|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

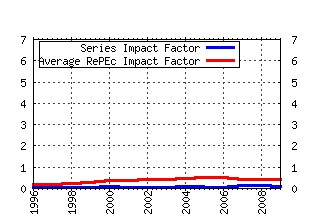

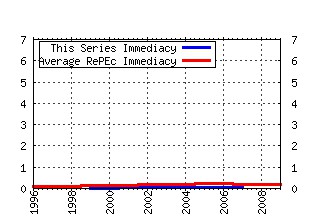

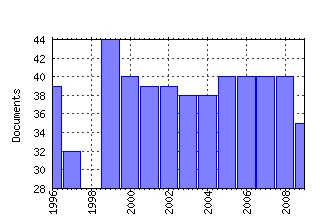

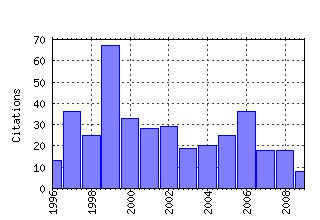

Review of Quantitative Finance and Accounting Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:rqfnac:v:13:y:1999:i:2:p:111-35

Estimating and Testing Exponential-Affine Term Structure Models by Kalman Filter. (1999). (2) RePEc:kap:rqfnac:v:27:y:2006:i:4:p:403-438 The impact of bank regulations, supervision, market structure, and bank characteristics on individual bank ratings: A cross-country analysis (2006). (3) RePEc:kap:rqfnac:v:15:y:2000:i:2:p:169-85

Managerial Ownership and Accounting Disclosures: An Empirical Study. (2000). (4) RePEc:kap:rqfnac:v:12:y:1999:i:3:p:283-301

Predicting UK Takeover Targets: Some Methodological Issues and an Empirical Study. (1999). (5) RePEc:kap:rqfnac:v:9:y:1997:i:2:p:131-46

The Relation between Patent Citations and Tobins Q in the Semiconductor Industry. (1997). (6) RePEc:kap:rqfnac:v:18:y:2002:i:2:p:95-118

Estimating Beta. (2002). (7) RePEc:kap:rqfnac:v:13:y:1999:i:4:p:323-45

Predicting Corporate Financial Distress: A Time-Series CUSUM Methodology. (1999). (8) RePEc:kap:rqfnac:v:30:y:2008:i:2:p:187-223 International evidence on the impact of regulations and supervision on banks technical efficiency: an application of two-stage data envelopment analysis (2008). (9) RePEc:kap:rqfnac:v:9:y:1997:i:1:p:53-70

Asset Allocation via the Conditional First Exit Time or How to Avoid Outliving Your Money. (1997). (10) RePEc:kap:rqfnac:v:9:y:1997:i:3:p:251-67

Nonparametric Smoothing of Yield Curves. (1997). (11) RePEc:kap:rqfnac:v:13:y:1999:i:1:p:39-62

Review of Categorical Models for Classification Issues in Accounting and Finance. (1999). (12) RePEc:kap:rqfnac:v:17:y:2001:i:3:p:223-35

Value Relevance of Nonfinancial Information: The Case of Patent Data. (2001). (13) RePEc:kap:rqfnac:v:8:y:1997:i:1:p:69-81

Do Interest Rates Follow Unit-Root Processes? Evidence from Cross-Maturity Treasury Bill Yields. (1997). (14) RePEc:kap:rqfnac:v:33:y:2009:i:4:p:371-391 The effect of earnings quality and country-level institutions on the value relevance of earnings (2009). (15) RePEc:kap:rqfnac:v:13:y:1999:i:2:p:171-88

Random Walks and Market Efficiency Tests: Evidence from Emerging Equity Markets. (1999). (16) RePEc:kap:rqfnac:v:22:y:2004:i:2:p:79-95 Value-at-Risk Analysis for Taiwan Stock Index Futures: Fat Tails and Conditional Asymmetries in Return Innovations (2004). (17) RePEc:kap:rqfnac:v:10:y:1998:i:3:p:269-84

Product Quality and Payment Policy. (1998). (18) RePEc:kap:rqfnac:v:28:y:2007:i:3:p:257-285 The empirical relationship between ownership characteristics and audit fees (2007). (19) RePEc:kap:rqfnac:v:19:y:2002:i:2:p:155-80

Intraday Return Volatility Process: Evidence from NASDAQ Stocks. (2002). (20) RePEc:kap:rqfnac:v:27:y:2006:i:3:p:311-340 An integrated multi-model credit rating system for private firms (2006). (21) RePEc:kap:rqfnac:v:9:y:1997:i:1:p:17-34

Does Post-Earnings-Announcement Drift in Stock Prices Reflect a Market Inefficiency? A Stochastic Dominance Approach. (1997). (22) RePEc:kap:rqfnac:v:16:y:2001:i:2:p:149-70

Comparative Performance of Chinese Commercial Banks: Analysis, Findings and Policy Implications. (2001). (23) RePEc:kap:rqfnac:v:12:y:1999:i:1:p:89-96

