|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

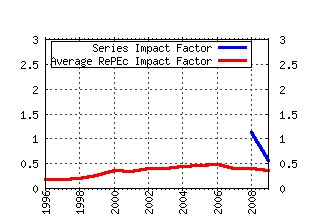

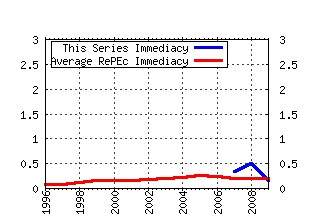

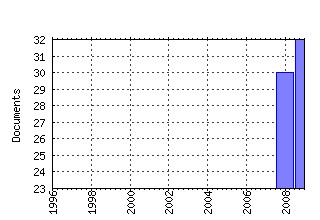

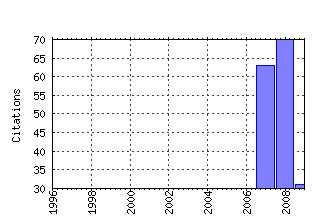

Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:btx:wpaper:0702 The Impact of Taxation on the Location of Capital, Firms and Profit: a Survey of Empirical Evidence (2007). (2) RePEc:btx:wpaper:0803 What determines the use of holding companies and ownership chains? (2008). (3) RePEc:btx:wpaper:0705 Taxing corporate income (2007). (4) RePEc:btx:wpaper:0821 Corporate taxation in the OECD in a wider context (2008). (5) RePEc:btx:wpaper:0715 Should Capital Income be Subject to Consumption-Based Taxation? (2007). (6) RePEc:btx:wpaper:0908 Incorporation and Taxation: Theory and Firm-level Evidence (2009). (7) RePEc:btx:wpaper:0822 Corporate Tax Elasticities A Readers Guide to Empirical Findings (2008). (8) RePEc:btx:wpaper:0904 Corporate Taxation and Multinational Activity (2009). (9) RePEc:btx:wpaper:0707 The Direct Incidence of Corporate Income Tax on Wages (2007). (10) RePEc:btx:wpaper:0812 Increased efficiency through consolidation and formula apportionment in the European Union? (2008). (11) RePEc:btx:wpaper:0811 Firm-specific Forward-looking Effective Tax Rates (2008). (12) RePEc:btx:wpaper:0824 Taxation of Outbound Direct Investment: Economic Principles and Tax Policy Considerations (2008). (13) RePEc:btx:wpaper:0801 The Property Tax Incidence Debate and the Mix of State and Local Finance of Local Public Expenditures (2008). (14) RePEc:btx:wpaper:0916 Profit Taxation and Finance Constraints (2009). (15) RePEc:btx:wpaper:0804 Thin Capitalization Rules in the Context of the CCCTB (2008). (16) RePEc:btx:wpaper:0924 The Power of Dynastic Commitment (2009). (17) RePEc:btx:wpaper:0706 The Effects of EU Formula Apportionment on Corporate Tax Revenues (2007). (18) RePEc:btx:wpaper:0802 Bilateral Effective Tax Rates and Foreign Direct Investment (2008). (19) RePEc:btx:wpaper:0820 What Problems and Opportunities are Created by Tax Havens? (2008). (20) RePEc:btx:wpaper:0918 Internal Debt and Multinationals Profit Shifting - Empirical Evidence from Firm-Level Panel Data (2009). (21) RePEc:btx:wpaper:0830 Tax Competition in an Expanding European Union (2008). (22) RePEc:btx:wpaper:0810 Economic integration and the relationship between profit and wage taxes (2008). (23) RePEc:btx:wpaper:0704 Developments in the Taxation of Corporate Profit in the OECD since 1965: Rates, Bases and Revenues (2007). (24) RePEc:btx:wpaper:0815 Firms financial choices and thin capitalization rules under corporate tax competition (2008). (25) RePEc:btx:wpaper:0814 Alternative Approaches to Tax Risk and Tax Avoidance: analysis of a face-to-face corporate survey (2008). (26) RePEc:btx:wpaper:0914 Corporate Taxation and the Choice of Patent Location within Multinational Firms (2009). (27) RePEc:btx:wpaper:0931 Corporate Taxation and the Choice of Patent Location within Multinational Firms (2009). (28) RePEc:btx:wpaper:0823 The European Commission´s Proposal for a Common Consolidated Corporate Tax Base (2008). (29) RePEc:btx:wpaper:0907 Optimal tax policy when firms are internationallly mobile (2009). (30) RePEc:btx:wpaper:0828 Taxes, Institutions and Foreign Diversification Opportunities (2008). (31) RePEc:btx:wpaper:0703 Taxes in the EU New Member States and the Location of Capital and Profit (2007). (32) RePEc:btx:wpaper:0719 Taxing Foreign Profits with International Mergers and Acquisitions (2007). (33) RePEc:btx:wpaper:1013 Corporate tax effects on the quality and quantity of FDI (2010). (34) RePEc:btx:wpaper:1123 Wages and International Tax Competition (2011). (35) RePEc:btx:wpaper:0903 Investment abroad and adjustment at home: evidence from UK multinational firms (2009). (36) RePEc:btx:wpaper:1007 Evaluating Neutrality Properties of Corporate Tax Reforms (2010). (37) RePEc:btx:wpaper:0825 International Taxation and Multinational Firm Location Decisions (2008). (38) RePEc:btx:wpaper:1105 Measuring the burden of the corporate income tax under imperfect competition (2011). (39) RePEc:btx:wpaper:0701 The Effects of Dividend Taxes on Equity Prices: A Re-examination of the 1997 UK Tax Reform (2007). (40) RePEc:btx:wpaper:0901 Formula Apportionment: Is it better than the current system and are there better alternatives? (2009). (41) RePEc:btx:wpaper:0713 Corporation Tax Revenue Growth in the UK: A Microsimulation Analysis (2007). (42) RePEc:btx:wpaper:1001 Corporate tax consolidation and enhanced coorporation in the European Union (2010). (43) RePEc:btx:wpaper:0926 Foreign Taxes, Domestic Income, and the Jump in the Share of