|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

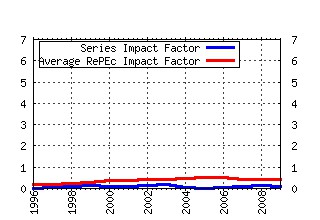

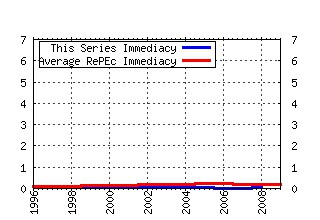

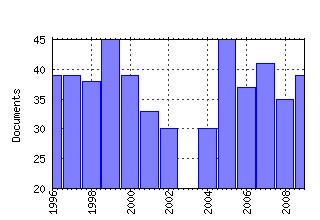

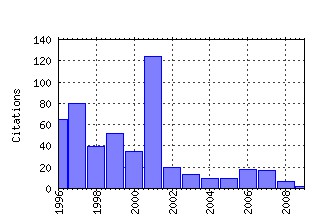

Journal of Applied Corporate Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jacrfn:v:14:y:2001:i:1:p:67-79 DISAPPEARING DIVIDENDS: CHANGING FIRM CHARACTERISTICS OR LOWER PROPENSITY TO PAY? (2001). (2) RePEc:bla:jacrfn:v:8:y:1995:i:2:p:4-18 SPECIFIC AND GENERAL KNOWLEDGE, AND ORGANIZATIONAL STRUCTURE (1995). (3) RePEc:bla:jacrfn:v:9:y:1997:i:4:p:8-22 THE POLITICAL ROOTS OF AMERICAN CORPORATE FINANCE (1997). (4) RePEc:bla:jacrfn:v:7:y:1995:i:4:p:4-19 THE DETERMINANTS OF CORPORATE LEVERAGE AND DIVIDEND POLICIES (1995). (5) RePEc:bla:jacrfn:v:6:y:1993:i:3:p:16-32 THEORY OF RISK CAPITAL IN FINANCIAL FIRMS (1993). (6) RePEc:bla:jacrfn:v:4:y:1991:i:2:p:13-34 CORPORATE CONTROL AND THE POLITICS OF FINANCE (1991). (7) RePEc:bla:jacrfn:v:4:y:1992:i:4:p:12-22 FINANCIAL INNOVATION AND ECONOMIC PERFORMANCE (1992). (8) RePEc:bla:jacrfn:v:5:y:1992:i:2:p:4-16 CAPITAL CHOICES: CHANGING THE WAY AMERICA INVESTS IN INDUSTRY (1992). (9) RePEc:bla:jacrfn:v:14:y:2001:i:3:p:8-21 VALUE MAXIMIZATION, STAKEHOLDER THEORY, AND THE CORPORATE OBJECTIVE FUNCTION (2001). (10) RePEc:bla:jacrfn:v:7:y:1994:i:1:p:66-74 THE MARKETS PROBLEMS WITH THE PRICING OF INITIAL PUBLIC OFFERINGS (1994). (11) RePEc:bla:jacrfn:v:9:y:1996:i:3:p:8-25 RETHINKING RISK MANAGEMENT (1996). (12) RePEc:bla:jacrfn:v:9:y:1996:i:3:p:52-63 INCORPORATING COUNTRY RISK IN THE VALUATION OF OFFSHORE PROJECTS (1996). (13) RePEc:bla:jacrfn:v:11:y:1998:i:3:p:8-15 Financial Markets and Economic Growth (1998). (14) RePEc:bla:jacrfn:v:7:y:1994:i:2:p:4-19 THE NATURE OF MAN (1994). (15) RePEc:bla:jacrfn:v:2:y:1989:i:1:p:35-44 Active Investors, LBOs, and the Privatization of Bankruptcy (1989). (16) RePEc:bla:jacrfn:v:3:y:1990:i:1:p:65-76 THE PERFORMANCE OF REAL ESTATE AS AN ASSET CLASS (1990). (17) RePEc:bla:jacrfn:v:7:y:1995:i:4:p:62-76 METALLGESELLSCHAFT AND THE ECONOMICS OF SYNTHETIC STORAGE (1995). (18) RePEc:bla:jacrfn:v:2:y:1990:i:4:p:6-18 STRATEGIC RISK MANAGEMENT (1990). (19) RePEc:bla:jacrfn:v:12:y:1999:i:1:p:8-20 THE CAPITAL STRUCTURE PUZZLE: ANOTHER LOOK AT THE EVIDENCE (1999). (20) RePEc:bla:jacrfn:v:3:y:1990:i:2:p:60-69 Do Bad Bidders Become Good Targets? (1990). (21) RePEc:bla:jacrfn:v:10:y:1997:i:1:p:114-122 TWO DCF APPROACHES FOR VALUING COMPANIES UNDER ALTERNATIVE FINANCING STRATEGIES (AND HOW TO CHOOSE BETWEEN THEM) (1997). (22) RePEc:bla:jacrfn:v:11:y:1999:i:4:p:8-20 THE ACTIVE BOARD OF DIRECTORS AND ITS EFFECT ON THE PERFORMANCE OF THE LARGE PUBLICLY TRADED CORPORATION (1999). (23) RePEc:bla:jacrfn:v:15:y:2002:i:1:p:8-23 HOW DO CFOs MAKE CAPITAL BUDGETING AND CAPITAL STRUCTURE DECISIONS? (2002). (24) RePEc:bla:jacrfn:v:10:y:1997:i:3:p:84-95 Financial Innovation in the Management of Catastrophe Risk (1997). (25) RePEc:bla:jacrfn:v:6:y:1993:i:3:p:33-41 THE TRAJECTORY OF CORPORATE FINANCIAL RISK MANAGEMENT (1993). (26) RePEc:bla:jacrfn:v:9:y:1996:i:2:p:83-93 RAROC AT BANK