|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

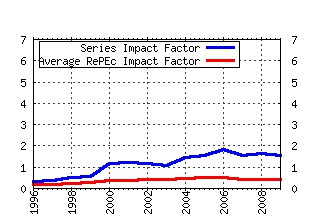

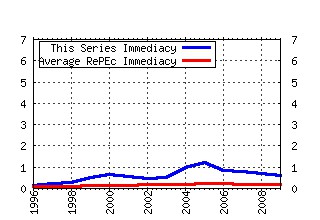

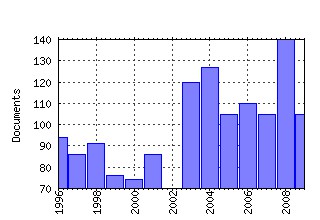

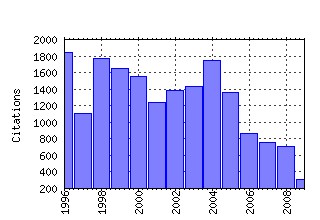

Journal of Public Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:pubeco:v:61:y:1996:i:3:p:359-381 Satisfaction and comparison income (1996). (2) RePEc:eee:pubeco:v:1:y:1972:i:3-4:p:323-338 Income tax evasion: a theoretical analysis (1972). (3) RePEc:eee:pubeco:v:29:y:1986:i:1:p:25-49 On the private provision of public goods (1986). (4) RePEc:eee:pubeco:v:88:y:2004:i:7-8:p:1359-1386 Well-being over time in Britain and the USA (2004). (5) RePEc:eee:pubeco:v:76:y:2000:i:3:p:399-457 The causes of corruption: a cross-national study (2000). (6) RePEc:eee:pubeco:v:28:y:1985:i:1:p:59-83 Redistributive taxation in a simple perfect foresight model (1985). (7) RePEc:eee:pubeco:v:6:y:1976:i:1-2:p:55-75 The design of tax structure: Direct versus indirect taxation (1976). (8) RePEc:eee:pubeco:v:52:y:1993:i:3:p:309-328 Strategies for the international protection of the environment (1993). (9) RePEc:eee:pubeco:v:85:y:2002:i:2:p:207-234 Who trusts others? (2002). (10) RePEc:eee:pubeco:v:68:y:1998:i:3:p:335-367 Taxes and the location of production: evidence from a panel of US multinationals (1998). (11) RePEc:eee:pubeco:v:8:y:1977:i:3:p:329-340 Voting over income tax schedules (1977). (12) RePEc:eee:pubeco:v:76:y:2000:i:3:p:459-493 Dodging the grabbing hand: the determinants of unofficial activity in 69 countries (2000). (13) RePEc:eee:pubeco:v:41:y:1990:i:1:p:45-72 The impact of the potential duration of unemployment benefits on the duration of unemployment (1990). (14) RePEc:eee:pubeco:v:89:y:2005:i:5-6:p:997-1019 Income and well-being: an empirical analysis of the comparison income effect (2005). (15) RePEc:eee:pubeco:v:83:y:2002:i:3:p:325-345 Decentralization and corruption: evidence across countries (2002). (16) RePEc:eee:pubeco:v:74:y:1999:i:2:p:171-190 Fiscal policy and growth: evidence from OECD countries (1999). (17) RePEc:eee:pubeco:v:52:y:1993:i:3:p:285-307 Budget spillovers and fiscal policy interdependence : Evidence from the states (1993). (18) RePEc:eee:pubeco:v:35:y:1988:i:2:p:229-240 Nash equilibria in models of fiscal competition (1988). (19) RePEc:eee:pubeco:v:5:y:1976:i:3-4:p:193-208 Effluent charges and licenses under uncertainty (1976). (20) RePEc:eee:pubeco:v:37:y:1988:i:3:p:291-304 Why free ride? : Strategies and learning in public goods experiments (1988). (21) RePEc:eee:pubeco:v:17:y:1982:i:2:p:213-240 Self-selection and Pareto efficient taxation (1982). (22) RePEc:eee:pubeco:v:25:y:1984:i:3:p:329-369 A complete solution to a class of principal-agent problems with an application to the control of a self-managed firm (1984). (23) RePEc:eee:pubeco:v:35:y:1988:i:3:p:333-354 Economic competition among jurisdictions: efficiency enhancing or distortion inducing? (1988). (24) RePEc:eee:pubeco:v:38:y:1989:i:2:p:183-198 Overlapping families of infinitely-lived agents (1989). (25) RePEc:eee:pubeco:v:3:y:1974:i:4:p:303-328 The measurement of urban travel demand (1974). (26) RePEc:eee:pubeco:v:2:y:1973:i:3:p:193-216 Higher education as a filter (1973). (27) RePEc:eee:pubeco:v:69:y:1998:i:2:p:263-279 Corruption and the composition of government expenditure (1998). (28) RePEc:eee:pubeco:v:48:y:1992:i:1:p:21-38 Why do people pay taxes? (1992). (29) RePEc:eee:pubeco:v:89:y:2005:i:5-6:p:897-931 Preferences for redistribution in the land of opportunities (2005). (30) RePEc:eee:pubeco:v:10:y:1978:i:3:p:295-336 A model of social insurance with variable retirement (1978). (31) RePEc:eee:pubeco:v:84:y:2002:i:1:p:1-32 The elasticity of taxable income: evidence and implications (2002). (32) RePEc:eee:pubeco:v:72:y:1999:i:3:p:329-360 The cost-effectiveness of alternative instruments for environmental protection in a second-best setting (1999). (33) RePEc:eee:pubeco:v:69:y:1998:i:3:p:305-321 Openness, country size and government (1998). (34) RePEc:eee:pubeco:v:66:y:1997:i:2:p:247-274 The selection principle and market failure in systems competition (1997). (35) RePEc:eee:pubeco:v:11:y:1979:i:1:p:25-45 Incentives and incomplete information (1979). (36) RePEc:eee:pubeco:v:14:y:1980:i:1:p:49-68 Redistributive taxation as social insurance (1980). (37) RePEc:eee:pubeco:v:15:y:1981:i:1:p:1-22 The incidence and allocation effects of a tax on corporate distributions (1981). (38) RePEc:eee:pubeco:v:62:y:1996:i:3:p:297-325 Ends against the middle: Determining public service provision when there are private alternatives (1996). (39) RePEc:eee:pubeco:v:83:y:2002:i:1:p:83-107 Individual preferences for political redistribution (2002). (40) RePEc:eee:pubeco:v:6:y:1976:i:4:p:327-358 Optimal tax theory : A synthesis (1976). (41) RePEc:eee:pubeco:v:87:y:2003:i:12:p:2611-2637 Centralized versus decentralized provision of local public goods: a political economy approach (2003). (42) RePEc:eee:pubeco:v:88:y:2004:i:9-10:p:2009-2042 Inequality and happiness: are Europeans and Americans different? (2004). (43) RePEc:eee:pubeco:v:80:y:2001:i:2:p:269-286 The simple analytics of the environmental Kuznets curve (2001). (44) RePEc:eee:pubeco:v:81:y:2001:i:3:p:345-368 Early childhood nutrition and academic achievement: a longitudinal analysis (2001). (45) RePEc:eee:pubeco:v:35:y:1988:i:1:p:57-73 Privately provided public goods in a large economy: The limits of altruism (1988). (46) RePEc:eee:pubeco:v:3:y:1974:i:2:p:201-202 Income tax evasion: A theoretical analysis (1974). (47) RePEc:eee:pubeco:v:29:y:1986:i:2:p:133-172 Commodity tax competition between member states of a federation: equilibrium and efficiency (1986). (48) RePEc:eee:pubeco:v:71:y:1999:i:1:p:121-139 Country size and tax competition for foreign direct investment (1999). (49) RePEc:eee:pubeco:v:85:y:2002:i:3:p:409-434 Combining price and quantity controls to mitigate global climate change (2002). (50) RePEc:eee:pubeco:v:59:y:1996:i:2:p:219-237 Majority voting with single-crossing preferences (1996). