|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

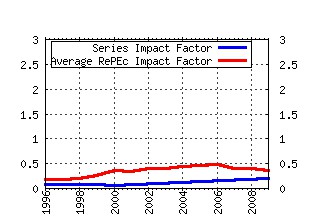

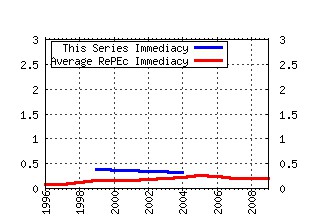

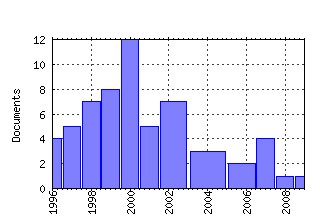

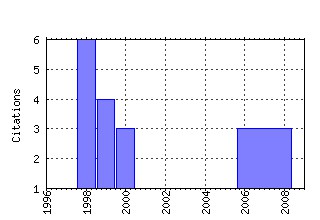

Development Discussion Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:qed:dpaper:7 THE MEASUREMENT OF RATES OF RETURN AND TAXATION FROM PRIVATE CAPITAL IN CANADA (1973). (2) RePEc:qed:dpaper:178 Measuring the Non-Neutralities of Sales and Excise Taxes in Canada (1988). (3) RePEc:qed:dpaper:128 VALUE ADDED TAX POLICY AND IMPLEMENTATION IN SINGAPORE (1998). (4) RePEc:qed:dpaper:60 BLUE GOLD: HYDRO-ELECTRIC RENT IN CANADA (1984). (5) RePEc:qed:dpaper:127 EVALUATION OF INVESTMENTS FOR THE EXPANSION OF AN ELECTRICITY DISTRIBUTION SYSTEM (1998). (6) RePEc:qed:dpaper:138 An Integrated Analysis of a Power Purchase Agreement (1999). (7) RePEc:qed:dpaper:98 FISCAL POLICIES TO CONTROL POLLUTION: INTERNATIONAL EXPERIENCE (1992). (8) RePEc:qed:dpaper:59 WORKER ADJUSTMENT POLICIES: AN ALTERNATIVE TO PROTECTIONISM (1982). (9) RePEc:qed:dpaper:135 EVALUATION OF AN EXPANSION OF THE ELECTRICITY TRANSMISSION SYSTEM IN MEXICO (1999). (10) RePEc:qed:dpaper:82 INTERNATIONAL TRADE IN ENERGY: THE CHUKHA HYDRO-ELECTRIC PROJECT IN BHUTAN (1991). (11) RePEc:qed:dpaper:244 CAPITAL IN CANADA - ITS SOCIAL AND PRIVATE PERFORMANCE 1965-1974 (1977). (12) RePEc:qed:dpaper:81 TRADE, EXCHANGE RATE AND AGRICULTURAL POLICIES IN MALAYSIA (1989). (13) RePEc:qed:dpaper:22 INFLATION - ITS FINANCIAL IMPACT ON BUSINESS IN CANADA (1977). (14) RePEc:qed:dpaper:101 ECONOMIC REFORM AND INSTITUTIONAL INNOVATION (1992). (15) RePEc:qed:dpaper:159 Information, Corruption, and Measures for the Promotion of Manufactured Exports (2007). (16) RePEc:qed:dpaper:35 THE COST OF U.S. DIRECT FOREIGN INVESTMENT (1980). (17) RePEc:qed:dpaper:100 PRIVATIZATION AND PENSION REFORM IN TRANSITION ECONOMIES (1991). (18) RePEc:qed:dpaper:9 FOREIGN TAX CREDITS AND THE INTERNATIONAL INTERDEPENDANCE OF CORPORATE TAX POLICIES (1974). (19) RePEc:qed:dpaper:156 Diagnostic and Proposal for the Reform of the Personal Income Tax System in the TRNC (2001). (20) RePEc:qed:dpaper:333 INFLATION AND COST-BENEFIT ANALYSIS (1978). (21) RePEc:qed:dpaper:114 GREEN TAXES AND INCENTIVE POLICIES: AN INTERNATIONAL PERSPECTIVE (1994). (22) RePEc:qed:dpaper:1888 Buenos Aires - Colonia Bridge Project, Financial and Economic Appraisal (1998). (23) RePEc:qed:dpaper:124 LINKING EAST AND WEST