|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

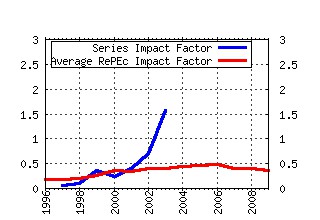

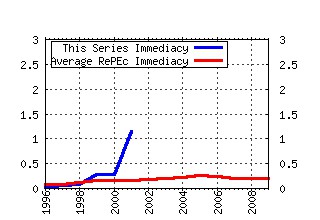

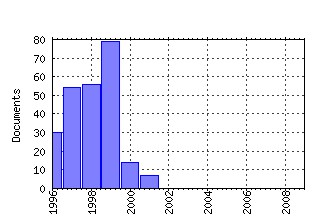

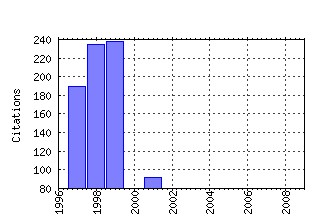

New York University, Leonard N. Stern School Finance Department Working Paper Seires Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:nystfi:98-007 The Effects of Bank Mergers and Acquisitions on Small Business Lending (1998). (2) RePEc:fth:nystfi:98-005 Economic News and the Yield Curve: Evidence from the U.S. Treasury Market (1997). (3) RePEc:fth:nystfi:99-059 The Distribution of Exchange Rate Volatility (1999). (4) RePEc:fth:nystfi:98-022 Cookie-Cutter versus Character: The Micro Structure of Small Business Lending by Large and Small Banks (1997). (5) RePEc:fth:nystfi:96-34 Why Do Security Prices Change? A Transaction-Level Analysis of NYSE Stocks (1996). (6) RePEc:fth:nystfi:99-014 Empirical Pricing Kernels (2000). (7) RePEc:fth:nystfi:01-11 Financial Globalization and Real Regionalization. (2001). (8) RePEc:fth:nystfi:98-081 Pitfalls and Opportunities in the Use of Extreme Value Theory in Risk Management (1998). (9) RePEc:fth:nystfi:96-9 Affine Models of Currency Pricing (1996). (10) RePEc:fth:nystfi:99-064 The Effects of Deregulation on the Performance of Financial Institutions: The Case of Spanish Savings Banks (1999). (11) RePEc:fth:nystfi:01-01 Fixed and Random Effects in Nonlinear Models. (2001). (12) RePEc:fth:nystfi:97-1 The Effects of Bank Mergers and Acquisitions on Small Business Lending (1997). (13) RePEc:fth:nystfi:00-07 Stretching Firm and Brand Reputation. (2000). (14) RePEc:fth:nystfi:99-003 When are Options Overpriced'DONE' The Black-Scholes Model and Alternative Characterizations of the Pricing Kernel (1999). (15) RePEc:fth:nystfi:01-07 The Effects of Dynamic Change in Bank Competition on the Supply of Small Business Credit. (2001). (16) RePEc:fth:nystfi:98-004 Market Microstructure and Securities Values: Evidence from the Tel Aviv Stock Exchange (1997). (17) RePEc:fth:nystfi:01-10 Estimating Econometric Models with Fixed Effects. (2001). (18) RePEc:fth:nystfi:99-063 Unit Root Tests are Useful for Selecting Forecasting Models (1999). (19) RePEc:fth:nystfi:99-046 Portfolio Performance and Agency (1999). (20) RePEc:fth:nystfi:98-038 Where Does the Money Come From? The Financing of Small Entrepreneurial Enterprises (1998). (21) RePEc:fth:nystfi:98-054 The Comparative Efficiency of Small-Firm Bankruptcies: A Study of the US and Finnish Bankruptcy Codes (1998). (22) RePEc:fth:nystfi:98-014 Hedge Funds and the Asian Currency Crisis of 1997 (1998). (23) RePEc:fth:nystfi:01-00 The Microsoft Antitrust Case. (2001). (24) RePEc:fth:nystfi:98-031 Testing the Volatility Term Structure using Option Hedging Criteria (1998). (25) RePEc:fth:nystfi:99-028 Semiparametric Pricing of Multivariate Contingent Claims (1999). (26) RePEc:fth:nystfi:98-028 Do Investors Care About Sentiment? (1998). (27) RePEc:fth:nystfi:98-080 How Relevant is Volatility Forecasting for Financial Risk Management'DONE' (1998). (28) RePEc:fth:nystfi:99-012 Trading Fast and Slow: Security Market Events in Real Time (1999). (29) RePEc:fth:nystfi:99-010 Regime Shifts and Bond Returns (1999). (30) RePEc:fth:nystfi:96-14 Managerial Entrenchment and Capital Structure Decisions (1996). (31) RePEc:fth:nystfi:99-077 Conditions for Survival: Changing Risk and the Performance of Hedge Fund Managers and CTAs (1999). (32) RePEc:fth:nystfi:99-036 Viability and Equilibrium in Securities Markets with Frictions (1999). (33) RePEc:fth:nystfi:99-027 Implied Volatility Functions: A Reprise (1999). (34) RePEc:fth:nystfi:99-061 (Understanding, Optimizing, Using and Forecasting) Realized Volatility and Correlation (1999). (35) RePEc:fth:nystfi:99-054 The IPO Lock-Up Period: Implications for Market Efficiency And Downward Sloping Demand Curves (2000). (36) RePEc:fth:nystfi:98-013 The Dow Theory: William Peter Hamiltons Track Record Re-Considered (1998). (37) RePEc:fth:nystfi:99-060 Exchange Rate Returns Standardized by Realized Volatility are (Nearly) Gaussian (1999). (38) RePEc:fth:nystfi:96-40 Universal Banking: A Shareholder Value Perspective (1997). (39) RePEc:fth:nystfi:99-032 Value-at-Risk Based Risk Management: Optimal Policies and Asset Prices (1999). (40) RePEc:fth:nystfi:99-083 Enhancing the Liquidity of U.S. Treasury Securities in an Era of Surpluses (1999). (41) RePEc:fth:nystfi:99-048 Costly Financing, Optimal Payout Policies and the Valuation of Corporate Debt (2000). (42) RePEc:fth:nystfi:99-013 A Direct Approach to Arbitrage-Free Pricing of Derivatives (1998). (43) RePEc:fth:nystfi:99-072 A Multifractal Model of Assets Returns (1999). (44) RePEc:fth:nystfi:99-057 On the Formation and Structure of International Exchanges (1999). (45) RePEc:fth:nystfi:99-062 Modeling Liquidity Risk With Implications for Traditional Market Risk Measurement and Management (1998). (46) RePEc:fth:nystfi:99-086 The Price of Options Illiquidity (1999). (47) RePEc:fth:nystfi:98-040 Has International Financial Integration Increased? (1997). (48) RePEc:fth:nystfi:99-073 Portfolio Choice and Equity Characteristics: Characterizing the Hedging Demands Induced by Return Predictability (2000). (49) RePEc:fth:nystfi:98-074 Time-Varying Sharpe Ratios and Market Timing (1997). (50) RePEc:fth:nystfi:99-052 Crisis Dynamics of Implied Default Recovery Ratios: Evidence From Russia and Argentina (1999). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||