|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

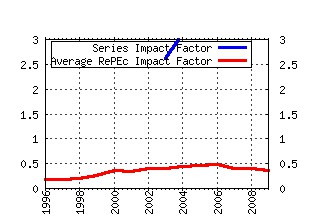

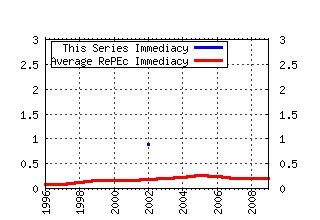

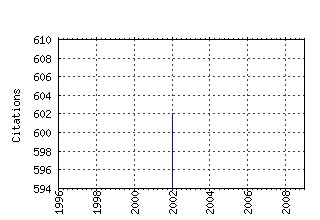

Handbook of Public Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:pubchp:3-22 Tax avoidance, evasion, and administration (2002). (2) RePEc:eee:pubchp:1-02 The theory of excess burden and optimal taxation (1985). (3) RePEc:eee:pubchp:4-30 Publicly provided education (2002). (4) RePEc:eee:pubchp:3-19 Taxation and corporate financial policy (2002). (5) RePEc:eee:pubchp:2-11 The economics of the local public sector (1987). (6) RePEc:eee:pubchp:4-33 Labor supply effects of social insurance (2002). (7) RePEc:eee:pubchp:4-32 Social security (2002). (8) RePEc:eee:pubchp:1-04 Taxes and labor supply (1985). (9) RePEc:eee:pubchp:2-15 Pareto efficient and optimal taxation and the new new welfare economics (1987). (10) RePEc:eee:pubchp:1-06 Tax policy in open economies (1985). (11) RePEc:eee:pubchp:3-20 Tax policy and business investment (2002). (12) RePEc:eee:pubchp:2-14 The theory of cost-benefit analysis (1987). (13) RePEc:eee:pubchp:3-21 Taxation and economic efficiency (2002). (14) RePEc:eee:pubchp:4-26 Tax incidence (2002). (15) RePEc:eee:pubchp:3-18 Taxation and saving (2002). (16) RePEc:eee:pubchp:4-28 International taxation (2002). (17) RePEc:eee:pubchp:3-23 Environmental taxation and regulation (2002). (18) RePEc:eee:pubchp:2-13 Income maintenance and social insurance (1987). (19) RePEc:eee:pubchp:1-05 The effects of taxation on savings and risk taking (1985). (20) RePEc:eee:pubchp:4-34 Welfare programs and labor supply (2002). (21) RePEc:eee:pubchp:2-16 Tax incidence (1987). (22) RePEc:eee:pubchp:1-01 A brief history of fiscal doctrine (1985). (23) RePEc:eee:pubchp:4-27 Generational policy (2002). (24) RePEc:eee:pubchp:1-07 Housing subsidies: Effects on housing decisions, efficiency, and equity (1985). (25) RePEc:eee:pubchp:2-09 Theory of public goods (1987). (26) RePEc:eee:pubchp:3-25 Economic analysis of law (2002). (27) RePEc:eee:pubchp:3-24 Political economics and public finance (2002). (28) RePEc:eee:pubchp:4-31 Health care and the public sector (2002). (29) RePEc:eee:pubchp:4-29 Local public goods and clubs (2002). (30) RePEc:eee:pubchp:2-10 Incentives and the allocation of public goods (1987). (31) RePEc:eee:pubchp:1-08 The taxation of natural resources (1985). (32) RePEc:eee:pubchp:3-17 Taxation, risk-taking, and household portfolio behavior (2002). (33) RePEc:eee:pubchp:2-12 Markets, governments, and the new political economy (1987). (34) RePEc:eee:pubchp:1-03 Public sector pricing (1985). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||