|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

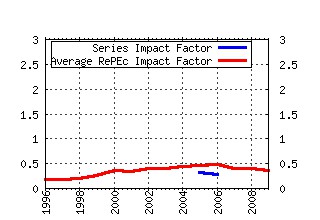

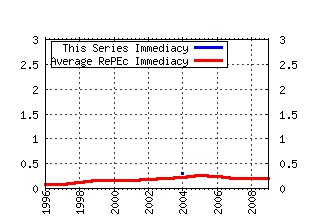

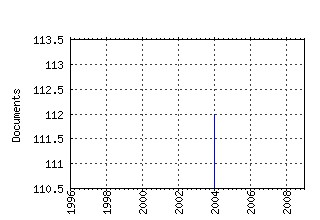

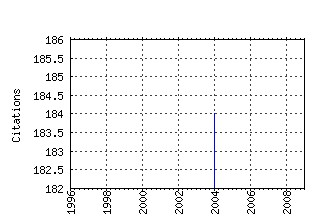

Money Macro and Finance (MMF) Research Group Conference 2003 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:mmf:mmfc03:48 A joint econometric model of macroeconomic and term structure dynamics (2004). (2) RePEc:mmf:mmfc03:18 Endogenous markups and fiscal policy (2004). (3) RePEc:mmf:mmfc03:30 Inflation, inflation uncertainty, and a common European Monetary Policy (2004). (4) RePEc:mmf:mmfc03:25 Macro factors and the term structure of interest rates (2004). (5) RePEc:mmf:mmfc03:99 Optimal monetary policy and productivity growth (2004). (6) RePEc:mmf:mmfc03:67 Reconsidering the evidence: are Eurozone business cycles converging? (2004). (7) RePEc:mmf:mmfc03:70 Consumer credit conditions in the UK (2004). (8) RePEc:mmf:mmfc03:28 Monetary policy in a world with different financial systems (2004). (9) RePEc:mmf:mmfc03:103 The interaction of fiscal and monetary policies: some evidence using structural econometric models (2004). (10) RePEc:mmf:mmfc03:1 Money market rates and implied CCAPM rates: some international evidence (2004). (11) RePEc:mmf:mmfc03:92 Epidemiological expectations and consumption dynamics (2004). (12) RePEc:mmf:mmfc03:17 The Feldstein-Horioka puzzle is not as bad as you think (2004). (13) RePEc:mmf:mmfc03:36 Supply-side reforms and learning dynamics (2004). (14) RePEc:mmf:mmfc03:34 International financial rescues and debtor country moral hazard (2004). (15) RePEc:mmf:mmfc03:91 Evidence on purchasing power parity from univariate models: the case of smooth transition trend-stationarity (2004). (16) RePEc:mmf:mmfc03:24 Money creation in a random matching model (2004). (17) RePEc:mmf:mmfc03:72 The impact of imperfect credibility in a transition to price stability (2004). (18) RePEc:mmf:mmfc03:104 Recursive global games (2004). (19) RePEc:mmf:mmfc03:102 The consumption-real exchange rate anomaly (2004). (20) RePEc:mmf:mmfc03:84 Why is the index smile so steep? (2004). (21) RePEc:mmf:mmfc03:39 Foreign direct investment and exchange rate uncertainty in imperfectly competitive industries (2004). (22) RePEc:mmf:mmfc03:50 A note on timeless perspective policy design (2004). (23) RePEc:mmf:mmfc03:79 Risk factors of inflation-indexed and conventional government bonds and the APT (2004). (24) RePEc:mmf:mmfc03:62 The informational content of empirical measures of real interest rate and output gaps for the United Kingdom (2004). (25) RePEc:mmf:mmfc03:9 Testing financial constraints on firm investment using variable capital (2004). (26) RePEc:mmf:mmfc03:96 Measuring the time-inconsistency of US monetary policy (2004). (27) RePEc:mmf:mmfc03:60 Optimising microfoundations for observed inflation persistence (2004). (28) RePEc:mmf:mmfc03:87 The fiscal smile - on the effectiveness and limits of fiscal stabilizers (2004). (29) RePEc:mmf:mmfc03:2 Non-linear and non-symmetric exchange-rate adjustment: new evidence from medium- and high-inflation economies (2004). (30) RePEc:mmf:mmfc03:4 Foreign direct investment in industrial R&D and exchange rate uncertainty in the UK (2004). (31) RePEc:mmf:mmfc03:107 A vectorautoregressive investment model (VIM) and monetary policy transmission: panel evidence from German firms (2004). (32) RePEc:mmf:mmfc03:82 Inflation targeting and monetary analysis in Chile and Mexico (2004). (33) RePEc:mmf:mmfc03:16 Testing for the uncovered interest parity using distributions implied by FX options (2004). (34) RePEc:mmf:mmfc03:98 Long-term public finance report: an analysis of fiscal sustainability (2004). (35) RePEc:mmf:mmfc03:35 Inside the black box: permanent vs transitory components and economic fundamentals (2004). (36) RePEc:mmf:mmfc03:42 Monetary policy uncertainty and unionized labour markets (2004). (37) RePEc:mmf:mmfc03:73 Fiscal, monetary and wage policies in a MU: is there a need for fiscal rules? (2004). (38) RePEc:mmf:mmfc03:14 Option value, policy uncertainty, and the foreign direct investment decision (2004). (39) RePEc:mmf:mmfc03:12 Describing the Feds conduct with simple Taylor rules: is interest rate smoothing important? (2004). (40) RePEc:mmf:mmfc03:94 Demand and supply in the ECBs main refinancing operations (2004). (41) RePEc:mmf:mmfc03:59 Nonlinear inflation dynamics: evidence from the UK (2004). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||