|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

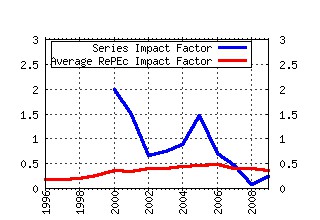

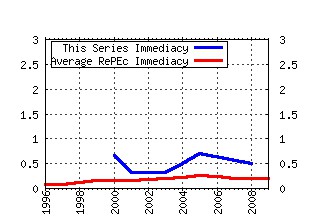

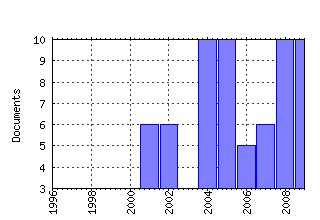

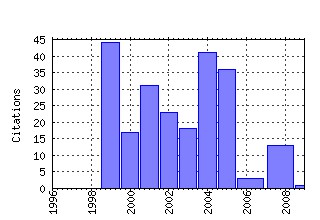

EUROMOD Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ese:emodwp:em0-99 An introduction to EUROMOD (1999). (2) RePEc:ese:emodwp:em9-01 EUROMOD: an integrated European benefit-tax model: final report (2001). (3) RePEc:ese:emodwp:em9-05 Household incomes and redistribution in the European Union: quantifying the equalising properties of taxes and benefits (2005). (4) RePEc:ese:emodwp:em1-01 Imputation of gross amounts from net incomes in household surveys: an application using EUROMOD (2001). (5) RePEc:ese:emodwp:em4-05 The impact of tax and transfer systems on children in the European Union (2005). (6) RePEc:ese:emodwp:em3-04 Falling up the stairs: an exploration of the effects of bracket creep on household incomes (2004). (7) RePEc:ese:emodwp:em2-02 The distribution of average and marginal effective tax rates in European Union Member States (2002). (8) RePEc:ese:emodwp:em3-03 Employment transitions in 13 European countries: levels, distributions and determining factors of net replacement rates (2003). (9) RePEc:ese:emodwp:em1-04 Welfare reform in European countries: a micro-simulation analysis (2004). (10) RePEc:ese:emodwp:em3-00 A European social agenda: poverty benchmarking and social transfers (2000). (11) RePEc:ese:emodwp:em1-00 Child poverty and child benefits in the European Union (2000). (12) RePEc:ese:emodwp:em3-01 The impact of tax benefit systems on low income households in the benelux countries. A simulation approach using synthetic datasets (2001). (13) RePEc:ese:emodwp:em5-04 Redistributive effect and progressivity of taxes: an international comparison across the EU using EUROMOD (2004). (14) RePEc:ese:emodwp:em1-05 EUROMOD and the development of EU social policy (2005). (15) RePEc:ese:emodwp:em4-04 In-work policies in Europe: killing two birds with one stone? (2004). (16) RePEc:ese:emodwp:em2-08 Effects of flat tax reforms in Western Europe on equity and efficiency (2008). (17) RePEc:ese:emodwp:em1-03 Social indicators and other income statistics using the EUROMOD baseline: a comparison with Eurostat and National Statistics (2003). (18) RePEc:ese:emodwp:em2-03 Child-targeted tax-benefit reform in Spain in a European context: a microsimulation analysis using EUROMOD (2003). (19) RePEc:ese:emodwp:em3-02 Indicators for social inclusion in the European Union: how responsive are they to macro-level changes? (2002). (20) RePEc:ese:emodwp:em2-00 The impact of inflation on income tax and social insurance contributions in Europe (2000). (21) RePEc:ese:emodwp:em9-08 Tax-benefit revealed social preferences (2008). (22) RePEc:ese:emodwp:em5-05 Pension incomes in the European Union: policy reform strategies in comparative perspective (2005). (23) RePEc:ese:emodwp:em4-02 Evaluation of national action plans on social inclusion: the role of EUROMOD (2002). (24) RePEc:ese:emodwp:em2-04 Child poverty and family transfers in Southern Europe (2004). (25) RePEc:ese:emodwp:em5-01 Reducing child poverty in Europe: what can static microsimulation models tell us? (2001). (26) RePEc:ese:emodwp:em7-04 Fiscal stabilisers in Europe: the macroeconomic