|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

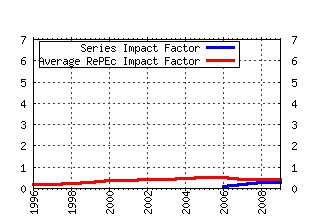

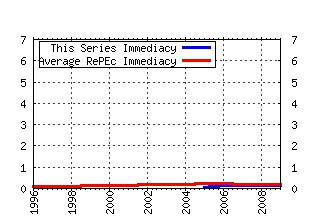

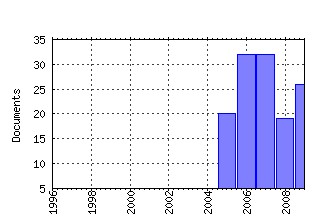

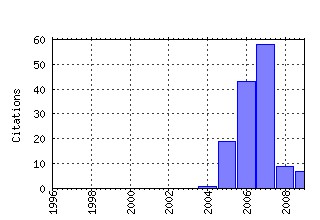

Financial Markets and Portfolio Management Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:fmktpm:v:21:y:2007:i:4:p:445-470 Heterogeneous multiple bank financing: does it reduce inefficient credit-renegotiation incidences? (2007). (2) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:3-43 Advice and monitoring in venture finance (2007). (3) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:369-398 Provincial preferences in private equity (2006). (4) RePEc:kap:fmktpm:v:20:y:2006:i:3:p:339-360 Making prospect theory fit for finance (2006). (5) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:442-471 Performance measurement of hedge funds using data envelopment analysis (2006). (6) RePEc:kap:fmktpm:v:21:y:2007:i:3:p:269-292 Credit default swap prices as risk indicators of listed German banks (2007). (7) RePEc:kap:fmktpm:v:20:y:2006:i:1:p:7-18 Monetary Policy and Financial Markets (2006). (8) RePEc:kap:fmktpm:v:20:y:2006:i:1:p:19-32 Stock and Bond Liquidity and its Effect on Prices and Financial Policies (2006). (9) RePEc:kap:fmktpm:v:19:y:2005:i:3:p:239-260 Market Timing And Model Uncertainty: An Exploratory Study For The Swiss Stock Market (2005). (10) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:399-418 How do investment patterns of independent and captive private equity funds differ? Evidence from Germany (2006). (11) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:472-491 A fully parametric approach to return modelling and risk management of hedge funds (2006). (12) RePEc:kap:fmktpm:v:21:y:2007:i:3:p:397-398 Philippe Jorion: Value at Risk â The New Benchmark for Managing Financial Risk (2007). (13) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:69-94 Do venture capitalists imitate portfolio size? (2007). (14) RePEc:kap:fmktpm:v:20:y:2006:i:2:p:221-234 Recent Developments in Credit Markets (2006). (15) RePEc:kap:fmktpm:v:22:y:2008:i:3:p:241-258 Enterprise risk management in financial groups: analysis of risk concentration and default risk (2008). (16) RePEc:kap:fmktpm:v:20:y:2006:i:3:p:309-337 The Effect of Market Regimes on Style Allocation (2006). (17) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:45-67 Performance differentiation: cutting losses and maximizing profits of private equity and venture capital investments (2007). (18) RePEc:kap:fmktpm:v:23:y:2009:i:4:p:349-359 The implementation of SNB monetary policy (2009). (19) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:419-441 Relative importance of hedge fund characteristics (2006). (20) RePEc:kap:fmktpm:v:24:y:2010:i:2:p:159-170 Do financial advisors exhibit myopic loss aversion? (2010). (21) RePEc:kap:fmktpm:v:19:y:2005:i:1:p:99-108 The Regulatory Burden in the Swiss Wealth Management Industry (2005). (22) repec:kap:fmktpm:v:19:y:2005:i:4:p:381-396 (). (23) RePEc:kap:fmktpm:v:22:y:2008:i:2:p:147-167 Optimal investments in volatility (2008). (24) RePEc:kap:fmktpm:v:20:y:2006:i:3:p:265-285 Portfolio management and retirement: what is the best arrangement for a family? (2006). (25) RePEc:kap:fmktpm:v:24:y:2010:i:1:p:87-102 Trends in corporate diversification (2010). (26) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:121-134 Return decomposition of absolute-performance multi-asset class portfolios (2007). (27) RePEc:kap:fmktpm:v:21:y:2007:i:4:p:425-444 The tactical and strategic value of hedge fund strategies: a cointegration approach (2007). (28) RePEc:kap:fmktpm:v:20:y:2006:i:1:p:49-73 C-CAPM Refinements and the Cross-Section of Returns (2006). (29) RePEc:kap:fmktpm:v:20:y:2006:i:3:p:243-264 Uncertainty in Value-at-risk Estimates under Parametric and Non-parametric Modeling (2006). (30) RePEc:kap:fmktpm:v:19:y:2005:i:1:p:29-46 Time-Varying Betas of German Stock Returns (2005). (31) RePEc:kap:fmktpm:v:19:y:2005:i:4:p:343-359 Determinants of Financial Distress Costs (2005). (32) RePEc:kap:fmktpm:v:19:y:2005:i:2:p:153-167 Mutual Fund Growth in Standard and Specialist Market Segments (2005). (33) RePEc:kap:fmktpm:v:18:y:2004:i:4:p:442-457 What is going on in the oil market? (2004). (34) RePEc:kap:fmktpm:v:19:y:2005:i:3:p:313-322 