|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

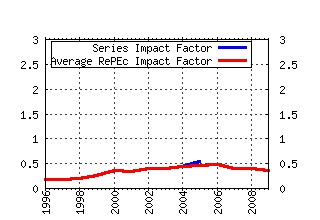

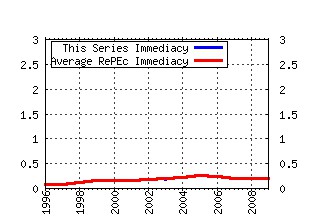

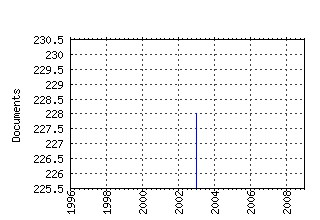

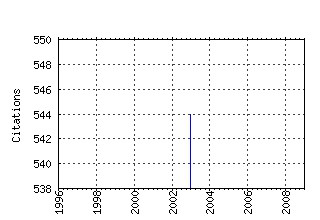

Computing in Economics and Finance 2003 Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:sce:scecf3:291 Robust Monetary Polciy with Competing Reference Models (2003). (2) RePEc:sce:scecf3:143 The Generalized Dynamic Factor Model: One-Sided Estimation and Forecasting (2003). (3) RePEc:sce:scecf3:38 Public and Private Information in Monetary Policy Models (2003). (4) RePEc:sce:scecf3:162 Calculating and Using Second Order Accurate Solution of Discrete Time Dynamic Equilibrium Models (2003). (5) RePEc:sce:scecf3:12 Endogenous Price Stickiness, Trend Inflation, and the New Keynesian Phillips Curve (2003). (6) RePEc:sce:scecf3:106 Endogenous Nontradability and Macroeconomic Implications (2003). (7) RePEc:sce:scecf3:138 The Zero-Interest-Rate Bound and the Role of the Exchange Rate for Monetary Policy in Japan (2003). (8) RePEc:sce:scecf3:263 Optimal Monetary Policy with Imperfect Common Knowledge (2003). (9) RePEc:sce:scecf3:171 Evolving Post-World War II U.K. Economic Performance (2003). (10) RePEc:sce:scecf3:169 Structural Breaks in Inflation Dynamics (2003). (11) RePEc:sce:scecf3:129 Did the Great Inflation Occur Despite Policymaker Commitment to a Taylor Rule? (2003). (12) RePEc:sce:scecf3:137 Persistence, the Transmission Mechanism and Robust Monetary Policy (2003). (13) RePEc:sce:scecf3:61 Does Exchange Rate Risk Matter for Welfare? (2003). (14) RePEc:sce:scecf3:206 Macroeconomics and the Yield Curve (2003). (15) RePEc:sce:scecf3:298 Is Inflation Persistence Intrinsic in Industrial Economies? (2003). (16) RePEc:sce:scecf3:170 Complex Dyanmics in a Simple Model of Economic Specialization (2003). (17) RePEc:sce:scecf3:215 Parameter Uncertainty and the Central Banks Objective Function (2003). (18) RePEc:sce:scecf3:132 Learning Dynamics and Endogenous Currency Crises (2003). (19) RePEc:sce:scecf3:92 Alternative Sources of the Lag Dynamics of Inflation (2003). (20) RePEc:sce:scecf3:181 Can Rational Expectations Sticky-Price Models Explain Inflation Dynamics? (2003). (21) RePEc:sce:scecf3:246 Credit Contagion and Aggregate Losses (2003). (22) RePEc:sce:scecf3:310 Monetary Fundamentals and Exchange Rate Dynamics Under Different Nominal Regimes (2003). (23) RePEc:sce:scecf3:294 Shocking Escapes (2003). (24) RePEc:sce:scecf3:69 The Impact of Macroeconomic Uncertainty on Cash Holdings for Non-Financial Firms (2003). (25) RePEc:sce:scecf3:66 The Use of Simulations in Developing Robust Knowledge about Causal Processes: Methodological Considerations and an Application to Industrial Evolution (2003). (26) RePEc:sce:scecf3:242 EUROCOIN: A REAL TIME COINCIDENT INDICATOR OF THE EURO AREA BUSINESS CYCLE (2003). (27) RePEc:sce:scecf3:183 The Predictive Content of the Output Gap for Inflation: Resolving In-Sample and Out-of-Sample Evidence (2003). (28) RePEc:sce:scecf3:7 Evolution of Worker-Employer Networks and Behaviors Under Alternative Non-Employment Benefits: An Agent-Based Computational Study (2003). (29) RePEc:sce:scecf3:256 Output gaps:theory versus practice (2003). (30) RePEc:sce:scecf3:222 Peer effects and selection effects in youth smoking (2003). (31) RePEc:sce:scecf3:26 Cartel Pricing Dynamics in the Presence of an Antitrust Authority (2003). (32) RePEc:sce:scecf3:63 Schellings Spatial Proximity Model of Segregation Revisited (2003). (33) RePEc:sce:scecf3:273 The Beveridge Curve, Job Creation, and the Propagation of Shocks (2003). (34) RePEc:sce:scecf3:71 Optimal Experimentation and the Perturbation Method. (2003). (35) RePEc:sce:scecf3:108 Structural Time-Series Models with Common Trends and Common Cycles (2003). (36) RePEc:sce:scecf3:229 Competitive Convergence and Divergence: Capability and Position Dynamics (2003). (37) RePEc:sce:scecf3:31 Fading Memory Learning in the Cobweb Model with Risk Averse Heterogeneous Producers (2003). (38) RePEc:sce:scecf3:245 Expectations and Currency Crisis - An experimental approach (2003). (39) RePEc:sce:scecf3:150 The Monopolists Market with Discrete Choices and Network Externality Revisited: Small-Worlds, Phase Transition and Avalanches in an ACE Framework (2003). (40) RePEc:sce:scecf3:244 Computer Testbeds: The Dynamics of Groves-Ledyard Mechanisms (2003). (41) RePEc:sce:scecf3:27 Unemployment Benefits and the Persistence of European Unemployment (2003). (42) RePEc:sce:scecf3:88 Multi-Asset Market Dynamics (2003). (43) RePEc:sce:scecf3:190 In Search of the Natural Rate of Unemployment (2003). (44) RePEc:sce:scecf3:290 Equity Prices and Monetary Policy: An Overview with an Exploratory Model (2003). (45) RePEc:sce:scecf3:178 Aggregate Uncertainty, Individual Uncertainty and the Housing Market (2003). (46) RePEc:sce:scecf3:72 Habit Formation and the Persistence of Monetary Shocks (2003). (47) RePEc:sce:scecf3:65 An Empirical Examination of Term Structure Models with Regime Shifts (2003). (48) RePEc:sce:scecf3:207 Robust Control: A Note on the Response of the Control to Changes in the Free Parameter (2003). (49) RePEc:sce:scecf3:296 Monetary policy, investment and non-fundamental shocks (2003). (50) RePEc:sce:scecf3:54 Solving Asset Pricing Models with Stochastic Dynamic Programming (2003). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||