|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

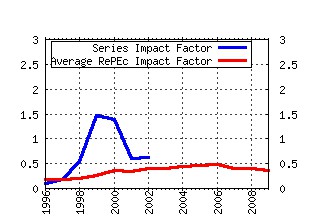

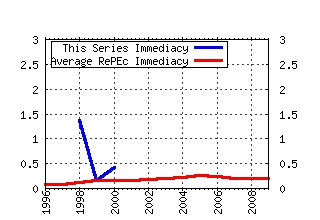

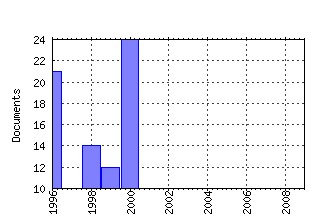

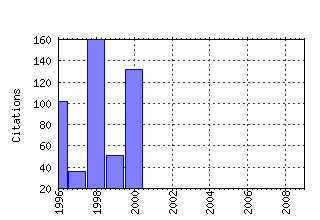

Banca Italia - Servizio di Studi Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:banita:343 What Caused the Asian Currency and Financial Crisis?. (1998). (2) RePEc:fth:banita:161 Earning Uncertainty and Precautionary Saving. (1992). (3) RePEc:fth:banita:269 Do Measures of Monetary Policy in a VAR Make Sense? (1996). (4) RePEc:fth:banita:389 The Monetary Transmission Mechanism: Evidence from the Industries of Five OECD Countries. (2000). (5) RePEc:fth:banita:256 The Credit Channel of Policy Across Heterogeneous Banks:the Case of Italy. (1995). (6) RePEc:fth:banita:374 Strategic Monetary Policy with Non-Atomistic Wage-Setters. (2000). (7) RePEc:fth:banita:170 Finance and Development : the Case of Southern Italy. (1992). (8) RePEc:fth:banita:272 Institutions and Labor Reallocation. (1996). (9) RePEc:fth:banita:383 (Fractional) Beta Convergence. (2000). (10) RePEc:fth:banita:323 Education, Infrastructure, Geography and Growth: An Empirical Analysis of the Development of Italian Provinces (1997). (11) RePEc:fth:banita:289 Investment and Demand Uncertainty. (1996). (12) RePEc:fth:banita:370 Forecasting Industrial Production in the Euro Area. (2000). (13) RePEc:fth:banita:362 Markup and the Business Cycle: Evidence from Italian Manufacturing Branches. (1999). (14) RePEc:fth:banita:167 Why is Italy Saving Rate so High? (1992). (15) RePEc:fth:banita:377 The Italian Business Cycle: Coincident and Leading Indicators and Some Stylized Facts. (2000). (16) RePEc:fth:banita:193 On the Economics of Interbank Payment Systems. (1993). (17) RePEc:fth:banita:332 Central Bank Independence, Centralization of Wage Bargaining, Inflation and Unemployment: Theory and Evidence (1998). (18) RePEc:fth:banita:355 The Economic Policy of Fiscal Consolidations: The European Experience. (1999). (19) RePEc:fth:banita:187 Rating the EC as an Optimal Currency Area. (1993). (20) RePEc:fth:banita:281 Coordination and Correlation in Markov Rational Belief Equilibria. (1996). (21) RePEc:fth:banita:361 Why do Banks Merge?. (1999). (22) RePEc:fth:banita:219 An Econometric Analysis of Money Demand in Italy. (1993). (23) RePEc:fth:banita:380 Bank Competition and Regulatory Reform: The Case of the Italian Banking Industry. (2000). (24) RePEc:fth:banita:312 Credibility without Rules? Monetary Frameworks in the Post-Bretton Woods Era (1997). (25) RePEc:fth:banita:375 Emu Fiscal Rules: is There a Gap?. (2000). (26) RePEc:fth:banita:353 Is there an Equity Premium Puzzle in Italy? A Look at Asset Returns, Consumption and Financial Structure Data Over the Last Century. (1999). (27) RePEc:fth:banita:325 Style, Fees and Performance of Italian Equity Funds (1998). (28) RePEc:fth:banita:359 Does Market Transparency Matter? A Case Study. (1999). (29) RePEc:fth:banita:365 Labor Markets and Monetary Union: a Strategic Analysis. (2000). (30) RePEc:fth:banita:163 Cross-Border Deposits and Monetary Aggregates in the Transition to EMU. (1992). (31) RePEc:fth:banita:261 Debt Restructuring with Multiple Creditors and the Role of Exchange Offers. (1996). (32) RePEc:fth:banita:171 Generational Accounting : The Case of Italy. (1992). (33) RePEc:fth:banita:372 Investment and Growth in Europe and in the United States in the Nineties. (2000). (34) RePEc:fth:banita:165 Bequests and Saving for Retirement. What Impels the Accumulation of Wealth. (1992). (35) RePEc:fth:banita:344 Investment and the Exchange Rate. (1998). (36) RePEc:fth:banita:322 Long-Term Interest Rate Convergence in Europe and the Probability of EMU (1997). (37) RePEc:fth:banita:321 Finance, Human Capital and Infrastructure: An Empirical Investigation of Post-War Italian Growth (1997). (38) RePEc:fth:banita:368 Information Spillovers and Factor Adjustment. (2000). (39) RePEc:fth:banita:381 The Determinants of Cross-Border Bank Share holdings: an Analysis with Bank-Level Data from OECD Countries. (2000). (40) RePEc:fth:banita:184 Durables and Nondurables Consumption: Edidence from Italian Household Data. (1992). (41) RePEc:fth:banita:379 Promise and Pitfalls in the Use of Secondary Data -Sets: Income Inequality in OECD Countries. (2000). (42) RePEc:fth:banita:275 Intergenerational Transfers, Borrowing Constraints and the Timing of Home Ownership. (1996). (43) RePEc:fth:banita:350 The Distribution of Personal Income in Post-War Italy: Source Description, Date Quality, and the Time Pattern of Income Inequality. (1999). (44) RePEc:fth:banita:340 Heterogeneous Credit Channels and Optimal Monetary Policy in a Monetary Union. (1998). (45) RePEc:fth:banita:345 Reallocation and Learning Over the Business Cycle. (1998). (46) RePEc:fth:banita:339 The Probability Density Function of Interest Rates Implied in the Price of Options. (1998). (47) RePEc:fth:banita:384 Will a Common European Monetary Policy Have Asymmetric Effects?. (2000). (48) RePEc:fth:banita:199 Liquidity Effects and the Determinants of Short-Term Interest Rates in Italy. (1993). (49) RePEc:fth:banita:268 Asset Pricing Lessons for Modeling Business Cycles. (1996). (50) RePEc:fth:banita:282 The Equity Premium Is No Puzzle. (1996). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||