|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

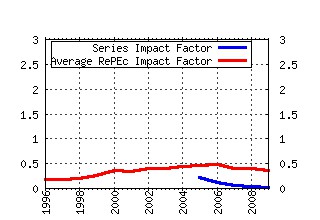

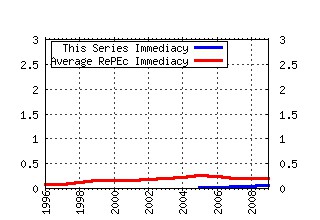

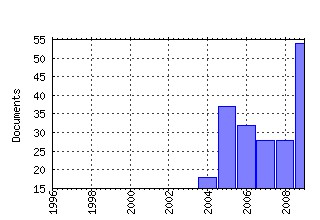

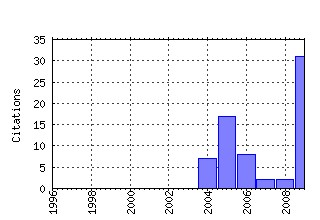

CARF F-Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cfi:fseres:cf164 The Ten Commandments for Optimizing Value-at-Risk and Daily Capital Charges (2009). (2) RePEc:cfi:fseres:cf158 Has the Basel II Accord Encouraged Risk Management During the 2008-09 Financial Crisis? (2009). (3) RePEc:cfi:fseres:cf156 Do We Really Need Both BEKK and DCC? A Tale of Two Covariance Models (2009). (4) RePEc:cfi:fseres:cf159 A Decision Rule to Minimize Daily Capital Charges in Forecasting Value-at-Risk (2009). (5) RePEc:cfi:fseres:cf047 Multi-Period Corporate Default Prediction With Stochastic Covariates (2005). (6) RePEc:cfi:fseres:cf054 Trade Credit, Bank Loans, and Monitoring: Evidence from Japan (2005). (7) RePEc:cfi:fseres:cf004 Cost of Enforcement in Developing Countries with Credit Market Imperfection (2004). (8) RePEc:cfi:fseres:cf014 Testing for Linearity in Regressions with I (1) processes (2004). (9) RePEc:cfi:fseres:cf180 Non-Traditional Monetary Polices: G7 Central Banks during 2007-2009 and the Bank of Japan during 1998-2006 (2009). (10) RePEc:cfi:fseres:cf192 Daily Tourist Arrivals, Exchange Rates and Volatility for Korea and Taiwan (2009). (11) RePEc:cfi:fseres:cf028 Saving and Interest Rates in Japan: Why They Have Fallen and Why They Will Remain Low (2005). (12) RePEc:cfi:fseres:cf209 Role of Linking Mechanisms in Multitask Agency with Hidden Information ( Revised version of CARF-F-059 (2006); Accepted in Journal of Economic Theory. ) (2010). (13) RePEc:cfi:fseres:cf078 The Role of Trade Credit for Small Firms: An Implication from Japans Banking Crisis (2006). (14) RePEc:cfi:fseres:cf030 Monte Carlo Simulation with Asymptotic Method (Published in Journal of Japan Statistical Society, Vol.35-2, 171-203, 2005. ) (2005). (15) RePEc:cfi:fseres:cf194 An Asymptotic Expansion with Push-Down of Malliavin Weights ( Revised in April 2011; Revised as CARF-F-256) (2009). (16) RePEc:cfi:fseres:cf093 Pioneering Modern Corporate Governance: a View from London in 1900 (Subsequently published in Enterprise and Society, vol. 8, no. 3, September 2007, pp. 642-86. ) (2007). (17) RePEc:cfi:fseres:cf029 Bank Health and Investment: An Analysis of Unlisted Companies in Japan (2005). (18) RePEc:cfi:fseres:cf212 New Unified Computational Algorithm in a High-Order Asymptotic Expansion Scheme ( Forthcoming in The Proceedings of KIER-TMU International Workshop on Financial Engineering 2009.) (2010). (19) RePEc:cfi:fseres:cf066 Banking in General Equilibrium with an Application to Japan (2006). (20) RePEc:cfi:fseres:cf147 The Determinants of Bank Capital Ratios in a Developing Economy (2009). (21) RePEc:cfi:fseres:cf045 Scanning Multivariate Conditional Densities with Probability Integral Transforms (2005). (22) RePEc:cfi:fseres:cf082 Pricing Currency Options with a Market Model of Interest Rates under Jump-Diffusion Stochastic Volatility Processes of Spot Exchange Rates (2006). (23) RePEc:cfi:fseres:cf162 Modelling Conditional Correlations for Risk Diversification in Crude Oil Markets (2009). (24) RePEc:cfi:fseres:cf064 Intra-day Seasonality in Activities of the Foreign Exchange Markets: Evidence from the Electronic Broking System (Subsequently published in Journal of the Japanese and International Economies, Volume (2006). (25) RePEc:cfi:fseres:cf119 Technology Shocks and Asset Price Dynamics:The Role of Housing in General Equilibrium (2008). (26) RePEc:cfi:fseres:cf191 Multivariate Stochastic Volatility with Cross Leverage ( Revised as CARF-F-198(2009) ) (2009). (27) RePEc:cfi:fseres:cf041 A Theory of International Currency and Seigniorage Competition (2005). (28) RePEc:cfi:fseres:cf202 Conditional Correlations and Volatility Spillovers Between Crude Oil and Stock Index Returns (2010). (29) RePEc:cfi:fseres:cf060 Collective Risk Control And Group Security: The Unexpected Consequences of Differential Risk Aversion (2006). (30) RePEc:cfi:fseres:cf116 A Hybrid Asymptotic Expansion Scheme: an Application to Long-term Currency Options ( Revised in April 2008, January 2009 and April 2010; forthcoming in International Journal of Theoretical and Applie (2008). (31) RePEc:cfi:fseres:cf035 Monetary Policy during Japans Lost Decade (2005). (32) RePEc:cfi:fseres:cf242 A General Computation Scheme for a High-Order Asymptotic Expansion Method (Revised in July 2011) (2011). (33) RePEc:cfi:fseres:cf072 A Dynamic Theory of Debt Restructuring (2006). (34) RePEc:cfi:fseres:cf009 Decentralized Trade, Random Utility and the Evolution of Social Welfare (Journal of Economic Theory, 2008, Vol.140, .No. 1, 328-338. ) (2004). (35) RePEc:cfi:fseres:cf198 Efficient Bayesian estimation of a multivariate stochastic volatility model with cross leverage and heavy-tailed errors ( Revised version of CARF-F-191(2009) ) (2009). (36) RePEc:cfi:fseres:cf106 Consumption Insurance and Risk-Coping Strategies under Non-Separable Utility: Evidence from the Kobe Earthquake (2007). (37) RePEc:cfi:fseres:cf176 Pricing Barrier and Average Options under Stochastic Volatility Environment ( Revised in May 2010; Forthcoming in the Journal of Computational Finance. ) (2009). (38) RePEc:cfi:fseres:cf216 Collateral Posting and Choice of Collateral Currency -Implications for Derivative Pricing and Risk Management- (2010). (39) RePEc:cfi:fseres:cf067 Relative Performance Evaluation between Multitask Agents (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:clu:wpaper:0910-19 The Central-Bank Balance Sheet as an Instrument of Monetary Policy (2009). Discussion Papers (2) RePEc:pra:mprapa:20975 Optimal Risk Management Before, During and After the 2008-09 Financial Crisis (2009). MPRA Paper (3) RePEc:ucm:doicae:1001 GFC-Robust Risk Management Strategies under the Basel Accord (2009). Documentos del Instituto Complutense de Análisis Económico Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:tky:fseres:2006cf450 Patterns of Non-exponential Growth of Macroeconomic Models: Two-parameter Poisson-Dirichlet Models (2006). CIRJE F-Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||