|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

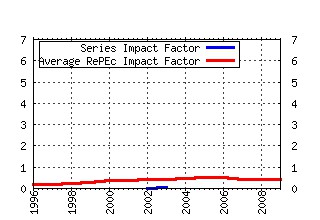

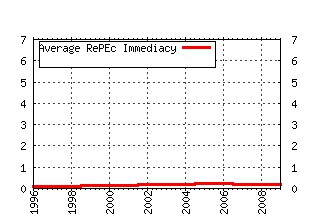

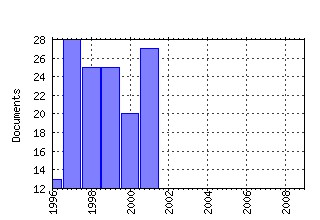

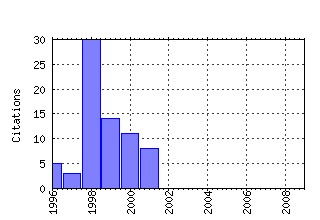

Financial Services Review Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finser:v:7:y:1998:i:4:p:301-316 Mutual fund shareholders: characteristics, investor knowledge, and sources of information (1998). (2) RePEc:eee:finser:v:7:y:1998:i:2:p:107-128 An Analysis of Personal Financial Literacy Among College Students (1998). (3) RePEc:eee:finser:v:4:y:1995:i:2:p:137-156 Household insolvency: A review of household debt repayment, delinquency, and bankruptcy (1995). (4) RePEc:eee:finser:v:8:y:1999:i:1:p:1-10 Gender differences in defined contribution pension decisions (1999). (5) RePEc:eee:finser:v:10:y:2001:i:1-4:p:291-302 Book-to-market and size as determinants of returns in small illiquid markets: the New Zealand case (2001). (6) RePEc:eee:finser:v:9:y:2000:i:2:p:159-170 Risk tolerance and asset allocation for investors nearing retirement (2000). (7) RePEc:eee:finser:v:9:y:2000:i:1:p:47-63 The asset allocation decision in retirement: lessons from dollar-cost averaging (2000). (8) RePEc:eee:finser:v:5:y:1996:i:2:p:87-99 Risk aversion measures: comparing attitudes and asset allocation (1996). (9) RePEc:eee:finser:v:1:y:1991:i:1:p:35-44 Determinants of household check writing: the impacts of the use of electronic banking services and alternative pricing of services (1991). (10) RePEc:eee:finser:v:7:y:1998:i:2:p:129-143 Putting Your Money Where Your Mouth Is A Profile of Ethical Investors (1998). (11) RePEc:eee:finser:v:8:y:1999:i:3:p:163-181 Financial risk tolerance revisited: the development of a risk assessment instrument* (1999). (12) RePEc:eee:finser:v:9:y:2000:i:1:p:1-15 Determinants of planned retirement age (2000). (13) RePEc:eee:finser:v:10:y:2001:i:1-4:p:101-116 The fallacy of cookie cutter asset allocation: some evidence from New Yorks College Savings Program (2001). (14) RePEc:eee:finser:v:8:y:1999:i:4:p:235-251 Student learning style and educational outcomes: evidence from a family financial management course (1999). (15) RePEc:eee:finser:v:4:y:1995:i:2:p:123-136 Credit cards and the option to default (1995). (16) RePEc:eee:finser:v:7:y:1998:i:1:p:25-44 Term Spreads and Predictions of Bond and Stock Excess Returns (1998). (17) RePEc:eee:finser:v:10:y:2001:i:1-4:p:303-314 Portfolio diversification in a highly inflationary emerging market (2001). (18) RePEc:eee:finser:v:3:y:1994:i:2:p:109-126 Asset allocation, life expectancy and shortfall (1994). (19) RePEc:eee:finser:v:7:y:1998:i:1:p:11-23 A Tax-Free Exploitation of the Turn-of-the-Month Effect: C.R.E.F. (1998). (20) RePEc:eee:finser:v:5:y:1996:i:2:p:133-147 The effects of mutual fund managers characteristics on their portfolio performance, risk and fees (1996). (21) RePEc:eee:finser:v:8:y:1999:i:3:p:149-162 Racial differences in investor decision making (1999). (22) RePEc:eee:finser:v:2:y:1992-1993:i:1:p:51-61 Nobody gains from dollar cost averaging analytical, numerical and empirical results (1992). (23) RePEc:eee:finser:v:9:y:2000:i:3:p:277-293 Consumer information search for home mortgages: who, what, how much, and what else? (2000). (24) RePEc:eee:finser:v:6:y:1997:i:4:p:227-242 An analysis of the tradeoff between tax deferred earnings in iras and preferential capital gains (1997). (25) RePEc:eee:finser:v:7:y:1998:i:4:p:291-300 Planning to move to retirement housing (1998). (26) RePEc:eee:finser:v:10:y:2001:i:1-4:p:145-161 Variable annuities versus mutual funds: a Monte-Carlo analysis of the options (2001). (27) RePEc:eee:finser:v:8:y:1999:i:4:p:261-268 An integrated model for financial planning (1999). (28) RePEc:eee:finser:v:5:y:1996:i:1:p:43-56 Churning: Excessive trading in retail securities accounts (1996). (29) RePEc:eee:finser:v:7:y:1998:i:1:p:57-68 Performance Persistence of Experienced Mutual Fund Managers (1998). (30) RePEc:eee:finser:v:8:y:1999:i:2:p:117-127 Does retirement planning affect the level of retirement satisfaction? (1999). (31) RePEc:eee:finser:v:6:y:1997:i:1:p:53-67 Adverse selection, search costs and sticky credit card rates (1997). (32) RePEc:eee:finser:v:7:y:1998:i:3:p:207-215 Credit union industry structure: an examination of potential risks (1998). (33) RePEc:eee:finser:v:10:y:2001:i:1-4:p:117-127 Does loss aversion explain dollar-cost averaging? (2001). (34) RePEc:eee:finser:v:8:y:1999:i:4:p:253-260 Does education affect how well students forecast the market? (1999). (35) RePEc:eee:finser:v:7:y:1998:i:1:p:45-55 Explaining Persistence in Mutual Fund Performance (1998). (36) RePEc:eee:finser:v:8:y:1999:i:1:p:37-45 A nineties perspective on international diversification (1999). (37) RePEc:eee:finser:v:1:y:1991:i:1:p:23-34 Life insurance companies as investment managers: New implications for consumers (1991). (38) RePEc:eee:finser:v:9:y:2000:i:1:p:65-78 Social Security investment accounts: lessons from participant-directed 401(k) data (2000). (39) RePEc:eee:finser:v:6:y:1997:i:1:p:19-25 The congressional calendar and stock market performance (1997). (40) RePEc:eee:finser:v:7:y:1998:i:3:p:175-193 Mean and pessimistic projections of retirement adequacy (1998). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||