|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

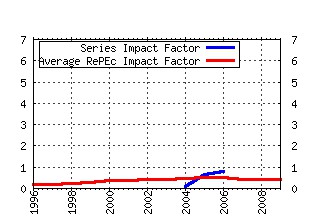

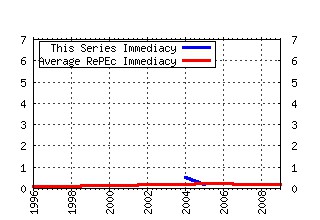

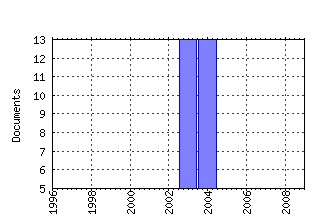

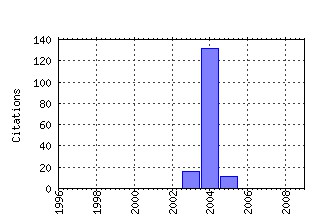

Review of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:eurfin:v:8:y:2004:i:1:p:75-108 Venture Capital Finance: A Security Design Approach (2004). (2) RePEc:kap:eurfin:v:8:y:2004:i:2:p:171-197 Measuring Systematic Risk in EMU Government Yield Spreads (2004). (3) RePEc:kap:eurfin:v:8:y:2004:i:1:p:1-18 Liquidity Black Holes (2004). (4) RePEc:kap:eurfin:v:10:y:2006:i:1:p:153-187 (). (5) RePEc:kap:eurfin:v:9:y:2005:i:4:p:437-481 (). (6) RePEc:kap:eurfin:v:10:y:2006:i:1:p:99-152 (). (7) RePEc:kap:eurfin:v:7:y:2003:i:3:p:515-539 Taxes and Venture Capital Support (2003). (8) RePEc:kap:eurfin:v:8:y:2004:i:2:p:135-169 Basic Principles of Asset Pricing Theory: Evidence from Large-Scale Experimental Financial Markets (2004). (9) RePEc:kap:eurfin:v:9:y:2005:i:2:p:201-242 (). (10) RePEc:kap:eurfin:v:8:y:2004:i:2:p:199-277 Regulating Insider Trading When Investment Matters (2004). (11) RePEc:kap:eurfin:v:9:y:2005:i:2:p:165-200 Optimal Liquidity Trading (2005). (12) RePEc:kap:eurfin:v:8:y:2004:i:3:p:403-443 Performance and Employer Stock in 401(k) Plans (2004). (13) RePEc:kap:eurfin:v:9:y:2005:i:3:p:353-383 (). (14) RePEc:kap:eurfin:v:9:y:2005:i:1:p:65-96 (). (15) RePEc:kap:eurfin:v:8:y:2004:i:3:p:327-353 Exit Options in Corporate Finance: Liquidity versus Incentives (2004). (16) RePEc:kap:eurfin:v:9:y:2005:i:2:p:281-304 (). (17) RePEc:kap:eurfin:v:9:y:2005:i:4:p:537-567 (). (18) RePEc:kap:eurfin:v:8:y:2004:i:2:p:279-324 Robustness and Ambiguity Aversion in General Equilibrium (2004). (19) RePEc:kap:eurfin:v:8:y:2004:i:3:p:445-480 Heterogeneity in Financial Market Participation: Appraising its Implications for the C-CAPM (2004). (20) RePEc:kap:eurfin:v:10:y:2006:i:3:p:353-387 (). (21) RePEc:kap:eurfin:v:9:y:2005:i:1:p:1-32 The Price of Future Liquidity: Time-Varying Liquidity in the U.S. Treasury Market (2005). (22) RePEc:kap:eurfin:v:9:y:2005:i:3:p:305-351 (). (23) RePEc:kap:eurfin:v:9:y:2005:i:1:p:97-137 (). (24) RePEc:kap:eurfin:v:10:y:2006:i:3:p:443-482 (). (25) RePEc:kap:eurfin:v:7:y:2003:i:3:p:361-383 Pricing and Hedging American Options Using Approximations by Kim Integral Equations (2003). (26) RePEc:kap:eurfin:v:10:y:2006:i:4:p:613-644 (). (27) RePEc:kap:eurfin:v:8:y:2004:i:1:p:49-74 Price Discovery across the Rhine (2004). (28) RePEc:kap:eurfin:v:7:y:2003:i:3:p:511-514 Comment on `Some Evidence that a Tobin Tax on Foreign Exchange Transactions may Increase Volatility (2003). (29) RePEc:kap:eurfin:v:8:y:2004:i:1:p:109-127 Why is the Index Smile So Steep? (2004). (30) RePEc:kap:eurfin:v:7:y:2003:i:3:p:481-510 Some Evidence that a Tobin Tax on Foreign Exchange Transactions May Increase Volatility (2003). (31) RePEc:kap:eurfin:v:7:y:2003:i:3:p:547-582 Household Portfolio Choices in Taxable and Tax-Deferred Accounts: Another Puzzle? (2003). (32) RePEc:kap:eurfin:v:9:y:2005:i:1:p:33-63 (). (33) RePEc:kap:eurfin:v:10:y:2006:i:3:p:321-352 (). (34) RePEc:kap:eurfin:v:10:y:2006:i:4:p:587-612 (). (35) RePEc:kap:eurfin:v:9:y:2005:i:2:p:139-164 (). (36) RePEc:kap:eurfin:v:10:y:2006:i:4:p:487-506 (). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||