|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

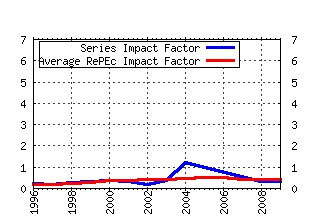

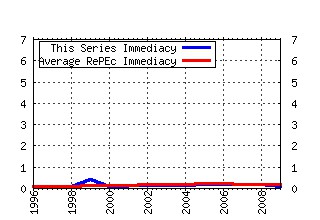

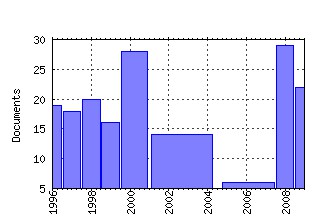

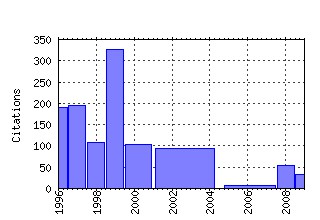

Mathematical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:mathfi:v:9:y:1999:i:3:p:203-228 Coherent Measures of Risk (1999). (2) RePEc:bla:mathfi:v:6:y:1996:i:4:p:379-406 A YIELD-FACTOR MODEL OF INTEREST RATES (1996). (3) repec:bla:mathfi:v:7:y:1997:i:2:p:211-239 (). (4) RePEc:bla:mathfi:v:8:y:1998:i:4:p:291-323 Long memory in continuous-time stochastic volatility models (1998). (5) RePEc:bla:mathfi:v:2:y:1992:i:2:p:87-106 ALTERNATIVE CHARACTERIZATIONS OF AMERICAN PUT OPTIONS (1992). (6) RePEc:bla:mathfi:v:10:y:2000:i:1:p:39-52 The Minimal Entropy Martingale Measure and the Valuation Problem in Incomplete Markets (2000). (7) RePEc:bla:mathfi:v:5:y:1995:i:1:p:55-72 VOLATILITY STRUCTURES OF FORWARD RATES AND THE DYNAMICS OF THE TERM STRUCTURE (1995). (8) RePEc:bla:mathfi:v:1:y:1991:i:2:p:1-14 Optimal Stopping and the American Put (1991). (9) RePEc:bla:mathfi:v:2:y:1992:i:2:p:63-86 DERIVATIVE ASSET PRICING WITH TRANSACTION COSTS (1992). (10) RePEc:bla:mathfi:v:7:y:1997:i:1:p:1-71 Backward Stochastic Differential Equations in Finance (1997). (11) RePEc:bla:mathfi:v:4:y:1994:i:2:p:155-167 MAXIMUM LIKELIHOOD ESTIMATION USING PRICE DATA OF THE DERIVATIVE CONTRACT (1994). (12) RePEc:bla:mathfi:v:4:y:1994:i:2:p:183-204 MODELING STOCHASTIC VOLATILITY: A REVIEW AND COMPARATIVE STUDY (1994). (13) RePEc:bla:mathfi:v:6:y:1996:i:3:p:279-302 OPTION HEDGING AND IMPLIED VOLATILITIES IN A STOCHASTIC VOLATILITY MODEL (1996). (14) RePEc:bla:mathfi:v:9:y:1999:i:4:p:323-348 Interest Rate Dynamics and Consistent Forward Rate Curves (1999). (15) RePEc:bla:mathfi:v:2:y:1992:i:3:p:153-187 Option Pricing Under Incompleteness and Stochastic Volatility (1992). (16) RePEc:bla:mathfi:v:5:y:1995:i:3:p:197-232 ARBITRAGE IN SECURITIES MARKETS WITH SHORT-SALES CONSTRAINTS (1995). (17) RePEc:bla:mathfi:v:12:y:2002:i:3:p:271-286 Monte Carlo valuation of American options (2002). (18) RePEc:bla:mathfi:v:5:y:1995:i:1:p:13-32 THE GARCH OPTION PRICING MODEL (1995). (19) RePEc:bla:mathfi:v:15:y:2005:i:1:p:1-26 (). (20) RePEc:bla:mathfi:v:7:y:1997:i:2:p:157-176 The Potential Approach to the Term Structure of Interest Rates and Foreign Exchange Rates (1997). (21) RePEc:bla:mathfi:v:7:y:1997:i:4:p:399-412 Contingent Claims and Market Completeness in a Stochastic Volatility Model (1997). (22) RePEc:bla:mathfi:v:7:y:1997:i:1:p:95-105 Arbitrage with Fractional Brownian Motion (1997). (23) RePEc:bla:mathfi:v:8:y:1998:i:1:p:49-65 Consumption and Portfolio Selection with Labor Income: A Continuous Time Approach (1998). (24) RePEc:bla:mathfi:v:8:y:1998:i:1:p:27-48 Complete Models with Stochastic Volatility (1998). (25) RePEc:bla:mathfi:v:9:y:1999:i:1:p:31-53 Term Structure Models Driven by General Lévy Processes (1999). (26) RePEc:bla:mathfi:v:2:y:1992:i:4:p:217-237 Pricing Options On Risky Assets In A Stochastic Interest Rate Economy (1992). (27) RePEc:bla:mathfi:v:12:y:2002:i:4:p:287-298 A DIFFUSION MODEL FOR ELECTRICITY PRICES (2002). (28) RePEc:bla:mathfi:v:11:y:2001:i:4:p:385-413 (). (29) RePEc:bla:mathfi:v:7:y:1997:i:2:p:127-155 The Market Model of Interest Rate Dynamics (1997). (30) RePEc:bla:mathfi:v:11:y:2001:i:4:p:447-474 (). (31) RePEc:bla:mathfi:v:18:y:2008:i:2:p:269-292 