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:aea:aecrev:v:99:y:2009:i:5:p:2247-57 Individual Behavior and Group Membership: Comment (2009). American Economic Review (2) RePEc:bol:bodewp:665 How groups reach agreement in risky choices: an experiment. (2009). Working Papers (3) RePEc:btx:wpaper:0930 Transfer Pricing Policy and the Intensity of Tax Rate Competition (2009). Working Papers (4) RePEc:cdx:dpaper:2009-07 Sequential versus simultaneous contributions to public goods: Experimental evidence (2009). Discussion Papers (5) RePEc:cep:cepdps:dp0943 Theory of Values (2009). CEP Discussion Papers (6) RePEc:ces:ceswps:_2602 Sequential versus Simultaneous Contributions to Public Goods: Experimental Evidence (2009). CESifo Working Paper Series (7) RePEc:ces:ceswps:_2670 Incentive Contracts and Efficient Unemployment Benefits (2009). CESifo Working Paper Series (8) RePEc:ces:ceswps:_2691 Political Stability and Fiscal Policy - Time Series Evidence for the Swiss Federal Level since 1849 (2009). CESifo Working Paper Series (9) RePEc:ces:ceswps:_2701 Optimal Income Taxation and Public Goods Provision in a Large Economy with Aggregate Uncertainty (2009). CESifo Working Paper Series (10) RePEc:ces:ceswps:_2711 Incomplete Property Rights and Overinvestment (2009). CESifo Working Paper Series (11) RePEc:ces:ceswps:_2717 Annuity Market Imperfection, Retirement and Economic Growth (2009). CESifo Working Paper Series (12) RePEc:ces:ceswps:_2756 The Impact of Dividend Taxation on Dividends and Investment: New Evidence Based on a Natural Experiment (2009). CESifo Working Paper Series (13) RePEc:ces:ceswps:_2789 Federalism and Accountability with Distorted Election Choices (2009). CESifo Working Paper Series (14) RePEc:ces:ceswps:_2805 Aid, Growth and Devolution (2009). CESifo Working Paper Series (15) RePEc:ces:ceswps:_2877 Econometric Methods for Causal Evaluation of Education Policies and Practices: A Non-Technical Guide (2009). CESifo Working Paper Series (16) RePEc:ces:ceswps:_2881 Corporate Taxation and Corporate Governance (2009). CESifo Working Paper Series (17) RePEc:ces:ceswps:_2896 Voting on Thresholds for Public Goods: Experimental Evidence (2009). CESifo Working Paper Series (18) RePEc:ces:ceswps:_2902 Behavioral and Experimental Economics Can Inform Public Policy: Some Thoughts (2009). CESifo Working Paper Series (19) RePEc:ces:ceswps:_2905 The Effect of Surveillance Cameras on Crime: Evidence from the Stockholm Subway (2009). CESifo Working Paper Series (20) RePEc:cpr:ceprdp:7299 Public School Availability for Two-year Olds and Mothers Labour Supply (2009). CEPR Discussion Papers (21) RePEc:diw:diwsop:diw_sp226 Marital Risk, Family Insurance, and Public Policy (2009). SOEPpapers (22) RePEc:diw:diwsop:diw_sp241 Expected Future Earnings, Taxation, and University Enrollment: A Microeconometric Model with Uncertainty (2009). SOEPpapers (23) RePEc:ebl:ecbull:eb-09-00460 Mixed oligopoly and spatial agglomeration in quasi-linear city (2009). Economics Bulletin (24) RePEc:eth:wpswif:09-123 Tax Contracts and Elections (2009). CER-ETH Economics working paper series (25) RePEc:eui:euiwps:eco2009/40 Pre-announcement and Timing - The Effects of a Government Expenditure Shock (2009). (26) RePEc:fip:fedhwp:wp-09-02 Why do the elderly save? the role of medical expenses (2009). Working Paper Series (27) RePEc:geo:guwopa:gueconwpa~09-09-03 Valuing Public Goods Using Happiness Data: The Case of Air Quality (2009). Working Papers (28) RePEc:hhs:iuiwop:0801 Common Trends and Shocks to Top Incomes â A Structural Breaks Approach (2009). Working Paper Series (29) RePEc:hhs:sdueko:2009_005 The optimal legal retirement age in an OLG model with endogenous labour supply (2009). Discussion Papers of Business and Economics (30) RePEc:hou:wpaper:2009-04 DOES IT PAY TO GET AN A? SCHOOL RESOURCE ALLOCATIONS IN RESPONSE TO ACCOUNTABILITY RATINGS (2009). Working Papers (31) RePEc:ieb:wpaper:2009/12/doc2009-36 Do re-election probabilities influence public investment? (2009). Working Papers (32) RePEc:iis:dispap:iiisdp316 Cross-Border Investment in Small International Financial Centers (2009). The Institute for International Integration Studies Discussion Paper Series (33) RePEc:jku:econwp:2009_11 Early tracking and the misfortune of being young (2009). Economics working papers (34) RePEc:jku:nrnwps:2009_20 Early tracking and the misfortune of being young (2009). NRN working papers (35) RePEc:kap:expeco:v:12:y:2009:i:1:p:113-132 Subject pool effects in a corruption experiment: A comparison of Indonesian public servants and Indonesian students (2009). Experimental Economics (36) RePEc:kap:expeco:v:12:y:2009:i:4:p:488-503 The effects of externalities and framing on bribery in a petty corruption experiment (2009). Experimental Economics (37) RePEc:kap:jecinq:v:7:y:2009:i:1:p:29-54 Informatization, voter turnout and income inequality (2009). Journal of Economic Inequality (38) RePEc:kap:pubcho:v:138:y:2009:i:3:p:317-345 The life satisfaction approach to valuing public goods: The case of terrorism (2009). Public Choice (39) RePEc:kud:kuiedp:0927 Voting on Thresholds for Public Goods: Experimental Evidence (2009). Discussion Papers (40) RePEc:mar:magkse:200920 Geringqualifizierte Arbeit, Marktlöhne und Sozialpolitik: Konzepte für Deutschland (2009). MAGKS Papers on Economics (41) RePEc:mcm:deptwp:2009-08 How groups reach agreement in risky choices: an experiment (2009). Department of Economics Working Papers (42) RePEc:mia:wpaper:2010-12 Competition for Access and Full Revelation of Evidence (2009). Working Papers (43) RePEc:nbr:nberwo:14801 Civil War (2009). NBER Working Papers (44) RePEc:nbr:nberwo:14839 Employer-Sponsored Health Insurance and the Promise of Health Insurance Reform (2009). NBER Working Papers (45) RePEc:nbr:nberwo:14951 Do Investments in Universal Early Education Pay Off? Long-term Effects of Introducing Kindergartens into Public Schools (2009). NBER Working Papers (46) RePEc:nbr:nberwo:15044 Firm Heterogeneity and the Long-run Effects of Dividend Tax Reform (2009). NBER Working Papers (47) RePEc:nbr:nberwo:15097 Skill Dispersion and Trade Flows (2009). NBER Working Papers (48) RePEc:nbr:nberwo:15408 Top Incomes in the Long Run of History (2009). NBER Working Papers (49) RePEc:nbr:nberwo:15497 Family Violence and Football: The Effect of Unexpected Emotional Cues on Violent Behavior (2009). NBER Working Papers (50) RePEc:ner:leuven:urn:hdl:123456789/252863 School accountability: (how) can we reward schools and avoid cream-skimming?. (2009). Open Access publications from Katholieke Universiteit Leuven (51) RePEc:nwu:cmsems:1483 Market and Non-Market Mechanisms for the Optimal Allocation of Scarce Resources (2009). Discussion Papers (52) RePEc:nya:albaec:09-01 Do Fundraisers Select