|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

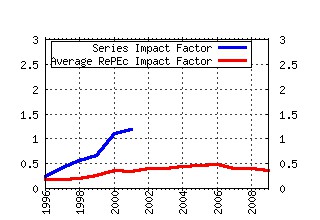

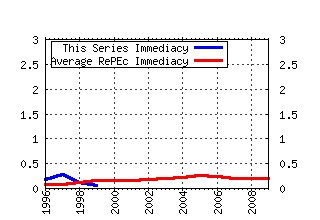

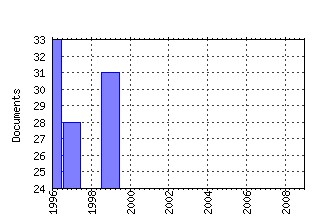

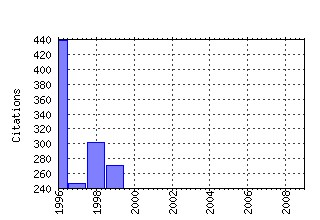

Working papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:mit:worpap:427 Hysteresis and the European Unemployment Problem (1986). (2) RePEc:mit:worpap:22 Optimal Taxation and Public Production (1968). (3) RePEc:mit:worpap:505 Quasi-Maximum Likelihood Estimation of Dynamic Models with Time-Varying Covariances (1988). (4) RePEc:mit:worpap:103 Intergenerational Equity and Exhaustable Resources (1973). (5) RePEc:mit:worpap:96-23 Wage Inequality and Segregation by Skill. (1996). (6) RePEc:mit:worpap:553 AN AGING SOCIETY: OPPORTUNITY OR CHALLENGE. (1990). (7) RePEc:mit:worpap:548 VERTICAL INTEGRATION AND MARKET FORECLOSURE. (1990). (8) RePEc:mit:worpap:92-11 The Economics of Bankruptcy Reform. (1992). (9) RePEc:mit:worpap:176 Optimal Tax Theory: A Synthesis (1976). (10) RePEc:mit:worpap:97-4 A Theory of Misgovernance (1997). (11) RePEc:mit:worpap:58 Optimum Consumption and Portfolio Rules in a Continuous-time Model (1970). (12) RePEc:mit:worpap:345 Standardization, Compatibility and Innovation (1984). (13) RePEc:mit:worpap:497 The Dynamic Effects of Aggregate Demand and Supply Disturbance (1988). (14) RePEc:mit:worpap:385 Installed Base and Compatibility With Implications for Product Preannouncements (1985). (15) RePEc:mit:worpap:418 The Theory of Contracts (1986). (16) RePEc:mit:worpap:98-23 Collusion and Price Rigidity (1998). (17) RePEc:mit:worpap:98-12 Beyond Becker: Training in Imperfect Labor Markets (1998). (18) RePEc:mit:worpap:440 One Share/One Vote and The Market for Corporate Control (1987). (19) RePEc:mit:worpap:95-5 The Economic Returns to Schooling in the West Bank and Gaza Strip (1995). (20) RePEc:mit:worpap:99-17 Optimal Collusion with Private Information (1999). (21) RePEc:mit:worpap:93-8 On the Speed of Transition in Central Europe. (1993). (22) RePEc:mit:worpap:97-21 Exceptional Exporter Performance: Cause, Effect, or Both? (1997). (23) RePEc:mit:worpap:520 DEFAULT AND RENEGOTIATION: A DYNAMIC MODEL OF DEBT. (1989). (24) RePEc:mit:worpap:99-30 How Large are the Social Returns to Education? Evidence from Compulsory Schooling Laws (1999). (25) RePEc:mit:worpap:178 Comparative Advantage, Trade and Payments in a Ricardian Model With a Continuum of Goods (1976). (26) RePEc:mit:worpap:96-10 Exports and Success in German Manufacturing. (1996). (27) RePEc:mit:worpap:572 Privatization and Incentives (1991). (28) RePEc:mit:worpap:98-18 Emerging Market Crises: An Asset Markets Perspective (1998). (29) RePEc:mit:worpap:92-2 Testing for Price Anomalies in Real Estate Auctions. (1992). (30) RePEc:mit:worpap:96-2 Stock Ownership Patterns, Stock Market Fluctuations, and Consumption. (1996). (31) RePEc:mit:worpap:96-5 Property Rights, Corruption and the Allocation of Talent: A General

Equilibrium Approach. (1996). (32) RePEc:mit:worpap:545 SPECULATIVE DYNAMICS AND THE ROLE OF FEEDBACK TRADERS. (1990). (33) RePEc:mit:worpap:95-11 Access Pricing and Competition (1994). (34) RePEc:mit:worpap:94-31 Access Pricing and Competition (1994). (35) RePEc:mit:worpap:146 A Many-Person Ramsey Tax Rule (1975). (36) RePEc:mit:worpap:510 LIFETIME INCIDENCE AND THE DISTRIBUTIONAL BURDEN OF EXCISE TAXES. (1989). (37) RePEc:mit:worpap:361 Vertical Integration and Long Term Contracts: The Case of Coal Burning Electric Generating Plants (1984). (38) RePEc:mit:worpap:580 Growth, Macroeconomics, and Development. (1991). (39) RePEc:mit:worpap:96-14 Fixed Costs: The Demise of Marginal q. (1996). (40) RePEc:mit:worpap:581 Self-Confirming Equilibrium . (1991). (41) RePEc:mit:worpap:191 Contractionary Effects of Devaluations (1976). (42) RePEc:mit:worpap:128 Inflation and Environmental Concern: Structural Change in the Process of Public Utility Price Regulation (1974). (43) RePEc:mit:worpap:518 CHEAP TALK WITH TWO AUDIENCES. (1989). (44) RePEc:mit:worpap:96-30 Disorganization. (1996). (45) RePEc:mit:worpap:97-15 Observations and Conjectures on the U.S. Employment Miracle. (1997). (46) RePEc:mit:worpap:211 The Effect of Taxation on Labor Supply: Evaluating the Gary Negative Income Tax Experiment (1977). (47) RePEc:mit:worpap:96-7 Why Do Firms Train? Theory and Evidence. (1996). (48) RePEc:mit:worpap:339 Tax Subsidies to Owner-occupied Housing: An Asset Market Approach (1983). (49) RePEc:mit:worpap:338 New Evidence that Taxes Affect the Valuation of Dividends (1984). (50) RePEc:mit:worpap:94-10 Tax Incentives and the Decision to Purchase Health Insurance:

Evidence from the Self-Employed. (1994). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||