|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

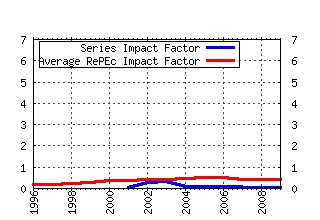

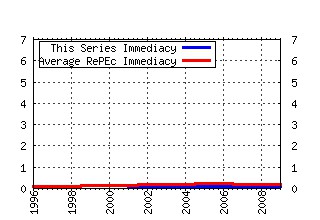

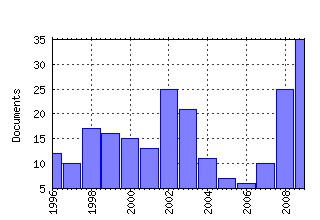

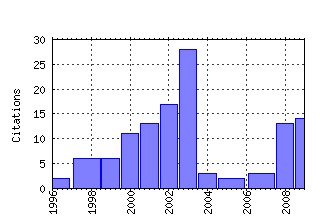

Economic Analysis and Policy (EAP) Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eap:articl:v:33:y:2003:i:2:p:275-292 The Impact of Corporate Taxation on the Location of Capital: A Review (2003). (2) RePEc:eap:articl:v:38:y:2008:i:1:p:55-71 Tax Effort in Developing Countries and High Income Countries: The Impact of Corruption, Voice and Accountability (2008). (3) RePEc:eap:articl:v:31:y:2001:i:1:p:25-32 The Impact of Fund Attrition on Superannuation Returns (2001). (4) RePEc:eap:articl:v39:y:2009:i:1:p:89-101 Publishing an E-Journal on a Shoe String: Is It a Sustainable Project? (2009). (5) RePEc:eap:articl:v:30:y:2000:i:1:p:33-48 Compulsory Superannuation and Australian Generational Accounts (2000). (6) RePEc:eap:articl:v:32:y:2002:i:2:p:27-49 World Heritage Listing of Australian Natural Sites: Tourism Stimulus and Its Economic Value (2002). (7) RePEc:eap:articl:v:17:y:1987:i:1:p:13-30 Tourism, The Environment and Profit (1987). (8) RePEc:eap:articl:v:32:y:2002:i:1:p:49-70 Retirement Income Strategy in Australia (2002). (9) RePEc:eap:articl:v:32:y:2002:i:1:p:35-47 Efficiency with Costly Information: A Study of Australian Wholesale Superannuation Fund Performance (2002). (10) RePEc:eap:articl:v:29:y:1999:i:2:p:187-206 Ethical Rules and the Demand for Free Range Eggs (1999). (11) RePEc:eap:articl:v:8:y:1978:i:1:p:35-86 Spatial Disaggregation of Orani Results: A Preliminary Analysis of the Impact of Protection at the State Level (1978). (12) RePEc:eap:articl:v:21:y:1991:i:1:p:47-78 Some Australian Evidence on the Consensual Approach to Poverty Measurement (1991). (13) RePEc:eap:articl:v:38:y:2008:i:2:p:313-339 Causes and Consequences of Tax Morale: An Empirical Investigation (2008). (14) RePEc:eap:articl:v:32:y:2002:i:1:p:19-33 Superannuation, Population Ageing and Living Standards in Australia (2002). (15) RePEc:eap:articl:v39:y:2009:i:1:p:143-152 The Economics of Open Bibliographic Data Provision (2009). (16) RePEc:eap:articl:v:32:y:2002:i:2:p:155-171 The Impact of Noosa National Park on Surrounding Property Values: An Application of the Hedonic Price Method (2002). (17) RePEc:eap:articl:v:30:y:2000:i:2:p:115-132 The Role of Market Share and Concentration in Firm Profitability: Implications for Competition Policy (2000). (18) RePEc:eap:articl:v:40:y:2010:i:3:p:393-410 Labor Market Institutions and Wage and Inflation Dynamics (2010). (19) RePEc:eap:articl:v:33:y:2003:i:2:p:251-273 Tax Treaties, Renegotiations, and Foreign Direct Investment (2003). (20) RePEc:eap:articl:v:13:y:1983:i:2:p:113-141 Economic Problems in Managing Australias Marine Resources (1983). (21) RePEc:eap:articl:v:23:y:1993:i:2:p:105-121 New Theory and Evidence on Economic Growth and their Implications for Australian Policy (1993). (22) RePEc:eap:articl:v:35:y:2005:i:1-2:p:61-71 The Economic Consequences of Droit De Suite in the European Union (2005). (23) RePEc:eap:articl:v:31:y:2001:i:1:p:33-56 Non-market Valuation Databases: How Useful Are They? (2001). (24) RePEc:eap:articl:v:28:y:1998:i:1:p:85-102 Regional Differences in the Japanese Diet: The Case of Drinking Milk (1998). (25) RePEc:eap:articl:v:34:y:2004:i:1:p:79-102 Attitudes to Entry Fees to National Parks: Results and Policy Implications from a Queensland Case Study (2004). (26) RePEc:eap:articl:v:18:y:1988:i:2:p:171-188 An Economic Analysis of the Higher Education Contribution Scheme of the Wran Report (1988). (27) RePEc:eap:articl:v39:y:2009:i:3:p:355-377 The Basic Economics of Match Fixing in Sport Tournaments (2009). (28) RePEc:eap:articl:v:32:y:2002:i:1:p:71-90 Informed Superannuation Choice: Constraints and Policy