Charitable Donors Based on Gender and Race? Evidence from Survey Data (2009). Discussion Papers (53) RePEc:osp:wpaper:09e005 On the Role of Job Assignment in a Comparison of Education Systems (2009). OSIPP Discussion Paper (54) RePEc:pra:mprapa:13028 Privatization, Governments Preference and Unionization Structure: A Mixed Oligopoly Approach (2009). MPRA Paper (55) RePEc:pra:mprapa:15468 Comparing Cournot and Bertrand Competition in a Unionized Mixed Duopoly (2009). MPRA Paper (56) RePEc:pra:mprapa:17221 Governments Preference and Timing of Endogenous Wage Setting: Perspectives on Privatization and Mixed Duopoly (2009). MPRA Paper (57) RePEc:pra:mprapa:18312 Fundraising and optimal policy rules (2009). MPRA Paper (58) RePEc:rwi:repape:0098 The Impact of a Large Parental Leave Benefit Reform on the Timing of Birth around the Day of Implementation (2009). Ruhr Economic Papers (59) RePEc:spr:jopoec:v:22:y:2009:i:3:p:585-601 Effects of public education and social security on fertility (2009). Journal of Population Economics (60) RePEc:zbw:ifweej:7602 DSGE Models and Central Banks (2009). Economics - The Open-Access, Open-Assessment E-Journal (61) RePEc:zbw:iwqwdp:082009 Product differentiation and welfare in a mixed duopoly with regulated prices: the case of a public and a private hospital (2009). IWQW Discussion Paper Series (62) RePEc:zur:iewwpx:460 Of bubbles and bankers: The impact of financial booms on labor markets (2009). IEW - Working Papers Recent citations received in: 2008 (1) RePEc:aub:autbar:723.08 Inter-Group Conflict and Intra-Group Punishment in an Experimental Contest Game (2008). UFAE and IAE Working Papers (2) RePEc:awi:wpaper:0466 How Delegation Improves Commitment (2008). Working Papers (3) RePEc:awi:wpaper:0467 The Design of Permit Schemes and Environmental Innovation (2008). Working Papers (4) RePEc:bro:econwp:2008-1 Getting Punnishment Right: Do Costly Monitoring or Redustributive Punishment Help? (2008). Working Papers (5) RePEc:btx:wpaper:0813 Corporate Taxation and the Welfare State (2008). Working Papers (6) RePEc:btx:wpaper:0816 Cross-Border Tax Effects on Affiliate Investment - Evidence from European Multinationals (2008). Working Papers (7) RePEc:btx:wpaper:0817 Transfer-pricing and Measured Productivity of Multinational Firms (2008). Working Papers (8) RePEc:btx:wpaper:0830 Tax Competition in an Expanding European Union (2008). Working Papers (9) RePEc:cep:cepdps:dp0890 Comparing Willingness-to-Pay and Subjective Well-Being in the Context of Non-Market Goods (2008). CEP Discussion Papers (10) RePEc:ces:ceswps:_2320 Corporate Income Taxation of Multinationals in a General Equilibrium Model (2008). CESifo Working Paper Series (11) RePEc:ces:ceswps:_2384 Corporate Tax Competition and the Decline of Public Investment (2008). CESifo Working Paper Series (12) RePEc:ces:ceswps:_2411 The Political Competition-Economic Performance Puzzle: Evidence from the OECD Countries and the Italian Regions (2008). CESifo Working Paper Series (13) RePEc:ces:ceswps:_2477 Corporate Income Tax and Economic Distortions (2008). CESifo Working Paper Series (14) RePEc:ces:ceswps:_2499 Fiscal Competition over Taxes and Public Inputs: Theory and Evidence (2008). CESifo Working Paper Series (15) RePEc:cii:cepidt:2008-17 Government Consumption Volatility and Country Size (2008). Working Papers (16) RePEc:cla:levarc:122247000000002387 Ideology and Competence in Alternative Electoral Systems (2008). Levine's Working Paper Archive (17) RePEc:clu:wpaper:0809-03 Skills, Schools, and Credit Constraints: Evidence from Massachusetts (2008). Discussion Papers (18) RePEc:clu:wpaper:0809-07 Storable Votes and Agenda Order Control Theories and Experiments (2008). Discussion Papers (19) RePEc:cpr:ceprdp:6774 Secondary Issues and Party Politics: An Application to Environmental Policy (2008). CEPR Discussion Papers (20) RePEc:cpr:ceprdp:6793 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). CEPR Discussion Papers (21) RePEc:cpr:ceprdp:6888 Governing the Governors: A Clinical Study of Central Banks (2008). CEPR Discussion Papers (22) RePEc:cpr:ceprdp:7013 Free Flows, Limited Diversification: Explaining the Fall and Rise of Stock Market Correlations, 1890-2001 (2008). CEPR Discussion Papers (23) RePEc:cpr:ceprdp:7044 Fiscal Sustainability and Demographics - Should We Save or Work More? (2008). CEPR Discussion Papers (24) RePEc:cpr:ceprdp:7050 Storable Votes and Agenda Order Control. Theory and Experiments (2008). CEPR Discussion Papers (25) RePEc:cpr:ceprdp:7067 The long-term effects of job search requirements: Evidence from the UK JSA reform. (2008). CEPR Discussion Papers (26) RePEc:csa:wpaper:2008-01 Subjective well-being, disability and adaptation: A case study from rural Ethiopia (2008). CSAE Working Paper Series (27) RePEc:ctc:serie6:itemq0851 Politicians Reputation and Policy (Un)persistence (2008). DISCE - Quaderni dell'Istituto di Teoria Economica e Metodi Quantitativi (28) RePEc:cwm:wpaper:72 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). Working Papers (29) RePEc:dgr:kubcen:200882 What is an Adequate Standard of Living During Retirement? (2008). Discussion Paper (30) RePEc:diw:diwwpp:dp829 Effective Profit Taxation and the Elasticity of the Corporate Income Tax Base: Evidence from German Corporate Tax Return Data (2008). Discussion Papers of DIW Berlin (31) RePEc:dnb:dnbwpp:180 Minimum Funding Ratios for Defined-Benefit Pension Funds (2008). DNB Working Papers (32) RePEc:ecb:ecbwps:20080928 Corporate tax competition and the decline of public investment (2008). Working Paper Series (33) RePEc:ecl:stabus:1993 The Economics and Politics of Corporate Social Performance (2008). Research Papers (34) RePEc:ema:worpap:2008-36 Modelling the employment and wage outcomes of spouses: Is she outearning him? (2008). THEMA Working Papers (35) RePEc:fce:doctra:0801 Modelling employment and wage outcomes of spouses: is she outearning him? (2008). Documents de Travail de l'OFCE (36) RePEc:fem:femwpa:2008.31 A Social Network Analysis of Occupational Segregation (2008). Working Papers (37) RePEc:fer:dpaper:465 A Distributional Analysis of Displacement Costs in an Economic Depression and Recovery (2008). Discussion Papers (38) RePEc:gla:glaewp:2008_15 Countercyclical Fiscal Policy and Cyclical Factor Utilization (2008). Working Papers (39) RePEc:gra:paoner:08/01 The Big Carrot: High Stake Incentives Revisited (2008). Papers on Economics of Religion (40) RePEc:hhs:iuiwop:0735 Identity and Redistribution (2008). Working Paper Series (41) RePEc:hhs:umnees:0740 Positional Concerns with Multiple Reference Points: Optimal Income Taxation and Public Goods in an OLG Model (2008). UmeÃ¥ Economic Studies (42) RePEc:igi:igierp:346 Do Better Paid Politicians Perform Better? Disentangling Incentives from Selection (2008). Working Papers (43) RePEc:imf:imfwpa:08/203 Zero Corporate Income Tax in Moldova: Tax Competition and Its Implications for Eastern Europe (2008). IMF Working Papers (44) RePEc:imf:imfwpa:08/227 Tax Reforms, Free Lunches, and Cheap Lunches in Open Economies (2008). IMF Working Papers (45) RePEc:inn:wpaper:2008-07 Choosing the carrot or the stick? ? Endogenous institutional choice in social dilemma situations (2008). Working Papers (46) RePEc:irv:wpaper:080907 International Coordination and Domestic Politics (2008). Working Papers (47) RePEc:isu:genres:12939 Deviant Generations, Ricardian Equivalence, and Growth Cycles (2008). Staff General Research Papers (48) RePEc:iza:izadps:dp3344 On the Curvature of the Reporting Function from Objective Reality to Subjective Feelings (2008). IZA Discussion Papers (49) RePEc:iza:izadps:dp3362 Heterogeneous Impacts in PROGRESA (2008). IZA Discussion Papers (50) RePEc:iza:izadps:dp3439 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). IZA Discussion Papers (51) RePEc:iza:izadps:dp3604 Happiness Dynamics with Quarterly Life Event Data (2008). IZA Discussion Papers (52) RePEc:iza:izadps:dp3801 Intergenerational Top Income Mobility in Sweden: A Combination of Equal Opportunity and Capitalistic Dynasties (2008). IZA Discussion Papers (53) RePEc:iza:izadps:dp3851 Age-Dependent Employment Protection (2008). IZA Discussion Papers (54) RePEc:iza:izadps:dp3856 The Long-Term Effects of Job Search Requirements: Evidence from the UK JSA Reform (2008). IZA Discussion Papers (55) RePEc:jku:econwp:2008_19 Layoff Tax and the Employment of the Elderly (2008). Economics working papers (56) RePEc:jku:nrnwps:2008_04 Layoff Tax and the Employment of the Elderly (2008). NRN working papers (57) RePEc:kap:jeczfn:v:95:y:2008:i:3:p:271-276 McChesney, R. W.: Communication revolution: critical junctures and the future of media (2008). Journal of Economics (58) RePEc:kof:wpskof:08-214 Does Aging Influence Sectoral Employment Shares? Evidence from Panel Datak (2008). KOF Working papers (59) RePEc:ler:wpaper:08.02.246 Persuasive Subsidies in a Clean Environment (2008). Working Papers (60) RePEc:lic:licosd:21608 Are your firms taxes set in Warsaw? Spatial tax competition in Europe (2008). LICOS Discussion Papers (61) RePEc:lmu:muenec:4450 Corporate Taxes, Profit Shifting and the Location of Intangibles within Multinational Firms (2008). Discussion Papers in Economics (62) RePEc:lmu:muenec:5294 Corporate Taxes and the Location of Intangible Assets Within Multinational Firms (2008). Discussion Papers in Economics (63) RePEc:lvl:pmmacr:2008-12 Will Formula-Based Funding and Decentralized Management Improve School Level Resources in Sri Lanka? (2008). Cahiers de recherche PMMA (64) RePEc:mar:magkse:200805 Participation and Decision Making: A Three-person Power-to-take Experiment (2008). MAGKS Papers on Economics (65) RePEc:mlb:wpaper:1036 Feedback; Punishment and Cooperation in Public Good Experiments (2008). Department of Economics - Working Papers Series (66) RePEc:mlb:wpaper:1058 Feuds in the Laboratory? A Social Dilemma Experiment (2008). Department of Economics - Working Papers Series (67) RePEc:nbr:nberwo:13956 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). NBER Working Papers (68) RePEc:nbr:nberwo:14307 Redistribution and Tax Expenditures: The Earned Income Tax Credit (2008). NBER Working Papers (69) RePEc:nbr:nberwo:14487 Storable Votes and Agenda Order Control. Theory and Experiments (2008). NBER Working Papers (70) RePEc:nbr:nberwo:14593 Empathy and Emulation: Life Satisfaction and the Urban Geography of Comparison Groups (2008). NBER Working Papers (71) RePEc:nbr:nberwo:14606 Can Hearts and Minds Be Bought? The Economics of Counterinsurgency in Iraq (2008). NBER Working Papers (72) RePEc:nbr:nberwo:14622 Behavioral Welfare Economics (2008). NBER Working Papers (73) RePEc:ner:sciepo:info:hdl:2441/9644 Wealth Effects and Public Debt in an Endogenous Growth Model. Banca dItalia Public Finance Workshop Fiscal Sustainability : Analytical Developments and Emerging Policy Issues, Perugia, 3-5 April 2008. (2008). Open Access publications from Sciences Po (74) RePEc:ner:sciepo:info:hdl:2441/9665 Modelling the employment and wage outcomes of spouses: is she outearning him?. (2008). Open Access publications from Sciences Po (75) RePEc:ner:ucllon:http://discovery.ucl.ac.uk/14353/ Social capital in the workplace: Evidence on its formation and consequences. (2008). Open Access publications from University College London (76) RePEc:pra:mprapa:10218 Comparison of neighborhood trust between generations in a racially homogeneous society: A case study from Japan. (2008). MPRA Paper (77) RePEc:pra:mprapa:11385 The role of social capital in homogeneous society: Review of recent researches in Japan (2008). MPRA Paper (78) RePEc:pra:mprapa:8585 The effects of population aging on optimal redistributive taxes in an overlapping generations model (2008). MPRA Paper (79) RePEc:ptu:bdpart:b200814 The Gains of Unemployment Insurance to Job Match Quality in the Portuguese Labor Market (2008). Economic Bulletin and Financial Stability Report Articles (80) RePEc:rdg:emxxdp:em-dp2008-65 His and Hers: Exploring Gender Puzzles and the Meaning of Life Satisfaction (2008). (81) RePEc:rdg:emxxdp:em-dp2008-73 Are We Getting It Right? Values and Life Satisfaction (2008). (82) RePEc:reg:wpaper:558 Happiness Research and Cost-Benefit Analysis (2008). Working paper (83) RePEc:shr:wpaper:08-22 Intertwined Federalism: Accountability Problems under Partial Decentralization (2008). Cahiers de recherche (84) RePEc:spr:portec:v:7:y:2008:i:1:p:17-41 Equality of opportunity and educational achievement in Portugal (2008). Portuguese Economic Journal (85) RePEc:ssb:dispap:552 Top Incomes in Norway (2008). Discussion Papers (86) RePEc:ums:papers:2008-13 Is altruism bad for cooperation? (2008). Working Papers (87) RePEc:upf:upfgen:1119 A century of global equity market correlations (2008). Economics Working Papers (88) RePEc:uto:dipeco:200804 