impact of tax and benefit systems (2004). (27) RePEc:ese:emodwp:em2-01 Towards a multi purpose framework for tax benefit microsimulation (2001). (28) RePEc:ese:emodwp:em6-05 Social indicators and other income statistics using EUROMOD: an assessment of the 2001 Baseline and Changes 1998-2001 (2005). (29) RePEc:ese:emodwp:em2-05 Replacement incomes and taxes: a distributional analysis for the EU-15 countries (2005). (30) RePEc:ese:emodwp:em6-01 The impact of means tested assistance in Southern Europe (2002). (31) RePEc:ese:emodwp:em10-08 Optimal taxation, social contract and the four worlds of welfare capitalism (2008). (32) RePEc:ese:emodwp:em7-01 Modelling the redistributive impact of indirect taxes in Europe: an application of EUROMOD (2004). (33) RePEc:ese:emodwp:em8-01 Indicators of social exclusion in euromod (2001). (34) RePEc:ese:emodwp:em2-99 Microsimulation and the formulation of policy: a case study of targeting in the European Union (1999). (35) RePEc:ese:emodwp:em1-02 Atkinson: evaluation of national action plans on social inclusion: the role of EUROMOD (2002). (36) RePEc:ese:emodwp:em7-05 Static data ageing techniques: accounting for population changes in tax-benefit microsimulation models (2005). (37) RePEc:ese:emodwp:em2-09 The distributional effects of tax-benefit policies under new labour: a shapley decomposition (2009). (38) RePEc:ese:emodwp:em4-01 Welfare benefits and work incentives: an analysis of the distribution of net replacement rates in Europe using EUROMOD, a multi-country microsimulation model (2002). (39) RePEc:ese:emodwp:em5-10 Discrete choice modelling of labour supply in Luxembourg through EUROMOD microsimulation (2010). (40) RePEc:ese:emodwp:em4-08 Improving the capacity and usability of EUROMOD: final report (2008). (41) RePEc:ese:emodwp:em3-06 An age perspective on economic well-being and social protection in nine OECD countries (2006). (42) RePEc:ese:emodwp:em5-06 Lessons from building and using EUROMOD (2006). (43) RePEc:ese:emodwp:em9-04 The role of tax and transfers in reducing personal income inequality in Europes regions: evidence form EUROMOD (2004). (44) RePEc:ese:emodwp:em2-06 Beans for breakfast? How exportable is the British workfare model? (2006). (45) RePEc:ese:emodwp:em3-05 Sharing resources within the household: a multi-country microsimulation analysis of the determinants of intrahousehold strategic weight differentials and their distributional outcomes (2005). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:diw:diwwpp:dp838 Optimal Income Taxation of Married Couples: An Empirical Analysis of Joint and Individual Taxation (2008). Discussion Papers of DIW Berlin (2) RePEc:ese:emodwp:em10-08 Optimal taxation, social contract and the four worlds of welfare capitalism (2008). EUROMOD Working Papers (3) RePEc:iza:izadps:dp3715 The Benefits of Linking CGE and Microsimulation Models: Evidence from a Flat Tax Analysis (2008). IZA Discussion Papers (4) RePEc:ner:leuven:urn:hdl:123456789/196767 A Belgian flat income tax: effects on labour supply and income distribution. (2008). Open Access publications from Katholieke Universiteit Leuven (5) RePEc:zbw:uoccpe:7364 The benefits of linking CGE and Microsimulation Models - Evidence from a Flat Tax analysis (2008). FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||