Multinational Company Income Abroad (2009). (44) RePEc:btx:wpaper:0816 Cross-Border Tax Effects on Affiliate Investment - Evidence from European Multinationals (2008). (45) RePEc:btx:wpaper:1016 Bank Bailouts, International Linkages and Cooperation (2010). (46) RePEc:btx:wpaper:0712 Corporation Tax Buoyancy and Revenue Elasticity in the UK (2007). (47) RePEc:btx:wpaper:0917 The Direct Incidence of Corporate Income Tax on Wages (2009). (48) RePEc:btx:wpaper:0720 Outsourcing, Unemployment and Welfare Policy (2007). (49) RePEc:btx:wpaper:0925 Tax Haven Activities and the Tax Liabilities of Multinational Groups (2009). (50) RePEc:btx:wpaper:1014 How Should Financial Intermediation Services be Taxed? (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:btx:wpaper:0915 Planning and Policy Issues Raised by the Structure of the U.S. International Tax Rules (2009). Working Papers (2) RePEc:btx:wpaper:0931 Corporate Taxation and the Choice of Patent Location within Multinational Firms (2009). Working Papers (3) RePEc:ces:ceswps:_2879 Corporate Taxation and the Choice of Patent Location within Multinational Firms (2009). CESifo Working Paper Series (4) RePEc:ces:ceswps:_2899 Taxation of Foreign Profits with Heterogeneous Multinational Firms (2009). CESifo Working Paper Series (5) RePEc:pra:mprapa:23441 Le tasse in Europa dagli anni novanta (2009). MPRA Paper Recent citations received in: 2008 (1) RePEc:ays:ispwps:paper0815 The Efficiency Costs of Local Property Tax (2008). International Studies Program Working Paper Series, at AYSPS, GSU (2) RePEc:btx:wpaper:0812 Increased efficiency through consolidation and formula apportionment in the European Union? (2008). Working Papers (3) RePEc:btx:wpaper:0815 Firms financial choices and thin capitalization rules under corporate tax competition (2008). Working Papers (4) RePEc:btx:wpaper:0821 Corporate taxation in the OECD in a wider context (2008). Working Papers (5) RePEc:btx:wpaper:0824 Taxation of Outbound Direct Investment: Economic Principles and Tax Policy Considerations (2008). Working Papers (6) RePEc:btx:wpaper:0827 Strategic Consolidation under Formula Apportionment (2008). Working Papers (7) RePEc:btx:wpaper:0830 Tax Competition in an Expanding European Union (2008). Working Papers (8) RePEc:ces:ceswps:_2366 (Post-)Materialist Attitudes and the Mix of Capital and Labour Taxation (2008). CESifo Working Paper Series (9) RePEc:ces:ceswps:_2429 Firmsâ Financial Choices and Thin Capitalization Rules under Corporate Tax Competition (2008). CESifo Working Paper Series (10) RePEc:ces:ceswps:_2456 Thin-Capitalization Rules and Company Responses Experience from German Legislation (2008). CESifo Working Paper Series (11) RePEc:ces:ceswps:_2484 Strategic Consolidation under Formula Apportionment (2008). CESifo Working Paper Series (12) RePEc:ces:ifowps:_62 The Impact of Thin-Capitalization Rules on External Debt Usage â A Propensity Score Matching Approach (2008). Ifo Working Paper Series (13) RePEc:han:dpaper:dp-404 (Post-)Materialist Attitudes and the Mix of Capital and Labour Taxation (2008). Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hannover (14) RePEc:hhs:nhhfms:2008_019 Multinationals, Minority Ownership and Tax-Efficient Financing Structures (2008). Discussion Papers (15) RePEc:zbw:bubdp1:7555 Foreign (in)direct investment and corporate taxation (2008). Discussion Paper Series 1: Economic Studies Recent citations received in: 2007 (1) RePEc:ays:ispwps:paper0715 Economic Effects of A Personal Capital Income Tax Add-on to a Consumption Tax (2007). International Studies Program Working Paper Series, at AYSPS, GSU (2) RePEc:ays:ispwps:paper0716 Consumption-Based Direct Taxes: A Guide Tour of the Amusement Park (2007). International Studies Program Working Paper Series, at AYSPS, GSU (3) RePEc:btx:wpaper:0714 Europe Slowly Lurches to a Common Consolidated Corporate Tax Base: Issues at Stake (2007). Working Papers (4) RePEc:ces:ceswps:_1884 Corporate Tax Policy and International Mergers and Acquisitions â Is the Tax Exemption System Superior? (2007). CESifo Working Paper Series (5) RePEc:ces:ceswps:_1887 Saving Taxes Through Foreign Plant Ownership (2007). CESifo Working Paper Series (6) RePEc:dgr:uvatin:20070076 Will Corporate Tax Consolidation improve Efficiency in the EU ? (2007). Tinbergen Institute Discussion Papers (7) RePEc:mlb:wpaper:998 Modelling Behavioural Responses to Profit Taxation: The Case of the UK Corporation Tax (2007). Department of Economics - Working Papers Series (8) RePEc:zbw:zewdip:6891 The Effects of Multinationals? Profit Shifting Activities on Real Investments (2007). ZEW Discussion Papers Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||