A Note on Perceptions of Finance Journal Quality. (1999). (24) RePEc:kap:rqfnac:v:15:y:2000:i:4:p:349-70

The Valuation Accuracy of the Price-Earnings and Price-Book Benchmark Valuation Methods. (2000). (25) RePEc:kap:rqfnac:v:20:y:2003:i:1:p:49-62

Are All Rivals Affected Equally by Bond Rating Downgrades? (2003). (26) RePEc:kap:rqfnac:v:10:y:1998:i:1:p:95-113

Fractionally Integrated Models with ARCH Errors: With an Application to the Swiss One-Month Euromarket Interest Rate. (1998). (27) RePEc:kap:rqfnac:v:23:y:2004:i:1:p:5-17 Institutional Herding in the ADR Market (2004). (28) RePEc:kap:rqfnac:v:29:y:2007:i:1:p:1-24 Disclosure and the cost of equity in international cross-listing (2007). (29) RePEc:kap:rqfnac:v:11:y:1998:i:2:p:165-82

Information Asymmetry around Earnings Announcements. (1998). (30) RePEc:kap:rqfnac:v:27:y:2006:i:3:p:235-266 The joint determination of audit fees, non-audit fees, and abnormal accruals (2006). (31) RePEc:kap:rqfnac:v:16:y:2001:i:3:p:269-90

Market Reactions to Corporate Restructurings. (2001). (32) RePEc:kap:rqfnac:v:18:y:2002:i:2:p:161-83

The Influence of Long-Term Performance Plans on Earnings Management and Firm Performance. (2002). (33) RePEc:kap:rqfnac:v:27:y:2006:i:4:p:383-401 The effect of increased disclosure on cost of capital: Evidence from China (2006). (34) RePEc:kap:rqfnac:v:24:y:2005:i:2:p:199-226 A Simple Induction Approach and an Efficient Trinomial Lattice for Multi-State Variable Interest Rate Derivatives Models (2005). (35) RePEc:kap:rqfnac:v:20:y:2003:i:2:p:115-26

Firm Financial Performance Following Mergers. (2003). (36) RePEc:kap:rqfnac:v:25:y:2005:i:4:p:413-427 The Value-Relevance of Derivative Disclosures by Commercial Banks: A Comprehensive Study of Information Content Under SFAS Nos. 119 and 133 (2005). (37) RePEc:kap:rqfnac:v:11:y:1998:i:3:p:293-310

Corporate Policy and Market Value: A q-Theory Approach. (1998). (38) RePEc:kap:rqfnac:v:26:y:2006:i:2:p:137-163 Mean Reversion of Short-Horizon Stock Returns: Asymmetry Property (2006). (39) RePEc:kap:rqfnac:v:20:y:2003:i:1:p:63-80

Managerial Incentives for Income Smoothing through Bank Loan Loss Provisions. (2003). (40) RePEc:kap:rqfnac:v:14:y:2000:i:2:p:155-60

Comparing Trading Performance of the Constant and Dynamic Hedge Models: A Note. (2000). (41) RePEc:kap:rqfnac:v:14:y:2000:i:4:p:361-80

A Complete Nonparametric Event Study Approach. (2000). (42) RePEc:kap:rqfnac:v:11:y:1998:i:3:p:219-47

Measurement Error and Nonlinearity in the Earnings-Returns Relation. (1998). (43) RePEc:kap:rqfnac:v:24:y:2005:i:4:p:343-357 Dynamic Linkages Between the Greater China Economic Area Stock MarketsMainland China, Hong Kong, and Taiwan (2005). (44) RePEc:kap:rqfnac:v:31:y:2008:i:2:p:121-145 Board size and firm performance: the moderating effects of the market for corporate control (2008). (45) RePEc:kap:rqfnac:v:18:y:2002:i:4:p:405-21

Information Content of Earnings and Earnings Components of Commercial Banks: Impact of SFAS No. 115. (2002). (46) RePEc:kap:rqfnac:v:24:y:2005:i:1:p:47-64 Ranking Research Productivity in Accounting for Asia-Pacific Universities (2005). (47) RePEc:kap:rqfnac:v:17:y:2001:i:1:p:63-79

An Empirical Examination of the Pricing of Seasoned Equity Offerings: A Test of the Signaling Hypothesis. (2001). (48) RePEc:kap:rqfnac:v:15:y:2000:i:2:p:107-26

The Effects of Downsizing on Operating Performance. (2000). (49) RePEc:kap:rqfnac:v:24:y:2005:i:3:p:313-334 What Determines the Variability of Accounting Accruals? (2005). (50) RePEc:kap:rqfnac:v:26:y:2006:i:1:p:23-39 The Cross-Section of Stock Returns on The Shanghai Stock Exchange (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:kap:rqfnac:v:29:y:2007:i:4:p:353-370 Value relevance of value-at-risk disclosure (2007). Review of Quantitative Finance and Accounting Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||