|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

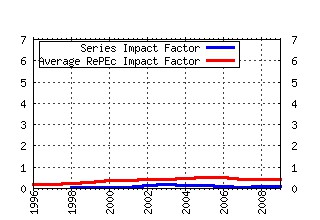

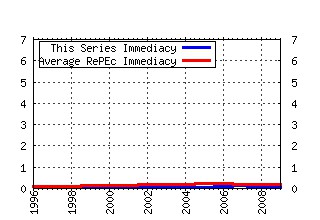

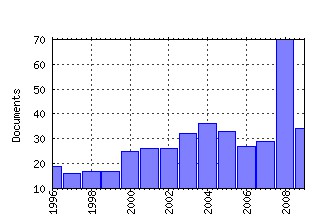

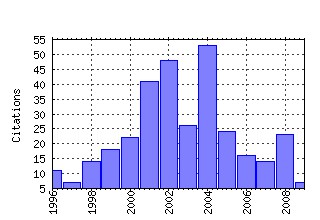

International Review of Financial Analysis Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finana:v:13:y:2004:i:5:p:633-647 Equity market integration in Central European emerging markets: A cointegration analysis with shifting regimes (2004). (2) RePEc:eee:finana:v:10:y:2001:i:3:p:203-218 What drives contagion: Trade, neighborhood, or financial links? (2001). (3) RePEc:eee:finana:v:13:y:2004:i:5:p:571-583 International equity market integration: Theory, evidence and implications (2004). (4) RePEc:eee:finana:v:7:y:1998:i:2:p:95-111 Two puzzles in the analysis of foreign exchange market efficiency (1998). (5) RePEc:eee:finana:v:1:y:1992:i:3:p:179-193 Prices and hedge ratios of average exchange rate options (1992). (6) RePEc:eee:finana:v:10:y:2001:i:2:p:135-156 Trading rule profits in Latin American currency spot rates (2001). (7) RePEc:eee:finana:v:11:y:2002:i:1:p:39-57 The costs of bankruptcy: A review (2002). (8) RePEc:eee:finana:v:17:y:2008:i:5:p:1156-1172 Bank efficiency in the new European Union member states: Is there convergence? (2008). (9) RePEc:eee:finana:v:13:y:2004:i:2:p:227-244 Private benefits, block transaction premiums and ownership structure (2004). (10) RePEc:eee:finana:v:11:y:2002:i:4:p:407-431 Stochastic chaos or ARCH effects in stock series?: A comparative study (2002). (11) RePEc:eee:finana:v:10:y:2001:i:1:p:87-96 Dynamic interdependence and volatility transmission of Asian stock markets: Evidence from the Asian crisis (2001). (12) RePEc:eee:finana:v:11:y:2002:i:2:p:219-227 The aggregate credit spread and the business cycle (2002). (13) RePEc:eee:finana:v:11:y:2002:i:1:p:1-27 The explanatory power of political risk in emerging markets (2002). (14) RePEc:eee:finana:v:13:y:2004:i:2:p:133-152 Managing extreme risks in tranquil and volatile markets using conditional extreme value theory (2004). (15) RePEc:eee:finana:v:10:y:2001:i:2:p:175-185 Response asymmetries in the Latin American equity markets (2001). (16) RePEc:eee:finana:v:5:y:1996:i:1:p:39-53 Common factors in international stock prices: Evidence from a cointegration study (1996). (17) RePEc:eee:finana:v:16:y:2007:i:1:p:41-60 Dynamic linkages between emerging European and developed stock markets: Has the EMU any impact? (2007). (18) RePEc:eee:finana:v:5:y:1996:i:1:p:19-38 Prospect theory: A literature review (1996). (19) RePEc:eee:finana:v:8:y:1999:i:2:p:123-138 Scaling laws in variance as a measure of long-term dependence (1999). (20) RePEc:eee:finana:v:9:y:2000:i:3:p:235-245 On the conditional relationship between beta and return in international stock returns (2000). (21) RePEc:eee:finana:v:15:y:2006:i:3:p:203-219 The CAPM and value at risk at different time-scales (2006). (22) RePEc:eee:finana:v:8:y:1999:i:1:p:35-52 Size and book-to-market factors in a multivariate GARCH-in-mean asset pricing application (1999). (23) RePEc:eee:finana:v:13:y:2004:i:5:p:621-632 Equity market integration in the Asia-Pacific region: A smooth transition analysis (2004). (24) RePEc:eee:finana:v:14:y:2005:i:3:p:283-303 Cost frontier efficiency and risk-return analysis in an emerging market (2005). (25) RePEc:eee:finana:v:10:y:2001:i:4:p:395-406 Multiperiod hedging in the presence of stochastic volatility (2001). (26) RePEc:eee:finana:v:2:y:1993:i:2:p:121-141 The event study: An industrial strength method (1993). (27) RePEc:eee:finana:v:6:y:1997:i:3:p:179-192 The Big Mac: More than a junk asset allocator? (1997). (28) RePEc:eee:finana:v:18:y:2009:i:5:p:294-302 The impact of banking regulations on banks cost and profit efficiency: Cross-country evidence (2009). (29) RePEc:eee:finana:v:14:y:2005:i:2:p:277-282 The use and abuse of the hedging effectiveness measure (2005). (30) RePEc:eee:finana:v:12:y:2003:i:5:p:579-590 Testing weak-form market efficiency: Evidence from the Istanbul Stock Exchange (2003). (31) RePEc:eee:finana:v:17:y:2008:i:1:p:47-63 Sudden