|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

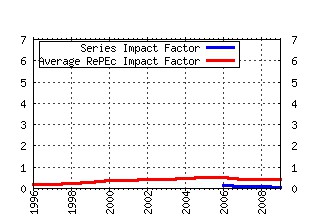

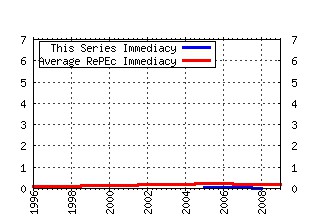

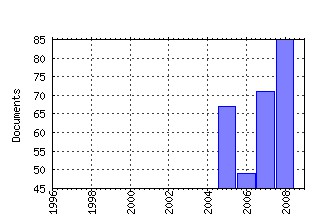

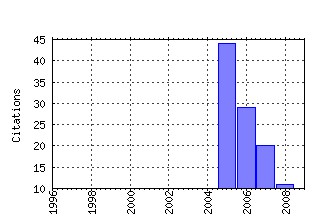

Applied Financial Economics Letters Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apfelt:v:2:y:2006:i:2:p:123-130 Flexible Dynamic Conditional Correlation multivariate GARCH models for asset allocation (2006). (2) RePEc:taf:apfelt:v:2:y:2006:i:3:p:151-154 Economic value added and systemic value added: symmetry, additive coherence and differences in performance (2006). (3) RePEc:taf:apfelt:v:3:y:2007:i:2:p:137-140 Project valuation and investment decisions: CAPM versus arbitrage (2007). (4) RePEc:taf:apfelt:v:1:y:2005:i:4:p:205-210 Forecast performance of neural networks and business cycle asymmetries (2005). (5) RePEc:taf:apfelt:v:1:y:2005:i:1:p:31-35 Temporal stability of estimates of risk aversion (2005). (6) RePEc:taf:apfelt:v:1:y:2005:i:3:p:157-163 The impact of financial deregulation on monetary aggregates and interest rates in Australia (2005). (7) RePEc:taf:apfelt:v:1:y:2005:i:2:p:89-93 A DCC analysis of international stock market correlations: the role of Japan on the Asian Four Tigers (2005). (8) RePEc:taf:apfelt:v:3:y:2007:i:6:p:359-363 Measuring the macroeconomic impact of workers remittances in a data-rich environment (2007). (9) RePEc:taf:apfelt:v:1:y:2005:i:6:p:381-385 On the relationship between central bank independence and inflation: some more bad news (2005). (10) RePEc:taf:apfelt:v:1:y:2005:i:1:p:41-46 Empirical identification of currency crises: differences and similarities between indicators (2005). (11) RePEc:taf:apfelt:v:1:y:2005:i:6:p:343-347 An alternative method to test for contagion with an application to the Asian financial crisis (2005). (12) RePEc:taf:apfelt:v:1:y:2005:i:2:p:65-69 REIT markets: periodically collapsing negative bubbles? (2005). (13) RePEc:taf:apfelt:v:4:y:2008:i:4:p:233-240 Mood and UK equity pricing (2008). (14) RePEc:taf:apfelt:v:1:y:2005:i:1:p:1-4 Measuring half-lives: using a non-parametric bootstrap approach (2005). (15) RePEc:taf:apfelt:v:3:y:2007:i:1:p:25-29 Nonlinear mean reversion in stock prices: evidence from Asian markets (2007). (16) RePEc:taf:apfelt:v:1:y:2005:i:3:p:151-156 An affine three-factor model of the German term structure of interest rates with macroeconomic content (2005). (17) RePEc:taf:apfelt:v:2:y:2006:i:3:p:179-182 The equity premium puzzle and decreasing relative risk aversion (2006). (18) RePEc:taf:apfelt:v:4:y:2008:i:2:p:115-120 Day of the week seasonality in African stock markets (2008). (19) RePEc:taf:apfelt:v:2:y:2006:i:1:p:25-30 Long memory properties of real interest rates for 16 countries (2006). (20) RePEc:taf:apfelt:v:3:y:2007:i:1:p:63-66 Measuring the US social discount rate (2007). (21) RePEc:taf:apfelt:v:1:y:2005:i:4:p:199-204 The shareholder wealth effects of voluntary foreign delistings: an empirical analysis (2005). (22) RePEc:taf:apfelt:v:3:y:2007:i:1:p:47-50 Corporate valuations and the Merton model (2007). (23) RePEc:taf:apfelt:v:3:y:2007:i:6:p:381-384 Structural breaks in financial ratios: evidence for nine international markets (2007). (24) RePEc:taf:apfelt:v:2:y:2006:i:1:p:1-7 Random walk versus multiple trend breaks in stock prices: evidence from 15 European markets (2006). (25) RePEc:taf:apfelt:v:4:y:2008:i:5:p:351-354 Firm survival and time aggregation bias (2008). (26) RePEc:taf:apfelt:v:2:y:2006:i:4:p:223-227 A nonparametric cointegration analysis of the forward rate unbiasedness hypothesis (2006). (27) RePEc:taf:apfelt:v:1:y:2005:i:1:p:53-57 Determinants of bank net interest margins in southeast asia (2005). (28) RePEc:taf:apfelt:v:3:y:2007:i:3:p:165-168 