|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

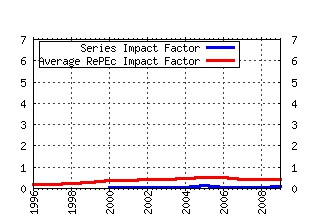

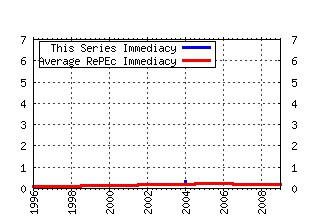

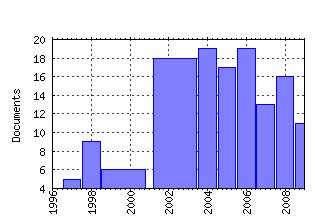

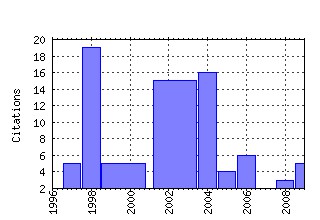

Asia-Pacific Financial Markets Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:apfinm:v:5:y:1998:i:2:p:99-128 Unconditional and Conditional Distributional Models for the Nikkei Index (1998). (2) RePEc:kap:apfinm:v:11:y:2004:i:1:p:1-22 Diversified Portfolios with Jumps in a Benchmark Framework (2004). (3) RePEc:kap:apfinm:v:10:y:2003:i:2:p:87-127 A Class of Jump-Diffusion Bond Pricing Models within the HJM Framework (2003). (4) RePEc:kap:apfinm:v:4:y:1997:i:2:p:97-124 Subordinated Market Index Models: A Comparison (1997). (5) RePEc:kap:apfinm:v:11:y:2004:i:1:p:55-77 Understanding the Implied Volatility Surface for Options on a Diversified Index (2004). (6) RePEc:kap:apfinm:v:10:y:2003:i:1:p:29-44 Price Linkages in Asian Equity Markets: Evidence Bordering the Asian Economic, Currency and Financial Crises (2003). (7) RePEc:kap:apfinm:v:10:y:2003:i:4:p:359-376 Are Banks Affiliated with Bank Holding Companies More Efficient Than Independent Banks? The Recent Experience Regarding Japanese Regional BHCs (2003). (8) RePEc:kap:apfinm:v:16:y:2009:i:3:p:169-181 Counterparty Risk for Credit Default Swaps: Markov Chain Interacting Intensities Model with Stochastic Intensity (2009). (9) RePEc:kap:apfinm:v:5:y:1998:i:3:p:191-209 The Impact of the U.S. and the Japanese Equity Markets on the Emerging Asia-Pacific Equity Markets (1998). (10) RePEc:kap:apfinm:v:6:y:1999:i:1:p:49-70 Pricing Options under Stochastic Interest Rates: A New Approach (1999). (11) RePEc:kap:apfinm:v:5:y:1998:i:2:p:129-158 The Pricing Formula for Commodity-Linked Bonds with Stochastic Convenience Yields and Default Risk (1998). (12) RePEc:kap:apfinm:v:5:y:1998:i:3:p:275-307 Monthly Pattern and Portfolio Effect on Higher Moments of Stock Returns: Empirical Evidence from Hong Kong (1998). (13) RePEc:kap:apfinm:v:13:y:2006:i:1:p:11-39 Risk-neutral and actual default probabilities with an endogenous bankruptcy jump-diffusion model (2006). (14) RePEc:kap:apfinm:v:11:y:2004:i:1:p:23-53 A Fair Pricing Approach to Weather Derivatives (2004). (15) RePEc:kap:apfinm:v:10:y:2003:i:2:p:151-162 On the Pricing of Defaultable Bonds Using the Framework of Barrier Options (2003). (16) RePEc:kap:apfinm:v:11:y:2004:i:4:p:431-444 A Complete-Market Generalization of the Black-Scholes Model (2004). (17) RePEc:kap:apfinm:v:17:y:2010:i:2:p:141-149 On the Predictability of Japanese Stock Returns Using Dividend Yield (2010). (18) RePEc:kap:apfinm:v:5:y:1998:i:2:p:159-183 Econometric Analysis of a Continuous Time Multi-Factor Generalized Vasicek Term Structure Model: International