Resolutions (2002). (29) RePEc:eap:articl:v:28:y:1998:i:1:p:69-83 Reducing Vertical Fiscal Imbalance in Australia: Is There a Need for State Personal Income Taxation? (1998). (30) RePEc:eap:articl:v:37:y:2007:i:1:p:77-98 The Value of a Recreational Beach Visit: An Application to Mooloolaba Beach and Comparisons with other Outdoor Recreation Sites (2007). (31) RePEc:eap:articl:v:41:y:2011:i:2:p:173-187 Economic Growth and FDI in Asia: A Panel-Data Approach (2011). (32) RePEc:eap:articl:v:38:y:2008:i:1:p:89-111 The Shadow Economy in Germany - A Blessing or a Curse for the Official Economy? (2008). (33) RePEc:eap:articl:v:31:y:2001:i:2:p:125-137 Industry Structure and the Reform of the Queensland Sugar Industry: A Computational Model (2001). (34) RePEc:eap:articl:v:24:y:1994:i:2:p:133-150 Sustainability and Sustainable Development: Are These Concepts a Help or a Hindrance to Economics? (1994). (35) RePEc:eap:articl:v:29:y:1999:i:1:p:77-85 The Asian Currency Crisis and the Australian Economy (1999). (36) RePEc:eap:articl:v:37:y:2007:i:1:p:1-14 Is bigger Better? Local Government Amalgamation and the South Australian Rising to the Challenge Inquiry (2007). (37) RePEc:eap:articl:v39:y:2009:i:2:p:235-253 DO TAX AMNESTIES WORK? THE REVENUE EFFECTS OF TAX AMNESTIES DURING THE TRANSITION IN THE RUSSIAN FEDERATION (2009). (38) RePEc:eap:articl:v:19:y:1989:i:1:p:1-28 Poverty Traps in the Australian Social Security System (1989). (39) RePEc:eap:articl:v:28:y:1998:i:1:p:103-108 A Note on the Australian Business Cycle (1998). (40) RePEc:eap:articl:v:30:y:2000:i:1:p:1-10 Economic Analysis and Policy: A Thirtieth Birthday Retrospective (2000). (41) RePEc:eap:articl:v:38:y:2008:i:1:p:73-87 Social Capital and Tax Morale in Spain (2008). (42) RePEc:eap:articl:v:31:y:2001:i:1:p:73-92 Excess Entry in the Deregulated Queensland Power Market (2001). (43) RePEc:eap:articl:v:32:y:2002:i:2:p:113-129 Economic Evaluation of Proposed Long-Distance Walking Tracks in the Wet Tropics of Queensland (2002). (44) RePEc:eap:articl:v:29:y:1999:i:1:p:73-76 The Asian Currency Crisis, the IMF, and the Role of Japan (1999). (45) RePEc:eap:articl:v:30:y:2000:i:1:p:99-102 Estimation Community Values of Lakes: A Study of Lake Mokoan in Victoria, Australia: A Comment (2000). (46) RePEc:eap:articl:v:40:y:2010:i:2:p:149-178 Informal eldercare across Europe: Estimates from the European Community Household Panel (2010). (47) RePEc:eap:articl:v:18:y:1988:i:2:p:199-212 Targeting Australias Current Account: A New Mercantilism? (1988). (48) RePEc:eap:articl:v:26:y:1996:i:2:p:145-155 Extended Measures of National Income and Saving (1996). (49) RePEc:eap:articl:v:33:y:2003:i:2:p:179-192 International Tax Competition: A New Framework for Analysis (2003). (50) RePEc:eap:articl:v40:y:2010:i:1:p:78-88 A Note on the Concept of Excess Burden (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:uca:ucapdv:118 Publishing an E-journal on a shoe string: Is it a sustainaible project?. (2009). POLIS Working Papers (2) RePEc:uca:ucapdv:129 Impact identification strategies for evaluating business incentive programs. (2009). POLIS Working Papers (3) RePEc:uca:ucapdv:134 The logic of party coalitions with political activism and public financing (2009). POLIS Working Papers (4) RePEc:uca:ucapdv:135 Formal and informal sectors: Interactions between moneylenders and traditional banks in the rural Indian credit market (2009). POLIS Working Papers Recent citations received in: 2008 (1) RePEc:eap:articl:v:38:y:2008:i:2:p:313-339 Causes and Consequences of Tax Morale: An Empirical Investigation (2008). Economic Analysis and Policy (EAP) (2) RePEc:pra:mprapa:19858 Successful tax reform: the experience of value added tax in the United Kingdom and goods and services tax in New Zealand (2008). MPRA Paper Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||