Project selection and equivalent CAPM-based investment criteria (2007). (29) RePEc:taf:apfelt:v:1:y:2005:i:4:p:233-238 New insights on the importance of agency costs for corporate debt maturity decisions (2005). (30) RePEc:taf:apfelt:v:4:y:2008:i:3:p:193-197 Deregulation and productivity changes in banking: evidence from European unification (2008). (31) RePEc:taf:apfelt:v:2:y:2006:i:1:p:65-68 Do common variations in liquidity exhibit a U-shaped pattern across weekdays? (2006). (32) RePEc:taf:apfelt:v:4:y:2008:i:5:p:341-345 An ordered probit model of Morningstar individual stock ratings (2008). (33) RePEc:taf:apfelt:v:3:y:2007:i:2:p:91-94 The monetary approach to exchange rate determination for Malaysia (2007). (34) RePEc:taf:apfelt:v:1:y:2005:i:4:p:211-216 Internal corporate governance mechanisms and corporate performance: evidence for UK firms (2005). (35) RePEc:taf:apfelt:v:4:y:2008:i:3:p:171-176 Provincial co-movement in Chinese stock returns (2008). (36) RePEc:taf:apfelt:v:2:y:2006:i:1:p:55-59 Asymmetric beta in bull and bear market conditions: evidences from India (2006). (37) RePEc:taf:apfelt:v:2:y:2006:i:5:p:333-336 WTP--WTA disparity among competitive and non-competitive subjects -- an experimental study (2006). (38) RePEc:taf:apfelt:v:3:y:2007:i:4:p:221-224 The roles of the exchange rate and the foreign interest rate in Estonias money demand function and policy implications (2007). (39) RePEc:taf:apfelt:v:4:y:2008:i:4:p:299-302 Estimating the value of victory: English football (2008). (40) RePEc:taf:apfelt:v:1:y:2005:i:1:p:37-40 Competition, risk taking, and governance structures in retail banking (2005). (41) RePEc:taf:apfelt:v:2:y:2006:i:4:p:257-260 A micro-econometric model of the UK property-liability insurance industry (2006). (42) RePEc:taf:apfelt:v:3:y:2007:i:3:p:197-199 A global network of stock markets and home bias puzzle (2007). (43) RePEc:taf:apfelt:v:1:y:2005:i:5:p:293-296 Bank sales, spread and profitability: an empirical analysis (2005). (44) RePEc:taf:apfelt:v:4:y:2008:i:4:p:269-275 Fractional return and fractional CAPM (2008). (45) RePEc:taf:apfelt:v:2:y:2006:i:2:p:77-86 Empirical investigation on the relationship between Japanese and Asian emerging equity markets (2006). (46) RePEc:taf:apfelt:v:3:y:2007:i:6:p:385-389 Time-varying nonlinear exchange rate exposure (2007). (47) RePEc:taf:apfelt:v:2:y:2006:i:1:p:19-23 The influence of performance on the flows into Spanish equity funds (2006). (48) RePEc:taf:apfelt:v:2:y:2006:i:4:p:229-232 Evidence on the relationship between Takaful insurance and fundamental perception of Islamic principles (2006). (49) RePEc:taf:apfelt:v:1:y:2005:i:1:p:9-14 Speculation or hedging in the Irish stock exchange (2005). (50) RePEc:taf:apfelt:v:3:y:2007:i:3:p:169-179 Investors reaction to dividend announcements: parametric versus nonparametric approach (2007). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 Recent citations received in: 2008 (1) RePEc:bog:econbl:y:2008:i:31:p:07-30 The determinants for the survival of firms in the Athens Exchange (2008). Economic Bulletin Recent citations received in: 2007 (1) RePEc:pra:mprapa:5471 Correct or incorrect application of CAPM? Correct or incorrect decisions with CAPM? (2007). MPRA Paper (2) RePEc:pra:mprapa:6330 THEORETICAL FLAWS IN THE USE OF THE CAPM FOR INVESTMENT DECISIONS (2007). MPRA Paper Recent citations received in: 2006 (1) RePEc:taf:apfelt:v:2:y:2006:i:4:p:275-278 Floor information and common variations in liquidity (2006). Applied Financial Economics Letters (2) RePEc:ven:wpaper:2006_53 A generalized Dynamic Conditional Correlation Model for Portfolio Risk Evaluation (2006). Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||