|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

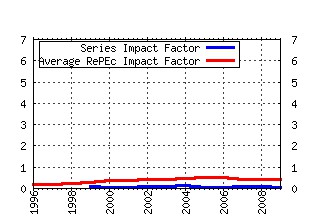

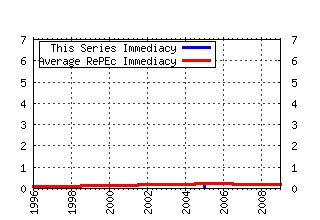

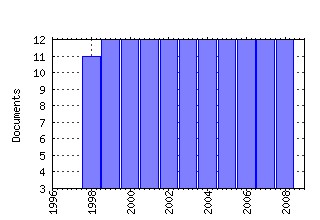

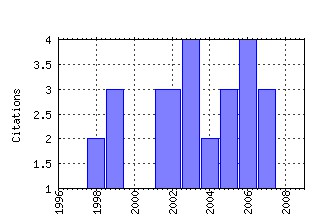

Monetary Trends Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fip:fedlmt:y:2005:i:jan Open mouth operations: a Swiss case study (2005). (2) RePEc:fip:fedlmt:y:2003:i:dec Does the TIPS spread overshoot? (2003). (3) RePEc:fip:fedlmt:y:1999:i:jan Nominal interest rates: less than zero? (1999). (4) RePEc:fip:fedlmt:y:2006:i:jan Greenspans unconventional view of the long-run inflation/output trade-off (2006). (5) RePEc:fip:fedlmt:y:2007:i:jun What is subprime lending? (2007). (6) RePEc:fip:fedlmt:y:2002:i:jun How expensive are stocks? (2002). (7) RePEc:fip:fedlmt:y:1998:i:feb Bond market inflation credibility (1998). (8) RePEc:fip:fedlmt:y:2003:i:mar Pushing on a string (2003). (9) RePEc:fip:fedlmt:y:2007:i:jul Inflation disconnect? (2007). (10) RePEc:fip:fedlmt:y:2000:i:oct Are the Fed and financial markets in sync? (2000). (11) RePEc:fip:fedlmt:y:2003:i:jan How effective is monetary policy? (2003). (12) RePEc:fip:fedlmt:y:2006:i:mar Measured pace in the conduct of monetary policy (2006). (13) RePEc:fip:fedlmt:y:1999:i:jul Quality spreads in the bond market (1999). (14) RePEc:fip:fedlmt:y:2004:i:oct The U.K.s rocky road to stability (2004). (15) RePEc:fip:fedlmt:y:2008:i:nov The LIBOR-OIS spread as a summary indicator (2008). (16) RePEc:fip:fedlmt:y:2006:i:jul The Feds inflation objective (2006). (17) RePEc:fip:fedlmt:y:2004:i:feb The FOMCs considerable period (2004). (18) RePEc:fip:fedlmt:y:2007:i:sep Measure for measure: headline versus core inflation (2007). (19) RePEc:fip:fedlmt:y:2002:i:nov Retail sweep programs and money demand (2002). (20) RePEc:fip:fedlmt:y:1998:i:oct M2 velocity looks to be on a new track (1998). (21) RePEc:fip:fedlmt:y:2003:i:oct Bond market mania (2003). (22) RePEc:fip:fedlmt:y:2005:i:jul Is the bond market irrational? (2005). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||