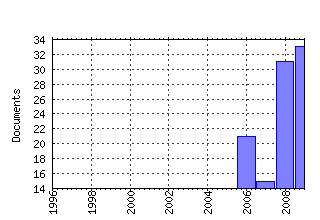

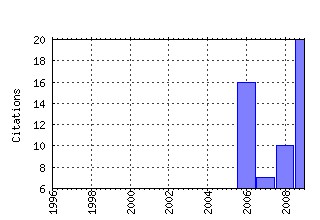

Financial Management Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:finmgt:v:38:y:2009:i:4:p:781-816 A Multistage Model of Loans and the Role of Relationships (2009). (2) RePEc:bla:finmgt:v:38:y:2009:i:1:p:1-37 Capital Structure Decisions: Which Factors Are Reliably Important? (2009). (3) RePEc:bla:finmgt:v:35:y:2006:i:1:p:5-29 Penny Stock IPOs (2006). (4) RePEc:bla:finmgt:v:39:y:2010:i:3:p:863-904 Family Control of Firms and Industries (2010). (5) RePEc:bla:finmgt:v:35:y:2006:i:2:p:43-65 The Dynamic Relation Between Returns and Idiosyncratic Volatility (2006). (6) RePEc:bla:finmgt:v:37:y:2008:i:1:p:103-124 An Empirical Analysis of the Stockholder-Bondholder Conflict in Corporate Spin-Offs (2008). (7) RePEc:bla:finmgt:v:38:y:2009:i:2:p:253-284 The Impact of Fundamentals on IPO Valuation (2009). (8) RePEc:bla:finmgt:v:37:y:2008:i:4:p:611-624 Managerial Response to the May 2003 Dividend Tax Cut (2008). (9) RePEc:bla:finmgt:v:35:y:2006:i:3:p:53-79 Institutional Environment and Sovereign Credit Ratings (2006). (10) RePEc:bla:finmgt:v:35:y:2006:i:3:p:5-33 On the Accuracy of Different Measures of q (2006). (11) RePEc:bla:finmgt:v:38:y:2009:i:1:p:139-160 Corporate Governance Ratings and Firm Performance (2009). (12) RePEc:bla:finmgt:v:38:y:2009:i:3:p:441-486 Should Venture Capitalists Put All Their Eggs in One Basket? Diversification versus Pure-Play Strategies in Venture Capital (2009). (13) RePEc:bla:finmgt:v:36:y:2007:i:3:p:49-62 Asset Opaqueness and Split Bond Ratings (2007). (14) RePEc:bla:finmgt:v:35:y:2006:i:4:p:49-70 A Comparison of Syndicated Loan Pricing at Investment and Commercial Banks (2006). (15) RePEc:bla:finmgt:v:36:y:2007:i:2:p:1-38 Whats in Your 403(b)? Academic Retirement Plans and the Costs of Underdiversification (2007). (16) RePEc:bla:finmgt:v:35:y:2006:i:3:p:97-116 Corporate Social Performance and Stock Returns: UK Evidence from Disaggregate Measures (2006). (17) RePEc:bla:finmgt:v:39:y:2010:i:4:p:1367-1401 What Matters in Venture Capital? Evidence from Entrepreneursâ Stated Preferences (2010). (18) RePEc:bla:finmgt:v:36:y:2007:i:2:p:1-21 Intra-lndustry Effects of Corporate Capital Investment Announcements (2007). (19) RePEc:bla:finmgt:v:37:y:2008:i:1:p:1-21 The Impact of Firm Location on Equity Issuance (2008). (20) RePEc:bla:finmgt:v:38:y:2009:i:1:p:185-206 International Evidence on Financial Derivatives Usage (2009). (21) RePEc:bla:finmgt:v:36:y:2007:i:2:p:1-20 IPO Underpricing, Firm Quality, and Analyst Forecasts (2007). (22) RePEc:bla:finmgt:v:37:y:2008:i:3:p:413-430 Corporate Debt Issuance and the Historical Level of Interest Rates (2008). (23) RePEc:bla:finmgt:v:38:y:2009:i:3:p:663-686 Trade Receivables Policy of Distressed Firms and Its Effect on the Costs of Financial Distress (2009). (24) RePEc:bla:finmgt:v:36:y:2007:i:3:p:63-80 Lockup and Voluntary Earnings Forecast Disclosure in IPOs (2007). (25) RePEc:bla:finmgt:v:39:y:2010:i:1:p:33-57 Protecting Minority Shareholders: Listed versus Unlisted Firms (2010). (26) RePEc:bla:finmgt:v:35:y:2006:i:4:p:5-30 Value of Conglomerates and Capital Market Conditions (2006). (27) RePEc:bla:finmgt:v:37:y:2008:i:2:p:341-364 Capital Structure Choice in a Nascent Market: Evidence from Listed Firms in China (2008). (28) RePEc:bla:finmgt:v:35:y:2006:i:2:p:67-91 The Determinants and Implications of Mutual Fund Cash Holdings: Theory and Evidence (2006). (29) RePEc:bla:finmgt:v:39:y:2010:i:4:p:1719-1742 Emerging from Chapter 11 Bankruptcy: Is It Good News or Bad News for Industry Competitors? (2010). (30) RePEc:bla:finmgt:v:39:y:2010:i:1:p:273-299 Do Lead Banks Exploit Syndicate Participants? Evidence from Ex Post Risk (2010). (31) RePEc:bla:finmgt:v:37:y:2008:i:1:p:45-79 The IPO Derby: Are There Consistent Losers and Winners on This Track? (2008). (32) RePEc:bla:finmgt:v:38:y:2009:i:2:p:381-409 Equity Market Comovement and Contagion: A Sectoral Perspective (2009). (33) RePEc:bla:finmgt:v:39:y:2010:i:4:p:1601-1642 Management Quality and Equity Issue Characteristics: A Comparison of SEOs and IPOs (2010). (34) RePEc:bla:finmgt:v:37:y:2008:i:4:p:769-790 Foreign Exchange Volatility Is Priced in Equities (2008). (35) RePEc:bla:finmgt:v:39:y:2010:i:1:p:129-152 Do Corporate Venture Capitalists Add Value to Start-Up Firms? Evidence from IPOs and Acquisitions of VC-Backed Companies (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:eti:dpaper:09043 Customer Relationships and the Provision of Trade Credit during a Recession (2009). Discussion papers (2) RePEc:kap:jfsres:v:35:y:2009:i:3:p:189-224 Relationship Banking and the Pricing of Financial Services (2009). Journal of Financial Services Research Recent citations received in: 2008 (1) RePEc:pra:mprapa:13155 The Effect of Corporate Break-ups on Information Asymmetry: A Market Microstructure Analysis (2008). MPRA Paper Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:ise:isegwp:wp352006 What Hides Behind Sovereign Debt Ratings? (2006). Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||