Towards an Economic Analysis of Financial Markets Regulation? (2005). (35) RePEc:kap:fmktpm:v:22:y:2008:i:1:p:21-45 Return enhancement trading strategies for size based portfolios (2008). (36) RePEc:kap:fmktpm:v:20:y:2006:i:2:p:205-220 Interest Rates and Exchange Rate Movements: Analyzing Short-term Investments in Long-term Bonds (2006). (37) RePEc:kap:fmktpm:v:19:y:2005:i:2:p:131-151 Analystsâ Earnings Forecasts for DAX100 Firms During the Stock Market Boom of the 1990s (2005). (38) RePEc:kap:fmktpm:v:19:y:2005:i:4:p:397-405 Markov Chain Monte Carlo Methods in Financial Econometrics (2005). (39) RePEc:kap:fmktpm:v:22:y:2008:i:3:p:219-240 Securitization of mezzanine capital in Germany (2008). (40) RePEc:kap:fmktpm:v:20:y:2006:i:3:p:287-307 Investment Policies and Excess Returns in Corporate Spin-offs: Evidence from the US Market (2006). (41) RePEc:kap:fmktpm:v:23:y:2009:i:2:p:111-135 The impact of monetary policy surprises on asset return volatility: the case of Germany (2009). (42) RePEc:kap:fmktpm:v:21:y:2007:i:2:p:241-261 The characteristics and development of the Swiss franc repurchase agreement market (2007). (43) RePEc:kap:fmktpm:v:19:y:2005:i:2:p:201-212 Forecasting Monetary Policy in Switzerland: Some Empirical Assistance (2005). (44) RePEc:kap:fmktpm:v:23:y:2009:i:1:p:59-91 The ex-dividend day stock price anomaly: evidence from the Greek stock market (2009). (45) RePEc:kap:fmktpm:v:19:y:2005:i:1:p:47-60 The Informational Content of Transactions (2005). (46) RePEc:kap:fmktpm:v:21:y:2007:i:2:p:221-240 Three aspects of the Swiss term structure: an empirical survey (2007). (47) RePEc:kap:fmktpm:v:19:y:2005:i:4:p:361-380 The Valuation of Structured Products: Empirical Findings for the Swiss Market (2005). (48) RePEc:kap:fmktpm:v:22:y:2008:i:2:p:127-146 How do commodity futures respond to macroeconomic news? (2008). (49) RePEc:kap:fmktpm:v:23:y:2009:i:4:p:401-410 Monetary policy shocks and stock returns: evidence from the British market (2009). (50) RePEc:kap:fmktpm:v:19:y:2005:i:2:p:179-200 Procyclicality: The Macroeconomic Impact of Risk-Based Capital Requirements (2005). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:bla:perwir:v:10:y:2009:i:4:p:436-468 Die Krise der Wirtschaft: Auch eine Krise der Wirtschaftswissenschaften? (2009). Perspektiven der Wirtschaftspolitik (2) RePEc:kap:fmktpm:v:23:y:2009:i:4:p:401-410 Monetary policy shocks and stock returns: evidence from the British market (2009). Financial Markets and Portfolio Management (3) RePEc:usg:dp2009:2009-18 Die Krise der Wirtschaft: Auch eine Krise der Wirtschaftswissenschaften? (2009). University of St. Gallen Department of Economics working paper series 2009 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:gra:wpaper:07/04 The January Effect across Volatility Regimes (2007). ThE Papers (2) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:3-43 Advice and monitoring in venture finance (2007). Financial Markets and Portfolio Management (3) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:45-67 Performance differentiation: cutting losses and maximizing profits of private equity and venture capital investments (2007). Financial Markets and Portfolio Management (4) RePEc:kap:fmktpm:v:21:y:2007:i:1:p:69-94 Do venture capitalists imitate portfolio size? (2007). Financial Markets and Portfolio Management Recent citations received in: 2006 (1) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:369-398 Provincial preferences in private equity (2006). Financial Markets and Portfolio Management (2) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:399-418 How do investment patterns of independent and captive private equity funds differ? Evidence from Germany (2006). Financial Markets and Portfolio Management (3) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:419-441 Relative importance of hedge fund characteristics (2006). Financial Markets and Portfolio Management (4) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:442-471 Performance measurement of hedge funds using data envelopment analysis (2006). Financial Markets and Portfolio Management (5) RePEc:kap:fmktpm:v:20:y:2006:i:4:p:472-491 A fully parametric approach to return modelling and risk management of hedge funds (2006). Financial Markets and Portfolio Management Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||