|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

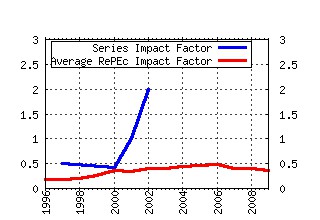

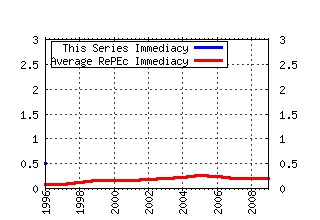

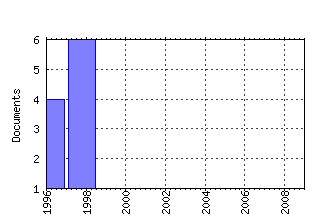

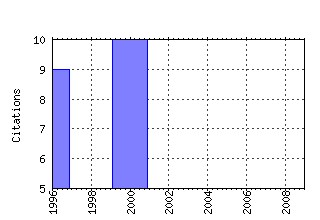

Weiss Center Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:pennif:1-90 ASSET PRICES UNDER HABIT FORMATION AND CATCHING UP WITH THE JONESES. (1990). (2) RePEc:fth:pennif:23-90 THE CONSUMPTION OF STOCKHOLDERS AND NON-STOCKHOLDERS. (1990). (3) RePEc:fth:pennif:3-91 Budget Balance Through Revenue or Spending Adjustments? Some Historical Evidence for the United States. (1991). (4) RePEc:fth:pennif:00-1 Using Asset Prices to Measure the Cost of Business Cycles. (2000). (5) RePEc:fth:pennif:93-4 Trends in Expected Returns in Currency and Bond Markets. (1993). (6) RePEc:fth:pennif:20-90 MONETARY CONTRACTING BETWEEN CENTRAL BANKS AND THE DESIGN OF SUSTAINABLE EXCHANGE-RATE ZONES. (1990). (7) RePEc:fth:pennif:94-7 Puzzles in international Financial Markets. (1994). (8) RePEc:fth:pennif:11-91 Option Prices and the Underlying Assets Return Distribution (1991). (9) RePEc:fth:pennif:96-3 The Effects of Industry Structure on Economic Exposure. (1996). (10) RePEc:fth:pennif:93-3 Does Foreign Exchange Intervention Signal Future Monetary Policy? (1992). (11) RePEc:fth:pennif:96-4 Consumption, Stock Returns, and the Gains from International Risk-Sharing. (1996). (12) RePEc:fth:pennif:93-7 Currency Option Pricing in Credible Target Zones. (1993). (13) RePEc:fth:pennif:98-03 Derivatives Usage in Risk Management by US and German Non-Financial Firms: A Comparative Survey (1998). (14) RePEc:fth:pennif:98-02 Both Sides of Corporate Diversification: The Value Impacts of Geographic and Industrial Diversification (1998). (15) RePEc:fth:pennif:26-90 MEASUREMENT DISTORTION AND MISSING CONTINGENCIES IN OPTIMAL CONTRACTS. (1990). (16) RePEc:fth:pennif:93-11 Are Foreign Exchange Intervention and Monetary Policy Related and Does it Really Matter. (1993). (17) RePEc:fth:pennif:4-92 Differences in execution Prices among the Nyse, the Regionals and the NASD. (1991). (18) RePEc:fth:pennif:93-8 Siegels Paradox and Pricing of Currency Options. (1993). (19) RePEc:fth:pennif:14-91 Limited Market Participation and Volatility of Asset Prices. (1991). (20) RePEc:fth:pennif:26-91 An Ordered Probit Analysis of Transaction Stock Prices. (1991). (21) RePEc:fth:pennif:93-2 Determinants of Short-Term Real Interest Differentials Between Japan and the United States. (1992). (22) RePEc:fth:pennif:2-92 Limited Market Participation and Volatility of Asset Prices. (1991). (23) RePEc:fth:pennif:93-13 Jumps and Stochastic Volatility: Exchange Rate Processes Implicit in PHLX Deutschemark Options. (1993). (24) RePEc:fth:pennif:1991-2 How Long do Unilateral Target Zones last? (1991). (25) RePEc:fth:pennif:29-91 Quantity-Adjusting Options and Forward Contracts. (1991). (26) RePEc:fth:pennif:93-5 Explaining Overnight Variation in Japanese Stock Returns: The Information Content of Derivative Securities. (1993). (27) RePEc:fth:pennif:1-92 Security Prices and Market Transparency. (1991). (28) RePEc:fth:pennif:19-91 On Testing Sustainability of Government Deficits in a Stochastic Environment. (1991). (29) RePEc:fth:pennif:28-91 Budget Deficits and Government Accounting. (1991). (30) RePEc:fth:pennif:98-05 Explaining Home Bias in Equities and Consumption (1998). (31) RePEc:fth:pennif:21-91 Stock Price Manipulation, Market Microstructure and Asymetric Information. (1991). (32) RePEc:fth:pennif:7-90 ASSET RETURNS, INVESTMENT HORIZONS, AND INTERTEMPORAL PREFERENCES. (1990). (33) RePEc:fth:pennif:15-91 Risk and Returns of low-Grade Bonds: An Update. (1991). (34) RePEc:fth:pennif:28-90 THE CRASH OF 87: WAS IT EXPECTED? THE EVIDENCE FROM OPTIONS MARKETS. (1990). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||