|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

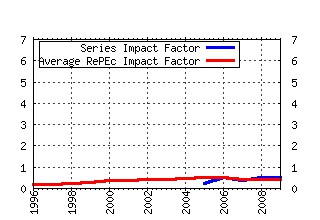

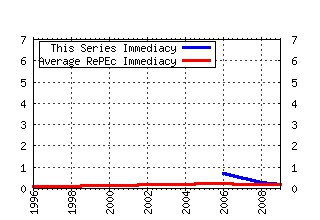

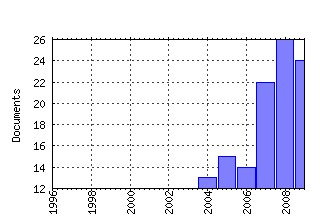

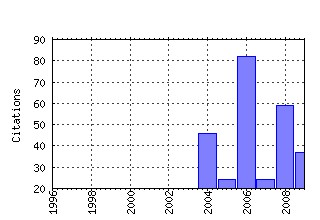

Journal of Financial Stability Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finsta:v:1:y:2004:i:1:p:1-30 A model to analyse financial fragility: applications (2004). (2) RePEc:eee:finsta:v:4:y:2008:i:3:p:205-231 Monetary policy and financial (in)stability: An integrated micro-macro approach (2008). (3) RePEc:eee:finsta:v:5:y:2009:i:3:p:224-255 A theory of systemic risk and design of prudential bank regulation (2009). (4) RePEc:eee:finsta:v:2:y:2006:i:3:p:243-265 Measuring financial stress in a developed country: An application to Canada (2006). (5) RePEc:eee:finsta:v:4:y:2008:i:2:p:89-120 Comparing early warning systems for banking crises (2008). (6) RePEc:eee:finsta:v:2:y:2006:i:1:p:95-112 Monetary policy and financial stability: What role for the futures market? (2006). (7) RePEc:eee:finsta:v:1:y:2005:i:3:p:308-341 Exploring interactions between real activity and the financial stance (2005). (8) RePEc:eee:finsta:v:2:y:2006:i:3:p:217-242 Foreign banks in emerging market crises: Evidence from Malaysia (2006). (9) RePEc:eee:finsta:v:2:y:2006:i:1:p:1-27 Contagion in international bond markets during the Russian and the LTCM crises (2006). (10) RePEc:eee:finsta:v:2:y:2006:i:2:p:113-151 A comparative analysis of macro stress-testing methodologies with application to Finland (2006). (11) RePEc:eee:finsta:v:4:y:2008:i:3:p:232-257 Multiple safety net regulators and agency problems in the EU: Is Prompt Corrective Action partly the solution? (2008). (12) RePEc:eee:finsta:v:3:y:2007:i:2:p:132-148 Slippery slopes of stress: Ordered failure events in German banking (2007). (13) RePEc:eee:finsta:v:2:y:2006:i:2:p:152-172 Defining and achieving financial stability (2006). (14) RePEc:eee:finsta:v:1:y:2004:i:1:p:93-110 Macroeconomic shocks and banking supervision (2004). (15) RePEc:eee:finsta:v:2:y:2006:i:2:p:173-193 Credit risk transfer and financial sector stability (2006). (16) RePEc:eee:finsta:v:1:y:2004:i:1:p:65-91 Corporate financial structure and financial stability (2004). (17) RePEc:eee:finsta:v:7:y:2011:i:2:p:78-97 Financial stress and economic contractions (2011). (18) RePEc:eee:finsta:v:4:y:2008:i:3:p:168-204 Cross-border banking and financial stability in the EU (2008). (19) RePEc:eee:finsta:v:1:y:2005:i:4:p:466-500 How accounting and auditing systems can counteract risk-shifting of safety-nets in banking: Some international evidence (2005). (20) RePEc:eee:finsta:v:5:y:2009:i:4:p:339-352 Flights and contagion--An empirical analysis of stock-bond correlations (2009). (21) RePEc:eee:finsta:v:1:y:2004:i:1:p:31-63 Alternatives to blanket guarantees for containing a systemic crisis (2004). (22) RePEc:eee:finsta:v:4:y:2008:i:1:p:23-39 Do weak supervisory systems encourage bank risk-taking? (2008). (23) RePEc:eee:finsta:v:2:y:2006:i:1:p:55-70 Derivatives and systemic risk: Netting, collateral, and closeout (2006). (24) RePEc:eee:finsta:v:2:y:2006:i:3:p:286-310 Market discipline in international banking regulation: Keeping the playing field level (2006). (25) RePEc:eee:finsta:v:2:y:2007:i:4:p:391-411 