|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

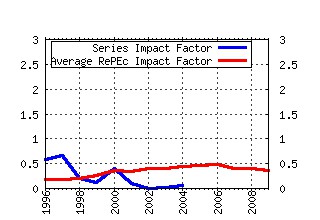

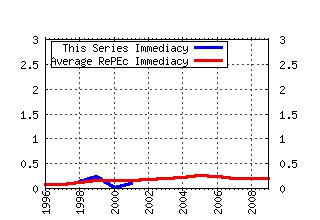

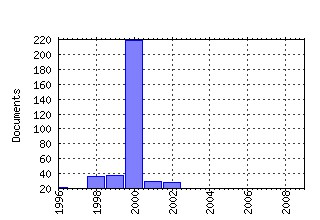

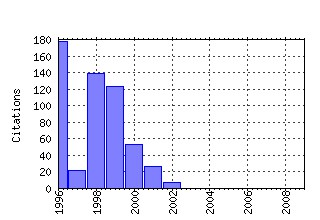

Rodney L. White Center for Financial Research Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:pennfi:1-90 ASSET PRICES UNDER HABIT FORMATION AND CATCHING UP WITH THE JONESES. (1990). (2) RePEc:fth:pennfi:3-95 Precautionary Saving and Social Insurance (1995). (3) RePEc:fth:pennfi:03-95 Precautionary Saving and Social Insurance (1995). (4) RePEc:fth:pennfi:8-96 Firm Performance and Mechanisms to Control Agency Problems Between Managers and Shareholders. (1996). (5) RePEc:fth:pennfi:11-90 The Origins of Banking Panics: Models, Facts, and Bank Regulation (1990). (6) RePEc:fth:pennfi:69 Testing for Liquidity Constraints in Euler Equations with Complementary Data Sources. (1998). (7) RePEc:fth:pennfi:15-95 Options, the Value of Capital, and Investment (1995). (8) RePEc:fth:pennfi:2-91 A Bayesian Model of Intraday Specialist Pricing (1991). (9) RePEc:fth:pennfi:25-92 A Quality and Risk-Adjusted Cost Function for Banks: Evidence on the Too Big-to-Fail Doctrine. (1992). (10) RePEc:fth:pennfi:22-88 Portfolio Performance Evaluation: Old Issues and New Insights (1988). (11) RePEc:fth:pennfi:10-96 Balanced Budget Rules and Public Deficits: Evidence from the U.S. States. (1996). (12) RePEc:fth:pennfi:11-92 What Does the Stock Market Tell Us About Real Estate Returns? (1992). (13) RePEc:fth:pennfi:18-99 Should Investors Avoid All Actively Managed Mutual Funds'DONE' A Study in Bayesian Performance Evaluation (1999). (14) RePEc:fth:pennfi:2-85 Investment Banking, Reputation and the Underpricing of Initial Public Offerings (1985). (15) RePEc:fth:pennfi:15-92 Stock Markets and Resource Allocation (Reprint 036) (1992). (16) RePEc:fth:pennfi:1-96 General Properties of Option Prices. (1996). (17) RePEc:fth:pennfi:09-87 Operative Gift and Bequest Motives (1987). (18) RePEc:fth:pennfi:03-98 The Declining Credit Quality of US Corporate Debt: Myth or Reality? (1998). (19) RePEc:fth:pennfi:67 The Declining Credit Quality of U.S. Corporate Debt: Myth or Reality? (1998). (20) RePEc:fth:pennfi:3-98 The Declining Credit Quality of US Corporate Debt: Myth or Reality? (1998). (21) RePEc:fth:pennfi:9-87 Operative Gift and Bequest Motives (1987). (22) RePEc:fth:pennfi:19-81 Private Discrimination and Social Intervention in Competitive Labor Markets (1981). (23) RePEc:fth:pennfi:3-91 Budget Balance Through Revenue or Spending Adjustments? Some Historical Evidence for the United States. (1991). (24) RePEc:fth:pennfi:08-98 The Cost of Institutional Equity Trades (1998). (25) RePEc:fth:pennfi:16-92 Finite Bubbles with Short Sale Constraints and Asymmetric Information (1992). (26) RePEc:fth:pennfi:07-89 Empirical Tests of the Consumption-Oriented CAPM (1989). (27) RePEc:fth:pennfi:7-89 Empirical Tests of the Consumption-Oriented CAPM (1989). (28) RePEc:fth:pennfi:21-88 Adverse Risk Incentives and the Design of Performance-Based Contracts (1988). (29) RePEc:fth:pennfi:68 The Cost of Institutional Equity Trades. (1998). (30) RePEc:fth:pennfi:8-98 The Cost of Institutional Equity Trades (1998). (31) RePEc:fth:pennfi:15-98 A Theory of Dividends Based on Tax Clienteles (1998). (32) RePEc:fth:pennfi:15-88 Stock Prices Under Time-Varying Dividend Risk: An Exact Solution in an Infinite-Horizon General Equilibrium Model (1988). (33) RePEc:fth:pennfi:6-95 Banks and Derivatives (1995). (34) RePEc:fth:pennfi:06-95 Banks and Derivatives (1995). (35) RePEc:fth:pennfi:08-96 Firm Performance and Mechanisms to Control Agency Problems between Managers and Shareholders (Revision of 29-94) (1996). (36) RePEc:fth:pennfi:15-94 Corporate Financial Structure, Incentives and Optimal Contracting (Reprint 049) (1994). (37) RePEc:fth:pennfi:03-85 The Week-End Effect in Common Stock Returns: The International Evidence (1985). (38) RePEc:fth:pennfi:3-85 The Week-End Effect in Common Stock Returns: The International Evidence (1985). (39) RePEc:fth:pennfi:05-97 Learning To Be Overconfident (1997). (40) RePEc:fth:pennfi:19-99 Estimating the Returns to Insider Trading (1999). (41) RePEc:fth:pennfi:06-83 The Pricing of Call and Put Options on Foreign Exchange (1983). (42) RePEc:fth:pennfi:6-83 The Pricing of Call and Put Options on Foreign Exchange (1983). (43) RePEc:fth:pennfi:14-93 A Unified Model of Investment Under Uncertainty (1993). (44) RePEc:fth:pennfi:23-79 Disclosure Laws and Takeover Bids (2000). (45) RePEc:fth:pennfi:21-95 The Effects of Irreversibility and Uncertainty on Capital Accumulation (1995). (46) RePEc:fth:pennfi:03-99 The Social Security Trust Fund, the Riskless Interest Rate, and Capital Accumulation. (1999). (47) RePEc:fth:pennfi:72 Costs of Equity Capital and Model Mispricing. (1999). (48) RePEc:fth:pennfi:01-87 Seasonality, Cost Shocks and the Production Smoothing Model of Inventories (2001). (49) RePEc:fth:pennfi:14-85 Dividend Yields and Stock Returns: Implications of Abnormal January Returns (1985). (50) RePEc:fth:pennfi:13-82 The Real Exchange Rate, the Current Account and the Speed of Adjustment (1982). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||