|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

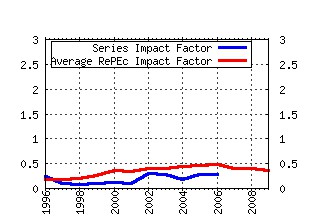

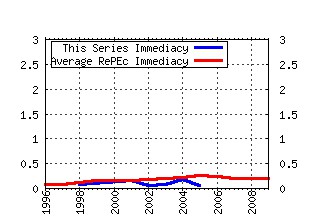

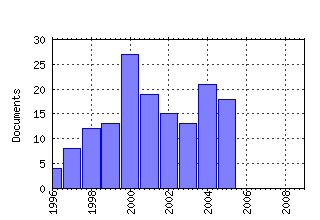

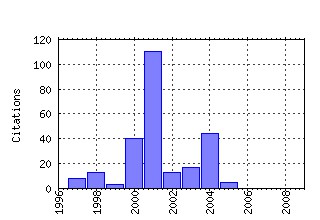

University of California at Los Angeles, Anderson Graduate School of Management Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cdl:anderf:71173 Valuing American Options by Simulation: A Simple Least-Squares Approach (2001). (2) RePEc:cdl:anderf:4687 Agency and Asset Pricing (1993). (3) RePEc:cdl:anderf:4852 The MIDAS Touch: Mixed Data Sampling Regression Models (2004). (4) RePEc:cdl:anderf:2304 The Components of Corporate Credit Spreads: Default, Recovery, Tax, Jumps, Liquidity, and Market Factors (2001). (5) RePEc:cdl:anderf:4684 An Analytic Solution for Interest Rate Swap Spreads (1995). (6) RePEc:cdl:anderf:2211 An Econometric Model of the Yield Curve With Macroeconomic Jump Effects (2001). (7) RePEc:cdl:anderf:5436 Price Volatility, International Market Links and their Implications for Regulatory Policies (1989). (8) RePEc:cdl:anderf:6386 Facilitation of Competing Bids and the Price of a Takeover Target (1989). (9) RePEc:cdl:anderf:3343 Credit Risk and Risk Neutral Default Probabilities: Information About Migrations and Defaults (1998). (10) RePEc:cdl:anderf:2887 Stochastic Correlation Across International Stock Markets (2000). (11) RePEc:cdl:anderf:2900 The Market Price of Credit Risk: An Empirical Analysis of Interest Rate Swap Spreads (2000). (12) RePEc:cdl:anderf:3404 Bond Pricing with Default Risk (1997). (13) RePEc:cdl:anderf:4681 Regime Shifts in Short Term Riskless Interest Rates (1995). (14) RePEc:cdl:anderf:3339 Relative Pricing of Options with Stochastic Volatility (2002). (15) RePEc:cdl:anderf:10277 How Did It Happen? (2004). (16) RePEc:cdl:anderf:2213 Dynamic Portfolio Selection by Augmenting the Asset Space (2004). (17) RePEc:cdl:anderf:13188 Bidding and Performance in Repo Auctions: Evidence from ECB Open Market Operations (2004). (18) RePEc:cdl:anderf:2297 The Disposition Effect and Momentum (2001). (19) RePEc:cdl:anderf:2291 International Risk Sharing is Better Than You Think (or Exchange Rates are Much Too Smooth! (2001). (20) RePEc:cdl:anderf:19658 Losing Money on Arbitrages: Optimal Dynamic Portfolio Choice in Markets with Arbitrage Opportunities (2000). (21) RePEc:cdl:anderf:2864 The Feds Effect on Excess Returns and Inflation is Much Bigger Than You Think (2000). (22) RePEc:cdl:anderf:3394 Resolution of a Financial Puzzle (1998). (23) RePEc:cdl:anderf:19666 The Relative Valuation of Caps and Swaptions: Theory and Empirical Evidence (2000). (24) RePEc:cdl:anderf:2620 Empirical TIPs (2003). (25) RePEc:cdl:anderf:2243 Estimation and Test of a Simple Model of Intertemporal Capital Asset Pricing (2003). (26) RePEc:cdl:anderf:2863 Learning About Predictability: The Effects of Parameter Uncertainty on Dynamic Asset Allocation (2000). (27) RePEc:cdl:anderf:11136 European M&A Regulation is Protectionist (2004). (28) RePEc:cdl:anderf:2702 A Unifying Theory of Value Based Management (2003). (29) RePEc:cdl:anderf:2867 Electricity prices and power derivatives: Evidence from the Nordic Power Exchange (2000). (30) RePEc:cdl:anderf:13185 THE MARKET PRICE OF RISK IN INTEREST RATE SWAPS: THE ROLES OF DEFAULT AND LIQUIDITY RISKS (2004). (31) RePEc:cdl:anderf:2729 Electricity Forward Prices: A High-Frequency Empirical Analysis (2002). (32) RePEc:cdl:anderf:55039 Homeownership as a Constraint on Asset Allocation (2005). (33) RePEc:cdl:anderf:19654 ELECTRICITY FORWARD PRICES: A High-Frequency Empirical Analysis (2002). (34) RePEc:cdl:anderf:3329 Organization Capital and Intrafirm Communication (2003). (35) RePEc:cdl:anderf:4682 Is Institutional Investment in Initial Public Offerings Related to Long-Run Performance of These Firms? (1995). (36) RePEc:cdl:anderf:2910 Boundaries of Predictability: Noisy Predictive Regressions (2000). (37) RePEc:cdl:anderf:9458 Bond Pricing with Default Risk (2003). (38) RePEc:cdl:anderf:2868 Transactions Costs in the Foreign Exchange Market (2000). (39) RePEc:cdl:anderf:55054 Jump and Volatility Risk and Risk Premia: A New Model and Lessons from S&P 500 Options (2004). (40) RePEc:cdl:anderf:13186 Strategic Behavior and Underpricing in Uniform Price Auctions: Evidence from Finnish Treasury Auctions (2004). (41) RePEc:cdl:anderf:3124 The Term Structure with Highly Persistent Interest Rates (1999). (42) RePEc:cdl:anderf:2898 Political Cycles and the Stock Market (2000). (43) RePEc:cdl:anderf:2701 Changing Motives for Share Repurchases (2003). (44) RePEc:cdl:anderf:55048 Parametric Portfolio Policies: Exploiting Characteristics in the Cross Section of Equity Returns (2005). (45) RePEc:cdl:anderf:2912 Demographics and the Equity Premium (2000). (46) RePEc:cdl:anderf:48570 Using Option Pricing Theory to Infer About Historical Equity Premiums (2005). (47) RePEc:cdl:anderf:2894 East Asia and Europe During the 1997 Asian Collapse: A Clinical Study of a Financial Crisis (2002). (48) RePEc:cdl:anderf:6416 The Information Conveyed by a Takeover Bid (1984). (49) RePEc:cdl:anderf:3330 Term Structure Estimation in Low-Frequency Transaction Markets: A Kalman Filter Approach with Incomplete Panel-Data (2003). (50) RePEc:cdl:anderf:11259 Order Flow Patterns around Seasoned Equity Offerings and their Implications for Stock Price Movements (2004). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||