|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

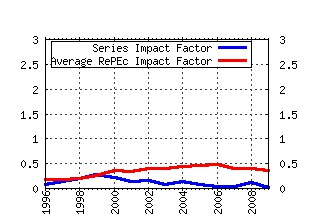

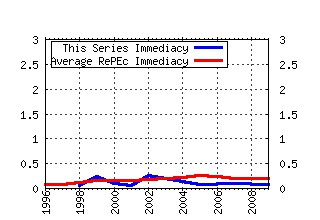

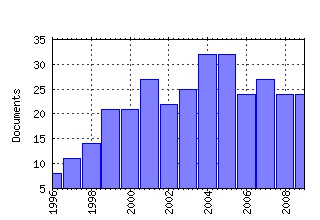

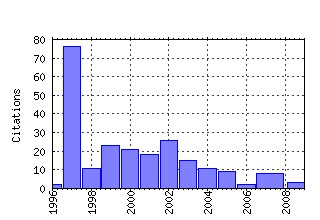

CEMA Working Papers: Serie Documentos de Trabajo. Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cem:doctra:115 Banks and Macroeconomic Disturbances Under

Predetermined Exchange Rates (1997). (2) RePEc:cem:doctra:81 Dollarization in Latin America: Greshams Law in

Reverse? (1992). (3) RePEc:cem:doctra:245 THE SEMANTICS OF GOVERNANCE. (The common thread running through

corporate, public, and global governance.) (2003). (4) RePEc:cem:doctra:225 How corporate governance and globalization can run afoul

of the law and good practices in business: The Enrons

(2002). (5) RePEc:cem:doctra:190 The Brokerage of Asymmetric Information (2001). (6) RePEc:cem:doctra:140 Elections and the Timing of Devaluations (1999). (7) RePEc:cem:doctra:161 A transaction costs approach to financial assets rates of

return (2000). (8) RePEc:cem:doctra:123 Political Stabilization Cycles in High Inflation

Economies (1997). (9) RePEc:cem:doctra:220 Incremental cash flows, information sets and conflicts of

interest. (2002). (10) RePEc:cem:doctra:82 Money and Credit Under Currency Substitution (1992). (11) RePEc:cem:doctra:216 Bank relationships: effect on the availability and marginal

cost of credit for firms in Argentina (2002). (12) RePEc:cem:doctra:134 Dynamic Arbitrage Gaps for Financial Assets (1998). (13) RePEc:cem:doctra:174 Real exchange rate cycles around elections (2000). (14) RePEc:cem:doctra:105 Ensayo Sobre el Plan de Convertibilidad (1995). (15) RePEc:cem:doctra:181 Inflation Risk and Portfolio Allocation in the Banking

System (2000). (16) RePEc:cem:doctra:122 Losing Credibility: The Stabilization Blues (1997). (17) RePEc:cem:doctra:132 El Potencial Argentino de Crecimiento (1998). (18) RePEc:cem:doctra:256 Differential rates, residual information sets and

transactional algebras (2004). (19) RePEc:cem:doctra:297 Public Governance. A Blueprint for Political Action and Better Government (2005). (20) RePEc:cem:doctra:275 Culture and social resistance to reform: a theory about the endogeneity of public beliefs with an application to the case of Argentina (2004). (21) RePEc:cem:doctra:198 The Twin Risks in the Dollarization Debate: Country and

Devaluation Risks (2001). (22) RePEc:cem:doctra:288 How trade splits up information sets and dealers carry out their brokerage of asymmetric information (2005). (23) RePEc:cem:doctra:151 Transactionally Efficient Markets, Dynamic Arbitrage and

Microstructure (1999). (24) RePEc:cem:doctra:2 El Atraso Cambiario en Argentina: Mito o Realidad? (1979). (25) RePEc:cem:doctra:226 Una introducción a la dinámica de la pobreza en la Argentina (2002). (26) RePEc:cem:doctra:356 Factoring governance risk into investors´expected rates of return by means of a weighted average governance index (2007). (27) RePEc:cem:doctra:149 Economists and Economic Policy: Argentina Since 1958 (1999). (28) RePEc:cem:doctra:293 A primer on governance and performance in small and medium-sized enterprises (2005). (29) RePEc:cem:doctra:197 Regime-Switching Stochastic Volatility and Short-Term

Interest Rates. (2001). (30) RePEc:cem:doctra:154 Corporate Governance in Argentina - New Developments

through 1991-2000 (1999). (31) RePEc:cem:doctra:24 PolÃtica Comercial y Salarios Reales (1981). (32) RePEc:cem:doctra:142 A Corporate Finance Cash Flow model with Float (1999). (33) RePEc:cem:doctra:70 The External Effects of Public Sector Deficits (1990). (34) RePEc:cem:doctra:217 Aplicación de la teorÃa de valores extremos al

gerenciamiento del riesgo. (2002). (35) RePEc:cem:doctra:395 Making rules credible: Divided government and political budget cycles (2009). (36) RePEc:cem:doctra:98 Interest Rates in Latin America (1994). (37) RePEc:cem:doctra:128 Y, si no hay más remedio... Inflación , Desconfianza y la

Desintegración del Sistema Financiero en Argentina (1998). (38) RePEc:cem:doctra:150 Macroeconomic Policies: Can We Transfer Lessons

Across LDCs? (1999). (39) RePEc:cem:doctra:283 Corporate Rent-Seeking and the managerial soft-budget constraint (2004). (40) RePEc:cem:doctra:113 Currency Substitution, Capital Flight and Real

Exchange Rates (1996). (41) RePEc:cem:doctra:344 Database of corporate bonds from Argentina (2007). (42) RePEc:cem:doctra:67 Reforma Monetaria y Financiera en Hiperinflación (1990). (43) RePEc:cem:doctra:251 Separation of Powers and Political Budget Cycles (2003). (44) RePEc:cem:doctra:184 Arbitrage Portfolios (2001). (45) RePEc:cem:doctra:125 Entendiendo el Riesgo PaÃs (1997). (46) RePEc:cem:doctra:212 The Governance Slack Model. A Cash Flow Approach for

the Budgeting and Accountability of some Corporate

(2002). (47) RePEc:cem:doctra:343 Loan and bond finance in Argentina, 1985-2005 (2007). (48) RePEc:cem:doctra:5 El Plan Argentino de Estabilización del 20 de Diciembre (1979). (49) RePEc:cem:doctra:158 Human Capital and Production Efficiency: Argentine

Agriculture (1999). (50) RePEc:cem:doctra:87 Inflation in Brazil (1992). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:cem:doctra:403 Temporal aggregation in political budget cycles (2009). CEMA Working Papers: Serie Documentos de Trabajo. (2) RePEc:pra:mprapa:27297 A reevaluation of the impact of financial development on economic growth and its sources by regions (2009). MPRA Paper Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:cem:doctra:343 Loan and bond finance in Argentina, 1985-2005 (2007). CEMA Working Papers: Serie Documentos de Trabajo. (2) RePEc:cem:doctra:348 Determinants of the development of corporate bond markets in Argentina: One size does not fit all (2007). CEMA Working Papers: Serie Documentos de Trabajo. (3) RePEc:cem:doctra:351 How the logic and pragmatics of sinking funds play a part in corporate governance (2007). CEMA Working Papers: Serie Documentos de Trabajo. Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||