|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

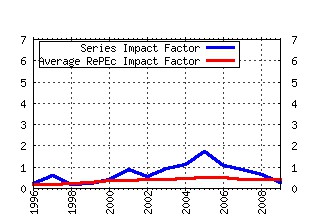

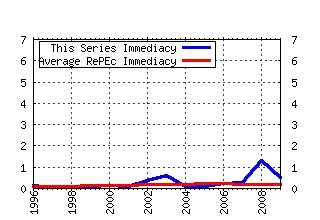

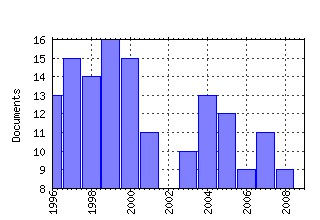

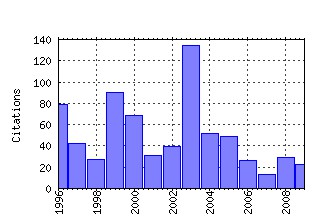

Current Issues in Economics and Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fip:fednci:y:2003:i:jan:n:v.9no.1 The impact of exchange rate movements on U.S. foreign debt (2003). (2) RePEc:fip:fednci:y:1995:i:jun:n:v.1no.3 Sovereign credit ratings (1995). (3) RePEc:fip:fednci:y:1996:i:mar:n:v.2no.3 Small business lending and bank consolidation: is there cause for concern? (1996). (4) RePEc:fip:fednci:y:2000:i:apr:n:v.6no.4 The unreliability of inflation indicators (2000). (5) RePEc:fip:fednci:y:1999:i:jul:n:v.5no.12 Are banks still important for financing large businesses? (1999). (6) RePEc:fip:fednci:y:2003:i:aug:n:v.9no.8 Has structural change contributed to a jobless recovery? (2003). (7) RePEc:fip:fednci:y:2004:i:sep:n:v.10no.10 Reserve accumulation: implications for global capital flows and financial markets (2004). (8) RePEc:fip:fednci:y:2002:i:jan:n:v.8no.1 Has foreign bank entry led to sounder banks in Latin America? (2002). (9) RePEc:fip:fednci:y:1996:i:jun:n:v.2no.7 The yield curve as a predictor of U.S. recessions (1996). (10) RePEc:fip:fednci:y:2003:i:sep:n:v.9no.9 What moves sovereign bond markets? The effects of economic news on U.S. and German yields (2003). (11) RePEc:fip:fednci:y:1999:i:apr:n:v.5no.5 Are stocks overtaking real estate in household portfolios? (1999). (12) RePEc:fip:fednci:y:2008:i:jan:n:v.14no.1 Liquidity, monetary policy, and financial cycles (2008). (13) RePEc:fip:fednci:y:1999:i:aug:n:v.5no.13 A decomposition of the increased stability of GDP growth (1999). (14) RePEc:fip:fednci:y:2001:i:aug:n:v.7no.8 To what extent does productivity drive the dollar? (2001). (15) RePEc:fip:fednci:y:2005:i:dec:n:v.11no.12 The income implications of rising U.S. international liabilities (2005). (16) RePEc:fip:fednci:y:2005:i:mar:n:v.11no.3 What financing data reveal about dealer leverage (2005). (17) RePEc:fip:fednci:y:2009:i:dec:n:v.15no.8 Why are banks holding so many excess reserves? (2009). (18) RePEc:fip:fednci:y:2006:i:jul:n:v.12no.5 The yield curve as a leading indicator: some practical issues (2006). (19) RePEc:fip:fednci:y:1997:i:may:n:v.3no.5 Falling reserve balances and the federal funds rate (1997). (20) RePEc:fip:fednci:y:1995:i:may:n:v.1no.2 The impact of interstate banking and branching reform: evidence from the states (1995). (21) RePEc:fip:fednci:y:1997:i:jul:n:v.3no.9 Designing effective auctions for treasury securities (1997). (22) RePEc:fip:fednci:y:2000:i:oct:n:v.6no.12 The emergence of electronic communications networks in the U.S. equity markets (2000). (23) RePEc:fip:fednci:y:1997:i:mar:n:v.3no.4 Bad debt rising (1997). (24) RePEc:fip:fednci:y:1996:i:sep:n:v.2no.10 Repo rate patterns for new Treasury notes (1996). (25) RePEc:fip:fednci:y:2004:i:dec:n:v.10no.13 Will the U.S. productivity resurgence continue? (2004). (26) RePEc:fip:fednci:y:2002:i:may:n:v.8no.5 Has inventory volatility returned? A look at the current cycle (2002). (27) RePEc:fip:fednci:y:2009:i:feb:n:v.15no.2 The Term Securities Lending Facility: origin, design, and effects (2009). (28) RePEc:fip:fednci:y:1999:i:feb:n:v.5no.3 Meet the new borrowers (1999). (29) RePEc:fip:fednci:y:2000:i:jul:n:v.6no.8 Understanding the recent behavior of U.S. inflation (2000). (30) RePEc:fip:fednci:y:2000:i:sep:n:v.6no.10 A nation of spendthrifts? An analysis of trends in personal and gross saving (2000). (31) RePEc:fip:fednci:y:2007:i:mar:n:v.13no.3 Measuring risk in the hedge fund sector (2007). (32) RePEc:fip:fednci:y:2005:i:aug:n:v.11no.8 U.S. jobs gained and lost through trade: a net measure (2005). (33) RePEc:fip:fednci:y:2003:i:dec:n:v.9no.12 After the refinancing boom: will consumers scale back their spending? (2003). (34) RePEc:fip:fednci:y:2004:i:apr:n:v.10no.5 Repurchase agreements with negative interest rates (2004). (35) RePEc:fip:fednci:y:2009:i:aug:n:v.15no.4 The Federal Reserves Primary Dealer Credit Facility (2009). (36) RePEc:fip:fednci:y:1998:i:dec:n:v.4no.13 Viewing the current account deficit as a capital inflow (1998). (37) RePEc:fip:fednci:y:2005:i:nov:n:v.11no.11 Intraday trading in the overnight federal funds market (2005). (38) RePEc:fip:fednci:y:2001:i:jun:n:v.7no.6 Investing in information technology: productivity payoffs for U.S. industries (2001). (39) RePEc:fip:fednci:y:2008:i:aug:n:v.14no.6 How economic news moves markets (2008). (40) RePEc:fip:fednci:y:2003:i:may:n:v.9no.6 Social security and the consumer price index for the elderly (2003). (41) RePEc:fip:fednci:y:2000:i:may:n:v.6no.6 Explaining the gap between new home sales and inventories (2000). (42) RePEc:fip:fednci:y:2004:i:nov:n:v.10no.11 Recent innovations in Treasury cash management (2004). (43) RePEc:fip:fednci:y:2006:i:oct:n:v.12no.7 Twin deficits, twenty years later (2006). (44) RePEc:fip:fednci:y:1997:i:feb:n:v.3no.3 Debt, delinquencies, and consumer spending (1997). (45) RePEc:fip:fednci:y:1999:i:oct:n:v.5no.14 Two new indexes offer a broad view of economic activity in the New York - New Jersey region (1999). (46) RePEc:fip:fednci:y:2003:i:nov:n:v.9no.11 Coping with terms-of-trade shocks in developing countries (2003). (47) RePEc:fip:fednci:y:2004:i:jul:n:v.10no.8 The evolution of U.S. bank branch networks: growth, consolidation, and strategy (2004). (48) RePEc:fip:fednci:y:2010:i:may:n:v.16no.5 The homeownership gap (2010). (49) RePEc:fip:fednci:y:1999:i:dec:n:v.5no.16 Explaining the recent divergence in payroll and household employment growth (1999). (50) RePEc:fip:fednci:y:2006:i:sep:n:v.12no.6 Have U.S. import prices become less responsive to changes in the dollar? (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:fip:fednci:y:2009:i:feb:n:v.15no.2 The Term Securities Lending Facility: origin, design, and effects (2009). Current Issues in Economics and Finance (2) RePEc:ijc:ijcjou:y:2009:q:4:a:1 Interbank Lending, Credit-Risk Premia, and Collateral (2009). International Journal of Central Banking (3) RePEc:nbr:nberwo:15414 Crises and Liquidity in Over-the-Counter Markets (2009). NBER Working Papers (4) RePEc:ums:papers:2009-13 The Bonus-Driven Rainmaker Financial Firm: How These Firms Enrich Top Employees, Destroy Shareholder Value and Create Systemic Financial Instability (2009). Working Papers Recent citations received in: 2008 (1) RePEc:bca:bocawp:08-36 The Role of Bank Capital in the Propagation of Shocks (2008). Working Papers (2) RePEc:bis:bisqtr:0812e Developments in repo markets during the financial turmoil (2008). BIS Quarterly Review (3) RePEc:cpr:ceprdp:7105 Securitization, Transparency and Liquidity (2008). CEPR Discussion Papers (4) RePEc:fip:fedfel:y:2008:i:apr18:n:2008-13-14 The financial markets, housing, and the economy (2008). FRBSF Economic Letter (5) RePEc:fip:fednsr:338 Financial intermediary leverage and value at risk (2008). Staff Reports (6) RePEc:fip:fednsr:346 Financial intermediaries, financial stability, and monetary policy (2008). Staff Reports (7) RePEc:fip:fednsr:357 The Federal Home Loan Bank System: the lender of next-to-last resort? (2008). Staff Reports (8) RePEc:hhs:vxcafo:2009_010 Do Macroeconomic Variables Forecast Changes in Liquidity? An Out-of-sample Study on the Order-driven Stock Markets in Scandinavia (2008). CAFO Working Papers (9) RePEc:mnb:opaper:2008/76 Contagion and the beginning of the crisis pre-Lehman period (2008). MNB Occasional Papers (10) RePEc:nbr:nberwo:14517 Intermediary Asset Pricing (2008). NBER Working Papers (11) RePEc:uma:periwp:wp181 Proposals for Effectively Regulating the U.S. Financial System to Avoid Yet Another Meltdown (2008). Working Papers (12) RePEc:ums:papers:2008-15 Proposals for Effectively Regulating the U.S. Financial System to Avoid Yet Another Meltdown (2008). Working Papers Recent citations received in: 2007 (1) RePEc:fip:fedgif:905 Frequency of observation and the estimation of integrated volatility in deep and liquid financial markets (2007). International Finance Discussion Papers (2) RePEc:fip:fednsr:291 Hedge funds, financial intermediation, and systemic risk (2007). Staff Reports (3) RePEc:fip:fednsr:299 How do treasury dealers manage their positions? (2007). Staff Reports Recent citations received in: 2006 (1) RePEc:fip:fednsr:261 Pass-through of exchange rates to consumption prices: what has changed and why (2006). Staff Reports (2) RePEc:nbr:nberwo:12547 Pass Through of Exchange Rates to Consumption Prices: What has Changed and Why? (2006). NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||