|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

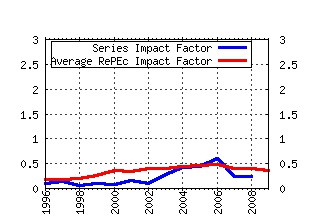

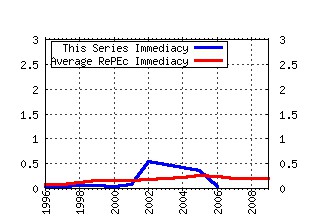

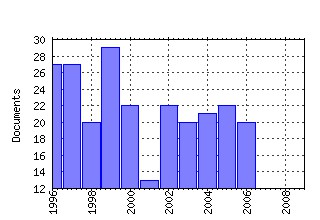

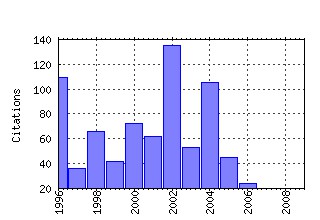

Financial Management Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fma:fmanag:hermalin91 The Effects of Board Composition and Direct Incentives on Firm Performance (1991). (2) RePEc:fma:fmanag:lerner94 The Syndication of Venture Capital Investments (1994). (3) RePEc:fma:fmanag:loughranritter04 Why Has IPO Underpricing Changed Over Time? (2004). (4) RePEc:fma:fmanag:franks96 A Comparison of UK, US and German Insolvency Codes (1996). (5) RePEc:fma:fmanag:ruback02 Capital Cash Flows: A Simple Approach to Valuing Risky Cash Flows (2002). (6) RePEc:fma:fmanag:chung94 A Simple Approximation of Tobins q (1994). (7) RePEc:fma:fmanag:laeven03 Does Financial Liberalization Reduce Financing Constraints? (2002). (8) RePEc:fma:fmanag:barry94 New Directions in Research on Venture Capital Finance (1994). (9) RePEc:fma:fmanag:lins02 Is Corporate Diversification Beneficial in Emerging Market? (2002). (10) RePEc:fma:fmanag:jensen05 Agency Costs of Overvalued Equity (2005). (11) RePEc:fma:fmanag:merton95 A Functional Perspective of Financial Intermediation (1995). (12) RePEc:fma:fmanag:brickley91 An Agency Perspective on Franchising (1991). (13) RePEc:fma:fmanag:kaiser96 European Bankruptcy Laws: Implications for Corporations Facing Financial Distress (1996). (14) RePEc:fma:fmanag:taggart91 Consistent valuation and Cost of Capital Expressions With Corporate and Personal Taxes (1991). (15) RePEc:fma:fmanag:merton92 On the Management of Financial Guarantees (1992). (16) RePEc:fma:fmanag:scherr01 The Debt Maturity Structure of Small Firms (2001). (17) RePEc:fma:fmanag:heaton02 Managerial Optimism and Corporate Finance (2002). (18) RePEc:fma:fmanag:kim93 Does Default Risk in Coupons Affect the Valuation of Corporate Bonds?: A Contingent Claims Model (1993). (19) RePEc:fma:fmanag:lee92 Board Composition and Shareholder Wealth: The Case of Management Buyouts (1992). (20) RePEc:fma:fmanag:meulbroek The Efficiency of Equity-Linked Compensation: Understanding the Full Cost of Awarding Executive Stock Options (2001). (21) RePEc:fma:fmanag:bancelmittoo04 Cross-Country Determinants of Capital Structure Choice: A Survey of European Firms (2004). (22) RePEc:fma:fmanag:long93 Trade Credit, Quality Guarantees, and Product (1993). (23) RePEc:fma:fmanag:hirshleifer93 Managerial Reputation and Corporate Investment Decisions (1993). (24) RePEc:fma:fmanag:bodnar98 1998 Wharton Survey of Financial Risk Management by US Non-Financial Firms (1998). (25) RePEc:fma:fmanag:gay98 The Underinvestment Problem and Corporate Derivatives Use (1998). (26) RePEc:fma:fmanag:brounenjongkoedijk04 Corporate Finance in Europe: Confronting Theory with Practice (2004). (27) RePEc:fma:fmanag:bessembinder98 Market Efficiency and the Returns to Technical Analysis (1998). (28) RePEc:fma:fmanag:petersen00 Risk Measurement and Hedging: With and Without Derivatives (2000). (29) RePEc:fma:fmanag:alderson96 Liquidation Costs and Accounting Data (1996). (30) RePEc:fma:fmanag:diltz02 Why Firms Diversify: An Empirical Examination (2002). (31) RePEc:fma:fmanag:ready02 Profits from Technical Trading Rules (2002). (32) RePEc:fma:fmanag:maria00 Privatization and the Rise of Global Capital Markets (2000). (33) RePEc:fma:fmanag:ravid98 The Comparative Efficiency of Small-Firm Bankruptcies: A Study of the US and Finnish Bankruptcy Codes (1998). (34) RePEc:fma:fmanag:bodnarwong03 Estimating Exchange Rate Exposures: Issues in Model Structure (2003). (35) RePEc:fma:fmanag:berkman96 Empirical Evidence on the Corporate Use of Derivatives (1996). (36) RePEc:fma:fmanag:trigeorgis Real Options and Interactions With Financial Flexibility (1993). (37) RePEc:fma:fmanag:villalonga04 Does Diversification Cause the Diversification Discount? (2004). (38) RePEc:fma:fmanag:tufano98 Agency Costs of Corporate Risk Management (1998). (39) RePEc:fma:fmanag:newman99 Does the Composition of the Compensation Committee Influence CEO Compensation Practices? (1999). (40) RePEc:fma:fmanag:mclaughlin96 The Operating Performance of Seasoned Equity Issuers: Free Cash Flow and Post-Issue Performance (1996). (41) RePEc:fma:fmanag:aggarwal93 The Aftermarket Performance of Initial Public Offerings in Latin America (1993). (42) RePEc:fma:fmanag:anderson00 Corporate Governance and Firm Diversification (2000). (43) RePEc:fma:fmanag:eberhardt93 Absolute Priority Rule Violations and Risk Incentives for Financially Distressed Firms (1993). (44) RePEc:fma:fmanag:bravlehavymichaely05 Using Expectations to Test Asset Pricing Models (2005). (45) RePEc:fma:fmanag:cook92 Bondholder Wealth Effects of Management Buyouts (1992). (46) RePEc:fma:fmanag:degryse01 Bank Relationships and Firm Profitability (2001). (47) RePEc:fma:fmanag:michaely295 Does the Choice of Auditor Convey Quality in an Initial Public Offering? (1995). (48) RePEc:fma:fmanag:howton98 Currency and Interest-Rate Derivatives Use in US Firms (1998). (49) RePEc:fma:fmanag:chakravarty97 An Analysis of Prices, Bid/Ask Spreads, and Bid and Ask Depths Surrounding Ivan Boeskys Illegal Trading in Carnations Stock (1997). (50) RePEc:fma:fmanag:smit93 A Real Options and Game-Theoretic Approach to (1993). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:ise:isegwp:wp352006 What Hides Behind Sovereign Debt Ratings? (2006). Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||