Evidence (1998). (19) RePEc:kap:apfinm:v:11:y:2004:i:3:p:267-300 Numerical Approach to Asset Pricing Models with Stochastic Differential Utility (2004). (20) RePEc:kap:apfinm:v:13:y:2006:i:2:p:95-111 Non-linear long horizon returns predictability: evidence from six south-east Asian markets (2006). (21) RePEc:kap:apfinm:v:16:y:2009:i:4:p:333-345 A Remark on a Singular Perturbation Method for Option Pricing Under a Stochastic Volatility Model (2009). (22) RePEc:kap:apfinm:v:6:y:1999:i:1:p:37-48 Financial Modeling in a Fast Mean-Reverting Stochastic Volatility Environment (1999). (23) RePEc:kap:apfinm:v:12:y:2005:i:3:p:273-287 A discrete Itô calculus approach to Hes framework for multi-factor discrete markets (2005). (24) RePEc:kap:apfinm:v:15:y:2008:i:3:p:175-184 A Method of Calculating the Downside Risk by Multivariate Nonnormal Distributions (2008). (25) RePEc:kap:apfinm:v:11:y:2004:i:2:p:143-160 A New Control Variate Estimator for an Asian Option (2004). (26) RePEc:kap:apfinm:v:13:y:2006:i:2:p:113-127 Portfolio optimization with a defaultable security (2006). (27) RePEc:kap:apfinm:v:16:y:2009:i:3:p:183-210 Dynamic Modeling of Tail Risk: Applications to China, Hong Kong and Other Asian Markets (2009). (28) RePEc:kap:apfinm:v:10:y:2003:i:4:p:281-300 Investor Familiarity and Home Bias: Japanese Evidence (2003). (29) RePEc:kap:apfinm:v:12:y:2005:i:2:p:143-157 Testing for Volatility Jumps in the Stochastic Volatility Process (2005). (30) RePEc:kap:apfinm:v:14:y:2007:i:3:p:229-253 Reduced-form Models with Regime Switching: An Empirical Analysis for Corporate Bonds (2007). (31) RePEc:kap:apfinm:v:12:y:2005:i:1:p:45-60 Market Efficiency and Returns to Simple Technical Trading Rules: Further Evidence from U.S., U.K., Asian and Chinese Stock Markets (2005). (32) RePEc:kap:apfinm:v:14:y:2007:i:3:p:211-227 Board Size, Independence and Performance: An Analysis of Thai Banks (2007). (33) RePEc:kap:apfinm:v:18:y:2011:i:1:p:89-103 A Note on Utility Maximization with Unbounded Random Endowment (2011). (34) RePEc:kap:apfinm:v:6:y:1999:i:1:p:71-84 Bayesian Estimation of ARMA-GARCH Model of Weekly Foreign Exchange Rates (1999). (35) RePEc:kap:apfinm:v:13:y:2006:i:1:p:1-9 Component structures of agricultural commodity futures traded on the Tokyo Grain Exchange (2006). (36) RePEc:kap:apfinm:v:15:y:2008:i:3:p:307-347 Recovery Process Model (2008). (37) RePEc:kap:apfinm:v:13:y:2006:i:4:p:327-344 Monte Carlo Option Pricing for Tempered Stable (CGMY) Processes (2006). (38) RePEc:kap:apfinm:v:12:y:2005:i:4:p:289-306 On the asymptotic behavior of the prices of Asian options (2005). (39) RePEc:kap:apfinm:v:15:y:2008:i:3:p:255-272 The Determinants of Bank Capital Ratios in a Developing Economy (2008). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||