OF AMERICA: FROM THEORY TO PRACTICE (1996). (27) RePEc:bla:jacrfn:v:7:y:1994:i:3:p:22-33 A FRAMEWORK FOR RISK MANAGEMENT (1994). (28) RePEc:bla:jacrfn:v:9:y:1997:i:4:p:30-45 CORPORATE OWNERSHIP AND CONTROL IN THE U.K., GERMANY, AND FRANCE (1997). (29) RePEc:bla:jacrfn:v:9:y:1996:i:3:p:25-39 USING PROJECT FINANCE TO FUND INFRASTRUCTURE INVESTMENTS (1996). (30) RePEc:bla:jacrfn:v:4:y:1992:i:4:p:4-11 FINANCIAL INNOVATION: ACHIEVEMENTS AND PROSPECTS (1992). (31) RePEc:bla:jacrfn:v:18:y:2006:i:2:p:98-105 Incentives and Investor Expectations (2006). (32) RePEc:bla:jacrfn:v:8:y:1995:i:1:p:106-121 MATURITY STRUCTURE OF A HEDGE MATTERS: LESSONS FROM THE METALLGESELLSCHAFT DEBACLE (1995). (33) RePEc:bla:jacrfn:v:14:y:2001:i:3:p:80-95 STRUCTURING LOAN SYNDICATES: A CASE STUDY OF THE HONG KONG DISNEYLAND PROJECT LOAN (2001). (34) RePEc:bla:jacrfn:v:19:y:2007:i:1:p:55-73 The Evolution of Shareholder Activism in the United States (2007). (35) RePEc:bla:jacrfn:v:12:y:2000:i:4:p:94-101 THE PRIVATE COMPANY DISCOUNT (2000). (36) RePEc:bla:jacrfn:v:10:y:1997:i:2:p:98-109 EVA AND DIVISIONAL PERFORMANCE MEASUREMENT: CAPTURING SYNERGIES AND OTHER ISSUES (1997). (37) RePEc:bla:jacrfn:v:13:y:2000:i:1:p:75-87 ARE PROJECT FINANCE LOANS DIFFERENT FROM OTHER SYNDICATED CREDITS? (2000). (38) RePEc:bla:jacrfn:v:5:y:1992:i:2:p:42-58 SHAREHOLDER TRADING PRACTICES AND CORPORATE INVESTMENT HORIZONS (1992). (39) RePEc:bla:jacrfn:v:11:y:1999:i:4:p:36-48 DOES VENTURE CAPITAL REQUIRE AN ACTIVE STOCK MARKET? (1999). (40) RePEc:bla:jacrfn:v:3:y:1990:i:3:p:36-49 CEO INCENTIVES - ITS NOT HOW MUCH YOU PAY, BUT HOW (1990). (41) RePEc:bla:jacrfn:v:1:y:1989:i:4:p:27-48 Managing Financial Risk (1989). (42) RePEc:bla:jacrfn:v:16:y:2004:i:4:p:89-100 Reappearing Dividends (2004). (43) RePEc:bla:jacrfn:v:17:y:2005:i:4:p:8-23 Pay Without Performance: Overview of the Issues (2005). (44) RePEc:bla:jacrfn:v:14:y:2001:i:3:p:35-48 RECENT DEVELOPMENTS IN GERMAN CAPITAL MARKETS AND CORPORATE GOVERNANCE (2001). (45) RePEc:bla:jacrfn:v:7:y:1994:i:2:p:40-45 SELF-INTEREST, ALTRUISM, INCENTIVES, AND AGENCY THEORY (1994). (46) RePEc:bla:jacrfn:v:6:y:1993:i:1:p:4-14 STILL SEARCHING FOR OPTIMAL CAPITAL STRUCTURE (1993). (47) RePEc:bla:jacrfn:v:15:y:2003:i:4:p:51-57 CREATING VALUE IN PENSION PLANS (OR, GENTLEMEN PREFER BONDS) (2003). (48) RePEc:bla:jacrfn:v:7:y:1995:i:4:p:90-104 SECURITIES INNOVATIONS: A HISTORICAL AND FUNCTIONAL PERSPECTIVE (1995). (49) RePEc:bla:jacrfn:v:11:y:1998:i:1:p:54-65 MEASURING CORPORATE TAX RATES AND TAX INCENTIVES: A NEW APPROACH (1998). (50) RePEc:bla:jacrfn:v:22:y:2010:i:3:p:8-21 The Squam Lake Report: Fixing the Financial System (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:uta:papers:2008_17 Ownership Structure and Financial Performance: Evidence from Panel Data of South Korea (2008). Working Paper Series, Department of Economics, University of Utah Recent citations received in: 2007 (1) RePEc:ecl:stabus:1918r2 The Wall Street Walk and Shareholder Activism: Exit as a Form of Voice (2007). Research Papers Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||