|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

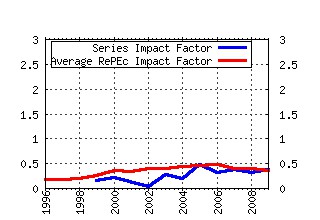

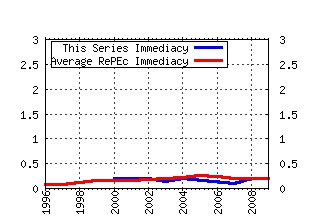

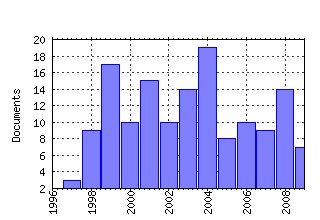

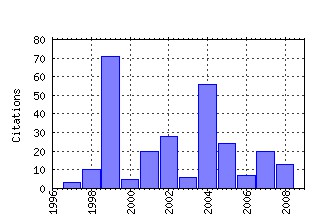

Working Paper Series: Finance and Accounting Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fra:franaf:41 The Economic Consequences of Increased Disclosure (1999). (2) RePEc:fra:franaf:106 German Banks and Banking Structure (2004). (3) RePEc:fra:franaf:141 Multiple but Asymmetric Bank Financing: The Case of Relationship Lending (2004). (4) RePEc:fra:franaf:78 Internationally Cross-Listed Stock Prices During Overlapping Trading Hours: Price Discovery and Exchange Rate Effects (2005). (5) RePEc:fra:franaf:96 Collateralized Loan Obligations (CLOs) â A Primer (2002). (6) RePEc:fra:franaf:27 Path Dependence, Corporate Governance and Complementarity (2002). (7) RePEc:fra:franaf:175 Cross-Border Bank Contagion in Europe (2007). (8) RePEc:fra:franaf:111 What Constitutes a Financial System in General and the German Financial System in Particular? (2004). (9) RePEc:fra:franaf:125 Financing Patterns: Measurement Concepts and Empirical Results (2004). (10) RePEc:fra:franaf:179 Trade Credit Defaults and Liquidity Provision by Firms (2007). (11) RePEc:fra:franaf:149 Heterogeneous Multiple Bank Financing Under Uncertainty: Does it Reduce Inefficient Credit Decisions? (2005). (12) RePEc:fra:franaf:66 Portfolio-aspects in real options management (2001). (13) RePEc:fra:franaf:35 Differences between Financial Systems in Europe: Consequences for EMU (2001). (14) RePEc:fra:franaf:64 Competition for Order Flow as a Coordination Game (2001). (15) RePEc:fra:franaf:152 Der Handel von Kreditrisiken: Eine neue Dimension des Kapitalmarktes (2005). (16) RePEc:fra:franaf:21 Voluntary Disclosure of Cash Flow Statements and Segment Data in Germany (1998). (17) RePEc:fra:franaf:174 Optimal Gradual Annuitization: Quantifying the Costs of Switching to Annuities (2008). (18) RePEc:fra:franaf:118 Corporate Governance in Germany: An Economic Perspective (2004). (19) RePEc:fra:franaf:48 IAS versus US GAAP: A New Market Based Comparison (2000). (20) RePEc:fra:franaf:95 Accounting for Financial Instruments in the Banking Industry (2002). (21) RePEc:fra:franaf:151 Settling for Efficiency - A Framework for the European Securities Transactions Industry (2007). (22) RePEc:fra:franaf:51 Inflation Risk Analysis of European Real Estate Securities (2002). (23) RePEc:fra:franaf:3 Corporate Governance: The Role of Other Constituencies (1997). (24) RePEc:fra:franaf:139 Preemptive Distress Resolution through Bank Mergers (2004). (25) RePEc:fra:franaf:187 Risk Transfer with CDOs (2008). (26) RePEc:fra:franaf:161 Home biased? A spatial analysis of the domestic merging behavior of US firms (2006). (27) RePEc:fra:franaf:22 Non-voting shares in France: An empirical analysis of the voting premium (1998). (28) RePEc:fra:franaf:160 Modelling the role of credit rating agencies - Do they spark off a virtuous circle? (2005). (29) RePEc:fra:franaf:108 Characteristics of German Real Estate Return Distributions: Evidence from Germany and Comparison to the U.S. and U.K. (2004). (30) RePEc:fra:franaf:190 The Quiet Life Hypothesis in Banking - Evidence from German Savings Banks (2008). (31) RePEc:fra:franaf:124 Estimating the Expected Cost of Equity Capital Using Consensus Forecasts (2004). (32) RePEc:fra:franaf:65 Pension Systems and Financial Systems in Europe: A Comparison from the Point of View of Complementarity (2001). (33) RePEc:fra:franaf:171 Determinants of banks engagement in loan securitization (2006). (34) RePEc:fra:franaf:72 The Future of Banking in Europe (2001). (35) RePEc:fra:franaf:165 Open-End Real Estate Funds in Germany - Genesis and Crisis (2008). (36) RePEc:fra:franaf:114 Return and Risk of German Open-End Real Estate Funds (2004). (37) RePEc:fra:franaf:136 Can Tests Based on Option Hedging Errors Correctly Identify Volatility Risk Premia? (2008). (38) RePEc:fra:franaf:102 Open Source as a Signalling Device - An Economic Analysis (2003). (39) RePEc:fra:franaf:94 Portfolio Choice and Estimation Risk: A Comparison of Bayesian to Heuristic Approaches (2006). (40) RePEc:fra:franaf:127 Value Based Management auf Basis von ERIC (2004). (41) RePEc:fra:franaf:67 International Equity Portfolios and Currency Hedging: The Viewpoint of German and Hungarian Investors (2002). (42) RePEc:fra:franaf:1 Insider Trading and Portfolio Structure in Experimental Asset Markets with a Long Lived Asset (1999). (43) RePEc:fra:franaf:12 Financial Development, Economic Growth and Corporate Governance (1998). (44) RePEc:fra:franaf:30 Credit Scoring and Incentives for Loan Officers in a Principal Agent Model (1999). (45) RePEc:fra:franaf:140 Is Jump Risk Priced? - What We Can (and Cannot) Learn From Option Hedging Errors (2004). (46) RePEc:fra:franaf:110 On the Stability of Different Financial Systems (2003). (47) RePEc:fra:franaf:4 Marketmaking in the Laboratory: Does Competition Matter? (2001). (48) RePEc:fra:franaf:14 Liquiditätsmessung auf experimentellen Aktienmärkten# (1999). (49) RePEc:fra:franaf:16 Der Neue Markt: Eine Bestandsaufnahme# (1998). (50) RePEc:fra:franaf:73 Mängel bei der AbschluÃprüfung: Tatsachenberichte und Analysen aus betriebswirtschaftlicher Sicht (2001). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:kap:revdev:v:11:y:2008:i:3:p:205-244 The cross-section of average delta-hedge option returns under stochastic volatility (2008). Review of Derivatives Research (2) RePEc:mrr:papers:wp178 Deferred Annuities and Strategic Asset Allocation (2008). Working Papers (3) RePEc:zbw:bubdp2:7320 Determinants of European banks engagement in loan securitization (2008). Discussion Paper Series 2: Banking and Financial Studies Recent citations received in: 2007 (1) RePEc:ecb:ecbwps:20070710 Pricing of settlement link services and mergers of central securities depositories (2007). Working Paper Series Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||