|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

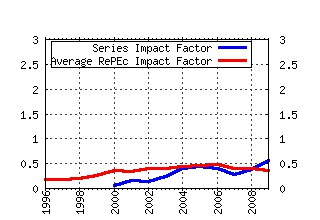

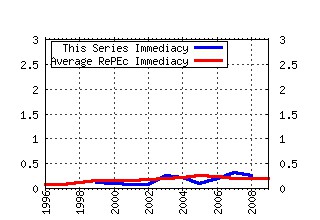

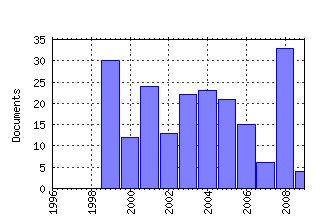

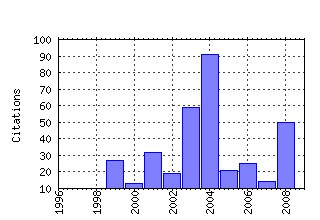

OFRC Working Papers Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sbs:wpsefe:2004fe21 A Central Limit Theorem for Realised Power and Bipower Variations of Continuous Semimartingales (2004). (2) RePEc:sbs:wpsefe:2003fe08 Equilibrium Analysis, Banking and Financial Instability (2003). (3) RePEc:sbs:wpsefe:2001fe11 Ownership and Control of German Corporations (2001). (4) RePEc:sbs:wpsefe:2004fe05 A Model to Analyse Financial Fragility: Applications (2004). (5) RePEc:sbs:wpsefe:2003fe13 A Model to Analyse Financial Fragility (2003). (6) RePEc:sbs:wpsefe:2007fe03 A Note on the Central Limit Theorem for Bipower Variation of General Functions (2007). (7) RePEc:sbs:wpsefe:2004fe20 Regular and Modified Kernel-Based Estimators of Integrated Variance: The Case with Independent Noise (2004). (8) RePEc:sbs:wpsefe:1999fe09 Finance, Investment and Growth (1999). (9) RePEc:sbs:wpsefe:2004fe02 Likelihood-based estimation of latent generalised ARCH structures (2004). (10) RePEc:sbs:wpsefe:2008fe22 Evaluating Volatility and Correlation Forecasts (2008). (11) RePEc:sbs:wpsefe:2006fe01 Evaluation of macroeconomic models for financial stability analysis (2006). (12) RePEc:sbs:wpsefe:2008fe07 Returns to Shareholder Activism (2008). (13) RePEc:sbs:wpsefe:2001fe01 Credit Derivatives, Disintermediation and Investment Decisions (2000). (14) RePEc:sbs:wpsefe:2005fe05 Estimating quadratic variation when quoted prices jump by a constant increment (2005). (15) RePEc:sbs:wpsefe:1999fe08 How Do Financial Systems Affect Economic Performance? (1999). (16) RePEc:sbs:wpsefe:2006fe09 Searching for a Metric for Financial Stability (2006). (17) RePEc:sbs:wpsefe:2008fe29 Multivariate realised kernels: consistent positive semi-definite estimators of the covariation of equity prices with noise and non-synchronous trading (2008). (18) RePEc:sbs:wpsefe:2003fe14 Ownership: Evolution and Regulation (2003). (19) RePEc:sbs:wpsefe:2005fe04 Why are Securitization Issues Tranched? (2005). (20) RePEc:sbs:wpsefe:2008fe20 Leverage and Pricing in Buyouts: An Empirical Analysis (2008). (21) RePEc:sbs:wpsefe:2004fe14 The Demise of Investment-Banking Partnerships: Theory and Evidence. (2004). (22) RePEc:sbs:wpsefe:2002mf05 Variational Sums and Power Variation: a unifying approach to model selection and estimation in semimartingale models (2002). (23) RePEc:sbs:wpsefe:2008fe21 Copula-Based Models for Financial Time Series (2008). (24) RePEc:sbs:wpsefe:2003fe03 Equilibrium Analysis, Banking, Contagion and Financial Fragility (2003). (25) RePEc:sbs:wpsefe:2004fe11 A Risk Assessment Model for Banks (2004). (26) RePEc:sbs:wpsefe:2006fe05 Designing realised kernels to measure the ex-post variation of equity prices

in the presence of noise (2006). (27) RePEc:sbs:wpsefe:2004fe10 Financial Liberalisation and Capital Regulation in Open Economies (2004). (28) RePEc:sbs:wpsefe:2003fe15 Spending Less Time with the Family: The Decline of Family Ownership in the UK (2003). (29) RePEc:sbs:wpsefe:2003fe06 Procyclicality and the new Basel Accord - Banks choice of loan rating system (2003). (30) RePEc:sbs:wpsefe:2002mf04 Distinguished Limits of Levy-Stable Processes, and Applications to Option Pricing (2002). (31) RePEc:sbs:wpsefe:2003fe11 Multinational Bank Capital Regulation with Deposit Insurance and Diversification Effects (2003). (32) RePEc:sbs:wpsefe:2005fe18 Commitment to Overinvest and Price Informativeness (2005). (33) RePEc:sbs:wpsefe:2001fe02 Business Groups and Risk Sharing around the World (2001). (34) RePEc:sbs:wpsefe:2008fe25 An Econometric Analysis of Modulated Realised Covariance,