changes in volatility in emerging markets: The case of Gulf Arab stock markets (2008). (32) RePEc:eee:finana:v:11:y:2002:i:1:p:29-38 The volatility of Japanese interest rates: evidence for Certificate of Deposit and Gensaki rates (2002). (33) RePEc:eee:finana:v:13:y:2004:i:3:p:265-276 Long memory in the U.S. interest rate (2004). (34) RePEc:eee:finana:v:9:y:2000:i:2:p:197-218 Restructuring the Japanese banking system Has Japan gone far enough? (2000). (35) RePEc:eee:finana:v:16:y:2007:i:2:p:172-182 The comovement of US and German bond markets (2007). (36) RePEc:eee:finana:v:10:y:2001:i:2:p:99-122 A nonparametric approach to model the term structure of interest rates: The case of Chile (2001). (37) RePEc:eee:finana:v:11:y:2002:i:3:p:297-309 An empirical analysis of credit default swaps (2002). (38) RePEc:eee:finana:v:12:y:2003:i:5:p:513-525 Trading volume and stock market volatility: The Polish case (2003). (39) RePEc:eee:finana:v:11:y:2002:i:2:p:111-138 Dividend policy theories and their empirical tests (2002). (40) RePEc:eee:finana:v:11:y:2002:i:3:p:375-406 Corporate bankruptcy prognosis: An attempt at a combined prediction of the bankruptcy event and time interval of its occurrence (2002). (41) RePEc:eee:finana:v:9:y:2000:i:4:p:405-420 Volatility and information flows in emerging equity market: A case of the Korean Stock Exchange (2000). (42) RePEc:eee:finana:v:11:y:2002:i:3:p:251-278 A perspective on credit derivatives (2002). (43) RePEc:eee:finana:v:13:y:2004:i:5:p:669-685 International equity market integration in a small open economy: Ireland January 1990-December 2000 (2004). (44) RePEc:eee:finana:v:7:y:1998:i:2:p:181-190 The relationship between international bond markets and international stock markets (1998). (45) RePEc:eee:finana:v:12:y:2003:i:2:p:173-188 Liquidity and stock returns in pure order-driven markets: evidence from the Australian stock market (2003). (46) RePEc:eee:finana:v:17:y:2008:i:3:p:571-591 Financial crisis and stock market efficiency: Empirical evidence from Asian countries (2008). (47) RePEc:eee:finana:v:13:y:2004:i:5:p:649-668 Equity market integration in Latin America: A time-varying integration score analysis (2004). (48) RePEc:eee:finana:v:17:y:2008:i:1:p:27-46 Stock returns and volatility following the September 11 attacks: Evidence from 53 equity markets (2008). (49) RePEc:eee:finana:v:8:y:1999:i:1:p:67-82 Forecasting currency prices using a genetically evolved neural network architecture (1999). (50) RePEc:eee:finana:v:14:y:2005:i:3:p:337-355 Weather, biorhythms, beliefs and stock returns--Some preliminary Irish evidence (2005). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:pra:mprapa:18872 Bank liquidity and the board of directors (2009). MPRA Paper Recent citations received in: 2008 (1) RePEc:pra:mprapa:26986 Cointegration and dynamic linkages of international stock markets: an emerging market perspective (2008). MPRA Paper (2) RePEc:pra:mprapa:8950 Competition between Latin America and China for US direct investment. (2008). MPRA Paper Recent citations received in: 2007 (1) RePEc:edn:esedps:157 What Drives Corporate Bond Market Betas? (2007). ESE Discussion Papers (2) RePEc:pra:mprapa:2607 LEvolution des Marchés Boursiers Européens: Enjeux et limites (2007). MPRA Paper (3) RePEc:tcb:cebare:v:7:y:2007:i:1:p:1-12 Testing Integration between the Major Emerging Markets (2007). Central Bank Review (4) RePEc:wdi:papers:2007-861 Time-Varying Comovements in Developed and Emerging European Stock Markets: Evidence from Intraday Data (2007). William Davidson Institute Working Papers Series Recent citations received in: 2006 (1) RePEc:cor:louvco:2006102 Market-wide liquidity co-movements, volatility regimes and market cap sizes (2006). CORE Discussion Papers (2) RePEc:ebl:ecbull:v:7:y:2006:i:4:p:1-7 Equity Diversification in Two Chinese Share Markets: Old Wine and New Bottle (2006). Economics Bulletin (3) RePEc:edj:ceauch:219 Portfolio management implications of volatility shifts: Evidence from simulated data (2006). Documentos de Trabajo Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||