Spend more, get more? An inquiry into English local government performance (2008). Department of Economics Working Papers (89) RePEc:uwo:hcuwoc:20084 Evidence About the Potential Role for Affirmative Action in Higher Education (2008). University of Western Ontario, CIBC Centre for Human Capital and Productivity Working Papers (90) RePEc:wbk:wbrwps:3935 Empowering parents to improve education : evidence from rural Mexico (2008). Policy Research Working Paper Series (91) RePEc:wrk:warwec:839 On the Curvature of the Reporting Function from Objective Reality to Subjective Feelings (2008). The Warwick Economics Research Paper Series (TWERPS) (92) RePEc:yor:yorken:08/08 Optimal Nonlinear Income Taxation with Learning-by-Doing (2008). Discussion Papers (93) RePEc:yor:yorken:08/21 Ill-Health as a Household Norm: Evidence from Other Peoples Health Problems (2008). Discussion Papers (94) RePEc:zbw:arqudp:47 Auswirkungen der deutschen Unternehmensteuerreform 2008 und der österreichischen Gruppenbesteuerung auf den grenzüberschreitenden Unternehmenserwerb (2008). arqus Discussion Papers in Quantitative Tax Research (95) RePEc:zbw:arqudp:57 Effective profit taxation and the elasticity of the corporate income tax base: Evidence from German corporate tax return data (2008). arqus Discussion Papers in Quantitative Tax Research (96) RePEc:zbw:uoccpe:7451 Fiscal Equalisation and the Soft Budget Constraint (2008). FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Recent citations received in: 2007 (1) RePEc:aub:autbar:711.07 Does Affirmative Action Reduce Effort Incentives? A Contest Game Analysis (2007). UFAE and IAE Working Papers (2) RePEc:ays:ispwps:paper0720 Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia (2007). International Studies Program Working Paper Series, at AYSPS, GSU (3) RePEc:ays:ispwps:paper0727 Tax Compliance, Tax Morale, and Governance Quality (2007). International Studies Program Working Paper Series, at AYSPS, GSU (4) RePEc:ays:ispwps:paper0728 Myth and Reality of Flat Tax Reform: Tax Evasion and Real Side Response of Russian Households (2007). International Studies Program Working Paper Series, at AYSPS, GSU (5) RePEc:cam:camdae:0742 Do Autocratic States Trade Less? (2007). Cambridge Working Papers in Economics (6) RePEc:ces:ceswps:_1952 Fiscal Interactions Among European Countries. Does the EU Matter? (2007). CESifo Working Paper Series (7) RePEc:ces:ceswps:_2013 Greasing the Wheels of Entrepreneurship? The Impact of Regulations and Corruption on Firm Entry (2007). CESifo Working Paper Series (8) RePEc:ces:ceswps:_2054 Federal Tax-Transfer Policy and Intergovernmental Pre-Commitment (2007). CESifo Working Paper Series (9) RePEc:ces:ceswps:_2069 Exit and Voice. Yardstick versus Fiscal Competition across Governments (2007). CESifo Working Paper Series (10) RePEc:ces:ceswps:_2072 The Choice of Apportionment Factors under Formula Apportionment (2007). CESifo Working Paper Series (11) RePEc:ces:ceswps:_2122 From Separate Accounting to Formula Apportionment: Analysis in a Dynamic Framework (2007). CESifo Working Paper Series (12) RePEc:cir:cirwor:2007s-22 Tax Evasion: Cheating Rationally or Deciding Emotionally? (2007). CIRANO Working Papers (13) RePEc:cla:levrem:122247000000001769 Crowding out Both Sides of the Philanthropy Market: Evidence from a Panel of Charities (2007). Levine's Bibliography (14) RePEc:cla:levrem:321307000000000886 Political Economy of Mechanisms (2007). Levine's Bibliography (15) RePEc:cpr:ceprdp:6129 Social Interactions and Labour Market Outcomes in Cities (2007). CEPR Discussion Papers (16) RePEc:cpr:ceprdp:6130 Ethnicity and Spatial Externalities in Crime (2007). CEPR Discussion Papers (17) RePEc:cpr:ceprdp:6362 Should Egalitarians Expropriate Philanthropists? (2007). CEPR Discussion Papers (18) RePEc:crm:wpaper:0711 How Immigration Affects U.S. Cities (2007). CReAM Discussion Paper Series (19) RePEc:cte:werepe:we078551 Tax rates, governance, and the informal economy in high-income countries (2007). Economics Working Papers (20) RePEc:dgr:uvatin:20070076 Will Corporate Tax Consolidation improve Efficiency in the EU ? (2007). Tinbergen Institute Discussion Papers (21) RePEc:diw:diwesc:diwesc2 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). ESCIRRU Working Papers (22) RePEc:diw:diwwpp:dp748 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). Discussion Papers of DIW Berlin (23) RePEc:ecl:corcae:07-04 A Dynamic Theory of Public Spending, Taxation and Debt (2007). Working Papers (24) RePEc:eui:euiwps:eco2007/09 The Value Added Tax: Its Causes and Consequences (2007). (25) RePEc:exc:wpaper:2007-09 An experimental inquiry into the effect of yardstick competition on corruption (2007). Experimental Economics Center Working Paper Series (26) RePEc:fem:femwpa:2007.45 Trust in International Organizations: An Empirical Investigation Focusing on the United Nations (2007). Working Papers (27) RePEc:fip:fedbwp:07-3 Impatience and credit behavior: evidence from a field experiment (2007). Working Papers (28) RePEc:fip:fedbwp:07-9 Doing good or doing well? Image motivation and monetary incentives in behaving prosocially (2007). Working Papers (29) RePEc:gat:wpaper:0707 Endogenous Leadership Selection and Influence (2007). Working Papers (30) RePEc:gat:wpaper:0724 Tax Evasion: Cheating Rationally or Deciding Emotionally? (2007). Working Papers (31) RePEc:gde:journl:gde_v66_n2_p207-246 Gone for Good? Determinants of School Dropout in Southern Italy (2007). Giornale degli Economisti (32) RePEc:hal:journl:halshs-00142461 Endogenous Leadership Selection and Influence (2007). Post-Print (33) RePEc:hal:wpaper:hal-00243056 Point-record incentives, asymmetric information and dynamic data (2007). Working Papers (34) RePEc:idb:wpaper:4521 Institutional Quality and Government Efficiency (2007). RES Working Papers (35) RePEc:idb:wpaper:4526 Informality and Productivity in the Labor Market: Peru 1986 - 2001 (2007). RES Working Papers (36) RePEc:idb:wpaper:4527 Informalidad y Productividad en el Mercado Laboral: Perú 1986-2001 (Informality and Productivity in the Labor Market: Peru 1986 - 2001) (2007). RES Working Papers (37) RePEc:imf:imfwpa:07/142 VAT Attacks! (2007). IMF Working Papers (38) RePEc:imf:imfwpa:07/183 The Value-Added Tax: Its Causes and Consequences (2007). IMF Working Papers (39) RePEc:isu:genres:12780 Unit Vs. Ad Valorem Taxes in Multi-Product Cournot Oligopoly (2007). Staff General Research Papers (40) RePEc:ivi:wpasad:2007-16 MODELLING SEGREGATION THROUGH CELLULAR AUTOMATA: A THEORETICAL ANSWER (2007). Working Papers. Serie AD (41) RePEc:iza:izadps:dp2843 Electoral Accountability and Corruption in Local Governments: Evidence from Audit Reports (2007). IZA Discussion Papers (42) RePEc:iza:izadps:dp2968 Doing Good or Doing Well? Image Motivation and Monetary Incentives in Behaving Prosocially (2007). IZA Discussion Papers (43) RePEc:iza:izadps:dp3103 Tax Evasion: Cheating Rationally or Deciding Emotionally? (2007). IZA Discussion Papers (44) RePEc:iza:izadps:dp3134 Incentives and Services for College Achievement: Evidence from a Randomized Trial (2007). IZA Discussion Papers (45) RePEc:iza:izadps:dp3228 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). IZA Discussion Papers (46) RePEc:iza:izadps:dp3267 Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia (2007). IZA Discussion Papers (47) RePEc:jku:econwp:2007_01 Shadow economy, tax morale, governance and institutional quality: A panel analysis (2007). Economics working papers (48) RePEc:jku:econwp:2007_02 The impact of tax morale and institutional quality on the shadow economy (2007). Economics working papers (49) RePEc:kap:itaxpf:v:14:y:2007:i:4:p:365-381 VAT attacks! (2007). International Tax and Public Finance (50) RePEc:kap:itaxpf:v:14:y:2007:i:5:p:605-626 How would the introduction of an EU-wide formula apportionment affect the distribution and size of the corporate tax base? An analysis based on German multinationals (2007). International Tax and Public Finance (51) RePEc:kap:jfsres:v:31:y:2007:i:1:p:1-32 Defined Contribution Pension Plans: Determinants of Participation and Contributions Rates (2007). Journal of Financial Services Research (52) RePEc:kap:jrisku:v:35:y:2007:i:3:p:237-264 Predicted risk perception and risk-taking behavior: The case of impaired driving (2007). Journal of Risk and Uncertainty (53) RePEc:kof:wpskof:07-181 Terrorism and Cabinet Duration: An Empirical Analysis (2007). KOF Working papers (54) RePEc:lau:crdeep:07.13 Do Agglomeration Economies Reduce the Sensitivity of Firm Location to Tax Differentials? (2007). Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) (55) RePEc:lpf:wpaper:04-2007 Shadow Economy, Tax Morale, Governance and Institutional Quality: A Panel Analysis (2007). Working Papers (56) RePEc:lpf:wpaper:05-2007 Trust in International Organizations: An Empirical Investigation Focusing on the United Nations (2007). Working Papers (57) RePEc:lvl:lacicr:0745 Physicians Multitasking and Incentives: Empirical Evidence from a Natural Experiment (2007). Cahiers de recherche (58) RePEc:mod:recent:005 The vanishing bequest tax. The Comparative Evolution of Bequest Taxation in Historical Perspective (2007). Center for Economic Research (RECent) (59) RePEc:mrr:papers:wp156 A Longitudinal Analysis of Entries and Exits of the Low-Income Elderly to and from the Supplemental Security Income Program (2007). Working Papers (60) RePEc:nbr:nberch:0588 Would More Compulsory Schooling Help Disadvantaged Youth? Evidence from Recent Changes to School-Leaving Laws (2007). NBER Chapters (61) RePEc:nbr:nberch:0596 The Role of Religious and Social Organizations in the Lives of Disadvantaged Youth (2007). NBER Chapters (62) RePEc:nbr:nberwo:13013 Is the US Population Behaving Healthier? (2007). NBER Working Papers (63) RePEc:nbr:nberwo:13105 The Joy of Giving or Assisted Living? Using Strategic Surveys to Separate Bequest and Precautionary Motives (2007). NBER Working Papers (64) RePEc:nbr:nberwo:13188 Maternal employment, breastfeeding, and health: Evidence from maternity leave mandates (2007). NBER Working Papers (65) RePEc:nbr:nberwo:13323 Race and Charitable Church Activity (2007). NBER Working Papers (66) RePEc:nbr:nberwo:13348 Diversity and Crowd-out: A Theory of Cold-Glow Giving (2007). NBER Working Papers (67) RePEc:nbr:nberwo:13352 The Impact of Employer Matching on Savings Plan Participation under Automatic Enrollment (2007). NBER Working Papers (68) RePEc:nbr:nberwo:13645 The General Equilibrium Incidence of Environmental Mandates (2007). NBER Working Papers (69) RePEc:nbr:nberwo:13656 Mental Accounting in Portfolio Choice: Evidence from a Flypaper Effect (2007). NBER Working Papers (70) RePEc:nys:sunysb:07-05 An Empirical Study of the Effects of Social Security Reforms on Claming Behavior and Benefits Receipt Using Aggregate and Public-Use Administrative Micro Data (2007). Department of Economics Working Papers (71) RePEc:pia:wpaper:32/2007 Location choices of multinational firms in Europe: the role of EU cohesion policy (2007). Quaderni del Dipartimento di Economia, Finanza e Statistica (72) RePEc:pra:mprapa:27535 Federalism, decentralisation and corruption (2007). MPRA Paper (73) RePEc:pra:mprapa:5236 The Effect of Information on the Bidding and Survival of Entrants in Procurement Auctions (2007). MPRA Paper (74) RePEc:pru:wpaper:40 Determinants Of Poverty During Transition: Household Survey Evidence From Ukraine (2007). PRUS Working Papers (75) RePEc:qut:dpaper:213 Trust in International Organizations: An Empirical Investigation Focusing on the United Nations (2007). School of Economics and Finance Discussion Papers and Working Papers Series (76) RePEc:sip:dpaper:06-043 Understanding the Increased Time to the Baccalaureate Degree (2007). Discussion Papers (77) RePEc:sip:dpaper:07-009 Distributional and Efficiency Impacts of Increased U.S. Gasoline Taxes (2007). Discussion Papers (78) RePEc:ssb:dispap:507 Driven to Drink. Sin Taxes Near a Border (2007). Discussion Papers (79) RePEc:upf:upfgen:1062 Do agglomeration economies reduce the sensitivity of firm location to tax differentials? (2007). Economics Working Papers (80) RePEc:use:tkiwps:0723 Financial Literacy and Stock Market Participation (2007). Working Papers (81) RePEc:wdi:papers:2007-892 The Political Economy of Corruption & the Role of Financial Institutions (2007). William Davidson Institute Working Papers Series (82) RePEc:wly:jpamgt:v:26:y:2007:i:1:p:149-175 The effects of state policy design features on take-up and crowd-out rates for the state childrens health insurance program (2007). Journal of Policy Analysis and Management (83) RePEc:wrk:warwec:797 Unit Versus Ad Valorem Taxes : The Private Ownership of Monopoly In General Equilibrium (2007). The Warwick Economics Research Paper Series (TWERPS) (84) RePEc:yca:wpaper:2007_9 Do Agglomeration Economies Reduce the Sensitivity of Firm Location to Tax Differentials? (2007). Working Papers (85) RePEc:yor:yorken:07/10 A Tax Reform Analysis of the Laffer Argument (2007). Discussion Papers (86) RePEc:zbw:gdec07:6805 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). Proceedings of the German Development Economics Conference, Göttingen 2007 Recent citations received in: 2006 (1) RePEc:ags:gewi06:14961 WHY AND HOW SHOULD THE GOVERNMENT FINANCE PUBLIC GOODS IN RURAL AREAS? A REVIEW OF ARGUMENTS (2006). 