|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

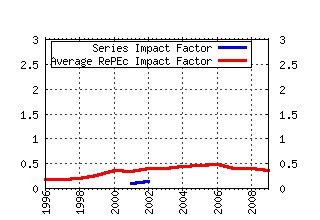

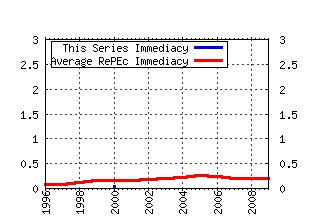

Computing in Economics and Finance 2000 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf0:92 WHAT WILL HAPPEN TO FINANCIAL MARKETS WHEN THE BABY BOOMERS RETIRE? (2000). (2) RePEc:sce:scecf0:361 MONETARY POLICY RULES FOR AN OPEN ECONOMY (2000). (3) RePEc:sce:scecf0:134 PREDICTING UK BUSINESS CYCLE REGIMES (2000). (4) RePEc:sce:scecf0:317 HEDGING HOUSE PRICE RISK WITH INCOMPLETE MARKETS (2000). (5) RePEc:sce:scecf0:24 A COMPARISON OF DISCRETE AND PARAMETRIC METHODS FOR CONTINUOUS-STATE DYNAMIC PROGRAMMING PROBLEMS (2000). (6) RePEc:sce:scecf0:306 OPTIMAL MONETARY POLICY IN A MODEL WITH HABIT FORMATION (2000). (7) RePEc:sce:scecf0:320 REQUIEM FOR THE REPRESENTATIVE CONSUMER? AGGREGATE IMPLICATIONS OF MICROECONOMIC CONSUMPTION BEHAVIOR (2000). (8) RePEc:sce:scecf0:186 OPTIMAL MONETARY POLICY IN AN OPEN ECONOMY (2000). (9) RePEc:sce:scecf0:282 FINANCIAL FRAGILITY, PATTERNS OF FIRMS ENTRY AND EXIT AND AGGREGATE DYNAMICS (2000). (10) RePEc:sce:scecf0:40 NON-PARAMETRIC SPECIFICATION TESTS FOR CONDITIONAL DURATION MODELS (2000). (11) RePEc:sce:scecf0:272 WAS HAYEK AN ACE? (2000). (12) RePEc:sce:scecf0:180 INFLATION TARGETING UNDER POTENTIAL OUTPUT UNCERTAINTY (2000). (13) RePEc:sce:scecf0:3 EMPLOYMENT AND WELFARE EFFECTS OF A TWO-TIER UNEMPLOYMENT COMPENSATION SYSTEM (2000). (14) RePEc:sce:scecf0:319 ASSET PRICES AND BUSINESS CYCLES UNDER LIMITED COMMITMENT (2000). (15) RePEc:sce:scecf0:297 PORTFOLIO CHOICE AND LIQUIDITY CONSTRAINTS (2000). (16) RePEc:sce:scecf0:145 ADAPTIVE POLAR SAMPLING WITH AN APPLICATION TO A BAYES MEASURE OF VALUE-AT-RISK (2000). (17) RePEc:sce:scecf0:203 THE PERFORMANCE OF FORECAST-BASED MONETARY POLICY RULES UNDER MODEL UNCERTAINTY (2000). (18) RePEc:sce:scecf0:316 EXHUMING Q: MARKET POWER VERSUS CAPITAL MARKET IMPERFECTIONS (2000). (19) RePEc:sce:scecf0:160 A COMPARATIVE STUDY OF ALTERNATIVE ECONOMETRIC PACKAGES: AN APPLICATION TO ITALIAN DEPOSIT INTEREST RATES (2000). (20) RePEc:sce:scecf0:254 ESTIMATING THE ACCURACY OF NUMERICAL SOLUTIONS TO DYNAMIC OPTIMIZATION PROBLEMS (2000). (21) RePEc:sce:scecf0:346 CAPITAL VERSUS LABOR INCOME TAXATION WITH HETEROGENEOUS AGENTS (2000). (22) RePEc:sce:scecf0:z133 IPOS AND THE GROWTH OF FIRMS (2000). (23) RePEc:sce:scecf0:299 LEARNING-INDUCED SECURITIES PRICE VOLATILITY (2000). (24) RePEc:sce:scecf0:309 EVALUATING REAL BUSINESS CYCLE MODELS USING LIKELIHOOD METHODS (2000). (25) RePEc:sce:scecf0:85 PROFITABILITY AND MARKET STABILITY: FUNDAMENTALS AND TECHNICAL TRADING RULES (2000). (26) RePEc:sce:scecf0:27 FISCAL POLICY AND