|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

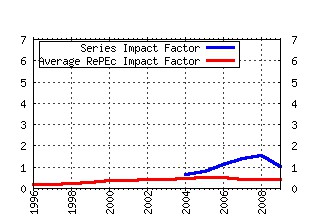

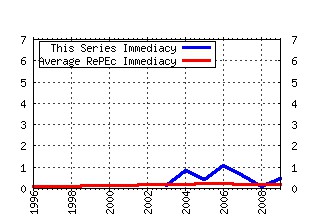

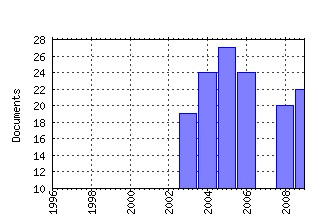

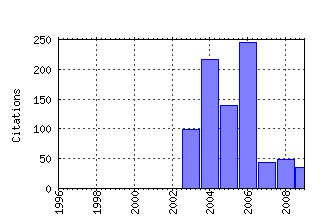

Journal of Financial Econometrics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:oup:jfinec:v:2:y:2004:i:1:p:1-37 Power and Bipower Variation with Stochastic Volatility and Jumps (2004). (2) RePEc:oup:jfinec:v:4:y:2006:i:4:p:537-572 Asymmetric Dynamics in the Correlations of Global Equity and Bond Returns (2006). (3) RePEc:oup:jfinec:v:4:y:2006:i:1:p:1-30 Econometrics of Testing for Jumps in Financial Economics Using Bipower Variation (2006). (4) RePEc:oup:jfinec:v:4:y:2006:i:1:p:53-89 Value-at-Risk Prediction: A Comparison of Alternative Strategies (2006). (5) RePEc:oup:jfinec:v:3:y:2005:i:4:p:456-499 The Relative Contribution of Jumps to Total Price Variance (2005). (6) RePEc:oup:jfinec:v:3:y:2005:i:4:p:525-554 A Realized Variance for the Whole Day Based on Intermittent High-Frequency Data (2005). (7) RePEc:oup:jfinec:v:2:y:2004:i:4:p:493-530 A New Approach to Markov-Switching GARCH Models (2004). (8) RePEc:oup:jfinec:v:7:y:2009:i:2:p:174-196 A Simple Approximate Long-Memory Model of Realized Volatility (2009). (9) RePEc:oup:jfinec:v:2:y:2004:i:1:p:130-168 On the Out-of-Sample Importance of Skewness and Asymmetric Dependence for Asset Allocation (2004). (10) RePEc:oup:jfinec:v:2:y:2004:i:2:p:211-250 Mixed Normal Conditional Heteroskedasticity (2004). (11) RePEc:oup:jfinec:v:2:y:2004:i:2:p:319-342 Persistence and Kurtosis in GARCH and Stochastic Volatility Models (2004). (12) RePEc:oup:jfinec:v:5:y:2007:i:1:p:68-104 Integrated Covariance Estimation using High-frequency Data in the Presence of Noise (2007). (13) RePEc:oup:jfinec:v:4:y:2006:i:3:p:353-384 Leverage and Volatility Feedback Effects in High-Frequency Data (2006). (14) RePEc:oup:jfinec:v:1:y:2003:i:1:p:26-54 Fourth Moment Structure of Multivariate GARCH Models (2003). (15) RePEc:oup:jfinec:v:5:y:2007:i:1:p:31-67 Why Do Absolute Returns Predict Volatility So Well? (2007). (16) RePEc:oup:jfinec:v:1:y:2003:i:2:p:159-188 Trades and Quotes: A Bivariate Point Process (2003). (17) RePEc:oup:jfinec:v:3:y:2005:i:4:p:555-577 Properties of Bias-Corrected Realized Variance Under Alternative Sampling Schemes (2005). (18) RePEc:oup:jfinec:v:1:y:2003:i:1:p:2-25 Dynamics of Trade-by-Trade Price Movements: Decomposition and Models (2003). (19) RePEc:oup:jfinec:v:1:y:2003:i:1:p:96-125 Modeling the U.S. Short-Term Interest Rate by Mixture Autoregressive Processes (2003). (20) RePEc:oup:jfinec:v:2:y:2004:i:4:p:531-564 Modeling the Conditional Covariance Between Stock and Bond Returns: A Multivariate GARCH Approach (2004). (21) RePEc:oup:jfinec:v:6:y:2008:i:3:p:326-360 Are There Structural Breaks in Realized Volatility? (2008). (22) RePEc:oup:jfinec:v:4:y:2006:i:3:p:450-493 Stochastic Conditional Intensity Processes (2006). (23) RePEc:oup:jfinec:v:4:y:2006:i:2:p:238-274 Structural Breaks and Predictive Regression Models of Aggregate U.S. Stock Returns (2006). (24) RePEc:oup:jfinec:v:1:y:2003:i:3:p:445-470 The