OPTIMAL RISK SHARING FOR LAW INVARIANT MONETARY UTILITY FUNCTIONS (2008). (32) RePEc:bla:mathfi:v:12:y:2002:i:4:p:329-339 MARKET SELECTION OF FINANCIAL TRADING STRATEGIES: GLOBAL STABILITY (2002). (33) RePEc:bla:mathfi:v:7:y:1997:i:4:p:351-374 Market Volatility and Feedback Effects from Dynamic Hedging (1997). (34) RePEc:bla:mathfi:v:15:y:2005:i:2:p:203-212 (). (35) RePEc:bla:mathfi:v:6:y:1996:i:3:p:303-322 MARTINGALE APPROACH TO PRICING PERPETUAL AMERICAN OPTIONS ON TWO STOCKS (1996). (36) RePEc:bla:mathfi:v:7:y:1997:i:3:p:241-286 The Valuation of American Options on Multiple Assets (1997). (37) RePEc:bla:mathfi:v:4:y:1994:i:3:p:223-245 CONTINGENT CLAIMS VALUED AND HEDGED BY PRICING AND INVESTING IN A BASIS (1994). (38) RePEc:bla:mathfi:v:6:y:1996:i:2:p:215-236 EQUILIBRIUM STATE PRICES IN A STOCHASTIC VOLATILITY MODEL (1996). (39) RePEc:bla:mathfi:v:10:y:2000:i:2:p:179-195 On Models of Default Risk (2000). (40) RePEc:bla:mathfi:v:18:y:2008:i:3:p:385-426 BEHAVIORAL PORTFOLIO SELECTION IN CONTINUOUS TIME (2008). (41) RePEc:bla:mathfi:v:5:y:1995:i:4:p:311-336 OPTION PRICING USING THE TERM STRUCTURE OF INTEREST RATES TO HEDGE SYSTEMATIC DISCONTINUITIES IN ASSET RETURNS (1995). (42) RePEc:bla:mathfi:v:7:y:1997:i:4:p:325-349 A Continuity Correction for Discrete Barrier Options (1997). (43) RePEc:bla:mathfi:v:7:y:1997:i:3:p:307-324 An Asymptotic Analysis of an Optimal Hedging Model for Option Pricing with Transaction Costs (1997). (44) RePEc:bla:mathfi:v:12:y:2002:i:2:p:125-134 (). (45) repec:bla:mathfi:v:10:y:2000:i:1:p:1-21 (). (46) RePEc:bla:mathfi:v:3:y:1993:i:3:p:241-276 OPTIMAL INVESTMENT STRATEGIES FOR CONTROLLING DRAWDOWNS (1993). (47) RePEc:bla:mathfi:v:12:y:2002:i:3:p:239-269 Portfolio Value-at-Risk with Heavy-Tailed Risk Factors (2002). (48) RePEc:bla:mathfi:v:1:y:1991:i:4:p:39-55 Option Pricing With V. G. Martingale Components (1991). (49) RePEc:bla:mathfi:v:2:y:1992:i:2:p:107-130 REPRESENTING MARTINGALE MEASURES WHEN ASSET PRICES ARE CONTINUOUS AND BOUNDED (1992). (50) RePEc:bla:mathfi:v:12:y:2002:i:4:p:427-446 PRICING COUPON-BOND OPTIONS AND SWAPTIONS IN AFFINE TERM STRUCTURE MODELS (2002). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:arx:papers:0906.0394 Asymptotic Formulas with Error Estimates for Call Pricing Functions and the Implied Volatility at Extreme Strikes (2009). Quantitative Finance Papers (2) RePEc:imf:imfwpa:09/162 Recent Advances in Credit Risk Modeling (2009). IMF Working Papers Recent citations received in: 2008 (1) RePEc:arx:papers:0803.2198 On Agents Agreement and Partial-Equilibrium Pricing in Incomplete Markets (2008). Quantitative Finance Papers (2) RePEc:ner:dauphi:urn:hdl:123456789/116 Méthodes numériques pour la valorisation doptions swings et autres problèmes sur les matières premières. (2008). Open Access publications from Université Paris-Dauphine (3) RePEc:rdg:icmadp:icma-dp2008-02 Stochastic Local Volatility (2008). (4) RePEc:spr:finsto:v:12:y:2008:i:3:p:423-439 Optimal capital and risk allocations for law- and cash-invariant convex functions (2008). Finance and Stochastics (5) RePEc:spr:finsto:v:12:y:2008:i:4:p:469-505 Arbitrage-free market models for option prices: the multi-strike case (2008). Finance and Stochastics Recent citations received in: 2007 (1) RePEc:cla:levrem:122247000000001669 Long-term Risk: An Operator Approach (2007). Levine's Bibliography Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||