|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

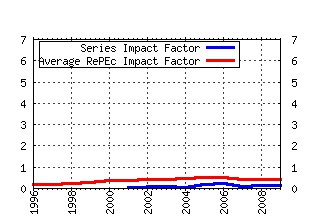

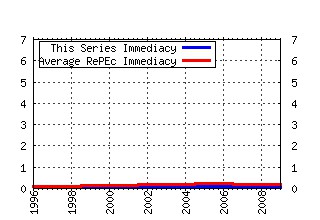

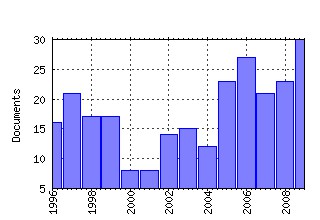

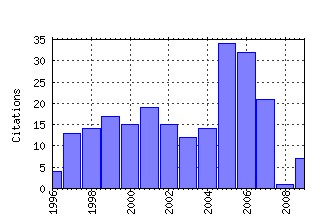

Global Finance Journal Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:glofin:v:17:y:2006:i:2:p:224-251 Oil price risk and emerging stock markets (2006). (2) RePEc:eee:glofin:v:16:y:2005:i:1:p:69-85 A panel study on real interest rate parity in East Asian countries: Pre- and post-liberalization era (2005). (3) RePEc:eee:glofin:v:11:y:2000:i:1-2:p:87-108 Long-run purchasing power parity, prices and exchange rates in transition: The case of six Central and East European countries (2000). (4) RePEc:eee:glofin:v:12:y:2001:i:1:p:1-33 Equity market linkages in the Asia Pacific region: A comparison of the orthogonalised and generalised VAR approaches (2001). (5) RePEc:eee:glofin:v:10:y:1999:i:2:p:161-172 Common stochastic trends and volatility in Asian-Pacific equity markets (1999). (6) RePEc:eee:glofin:v:3:y:1992:i:1:p:23-50 Intervention and the foreign exchange risk premium: An empirical investigation of daily effects (1992). (7) RePEc:eee:glofin:v:13:y:2002:i:2:p:217-235 International linkage of interest rates: Evidence from the emerging economies of Asia (2002). (8) RePEc:eee:glofin:v:8:y:1997:i:2:p:257-277 Co-movements of major European community stock markets: A vector autoregression analysis (1997). (9) RePEc:eee:glofin:v:9:y:1998:i:2:p:181-204 Cointegration, forecasting and international stock prices (1998). (10) RePEc:eee:glofin:v:15:y:2004:i:2:p:125-137 International transmission of stock exchange volatility: Empirical evidence from the Asian crisis (2004). (11) RePEc:eee:glofin:v:14:y:2003:i:3:p:271-286 Determinants of emerging-market bond spreads: Cross-country evidence (2003). (12) RePEc:eee:glofin:v:17:y:2007:i:3:p:419-438 A modified finite-lived American exchange option methodology applied to real options valuation (2007). (13) RePEc:eee:glofin:v:17:y:2007:i:3:p:350-378 How important is participation of different venture capitalists in German IPOs? (2007). (14) RePEc:eee:glofin:v:18:y:2007:i:2:p:228-250 The determinants of international financial integration (2007). (15) RePEc:eee:glofin:v:13:y:2002:i:1:p:29-38 Corporate risk management: Costs and benefits (2002). (16) RePEc:eee:glofin:v:10:y:1999:i:1:p:71-81 Cointegration and causality between macroeconomic variables and stock market returns (1999). (17) RePEc:eee:glofin:v:8:y:1997:i:2:p:309-321 Political instability and country risk (1997). (18) RePEc:eee:glofin:v:16:y:2006:i:3:p:245-263 Volatility co-movements between emerging sovereign bonds: Is there segmentation between geographical areas? (2006). (19) RePEc:eee:glofin:v:9:y:1998:i:2:p:241-251 On the relationship between stock returns and exchange rates: Tests of granger causality (1998). (20) RePEc:eee:glofin:v:15:y:2004:i:1:p:57-70 Financial markets and the financing choice of firms: Evidence from developing countries (2004). (21) RePEc:eee:glofin:v:20:y:2009:i:2:p:128-136 Forecasting Value-at-Risk using high frequency data: The realized range model (2009). (22) RePEc:eee:glofin:v:11:y:2000:i:1-2:p:31-52 The determination and international transmission of stock market volatility (2000). (23) RePEc:eee:glofin:v:16:y:2005:i:1:p:48-68 Contagion and impulse response of international stock markets around the 9-11 terrorist attacks (2005). (24) RePEc:eee:glofin:v:17:y:2006:i:1:p:1-22 Valuing volatility spillovers (2006). (25) RePEc:eee:glofin:v:18:y:2007:i:1:p:16-33 Optimal currency hedging (2007). (26) RePEc:eee:glofin:v:15:y:2005:i:3:p:251-280 An analysis of the determinants of sovereign ratings (2005). (27) RePEc:eee:glofin:v:16:y:2005:i:1:p:99-111 Biases in FX-forecasts: Evidence from panel data (2005). (28) RePEc:eee:glofin:v:10:y:1999:i:1:p:1-23 Nonlinear dynamics in foreign exchange rates (1999). (29) RePEc:eee:glofin:v:13:y:2002:i:1:p:63-91 Propagative causal price transmission among international stock markets: evidence from the pre- and postglobalization period (2002). (30) RePEc:eee:glofin:v:15:y:2005:i:3:p:303-320 New European Union members on their way to adopting the Euro: An analysis of macroeconomic disturbances (2005). (31) RePEc:eee:glofin:v:12:y:2001:i:1:p:35-53 Chaotic behavior in national stock market indices: New evidence from the close returns test (2001). (32) RePEc:eee:glofin:v:9:y:1998:i:2:p:173-180 The Latin American foreign debt revisited (1998). (33) RePEc:eee:glofin:v:8:y:1997:i:1:p:113-128 Growth effects of integration among unequal countries (1997). (34) RePEc:eee:glofin:v:15:y:2004:i:1:p:29-56 Filtering the BEER: A permanent and transitory decomposition (2004). (35) RePEc:eee:glofin:v:15:y:2005:i:3:p:281-302 Technical trading, monetary policy, and exchange rate regimes (2005). (36) RePEc:eee:glofin:v:16:y:2005:i:2:p:164-179 Market quality and price discovery: Introduction of the E-mini energy futures (2005). (37) RePEc:eee:glofin:v:14:y:2003:i:1:p:65-82 State equity ownership and firm market performance: evidence from Chinas newly privatized firms (2003). (38) RePEc:eee:glofin:v:9:y:1998:i:1:p:71-80 Causal relations among stock returns, inflation, real activity, and interest rates: Evidence from Japan (1998). (39) RePEc:eee:glofin:v:11:y:2000:i:1-2:p:129-149 The interaction and volatility asymmetry of unexpected returns in the greater China stock markets (2000). (40) RePEc:eee:glofin:v:3:y:1992:i:1:p:67-77 Portfolio diversification and the inter-temporal stability of international stock indices (1992). (41) RePEc:eee:glofin:v:14:y:2003:i:3:p:319-332 Asymmetric information transmission between a transition economy and the U.S. market: evidence from the Warsaw Stock Exchange (2003). (42) RePEc:eee:glofin:v:12:y:2001:i:1:p:109-119 US exports and time-varying volatility of real exchange rate (2001). (43) RePEc:eee:glofin:v:17:y:2006:i:2:p:214-223 Effects of size and international exposure of the US firms on the relationship between stock prices and exchange rates (2006). (44) RePEc:eee:glofin:v:12:y:2001:i:1:p:95-107 Price and volatility spillovers between interest rate and exchange value of the US dollar (2001). (45) RePEc:eee:glofin:v:7:y:1996:i:2:p:209-222 Foreign direct investment: The factors affecting the location of foreign branch plants in the United States (1996). (46) RePEc:eee:glofin:v:4:y:1993:i:1:p:1-19 Comovements of international equity returns: A comparison of the pre- and post-October 19, 1987, periods (1993). (47) RePEc:eee:glofin:v:13:y:2002:i:2:p:147-161 The impact of financial crises on international diversification (2002). (48) repec:eee:glofin:v:15:y:2004:i:1:p:81-102 (). (49) RePEc:eee:glofin:v:12:y:2001:i:1:p:55-77 An empirical investigation of trading volume and return volatility of the Taiwan Stock Market (2001). (50) RePEc:eee:glofin:v:14:y:2003:i:2:p:159-179 Wealth creation and managerial pay: MVA and EVA as determinants of executive compensation (2003). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:zbw:ifwedp:200942 Yes, we should discount the far-distant future at its lowest possible rate: a resolution of the Weitzman-Gollier puzzle (2009). Economics Discussion Papers Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:pra:mprapa:19656 What moves the primary stock and bond markets? Influence of macroeconomic factors on bond and equity issues in Malaysia and Korea (2007). MPRA Paper (2) RePEc:rif:dpaper:1067 Non-financial Value-added of Venture Capital: A Comparative Study of Different Venture Capital Investors (2007). Discussion Papers Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||