BANGLADESH: THE JAMUNA BRIDGE PROJECT (1997). (24) RePEc:qed:dpaper:83 TAX SHELTER FINANCE: HOW EFFICIENT IS IT? (1990). (25) RePEc:qed:dpaper:149 Fiscal Adjustment for Sustainable Growth in the Dominican Republic (2004). (26) RePEc:qed:dpaper:29 TRADE ADJUSTMENT ASSISTANCE: THE COSTS OF ADJUSTMENT AND POLICY PROPOSALS (1978). (27) RePEc:qed:dpaper:113 MODERNIZATION OF TAX ADMINISTRATIONS:REVENUE BOARDS AND PRIVATIZATION AS INSTRUMENTS FOR CHANGE (1994). (28) RePEc:qed:dpaper:69 TAXATION OF STATE-OWNED ENTERPRISES (1986). (29) RePEc:qed:dpaper:93 TAX POLICY ISSUES IN EMERGING MARKET ECONOMIES (1991). (30) RePEc:qed:dpaper:50 THE UNEMPLOYMENT EXPERIENCE OF INDIVIDUALS (1981). (31) RePEc:qed:dpaper:1200 POTABLE WATER SUPPLY EXPANSION: THE MANILA SOUTH WATER DISTRIBUTION PROJECT (1995). (32) RePEc:qed:dpaper:146 Diagnosis of Indirect Taxes and the Taxation of International Trade in the Dominican Republic (2007). (33) RePEc:qed:dpaper:103 BUILDING PRIVATE PENSION SYSTEMS (1992). (34) RePEc:qed:dpaper:67 COSTS AND CONCEQUENCES OF THE NEW PROTECTIONISM: THE CASE OF CANADAâS CLOTHING SECTOR (1985). (35) RePEc:qed:dpaper:134 CONTROL OF WATER AND COASTAL POLLUTION AN APPRAISAL FOR ESPIRITO,BRAZIL (1999). (36) RePEc:qed:dpaper:92 THE POLITICAL ECONOMY OF AGRICULTURAL PRICING POLICY: MALAYSIA (1991). (37) RePEc:qed:dpaper:169 Tax Analysis and Revenue Forecasting (2000). (38) RePEc:qed:dpaper:466 TAXATION AND THE DEVELOPMENT OF THE MINING SECTOR IN DEVELOPING COUNTRIES (1980). (39) RePEc:qed:dpaper:119 PUERTO RICO AND SECTION 936: A COSTLY DEPENDENCE (1995). (40) RePEc:qed:dpaper:142 MODERNIZATION OF TAX ADMINISTRATION IN LOW INCOME COUNTRIES: THE CASE OF NEPAL (2000). (41) RePEc:qed:dpaper:633 EVALUATION OF PERFORMANCE OF INDUSTRIAL PUBLIC ENTERPRISES: CRITERIA AND POLICIES (1984). (42) RePEc:qed:dpaper:90 RESOURCE TAXATION AND PROJECT FEASIBILITY: THE MISIMA GOLD MINE, PAPUA, NEW GUINEA (1991). (43) RePEc:qed:dpaper:117 ECONOMIC OPPORTUNITY COST OF LABOUR: A SYNTHESIS (1995). (44) RePEc:qed:dpaper:79 TAX REFORM: LESSONS LEARNED (1989). (45) RePEc:qed:dpaper:141 Promoting ExportâOriented Foreign Direct Investment in Developing Countries: Tax and Customs Issues (2000). (46) RePEc:qed:dpaper:99 MARKET-BASED INCENTIVE INSTRUMENTS FOR POLLUTION CONTROL (1992). (47) RePEc:qed:dpaper:200 MEASUREMENT OF THE FOREIGN EXCHANGE AND SALES TAX EXTERNALITY ON THE VALUE ADDED OF LABOUR (1977). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||