BUDGET DEFICIT STABILITY IN A CONTINUOUS TIME STOCHASTIC ECONOMY (2000). (27) RePEc:sce:scecf0:253 MACROECONOMIC EFFECTS OF SECTORAL SHOCKS IN US, UK AND GERMANY: A BVAR-GARCH-M APPROACH (2000). (28) RePEc:sce:scecf0:130 INCOMPLETE MARKETS, TRANSITORY SHOCKS AND WELFARE (2000). (29) RePEc:sce:scecf0:372 THE BUDGETARY AND ECONOMIC CONSEQUENCES OF AGEING IN THE NETHERLANDS (2000). (30) RePEc:sce:scecf0:128 A DYNAMIC MODEL OF LABOR SUPPLY, CONSUMPTION/SAVING, AND ANNUITY DECISIONS UNDER UNCERTAINTY (2000). (31) RePEc:sce:scecf0:318 ENDOGENOUS CREDIT CONSTRAINTS AND HUMAN CAPITAL FORMATION (2000). (32) RePEc:sce:scecf0:183 LEARNING, UNCERTAINTY AND CENTRAL BANK ACTIVISM IN AN ECONOMY WITH STRATEGIC INTERACTIONS (2000). (33) RePEc:sce:scecf0:107 FOREIGN AID AND THE BUSINESS CYCLE (2000). (34) RePEc:sce:scecf0:303 MONETARY POLICY IN AN ESTIMATED OPTIMIZATION-BASED MODEL WITH STICKY PRICES AND WAGES (2000). (35) RePEc:sce:scecf0:132 THIS IS WHAT THE LEADING INDICATORS LEAD (2000). (36) RePEc:sce:scecf0:142 A SYSTEMATIC COMPARISON OF ALTERNATIVE LINEAR RATIONAL EXPECTATION MODEL SOLUTION TECHNIQUES (2000). (37) RePEc:sce:scecf0:338 TOWARD AN INTEGRATION OF SOCIAL LEARNING AND INDIVIDUAL LEARNING IN AGENT-BASED COMPUTATIONAL STOCK MARKETS:THE APPROACH BASED ON POPULATION GENETIC PROGRAMMING (2000). (38) RePEc:sce:scecf0:202 THE FED IS NOT AS IGNORANT AS YOU THINK (2000). (39) RePEc:sce:scecf0:276 A DECENTRALIZED AGENT-BASED PLATFORM FOR AUTOMATED TRADE AND ITS SIMULATION (2000). (40) RePEc:sce:scecf0:173 SUM: A SURPRISING (UN)REALISTIC MARKET - BUILDING A SIMPLE STOCK MARKET STRUCTURE WITH SWARM. (2000). (41) RePEc:sce:scecf0:246 SIMULATING COMPUTABLE OVERLAPPING GENERATIONS MODELS WITH TROLL (2000). (42) RePEc:sce:scecf0:138 FRACTIONAL COINTEGRATING REGRESSION IN THE PRESENCE OF LINEAR TIME TRENDS (2000). (43) RePEc:sce:scecf0:197 FISCAL/MONETARY POLICY AND THE PRICE LEVEL IN AN OPEN ECONOMY (2000). (44) RePEc:sce:scecf0:129 MONOPOLISTIC SECURITY DESIGN IN FINANCE ECONOMIES (2000). (45) repec:sce:scecf0:172 (). (46) RePEc:sce:scecf0:349 THE IMPORTANCE OF THE NUMBER OF DIFFERENT AGENTS IN A HETEROGENEOUS ASSET-PRICING MODEL (2000). (47) RePEc:sce:scecf0:233 A MARKOVIAN APPROXIMATED SOLUTION TO A PORTFOLIO MANAGEMENT PROBLEM (2000). (48) RePEc:sce:scecf0:284 THE EVOLUTION OF INDUSTRIAL CLUSTERS- SIMULATING SPATIAL DYNAMICS (2000). (49) RePEc:sce:scecf0:133 ESTIMATED U.S. MANUFACTURING CAPITAL AND PRODUCTIVITY BASED ON AN ESTIMATED DYNAMIC ECONOMIC MODEL (2000). (50) RePEc:sce:scecf0:58 TESTING THE PRICING-TO-MARKET HYPOTHESIS CASE OF THE TRANSPORTATION EQUIPMENT INDUSTRY (2000). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||