|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

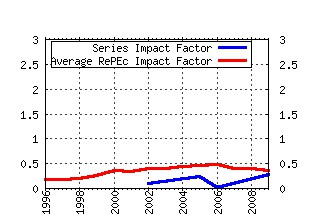

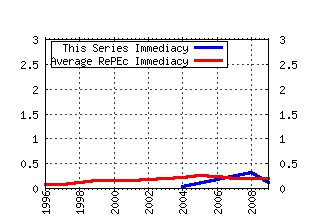

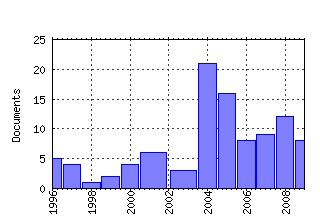

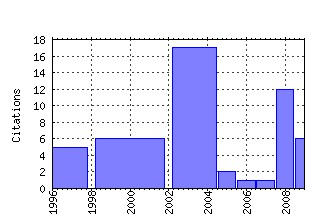

Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:npf:wpaper:00/1 Impact of grants on tax effort of local government. (2000). (2) RePEc:npf:wpaper:04/7 Fiscal restructuring in the context of trade reform. (2004). (3) RePEc:npf:wpaper:04/14 Telecommunications infrastructure and economic growth: Evidence from developing countries. (2004). (4) RePEc:npf:wpaper:09/62 The difficulties of the Chinese and Indian exchange rate regimes. (2009). (5) RePEc:npf:wpaper:08/55 Issues before the thirteenth finance commission. (2008). (6) RePEc:npf:wpaper:08/als1 Tax challenges facing developing countries. (2008). (7) RePEc:npf:wpaper:04/15 Fiscal developments and outlook in India. (2004). (8) RePEc:npf:wpaper:08/51 New issues in Indian macro policy. (2008). (9) RePEc:npf:wpaper:96/11 Brazil: Fiscal federalism and value added tax reform. (1996). (10) RePEc:npf:wpaper:04/20 Fiscal transfer in Australia: Review and relevance to India. (2004). (11) RePEc:npf:wpaper:10/70 A Floating versus managed exchange rate regime in a DSGE model of India. (2010). (12) RePEc:npf:wpaper:96/7 Fiscal and other determinants of the Indian inflation rate. (1996). (13) RePEc:npf:wpaper:06/39 Fiscal and distributional implications of property tax reforms in Indian cities. (2006). (14) RePEc:npf:wpaper:09/58 Fiscal health of selected Indian cities. (2009). (15) RePEc:npf:wpaper:tru1 Trends and issues in tax policy and reform in India. (2005). (16) RePEc:npf:wpaper:08/53 Fiscal policy economic reforms. (2008). (17) RePEc:npf:wpaper:05/37 Health damage cost of automotive air pollution: Cost benefit analysis of fuel quality upgradation for Indian cities. (2005). (18) RePEc:npf:wpaper:96/9 Harmonizing sales taxes in a federation case studies: India and Canada. (1996). (19) RePEc:npf:wpaper:04/18 Fiscal transfer in Canada: Drawing comparisons and lessons. (2004). (20) RePEc:npf:wpaper:08/52 Managing capital flows: The case of India. (2008). (21) RePEc:npf:wpaper:10/66 Interstate distribution of central expenditure and subsidies. (2010). (22) RePEc:npf:wpaper:08/57 Goods and services tax for India. (2008). (23) RePEc:npf:wpaper:10/65 Graduating to globalisation: A study of southern multinationals. (2010). (24) RePEc:npf:wpaper:04/22 Decomposition of total factor productivity growth: A regional analysis of Indian industrial manufacturing growth. (2004). (25) RePEc:npf:wpaper:07/48 Tracking functional devolution by states to panchayats. (2007). (26) RePEc:npf:wpaper:04/21 VAT versus the turnover tax with non-competitive firms. (2004). (27) RePEc:npf:wpaper:08/54 Early warnings of inflation in India. (2008). (28) RePEc:npf:wpaper:11/78 Monetary policy transmission in an emerging market setting. (2011). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:pra:mprapa:18619 ä¸ççµæ¸å±æ©ã¨ã°ãã¼ãã«ã»ããã¼ã®å¤å âå½éçµæ¸ç§©åºã¸ã®ã¤ã³ããªã±ã¼ã·ã§ã³ã¼ (2009). MPRA Paper Recent citations received in: 2008 (1) RePEc:ays:ispwps:paper0804 The BBLR Approach to tax Reform in Emerging Countries (2008). International Studies Program Working Paper Series, at AYSPS, GSU (2) RePEc:ess:wpaper:id:1570 Managing Capital Flows: The Case of India (2008). Working Papers (3) RePEc:ess:wpaper:id:1709 Issues Before the Thirteenth Finance Commission (2008). Working Papers (4) RePEc:ind:mudewp:31 STRENGTHENING DECENTRALIZATION - Augmenting the Consolidated Fund of the states by th Thirteenth Finacnce Commission: A NORMATIVE APPROACH (2008). Department of Economics, University of Mumbai, Mumbai Working Papers Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||