Local Whittle Estimator of Long-Memory Stochastic Volatility (2003). (25) RePEc:oup:jfinec:v:3:y:2005:i:3:p:399-421 Autoregressive Conditional Kurtosis (2005). (26) RePEc:oup:jfinec:v:1:y:2003:i:2:p:272-289 The Robustness of the Conditional CAPM with Human Capital (2003). (27) RePEc:oup:jfinec:v:3:y:2005:i:2:p:227-255 Nonparametric Inference of Value-at-Risk for Dependent Financial Returns (2005). (28) RePEc:oup:jfinec:v:4:y:2006:i:2:p:275-309 The Generalized Hyperbolic Skew Students t-Distribution (2006). (29) RePEc:oup:jfinec:v:4:y:2006:i:3:p:413-449 Inequality Constraints in the Fractionally Integrated GARCH Model (2006). (30) RePEc:oup:jfinec:v:1:y:2003:i:1:p:55-95 Time Inhomogeneous Multiple Volatility Modeling (2003). (31) RePEc:oup:jfinec:v:3:y:2005:i:3:p:372-398 Multivariate Lagrange Multiplier Tests for Fractional Integration (2005). (32) RePEc:oup:jfinec:v:4:y:2006:i:4:p:636-670 Long Memory and the Relation Between Implied and Realized Volatility (2006). (33) RePEc:oup:jfinec:v:2:y:2004:i:3:p:370-389 Asset Allocation by Variance Sensitivity Analysis (2004). (34) RePEc:oup:jfinec:v:6:y:2008:i:4:p:540-582 American Option Pricing Using GARCH Models and the Normal Inverse Gaussian Distribution (2008). (35) RePEc:oup:jfinec:v:3:y:2005:i:1:p:126-168 Evaluating Interest Rate Covariance Models Within a Value-at-Risk Framework (2005). (36) RePEc:oup:jfinec:v:2:y:2004:i:4:p:477-492 Pessimistic Portfolio Allocation and Choquet Expected Utility (2004). (37) RePEc:oup:jfinec:v:4:y:2006:i:2:p:310-345 Empirical Comparisons in Short-Term Interest Rate Models Using Nonparametric Methods (2006). (38) RePEc:oup:jfinec:v:6:y:2008:i:4:p:407-458 Econometric Asset Pricing Modelling (2008). (39) RePEc:oup:jfinec:v:3:y:2005:i:1:p:26-36 New Directions in Risk Management (2005). (40) RePEc:oup:jfinec:v:6:y:2008:i:1:p:87-107 Nonparametric Estimation of Expected Shortfall (2008). (41) RePEc:oup:jfinec:v:1:y:2003:i:3:p:365-419 A Closer Look at the Relation between GARCH and Stochastic Autoregressive Volatility (2003). (42) RePEc:oup:jfinec:v:9:y:2011:i:1:p:3-65 Risk-Price Dynamics (2011). (43) RePEc:oup:jfinec:v:3:y:2005:i:4:p:578-605 The Accuracy of Density Forecasts from Foreign Exchange Options (2005). (44) RePEc:oup:jfinec:v:4:y:2006:i:4:p:594-616 A Mixture Multiplicative Error Model for Realized Volatility (2006). (45) RePEc:oup:jfinec:v:6:y:2008:i:1:p:1-48 Size and Value Anomalies under Regime Shifts (2008). (46) RePEc:oup:jfinec:v:8:y:2010:i:1:p:29-56 Comparison of Volatility Measures: a Risk Management Perspective (2010). (47) RePEc:oup:jfinec:v:2:y:2004:i:1:p:84-108 Backtesting Value-at-Risk: A Duration-Based Approach (2004). (48) RePEc:oup:jfinec:v:2:y:2004:i:3:p:422-450 Nonparametric Tests for Positive Quadrant Dependence (2004). (49) RePEc:oup:jfinec:v:3:y:2005:i:1:p:3-25 The Present and Future of Financial Risk Management (2005). (50) RePEc:oup:jfinec:v:4:y:2006:i:1:p:136-160 Incomplete Information, Heterogeneity, and Asset Pricing (2006). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:aah:create:2009-26 Tails, Fears and Risk Premia (2009). CREATES Research Papers (2) RePEc:aah:create:2009-30 Long Memory and Tail dependence in Trading Volume and Volatility (2009). CREATES Research Papers (3) RePEc:aah:create:2009-31 A No Arbitrage Fractional Cointegration Analysis Of The Range Based Volatility (2009). CREATES Research Papers (4) RePEc:aah:create:2009-56 On the Economic Evaluation of Volatility Forecasts (2009). CREATES Research Papers (5) RePEc:fau:fauart:v:59:y:2009:i:4:p:334-359 Distribution and Dynamics of Central-European Exchange Rates: Evidence from Intraday Data (2009). Czech Journal of Economics and Finance (Finance a uver) (6) RePEc:fem:femwpa:2009.113 On the Realized Volatility of the ECX CO2 Emissions 2008 Futures Contract: Distribution, Dynamics and Forecasting (2009). Working Papers (7) RePEc:hal:wpaper:halshs-00387286 On the realized volatility of the ECX CO2 emissions 2008 futures contract: distribution, dynamics and forecasting (2009). Working Papers (8) RePEc:hhs:stavef:2009_026 International Diversification: An Extreme Value Approach (2009). UiS Working Papers in Economics and Finance (9) RePEc:hhs:stavef:2009_031 The Dependence Structure of Macroeconomic Variables in the US (2009). UiS Working Papers in Economics and Finance (10) RePEc:mop:credwp:09.05.84 On the realized volatility of the ECX CO2 emissions 2008 futures contract: distribution, dynamics and forecasting (2009). Cahiers du CREDEN (CREDEN Working Papers) Recent citations received in: 2008 (1) RePEc:hum:wpaper:sfb649dp2008-038 Dynamic Semiparametric Factor Models in Risk Neutral Density Estimation (2008). SFB 649 Discussion Papers (2) RePEc:udb:wpaper:uwec-2008-04 Improved small sample inference for efficient method of moments and indirect inference estimators (2008). Working Papers Recent citations received in: 2007 (1) RePEc:bfr:banfra:189 Multi-Lag Term Structure Models with Stochastic Risk Premia. (2007). Working papers (2) RePEc:fir:econom:wp2007_04 Volatility Forecasting Using Explanatory Variables and Focused Selection Criteria (2007). Econometrics Working Papers Archive (3) RePEc:knz:cofedp:0701 Dynamic Modeling of Large Dimensional Covariance Matrices (2007). CoFE Discussion Paper (4) RePEc:knz:cofedp:0707 Estimating High-Frequency Based (Co-) Variances: A Unified Approach (2007). CoFE Discussion Paper (5) RePEc:kyo:wpaper:634 Finite Sample Analysis of Weighted Realized Covariance with Noisy Asynchronous Observations (2007). KIER Working Papers (6) RePEc:osk:wpaper:0703 Test of Unbiasedness of the Integrated Covariance Estimation in the Presence of Noise (2007). Discussion Papers in Economics and Business Recent citations received in: 2006 (1) RePEc:cam:camdae:0649 Time-Varying Quantiles (2006). Cambridge Working Papers in Economics (2) RePEc:cfr:cefirw:w0092 Dynamic modeling under linear-exponential loss (2006). Working Papers (3) RePEc:cor:louvco:2006080 Modelling financial high frequency data using point processes (2006). CORE Discussion Papers (4) RePEc:cor:louvco:2006089 The information content of the Bond-Equity Yield Ratio: better than a random walk? (2006). CORE Discussion Papers (5) RePEc:cpr:ceprdp:5734 Optimal Currency Shares in International