46th Annual Conference, Giessen, Germany, October 4-6, 2006 (2) RePEc:boc:bocoec:639 Changing the Boston School Choice Mechanism (2006). Boston College Working Papers in Economics (3) RePEc:brn:wpaper:0602 Teaching to the Rating: School Accountability and the Distribution of Student Achievement (2006). Working Papers (4) RePEc:cbt:econwp:06/04 Another Look at what to do with Time-series Cross-section Data (2006). Working Papers in Economics (5) RePEc:cbt:econwp:06/05 The Determinants of U. S. State Economic Growth: A Less Extreme Bounds Analysis (2006). Working Papers in Economics (6) RePEc:cep:stipep:20 BEING THE NEW YORK TIMES: THEPOLITICAL BEHAVIOUR OF A NEWSPAPER (2006). STICERD - Political Economy and Public Policy Paper Series (7) RePEc:ces:ceswps:_1656 Efficient Revenue Sharing and Upper Level Governments: Theory and Application to Germany (2006). CESifo Working Paper Series (8) RePEc:ces:ceswps:_1661 Fiscal Policy, Monopolistic Competition, and Finite Lives (2006). CESifo Working Paper Series (9) RePEc:ces:ceswps:_1721 The Capital Structure of Multinational Companies under Tax Competition (2006). CESifo Working Paper Series (10) RePEc:ces:ceswps:_1741 Subsidies for Wages and Infrastructure: How to Restrain Undesired Immigration (2006). CESifo Working Paper Series (11) RePEc:ces:ceswps:_1754 Ex-Post Redistribution in a Federation: Implications for Corrective Policy (2006). CESifo Working Paper Series (12) RePEc:ces:ceswps:_1784 A Simple Explanation for the Unfavorable Tax Treatment of Investment Costs (2006). CESifo Working Paper Series (13) RePEc:ces:ceswps:_1795 Reforming the Taxation of Multijurisdictional Enterprises in Europe, a Tentative Appraisal (2006). CESifo Working Paper Series (14) RePEc:ces:ceswps:_1860 Reforming the Taxation of Multijurisdictional Enterprises in Europe, âCoopetitionâ in a Bottom-up Federation (2006). CESifo Working Paper Series (15) RePEc:ces:ceswps:_1865 Fiscal Equalization and Yardstick Competition (2006). CESifo Working Paper Series (16) RePEc:cfr:cefirw:w0063 Media Freedom, Bureaucratic Incentives, and the Resource Curse (2006). Working Papers (17) RePEc:cla:levrem:122247000000001022 Changing the Boston School Choice Mechanism (2006). Levine's Bibliography (18) RePEc:cor:louvco:2006109 Competing in taxes and investment under fiscal equalization (2006). CORE Discussion Papers (19) RePEc:cpr:ceprdp:5645 Multi-Battle Contests (2006). CEPR Discussion Papers (20) RePEc:cpr:ceprdp:5748 Media Freedom, Bureaucratic Incentives and the Resource Curse (2006). CEPR Discussion Papers (21) RePEc:cpr:ceprdp:5769 Exports, Foreign Direct Investment and the Costs of Coporate Taxation (2006). CEPR Discussion Papers (22) RePEc:cpr:ceprdp:5844 Multi-Stage Contests with Stochastic Ability (2006). CEPR Discussion Papers (23) RePEc:crr:crrwps:wp2006-26 Annuitized Wealth and Consumption at Older Ages (2006). Working Papers, Center for Retirement Research at Boston College (24) RePEc:ctl:louvec:2006062 Competing in taxes and investment under fiscal equalization (2006). Discussion Papers (ECON - Département des Sciences Economiques) (25) RePEc:diw:diwwpp:dp652 Parties Matter in Allocating Expenditures: Evidence from Germany (2006). Discussion Papers of DIW Berlin (26) RePEc:diw:diwwpp:dp653 Political Effects on the Allocation of Public Expenditures: Empirical Evidence from OECD Countries (2006). Discussion Papers of DIW Berlin (27) RePEc:dul:wpaper:06-04rr Analyse exploratoire dun programme dallocations-loyers en Région de Bruxelles-Capitale: comparaison internationale et évaluation budgétaire et économique selon trois scénarios (2006). DULBEA Working Papers (28) RePEc:ebl:ecbull:v:15:y:2006:i:11:p:1-10 Endogenous Market Structure and Fiscal Policy in an Endogenous Growth Model with Public Capital (2006). Economics Bulletin (29) RePEc:ecl:stabus:1927 Prediction Markets in Theory and Practice (2006). Research Papers (30) RePEc:ecl:wisagr:497 Should the Government Finance Public Goods in Rural Areas? A Review of Arguments (2006). Staff Paper Series (31) RePEc:edb:cedidp:06-10 Media Freedom, Bureaucratic Incentives, and the Resource Curse (2006). CEDI Discussion Paper Series (32) RePEc:edj:ceauch:220 Using School Scholarships to Estimate the Effect of Government Subsidized Private Education on Academic Achievement in Chile (2006). Documentos de Trabajo (33) RePEc:edj:ceauch:225 Socioeconomic status or noise? Tradeoffs in the generation of school quality information (2006). Documentos de Trabajo (34) RePEc:euf:ecopap:0265 Reforming the taxation of multijurisdictional enterprises in Europe: a tentative appraisal (2006). European Economy - Economic Papers (35) RePEc:fem:femwpa:2006.121 A Bayesian Approach to the Estimation of Environmental Kuznets Curves for CO2 Emissions (2006). Working Papers (36) RePEc:fip:fedfwp:2006-17 Measuring the miracle: market imperfections and Asias growth experience (2006). Working Paper Series (37) RePEc:fip:fedhwp:wp-06-05 The tradeoff between mortgage prepayments and tax-deferred retirement savings (2006). Working Paper Series (38) RePEc:han:dpaper:dp-348 TAXATION AND INTERNAL MIGRATION - EVIDENCE FROM THE SWISS CENSUS USING COMMUNITY-LEVEL VARIATION IN INCOME TAX RATES (2006). Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hannover (39) RePEc:hhs:gunwpe:0219 Bridging the Great Divide in South Africa: Inequality and Punishment in the Provision of Public Goods (2006). Working Papers in Economics (40) RePEc:hhs:uunewp:2006_012 Tax Evasion and Self-Employment in a High-Tax Country: Evidence from Sweden (2006). Working Paper Series (41) RePEc:idb:wpaper:4487 The Political Economy of Fiscal Policy: Survey (2006). RES Working Papers (42) RePEc:iep:wpidep:0608 Are Equalization Payments Making Canadians Better Off? A Two-Dimensional Dominance Answer (2006). IDEP Working Papers (43) RePEc:ifr:wpaper:2006-07 Disasters: Issues for State and Federal Government Finances (2006). Working Papers (44) RePEc:ifr:wpaper:2006-10 Reforming the taxation of Multijurisdictional Enterprises in Europe, Coopetition in a Bottom-up Federation (2006). Working Papers (45) RePEc:ifr:wpaper:2006-15 Fiscal Equalization and Yardstick Competition (2006). Working Papers (46) RePEc:iza:izadps:dp2333 Elder Parent Health and the Migration Decision of Adult Children: Evidence from Rural China (2006). IZA Discussion Papers (47) RePEc:iza:izadps:dp2374 Taxation and Internal Migration: Evidence from the Swiss Census Using Community-Level Variation in Income Tax Rates (2006). IZA Discussion Papers (48) RePEc:kap:ijhcfe:v:6:y:2006:i:1:p:25-47 Employer choices of family premium sharing (2006). International Journal of Health Care Finance and Economics (49) RePEc:kap:revind:v:29:y:2006:i:1:p:149-169 Public-Private Partnerships and Prices: Evidence from Water Distribution in France (2006). Review of Industrial Organization (50) RePEc:lmu:muenec:1153 Die Besteuerung multinationaler Unternehmen (2006). Discussion Papers in Economics (51) RePEc:lsu:lsuwpp:2006-04 School Choice and the Flight to Private Schools: To What Extent Are Public and Private Schools Substitutes? (2006). Departmental Working Papers (52) RePEc:man:cgbcrp:73 The Tyranny of Rules: Fiscal Discipline, Productive Spending, and Growth (2006). Centre for Growth and Business Cycle Research Discussion Paper Series (53) RePEc:mcm:sedapp:163 Tax Incentives and Household Portfolios: A Panel Data Analysis (2006). Social and Economic Dimensions of an Aging Population Research Papers (54) RePEc:mol:ecsdps:esdp06029 Wealth Accumulation and Growth in a Specific-Factors Model of Trade and Finance. (2006). Economics & Statistics Discussion Papers (55) RePEc:mtl:montec:02-2006 The Dynamic (In)efficiency of Monetary Policy by Committee (2006). Cahiers de recherche (56) RePEc:nbr:nberwo:11965 Changing the Boston School Choice Mechanism (2006). NBER Working Papers (57) RePEc:nbr:nberwo:12009 The Importance of Default Options for Retirement Savings Outcomes: Evidence from the United States (2006). NBER Working Papers (58) RePEc:nbr:nberwo:12049 Who Adjusts and When? On the Political Economy of Reforms (2006). NBER Working Papers (59) RePEc:nbr:nberwo:12103 Dynamic Scoring: Alternative Financing Schemes (2006). NBER Working Papers (60) RePEc:nbr:nberwo:12108 Persistence of Power, Elites and Institutions (2006). NBER Working Papers (61) RePEc:nbr:nberwo:12132 Antitrust in the Not-For-Profit Sector (2006). NBER Working Papers (62) RePEc:nbr:nberwo:12190 Pork Barrel Cycles (2006). NBER Working Papers (63) RePEc:nbr:nberwo:12259 Capital Levies and Transition to a Consumption Tax (2006). NBER Working Papers (64) RePEc:nbr:nberwo:12339 Optimal Control of Externalities in the Presence of Income Taxation (2006). NBER Working Papers (65) RePEc:nbr:nberwo:12502 The Tradeoff Between Mortgage Prepayments and Tax-Deferred Retirement Savings (2006). NBER Working Papers (66) RePEc:nbr:nberwo:12628 Cramming: The Effects of School Accountability on College-Bound Students (2006). NBER Working Papers (67) RePEc:nbr:nberwo:12641 Crime and Punishment in the American Dream (2006). NBER Working Papers (68) RePEc:nbr:nberwo:12707 What Drives Media Slant? Evidence from U.S. Daily Newspapers (2006). NBER Working Papers (69) RePEc:nbr:nberwo:12730 Taxing Consumption and Other Sins (2006). NBER Working Papers (70) RePEc:nbr:nberwo:12802 Which Countries Become Tax Havens? (2006). NBER Working Papers (71) RePEc:pab:wpaper:06.15 Side Effects of Campaign Finance Reform (2006). Working Papers (72) RePEc:pab:wpaper:06.21 Biased Contests (2006). Working Papers (73) RePEc:pra:mprapa:186 The Effect of Spillovers on the Provision of Local Public Goods (2006). MPRA Paper (74) RePEc:pra:mprapa:500 Crime and Punishment in the American Dream (2006). MPRA Paper (75) RePEc:pra:mprapa:9707 Budgetary Dynamics in The Local Authorities in Israel (2006). MPRA Paper (76) RePEc:pur:prukra:1187 Multi-battle contests. (2006). Purdue University Economics Working Papers (77) RePEc:pur:prukra:1192 Multi-Stage Contests with Stochastic Ability (2006). Purdue University Economics Working Papers (78) RePEc:qed:wpaper:1096 The Control of Land Rent in the Fortified Farming Town (2006). Working Papers (79) RePEc:red:issued:v:9:y:2006:i:2:p:211-223 Redistribution, Taxes and the Median Voter (2006). Review of Economic Dynamics (80) RePEc:rff:dpaper:dp-06-51 Fiscal and Externality Rationales for Alcohol Taxes (2006). Discussion Papers (81) RePEc:sip:dpaper:05-016 Public Enforcement of Law (2006). Discussion Papers (82) RePEc:taf:eurjhp:v:6:y:2006:i:2:p:131-149 Determinants of Mortgage Debt Growth in EU Countries (2006). European Journal of Housing Policy (83) RePEc:trf:wpaper:122 Multi-battle contests (2006). Discussion Papers (84) RePEc:trf:wpaper:125 Contests with multi-tasking (2006). Discussion Papers (85) RePEc:ubs:wpaper:ubs0606 The Capital Structure of Multinational Companies Under Tax Competition (2006). Working Papers (86) RePEc:ucn:wpaper:200613 Where Do the Sick Go? Health Insurance and Employment in Small and Large Firms (2006). Working Papers (87) RePEc:udb:wpaper:uwec-2007-17-p Education, Corruption and Constitutional Reform (2006). Working Papers (88) RePEc:usg:dp2006:2006-16 Extensive and Intensive Investment and the Dead Weight Loss of Corporate Taxation (2006). University of St. Gallen Department of Economics working paper series 2006 (89) RePEc:usg:dp2006:2006-17 Exports, Foreign Direct Investment and the Costs of Corporate Taxation (2006). University of St. Gallen Department of Economics working paper series 2006 (90) RePEc:uto:dipeco:200605 Declared vs. revealed yardstick competition: local government efficiency in Norway (2006). Department of Economics Working Papers (91) RePEc:wbk:wbrwps:4064 Public infrastructure and growth : new channels and policy implications (2006). Policy Research Working Paper Series (92) RePEc:wly:jpamgt:v:25:y:2006:i:3:p:691-735 Aiming for evidence-based gun policy (2006). Journal of Policy Analysis and Management (93) RePEc:zbw:tufwps:200612 Public venture capital in Germany: task force or forced task? (2006). Freiberg Working Papers (94) RePEc:zbw:wzbmpg:spii200614 Contests with multi-tasking (2006). Discussion Papers, Research Unit: Market Processes and Governance Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||