|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

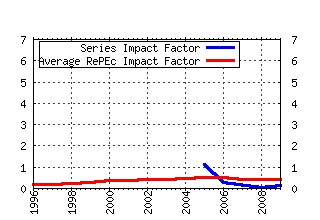

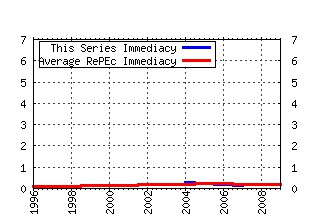

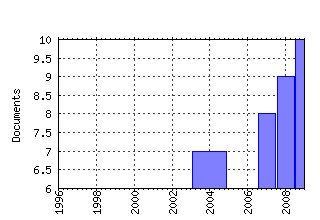

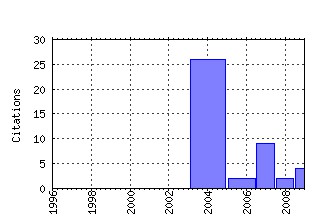

Review of Derivatives Research Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:revdev:v:7:y:2004:i:2:p:129-168 Assessing the Least Squares Monte-Carlo Approach to American Option Valuation (2004). (2) RePEc:kap:revdev:v:6:y:2003:i:2:p:129-155 (). (3) RePEc:kap:revdev:v:3:y:2000:i:3:p:263-282 (). (4) RePEc:kap:revdev:v:6:y:2003:i:2:p:107-128 (). (5) RePEc:kap:revdev:v:7:y:2004:i:2:p:99-127 On the Information in the Interest Rate Term Structure and Option Prices (2004). (6) RePEc:kap:revdev:v:3:y:1999:i:2:p:157-181 (). (7) RePEc:kap:revdev:v:6:y:2003:i:3:p:179-202 (). (8) RePEc:kap:revdev:v:4:y:2000:i:3:p:231-262 (). (9) RePEc:kap:revdev:v:10:y:2007:i:2:p:87-150 A new approach for option pricing under stochastic volatility (2007). (10) RePEc:kap:revdev:v:10:y:2007:i:2:p:151-180 Option pricing when correlations are stochastic: an analytical framework (2007). (11) RePEc:kap:revdev:v:7:y:2004:i:2:p:79-97 A Model of the Convenience Yields in On-the-Run Treasuries (2004). (12) RePEc:kap:revdev:v:7:y:2004:i:1:p:5-24 Theory of Storage and the Pricing of Commodity Claims (2004). (13) RePEc:kap:revdev:v:12:y:2009:i:3:p:169-191 Microstructural biases in empirical tests of option pricing models (2009). (14) RePEc:kap:revdev:v:12:y:2009:i:1:p:55-79 Option market making under inventory risk (2009). (15) RePEc:kap:revdev:v:11:y:2008:i:3:p:171-204 Distressed debt prices and recovery rate estimation (2008). (16) RePEc:kap:revdev:v:10:y:2007:i:1:p:39-58 The valuation of a firmâs investment opportunities: a reduced form credit risk perspective (2007). (17) RePEc:kap:revdev:v:10:y:2007:i:3:p:227-267 Discount curve construction with tension splines (2007). (18) RePEc:kap:revdev:v:9:y:2006:i:3:p:239-264 Static versus dynamic hedges: an empirical comparison for barrier options (2006). (19) RePEc:kap:revdev:v:5:y:2002:i:3:p:273-314 (). (20) RePEc:kap:revdev:v:9:y:2006:i:2:p:109-135 Model misspecification analysis for bond options and Markovian hedging strategies (2006). (21) RePEc:kap:revdev:v:5:y:2002:i:3:p:251-271 (). (22) RePEc:kap:revdev:v:6:y:2003:i:3:p:165-177 (). (23) RePEc:kap:revdev:v:10:y:2007:i:1:p:59-85 Modelling jumps in electricity prices: theory and empirical evidence (2007). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:kap:annfin:v:3:y:2007:i:4:p:411-453 Correlation and the pricing of risks (2007). Annals of Finance Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||