Reserves: The Impact of the Euro and the Prospects for the Dollar (2006). CEPR Discussion Papers (6) RePEc:ctl:louvec:2006039 Modelling Financial High Frequency Data Using Point Processes (2006). Discussion Papers (ECON - Département des Sciences Economiques) (7) RePEc:dgr:uvatin:20050044 The Euro Introduction and Non-Euro Currencies (2006). Tinbergen Institute Discussion Papers (8) RePEc:dul:wpaper:06-07rs Sector diversification during crises: a European perspective (2006). DULBEA Working Papers (9) RePEc:ecb:ecbwps:20060683 Financial integration of new EU Member States (2006). Working Paper Series (10) RePEc:ecb:ecbwps:20060694 Optimal currency shares in international reserves - the impact of the euro and the prospects for the dollar (2006). Working Paper Series (11) RePEc:ecl:ohidic:2007-2 Affine Term Structure Models (2006). Working Paper Series (12) RePEc:fip:fedgfe:2006-35 Realized jumps on financial markets and predicting credit spreads (2006). Finance and Economics Discussion Series (13) RePEc:hhs:hastef:0646 An introduction to univariate GARCH models (2006). Working Paper Series in Economics and Finance (14) RePEc:iis:dispap:iiisdp132 Have European Stocks Become More Volatile? An Empirical Investigation of Idiosyncratic and Market Risk in the Euro Area (2006). The Institute for International Integration Studies Discussion Paper Series (15) RePEc:iis:dispap:iiisdp139 The Euro and Financial Integration (2006). The Institute for International Integration Studies Discussion Paper Series (16) RePEc:man:cgbcrp:77 Periodic Dynamic Conditional Correlations between Stock Markets in Europe and the US (2006). Centre for Growth and Business Cycle Research Discussion Paper Series (17) RePEc:man:sespap:0629 Periodic Dynamic Conditional Correlations between Stock Markets in Europe and the US (2006). The School of Economics Discussion Paper Series (18) RePEc:nbr:nberwo:12333 Optimal Currency Shares in International Reserves: The Impact of the Euro and the Prospects for the Dollar (2006). NBER Working Papers (19) RePEc:nuf:econwp:0506 Limit theorems for bipower variation in financial econometrics (2006). Economics Papers (20) RePEc:nuf:econwp:0603 Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise (2006). Economics Papers (21) RePEc:nus:nusewp:wp0603 The Persistence and Predictive Power of the Dividend-Price Ratio (2006). Departmental Working Papers (22) RePEc:oxf:wpaper:264 Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise (2006). Economics Series Working Papers (23) RePEc:pra:mprapa:189 An Asymmetric Block Dynamic Conditional Correlation Multivariate GARCH Model (2006). MPRA Paper (24) RePEc:rut:rutres:200620 Predictive Density Estimators for Daily Volatility Based on the Use of Realized Measures (2006). Departmental Working Papers (25) RePEc:ven:wpaper:2006_53 A generalized Dynamic Conditional Correlation Model for Portfolio Risk Evaluation (2006). Working Papers (26) RePEc:zbw:sfb475:200651 Estimation of Volatility Functionals in the Simultaneous Presence of Microstructure Noise and Jumps (2006). Technical Reports Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||