Regression and Correlation in Noisy Diffusion Models (2008). (35) RePEc:sbs:wpsefe:2004fe18 A Time Series Analysis of Financial Fragility in the UK Banking System (2004). (36) RePEc:sbs:wpsefe:1999fe01 Who Disciplines Management in Poorly Performing Companies? (1999). (37) RePEc:sbs:wpsefe:2003fe02 Partnership Firms, Reputation and Human Capital (2003). (38) RePEc:sbs:wpsefe:2000fe04 Has the introduction of bookbuilding increased the efficiency of international IPOs? (2000). (39) RePEc:sbs:wpsefe:2002fe07 IPO Pricing in the Dot-com Bubble (2002). (40) RePEc:sbs:wpsefe:2008fe15 Board structures around the world: An experimental investigation (2008). (41) RePEc:sbs:wpsefe:2007fe02 Feasible inference for realised variance in the presence of jumps (2007). (42) RePEc:sbs:wpsefe:2004fe08 Is Deposit Insurance a Good Thing, and If So, Who Should Pay for It? (2004). (43) RePEc:sbs:wpsefe:2002fe06 Evidence of Information Spillovers in the Production of Investment Banking Services (2002). (44) RePEc:sbs:wpsefe:2002mf03 Analytical Comparisons of Option prices in Stochastic Volatility Models (2002). (45) RePEc:sbs:wpsefe:2001fe05 A Theory of the Syndicate: Form Follows Function (2001). (46) RePEc:sbs:wpsefe:2004fe04 Cancellation and uncertainty aversion on limit order books (2004). (47) RePEc:sbs:wpsefe:1999fe04 IPO Underpricing, Wealth Losses and the Curious Role of Venture Capitalists in the Creation of Public Companies (1999). (48) RePEc:sbs:wpsefe:2005mf01 Matched asymptotic expansions in financial engineering (2005). (49) RePEc:sbs:wpsefe:2000mf01 Non-Gaussian OU based models and some of their uses in financial economics (2000). (50) RePEc:sbs:wpsefe:2003mf05 Estimation of Integrated Volatility in Stochastic Volatility Models (2003). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:aah:create:2008-23 An Econometric Analysis of Modulated Realised Covariance, Regression and Correlation in Noisy Diffusion Models (2008). CREATES Research Papers (2) RePEc:ams:ndfwpp:08-10 Out-of-sample comparison of copula specifications in multivariate density forecasts (2008). CeNDEF Working Papers (3) RePEc:bla:randje:v:39:y:2008:i:4:p:1042-1058 Price-increasing competition (2008). RAND Journal of Economics (4) RePEc:cbr:cbrwps:wp366 The Influence of Stock Market Listing on Human Resource Managment: Evidence for France and Britain (2008). ESRC Centre for Business Research - Working Papers (5) RePEc:cpr:ceprdp:7080 The Regulation of Entry: A Survey (2008). CEPR Discussion Papers (6) RePEc:cte:wsrepe:ws086321 Copulas in finance and insurance (2008). Statistics and Econometrics Working Papers (7) RePEc:nbr:nberwo:14148 The Opportunity Cost of Capital of US Buyouts (2008). NBER Working Papers (8) RePEc:nbr:nberwo:14463 An Arbitrage-Free Generalized Nelson-Siegel Term Structure Model (2008). NBER Working Papers (9) RePEc:oxf:wpaper:397 Multivariate realised kernels: consistent positive semin-definite estimators of the covariation of equity prices with noise and non-synchronous trading (2008). Economics Series Working Papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-42 Power variation for Gaussian processes with stationary increments (2007). CREATES Research Papers (2) RePEc:cep:stiecm:/2007/523 Inference about Realized Volatility using Infill Subsampling (2007). STICERD - Econometrics Paper Series Recent citations received in: 2006 (1) RePEc:col:000094:002543 EL RIESGO DE MERCADO DE LA DEUDA PÃBLICA:¿UNA RESTRICCIÃN A LA POLÃTICA MONETARIA?EL CASO COLOMBIANO (2006). BORRADORES DE ECONOMIA (2) RePEc:dnb:dnbwpp:119 Modelling Scenario Analysis and Macro Stress-testing (2006). DNB Working Papers (3) RePEc:zbw:sfb475:200651 Estimation of Volatility Functionals in the Simultaneous Presence of Microstructure Noise and Jumps (2006). Technical Reports Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||