Comovements in the equity prices of large complex financial institutions (2007). (26) RePEc:eee:finsta:v:1:y:2004:i:2:p:257-273 Central banks and financial stability: a survey (2004). (27) RePEc:eee:finsta:v:1:y:2005:i:3:p:386-425 Resolving large financial intermediaries: Banks versus housing enterprises (2005). (28) RePEc:eee:finsta:v:5:y:2009:i:2:p:124-146 Politicians and financial supervision unification outside the central bank: Why do they do it? (2009). (29) RePEc:eee:finsta:v:2:y:2007:i:4:p:337-355 Financial stability reviews: A first empirical analysis (2007). (30) RePEc:eee:finsta:v:6:y:2010:i:3:p:121-129 Bank risk and monetary policy (2010). (31) RePEc:eee:finsta:v:6:y:2010:i:2:p:64-78 Stress-testing euro area corporate default probabilities using a global macroeconomic model (2010). (32) RePEc:eee:finsta:v:5:y:2009:i:2:p:199-219 The reaction of asset prices to macroeconomic announcements in new EU markets: Evidence from intraday data (2009). (33) RePEc:eee:finsta:v:3:y:2007:i:2:p:85-131 A market-based framework for bankruptcy prediction (2007). (34) RePEc:eee:finsta:v:6:y:2010:i:1:p:1-9 Partial credit guarantees: Principles and practice (2010). (35) RePEc:eee:finsta:v:6:y:2010:i:3:p:130-144 How well do aggregate prudential ratios identify banking system problems? (2010). (36) RePEc:eee:finsta:v:1:y:2004:i:1:p:111-135 Accounting and prudential regulation: from uncomfortable bedfellows to perfect partners? (2004). (37) RePEc:eee:finsta:v:1:y:2004:i:2:p:137-155 The subordinated debt alternative to Basel II (2004). (38) RePEc:eee:finsta:v:2:y:2006:i:2:p:194-216 Costs of financial instability, household-sector balance sheets and consumption (2006). (39) RePEc:eee:finsta:v:3:y:2007:i:1:p:18-32 Aggregate liquidity shortages, idiosyncratic liquidity smoothing and banking regulation (2007). (40) RePEc:eee:finsta:v:6:y:2010:i:1:p:26-35 Public initiatives to support entrepreneurs: Credit guarantees versus co-funding (2010). (41) RePEc:eee:finsta:v:6:y:2010:i:4:p:218-229 The role of house prices in the monetary policy transmission mechanism in small open economies (2010). (42) RePEc:eee:finsta:v:5:y:2009:i:4:p:353-373 Shocks at large banks and banking sector distress: The Banking Granular Residual (2009). (43) RePEc:eee:finsta:v:4:y:2008:i:3:p:275-303 On the independence of assets and liabilities: Evidence from U.S. commercial banks, 1990-2005 (2008). (44) RePEc:eee:finsta:v:4:y:2008:i:2:p:149-164 Predicting sovereign debt crises using artificial neural networks: A comparative approach (2008). (45) RePEc:eee:finsta:v:6:y:2010:i:4:p:203-217 Housing markets and the financial crisis of 2007-2009: Lessons for the future (2010). (46) RePEc:eee:finsta:v:2:y:2006:i:1:p:28-54 Assessing central bank credibility during the ERM crises: Comparing option and spot market-based forecasts (2006). (47) RePEc:eee:finsta:v:2:y:2006:i:3:p:266-285 Problem bank loans, conflicts of interest, and institutions (2006). (48) RePEc:eee:finsta:v:6:y:2010:i:2:p:103-117 Using synthetic data to evaluate the impact of RTGS on systemic risk in the Australian payments system (2010). (49) RePEc:eee:finsta:v:2:y:2007:i:4:p:356-390 Banking deregulation and credit risk: Evidence from the EU (2007). (50) RePEc:eee:finsta:v:4:y:2008:i:2:p:135-148 Bad luck or bad management? Emerging banking market experience (2008). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:dgr:kubcen:200945s Back to Basics in Banking? A Micro-Analysis of Banking System Stability (2009). Discussion Paper (2) RePEc:fip:fedawp:2009-20 The financial crisis of 2008 in fixed income markets (2009). Working Paper (3) RePEc:nbb:reswpp:200906-26 Back to the basics in banking ? A micro-analysis of banking system stability (2009). Working Paper Research (4) RePEc:rug:rugwps:09/579 Back to the Basics in Banking? A Micro-Analysis of Banking System Stability (2009). Working Papers of Faculty of Economics and Business Administration, Ghent University, Belgium (5) RePEc:zbw:bubdp2:200915 What macroeconomic shocks affect the German banking system? Analysis in an integrated micro-macro model (2009). Discussion Paper Series 2: Banking and Financial Studies Recent citations received in: 2008 (1) RePEc:bde:wpaper:0823 Determinants of domestic and cross-border bank acquisitions in the European Union (2008). Banco de España Working Papers (2) RePEc:bfr:banfra:226 Macroeconomic Fluctuations and Corporate Financial Fragility. (2008). Working papers (3) RePEc:ces:ifodic:v:6:y:2008:i:3:p:27-36 Towards an EU Framework for Safeguarding Financial Stability (2008). CESifo DICE Report (4) RePEc:ces:ifofor:v:9:y:2008:i:4:p:44-50 Avoiding the Next Crisis (2008). CESifo Forum (5) RePEc:crf:wpaper:08-04 How Bankruptcy Punishment Influences the Ex-Ante Design of Debt Contracts? (2008). LSF Research Working Paper Series (6) RePEc:fip:fedawp:2008-26 Determinants of domestic and cross-border bank acquisitions in the European Union (2008). Working Paper (7) RePEc:kie:kieliw:1419 How Resilient is the German Banking System to Macroeconomic Shocks? (2008). Kiel Working Papers Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:bis:bisbpc:28-02 Banks and aggregate credit: what is new? (2006). BIS Papers chapters (2) RePEc:bno:worpap:2006_07 Flexible inflation targeting and financial stability: Is it enough to stabilise inflation and output? (2006). Working Paper (3) RePEc:dgr:kubcen:200671 Diversification at Financial Institutions and Systemic Crises (2006). Discussion Paper (4) RePEc:dgr:kubcen:200672 The Broadening of Activities in the Financial System: Implications for Financial Stability and Regulation (2006). Discussion Paper (5) RePEc:dnb:dnbwpp:119 Modelling Scenario Analysis and Macro Stress-testing (2006). DNB Working Papers (6) RePEc:fip:fedhep:y:2006:i:qiv:p:22-29:n:v.30no.4 Derivatives clearing and settlement: a comparison of central counterparties and alternative structures (2006). Economic Perspectives (7) RePEc:fip:fedhwp:wp-06-01 U.S. corporate and bank insolvency regimes: an economic comparison and evaluation (2006). Working Paper Series (8) RePEc:ijc:ijcjou:y:2006:q:4:a:3 State-Dependent Stock Market Reactions to Monetary Policy (2006). International Journal of Central Banking (9) RePEc:ijc:ijcjou:y:2006:q:4:a:4 Monetary Policy Inertia: Fact or Fiction? (2006). International Journal of Central Banking (10) RePEc:kap:rqfnac:v:27:y:2006:i:4:p:365-382 The Enron Bankruptcy: When did the options market in Enron lose its smirk? (2006). Review of Quantitative Finance and Accounting Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||